fWY3TQgFdr

liked

fWY3TQgFdr

liked

On Thursday, winners beat losers by a 7 to 2 margin at the NYSE and by roughly 2 to 1 at the Nasdaq. Advancing volume took a commanding 77.8% share of composite NYSE-listed trade and a 67.4% share of composite Nasdaq-listed activity. Most importantly, aggregate trading volume on a day over day basis, was up 12.1% for NYSE-listings and up 5.2% for Nasdaq-listings.

For the third time since the start of November, or really since the three-month rising wedge pattern closed, the N...

For the third time since the start of November, or really since the three-month rising wedge pattern closed, the N...

6

fWY3TQgFdr

liked

$Fangdd Network (DUO.US)$ If 12k doesn't hold, Chinese stocks will keep dropping. So far, it looks like it'll probably will, causing more pain, and more investors will flee. DUO with no news is DEAD like I said. Chances to bounce to 0.80 now are 50/50....no serious buyers. China and its stocks are 💩💩💩💩💩.

7

4

fWY3TQgFdr

liked

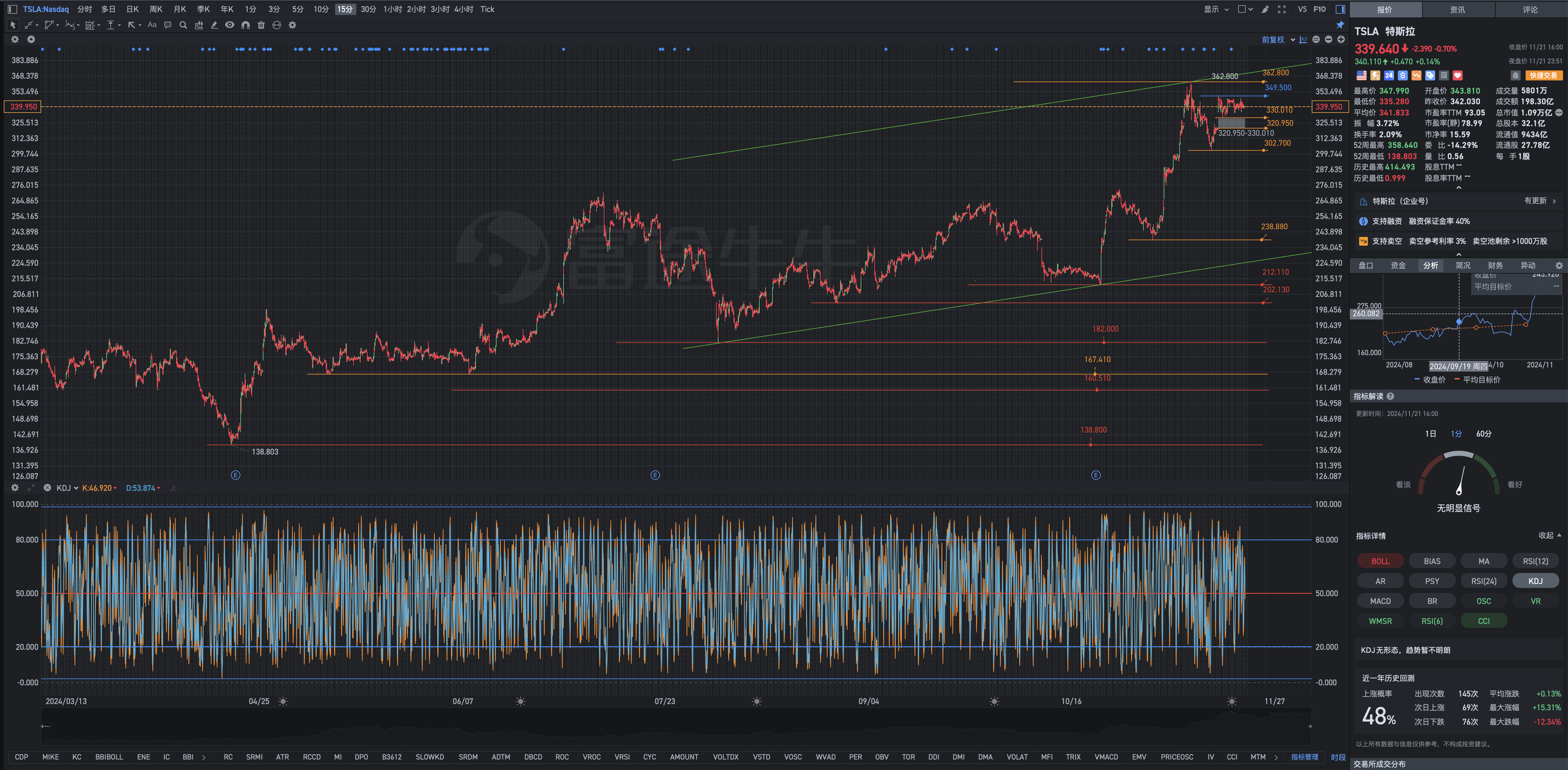

$Tesla (TSLA.US)$

The highest wisdom of an intelligent person is to understand and reconcile, reconcile with enemies, reconcile with loved ones, reconcile with oneself, and reconcile with the declining market conditions that are unfavorable to one's own positions (almost close positions with similar profits, small profits, and crucial moments, and even slightly lose and close positions to leave the market, preserve strength, and re-enter at lower price levels of oversold and severely oversold points), not letting emotions block the body, which is the best love for oneself. Liking to fight with people who won't reconcile is harming oneself and others.

Looking at Tesla again: How to deal with the current Tesla trend is not yet clear. The technical indicators and the proportion of profit chips function values are running at high levels.

There is actually nothing to study or discuss about the fundamentals of Tesla, as no one can convince each other. When it comes to fundamentals, everyone seems knowledgeable. It is not very meaningful. Those who study mathematics and use mathematical models, functions, limits, differentials, and quantitative analysis believe that the charts tell us everything. All forces and factors in the market interact with each other, ultimately forming the current market pattern.

