GeiGei

liked

$NVIDIA (NVDA.US)$

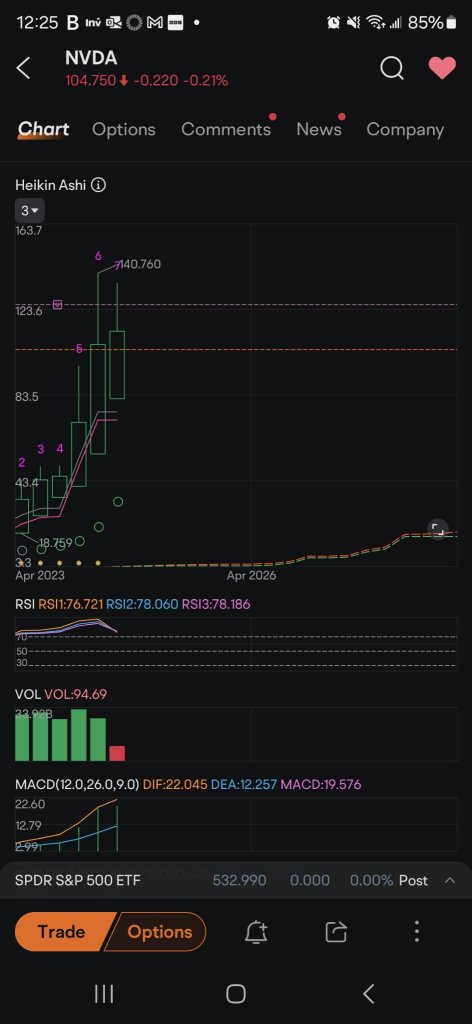

here we have the quarterly chart. the long top wicks are the bull rallies people buy high on sometimes then it falls back into the body area range where it drops to the bottom to consolidate up filling the body up since it's only at 7 could expect more up since trend is still bullish. second chart shows bearish long thin red wick from chart 2 which sucks because red dots starting still hopefully market conditions get rid of that if not in deep shit but still maybe required to ...

here we have the quarterly chart. the long top wicks are the bull rallies people buy high on sometimes then it falls back into the body area range where it drops to the bottom to consolidate up filling the body up since it's only at 7 could expect more up since trend is still bullish. second chart shows bearish long thin red wick from chart 2 which sucks because red dots starting still hopefully market conditions get rid of that if not in deep shit but still maybe required to ...

+1

10

2

GeiGei

liked

As Singapore lights up for its 59th birthday, I'm thrilled to share this stunning photo of Marina Bay Sands bathed in the vibrant red and white of our Singapore flag! The iconic light projection on Marina Bay Sands beautifully encapsulates the spirit of our nation’s celebration.

This iconic display is not just a feast for the eyes but a reminder of our progress and resilience. My heartfelt wish for Singapore is for our nation to ...

This iconic display is not just a feast for the eyes but a reminder of our progress and resilience. My heartfelt wish for Singapore is for our nation to ...

33

1

GeiGei

liked

$NVIDIA (NVDA.US)$

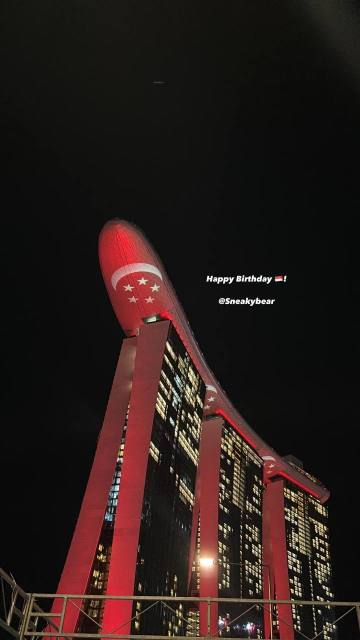

With the recent volatility of the US stock market and NASDAQ falling sharply by 13%, I will adapt a Futu options trading tutorial to explain how to effectively reduce losses through options. (Please note that the risks and margin requirements of the following operations are not discussed here due to the length of the content, please contact privately.)

Using the highly popular Nvidia as an example, suppose we recently purchased Nvidia stocks (100 shares) at a price of $120. As of August 9, 2024, the current market price has fallen to around $104. By selling a call option with a strike price of $120 and expiration date of August 23, we will immediately receive a premium of $87.5 to reduce position losses (please note that one option corresponds to 100 shares, not one share).

Assuming that due to macroeconomic factors, the stock price will not rise in the short term and remains below $120, the call option will not be exercised, and our option premium income will be $87.5. For example, if Nvidia's stock price rebounds to $110 on August 23, the investor's loss on the underlying stock is $1,000, which means that the final loss is $912.5 ($1,000 - $87.5). If the stock price breaks through $120 due to unexpected bullish news, then your call option will be exercised and you will recover the previously invested capital.

If the stock price continues to consolidate, we can continue to carry out similar protective call option trading, and the accumulated option premiums will offset some investment losses. For example, conducting a protective call option trading each month with a premium of $87 ...

With the recent volatility of the US stock market and NASDAQ falling sharply by 13%, I will adapt a Futu options trading tutorial to explain how to effectively reduce losses through options. (Please note that the risks and margin requirements of the following operations are not discussed here due to the length of the content, please contact privately.)

Using the highly popular Nvidia as an example, suppose we recently purchased Nvidia stocks (100 shares) at a price of $120. As of August 9, 2024, the current market price has fallen to around $104. By selling a call option with a strike price of $120 and expiration date of August 23, we will immediately receive a premium of $87.5 to reduce position losses (please note that one option corresponds to 100 shares, not one share).

Assuming that due to macroeconomic factors, the stock price will not rise in the short term and remains below $120, the call option will not be exercised, and our option premium income will be $87.5. For example, if Nvidia's stock price rebounds to $110 on August 23, the investor's loss on the underlying stock is $1,000, which means that the final loss is $912.5 ($1,000 - $87.5). If the stock price breaks through $120 due to unexpected bullish news, then your call option will be exercised and you will recover the previously invested capital.

If the stock price continues to consolidate, we can continue to carry out similar protective call option trading, and the accumulated option premiums will offset some investment losses. For example, conducting a protective call option trading each month with a premium of $87 ...

Translated

7

GeiGei

Set a live reminder

Follow Stephen “Sarge” Guilfoyle on moomoo

Dear mooers,

![]() As we venture deeper into the investment landscape, Sarge is geared up to join us for another enlightening live-streaming event. This session is dedicated to unraveling the mysteries behind the powerful "13F filings" and how understanding them can transform your investment strategy.

As we venture deeper into the investment landscape, Sarge is geared up to join us for another enlightening live-streaming event. This session is dedicated to unraveling the mysteries behind the powerful "13F filings" and how understanding them can transform your investment strategy.

For individual investors looking to mirror the moves of the market's biggest players, 13Fs are your gateway to the strategies of institution...

Dear mooers,

For individual investors looking to mirror the moves of the market's biggest players, 13Fs are your gateway to the strategies of institution...

Understanding 13Fs

Aug 14 08:00

33

31

GeiGei

liked

Resistance level identified at Fib 0.5 and 0.618 levels

Please trade with proper SL and rational TP levels...

Please trade with proper SL and rational TP levels...

9

2

GeiGei

liked

$Walmart (WMT.US)$

Idk why I didn't think of this before but highly possible stock price sideways in anticipation of earnings.

Idk why I didn't think of this before but highly possible stock price sideways in anticipation of earnings.

1

GeiGei

liked

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)