got the heart

liked

6

got the heart

liked

$Direxion Daily AMZN Bull 2X Shares (AMZU.US)$ this morning Trump threw down the gauntlet and it shows he's not taking any shit from anyone that he is going to rock the world change the system so that America is set up to win. the country not individuals specifically.

Canada Mexico we're told day one 25% tariffs on anything that they're planning on importing into the United States because why drugs borders must be secured and if you're going to permit drugs to be trafficked through and illegal a...

Canada Mexico we're told day one 25% tariffs on anything that they're planning on importing into the United States because why drugs borders must be secured and if you're going to permit drugs to be trafficked through and illegal a...

10

got the heart

liked

Hello everyone! Today I would like to talk to you about the recent trend of Bitcoin. I just saw that the price of Bitcoin dropped to $96,256, failing to break through the psychological barrier of $100,000, which surprised me. In fact, such fluctuations are not uncommon in the crypto market, but each time it makes me think deeply.

Why did Bitcoin drop again?

1. The pressure of the high point

On November 22, bitcoin briefly climbed to $99,645, almost reaching the milestone of $100,000. Since November 5, this wave of increase has been as high as 44%! However, with the change in market sentiment, the price has started to fall, leading to over $60 billion market cap evaporating. It makes me wonder, is the market sentiment really so fragile?

2. The Impact of Large-Scale Liquidation

According to the latest data, in the past 24 hours, there have been over $0.5 billion liquidations in the crypto market. This has affected nearly 0.2 million traders, with long liquidations accounting for a large portion. This situation reminds me of previous market crashes, which always feel frustrating.

3. Impact of external factors

The tense situation in the Mediterranean region has prompted investors to turn to traditional safe-haven assets, which makes me reflect on how we, as supporters of cryptocurrency, should respond to changes in the external environment. At the same time, the strong US job market and interest rate adjustments are making the market more complex, all of which are influencing our investment decisions.

Technical analysis and future outlook

From a technical analysis perspective, the current TD sequential...

Why did Bitcoin drop again?

1. The pressure of the high point

On November 22, bitcoin briefly climbed to $99,645, almost reaching the milestone of $100,000. Since November 5, this wave of increase has been as high as 44%! However, with the change in market sentiment, the price has started to fall, leading to over $60 billion market cap evaporating. It makes me wonder, is the market sentiment really so fragile?

2. The Impact of Large-Scale Liquidation

According to the latest data, in the past 24 hours, there have been over $0.5 billion liquidations in the crypto market. This has affected nearly 0.2 million traders, with long liquidations accounting for a large portion. This situation reminds me of previous market crashes, which always feel frustrating.

3. Impact of external factors

The tense situation in the Mediterranean region has prompted investors to turn to traditional safe-haven assets, which makes me reflect on how we, as supporters of cryptocurrency, should respond to changes in the external environment. At the same time, the strong US job market and interest rate adjustments are making the market more complex, all of which are influencing our investment decisions.

Technical analysis and future outlook

From a technical analysis perspective, the current TD sequential...

Translated

10

3

got the heart

liked

Weekly Performance Checkpoint

【SRT】

$CSOP S-REITs INDEX ETF (SRT.SG)$ ’s losses were led by industrial, office and retail subsectors, as well as CICT, FLT and CLINT by individual REITs. FLT fell after being cut to underweight at JPM.

【MMF】

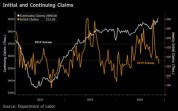

Swap market pricing less than 50% chance of a Fed rate cut in December. We expect $CSOP USD Money Market Fund (SGXZ96797238.MF)$ to continue to deliver stable yield in the near term. As of...

【SRT】

$CSOP S-REITs INDEX ETF (SRT.SG)$ ’s losses were led by industrial, office and retail subsectors, as well as CICT, FLT and CLINT by individual REITs. FLT fell after being cut to underweight at JPM.

【MMF】

Swap market pricing less than 50% chance of a Fed rate cut in December. We expect $CSOP USD Money Market Fund (SGXZ96797238.MF)$ to continue to deliver stable yield in the near term. As of...

19

1

got the heart

liked

$Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$ $VanEck Fabless Semiconductor ETF (SMHX.US)$

soxl may be getting bottom. if you think so and plan to buy consider smhx. reason is avoid the volatility decay rebalancing expense ratio/management fee. this is the type of thing you need to think about staging your positions and strategies. if you want to swing or day trade then soxl. remember this could put you into a higher tax bracket. smhx may go up and go sideways but isn't going to tank ...

soxl may be getting bottom. if you think so and plan to buy consider smhx. reason is avoid the volatility decay rebalancing expense ratio/management fee. this is the type of thing you need to think about staging your positions and strategies. if you want to swing or day trade then soxl. remember this could put you into a higher tax bracket. smhx may go up and go sideways but isn't going to tank ...

6

3

got the heart

liked

$Futu Holdings Ltd (FUTU.US)$ It's so undervalued - but whatever I just know it will go up, going to increase my position more

7

got the heart

liked

Fundamental Overview

– Despite the USD index trading stronger close to the 107.0 level, the ringgit appreciated slightly, trading within the 4.46-4.48 range against the USD. This resilience may partly reflect FX intervention and the repatriation of overseas funds. However, the negative yield differential between the 10-year MGS and UST widened to -60.0 bps, compared to -37.0 bps a month ago...

– Despite the USD index trading stronger close to the 107.0 level, the ringgit appreciated slightly, trading within the 4.46-4.48 range against the USD. This resilience may partly reflect FX intervention and the repatriation of overseas funds. However, the negative yield differential between the 10-year MGS and UST widened to -60.0 bps, compared to -37.0 bps a month ago...

15

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)