Do you understand the soul of JC financial trading? To truly understand the JC trading method, you should delve into it from five aspects in order to break through that layer of window paper; how to interpret common classic market language; how to accurately control the practical application of short-term breakthrough points, medium-term breakthrough points; the basic principles of practical points for USA equity index futures contracts and options contracts; what are the high-probability special speculative skills at this stage? Mastering rare skills is the key to breakthrough...

The highest wisdom of an intelligent person is to understand and reconcile, reconcile with enemies, reconcile with loved ones, reconcile with oneself, and reconcile with the declining market conditions that are unfavorable to one's own positions (almost close positions with similar profits, small profits, and crucial moments, and even slightly lose and close positions to leave the market, preserve strength, and re-enter at lower price levels of oversold and severely oversold points), not letting emotions block the body, which is the best love for oneself. Liking to fight with people who won't reconcile is harming oneself and others.

Looking at Tesla again: How to deal with the current Tesla trend is not yet clear. The technical indicators and the proportion of profit chips function values are running at high levels.

There is actually nothing to study or discuss about the fundamentals of Tesla, as no one can convince each other. When it comes to fundamentals, everyone seems knowledgeable. It is not very meaningful. Those who study mathematics and use mathematical models, functions, limits, differentials, and quantitative analysis believe that the charts tell us everything. All forces and factors in the market interact with each other, ultimately forming the current market pattern.

Do you understand the soul of JC financial trading? To truly understand the JC trading method, you should delve into it from five aspects in order to break through that layer of window paper; how to interpret common classic market language; how to accurately control the practical application of short-term breakthrough points, medium-term breakthrough points; the basic principles of practical points for USA equity index futures contracts and options contracts; what are the high-probability special speculative skills at this stage? Mastering rare skills is the key to breakthrough...

Translated

+10

28

fWY3TQgFdr

liked

exciting month... lots of happenings... bitcoin climbing all time high...

am I into crypto? not yet... took some profits off quick coinbase n mara, waiting for next dip to decide, if it happens![]() . or perhaps etf? cathie wood coming to moomoo, so excited. which other megastar is next?

