Good stock for accummulation

gchung1818

liked

Pre-Earnings Strategy: First things first—know the key numbers and the market expectations. But keep in mind, NVIDIA’s revenue recognition can get tricky, so don’t be surprised by unpredictable results. This is why a solid strategy, proper positioning, and downside protection are essential going into the report.

1. Core Numbers & Expectations

Where do Buy-Side Expectations Come From? NVIDIA has been beating guidance by around $2 billion each q...

1. Core Numbers & Expectations

Where do Buy-Side Expectations Come From? NVIDIA has been beating guidance by around $2 billion each q...

40

7

10

gchung1818

liked

Price at 276.50, Sold csp at nov 5/24, 44 dte dec 20/24, Premium 290, strike at 260, delta -0.208, iv 21.4%, Annualised Return 9.25%. Price at 288.73, Buy to close on nov 18/24 at 50c x 100 = $50, collected 240 premium 83% (ex fee) of 290 premium and still have 32 dte left. At times you can close out contract in 1 week , 2 weeks and etc. By default, we tried to collect 75% of premium. This is not a must, if happy and collected 50% in 2 weeks, can also close it. Th...

6

gchung1818

voted

Hi mooers! ![]()

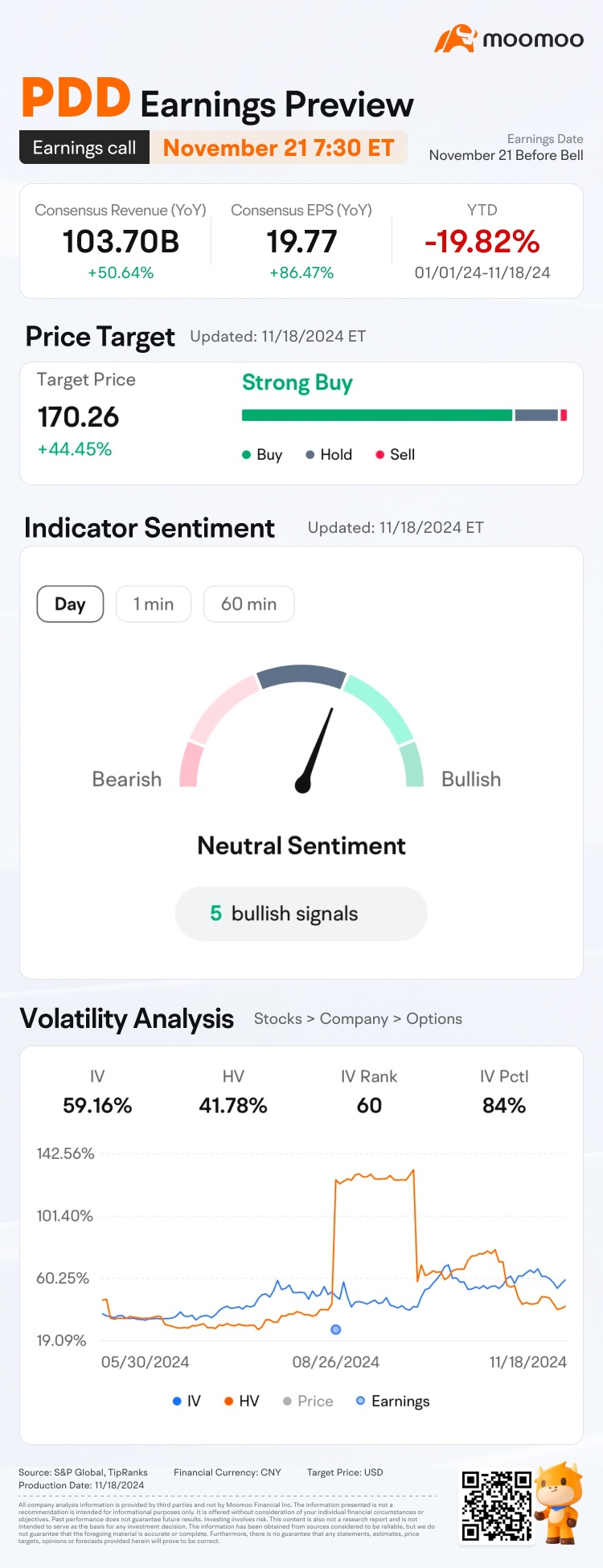

$PDD Holdings (PDD.US)$ is releasing its Q3 earnings on November 21 before the bell. Unlock insights with PDD Earnings Hub>>

$PDD Holdings (PDD.US)$' share prices often fluctuate a lot around earnings releases, like the +18.08% jump after 2023 Q3 earnings, and the -28.51% drop after 2024 Q3 earnings results. Amid recent economic stimulus policies from the Chinese government, how would this famous Chinese e-commerce co...

$PDD Holdings (PDD.US)$ is releasing its Q3 earnings on November 21 before the bell. Unlock insights with PDD Earnings Hub>>

$PDD Holdings (PDD.US)$' share prices often fluctuate a lot around earnings releases, like the +18.08% jump after 2023 Q3 earnings, and the -28.51% drop after 2024 Q3 earnings results. Amid recent economic stimulus policies from the Chinese government, how would this famous Chinese e-commerce co...

34

21

2

gchung1818

Set a live reminder

While the election may be over, the implications for your portfolio are likely not. Join our panelists as they discuss the market’s reaction over the past week to the results and what’s in store for the first 100 days of the new administration. This panel will explore the historical relationship between presidential election cycles and market performance as well as the potential impact of the president-elect’s policies on specific sectors and t...

How will the election results affect your portfolio?

Nov 17 00:40

5

gchung1818

Set a live reminder

Listen in as three women in finance share their journeys, strategies, and practical tips for women entering the trading world. This session covers overcoming challenges, debunking myths, and embracing opportunities, with actionable steps to help you start or advance your options trading path.

Helping women reach their financial goals

Nov 16 23:50

19

2

5

gchung1818

Set a live reminder

Moomoo is constantly updating its features, tools and product offerings to provide the best possible trading experience to its users. This session will examine how moomoo is working to meet its customers’ needs. Explore moomoo’s recent product rollouts including a live demo of how they work. Learn about the risk controls moomoo has in place and what the next cutting edge release will be in the coming year.

Next Gen trading: What's new on the moomoo app

Nov 16 23:00

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)