All matured mainstream tech stocks are always overvalued. When someone buys into tech they are buying into its future potential. That includes its future stock value. It is extremely overbought during its initial IPO inception into the stock market destined to never again reach a true value status based on 'hope hype' wrapped around the 'you never know' and existing only through the constant embrace of the potential idea that allows them to drink the 'Kool-Aid' that ...

$Apexigen (APGN.US)$

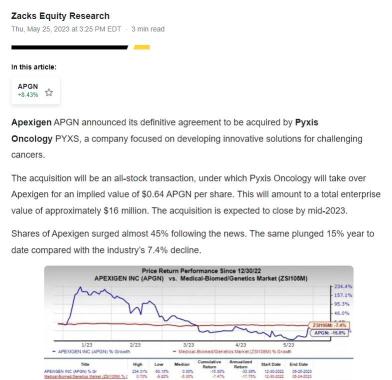

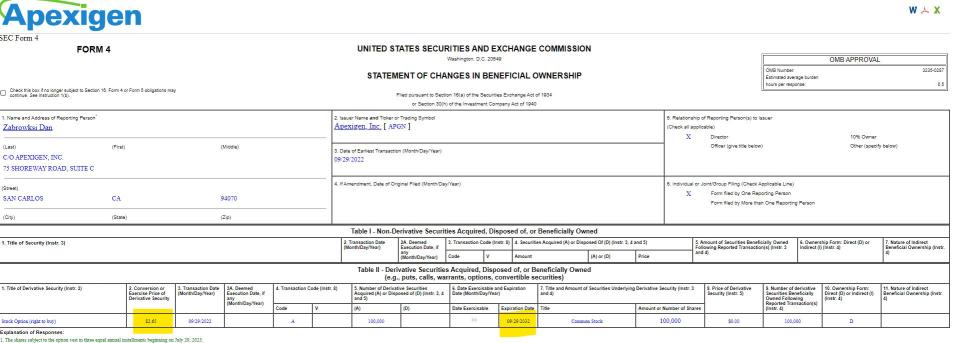

Apexigen will never reach the predicted high of $9.00 before the approximate "Mid-2023" acquisition by Pyxis Oncology (a Pfizer back company). Apexxigen is already laying employee off and those who stay and are deemed essential enough to stay are already siging insentive contracts that will grant them an exercise purchase price of $2.65 per share with an expiration date as far in the future as 2032. In order for this deal to benefit Pyxis Oncology upfront the deal would have ...

Apexigen will never reach the predicted high of $9.00 before the approximate "Mid-2023" acquisition by Pyxis Oncology (a Pfizer back company). Apexxigen is already laying employee off and those who stay and are deemed essential enough to stay are already siging insentive contracts that will grant them an exercise purchase price of $2.65 per share with an expiration date as far in the future as 2032. In order for this deal to benefit Pyxis Oncology upfront the deal would have ...

First choice: The Good Book ☝️😉 (Helps me find my Spiritual moat)

Second choice: The Little Book That Still Beats the Market by Joel Greenblatt (Helps me find good, low priced valued companies with great potential for growdth and strong moat)

Second choice: The Little Book That Still Beats the Market by Joel Greenblatt (Helps me find good, low priced valued companies with great potential for growdth and strong moat)

$Verb Technology (VERB.US)$ Limit Order @ 0.58. Don't like chasing. Patience is my friend.

16

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)