. or perhaps etf? cathie wood coming to moomoo, so excited. which other megastar is next?

summary of November

HSI took a dip. still holding to xpev and index leverage. no miracle from china stimulus yet.

with high volatility, tending to do quick trade. scared to be stuck (still too stubborn t...

am I into crypto? not yet... took some profits off quick coinbase n mara, waiting for next dip to decide, if it happens

summary of November

HSI took a dip. still holding to xpev and index leverage. no miracle from china stimulus yet.

with high volatility, tending to do quick trade. scared to be stuck (still too stubborn t...

+4

20

5

fWY3TQgFdr

liked

In this video, I’ll explain why I’m turning my attention back to the $Hang Seng Index (800000.HK)$ after its impressive 40% rally in under two months. We'll look at whether there are potential market opportunity, and the crucial levels to watch for traders and investors

Mentioned in this video are warrants to consider for short-term trading.

$HSI 21800MBeCW250127 (YL5W.SG)$

Mentioned in this video are warrants to consider for short-term trading.

$HSI 21800MBeCW250127 (YL5W.SG)$

58

fWY3TQgFdr

liked

INFY looks strong above $21.55 (20-day MA), with support at $21.78 and bullish signals from Parabolic SAR and RSI near 64. Eyes on resistance at $22.45—breakout potential brewing! Long-term trend intact above 250-day MA at $19.39. 🚀📈

4

fWY3TQgFdr

liked

🔴According to the clinical trial results announcement disclosed by the company on November 20, combined with the contents of the telephone conference held on the same day, the results of the clinical trial are summarized below.

⭕ My conclusion is bullish. The stock price dropped today, perhaps to cleanse unstable chips for the next round of uptrend. Currently, the long-term moving average is a strong support. After thorough cleansing, there may be consolidation, followed by another uptrend, then a new round of financing to raise funds for commercialization outside Europe and further expansionary clinical trials of NDA new drugs. Of course, the possibility of the company being acquired at a significant premium cannot be ruled out. Turbo overweight position, continue to hold.![]()

🔴Intoday's telephone conference, company management and Professor John Kastelein emphasized the synergistic effect of obicetrapib when used in combination with evolocumab. This means that the combined effect of the drugs is superior to the sum of the effects of the two drugs used alone. The management stated that the positive results of the TANDEM trial have strengthened the company's confidence in the ongoing PREVAIL trial. Once PREVAIL is successful in the future, the company valuation is expected to double.

————

🔥Interpretation of TANDEM Trial Results🔥

🔴Primary Endpoint: Percentage Reduction in LDL-C

Day 84:

Monotherapy with Evymlozumab: LDL-C decreased by 23.3% compared to placebo.

Monotherapy with Obicetrapib: LDL-C decreased by 31.5% compared to placebo.

O...

⭕ My conclusion is bullish. The stock price dropped today, perhaps to cleanse unstable chips for the next round of uptrend. Currently, the long-term moving average is a strong support. After thorough cleansing, there may be consolidation, followed by another uptrend, then a new round of financing to raise funds for commercialization outside Europe and further expansionary clinical trials of NDA new drugs. Of course, the possibility of the company being acquired at a significant premium cannot be ruled out. Turbo overweight position, continue to hold.

🔴Intoday's telephone conference, company management and Professor John Kastelein emphasized the synergistic effect of obicetrapib when used in combination with evolocumab. This means that the combined effect of the drugs is superior to the sum of the effects of the two drugs used alone. The management stated that the positive results of the TANDEM trial have strengthened the company's confidence in the ongoing PREVAIL trial. Once PREVAIL is successful in the future, the company valuation is expected to double.

————

🔥Interpretation of TANDEM Trial Results🔥

🔴Primary Endpoint: Percentage Reduction in LDL-C

Day 84:

Monotherapy with Evymlozumab: LDL-C decreased by 23.3% compared to placebo.

Monotherapy with Obicetrapib: LDL-C decreased by 31.5% compared to placebo.

O...

Translated

12

3

fWY3TQgFdr

liked

$Advanced Micro Devices (AMD.US)$ AMD's technology has always been bad, even if the performance is good, it's hard to rise, just get used to it. However, currently, their CPU is dominant, there is still opportunity in the long term.![]()

Translated

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)