Gululu

commented on

You may notice that global chips supplement has been facing a serious problem in recent months. News about chips kept popping up, indicating how these companies are desperate for semiconductors. There just aren't enough of them to meet industry demand, many popular products like cars, PC, and smartphones, etc. are in short supply. However, The crisis could be a great opportunity for another industry, brought out hope to thrive.

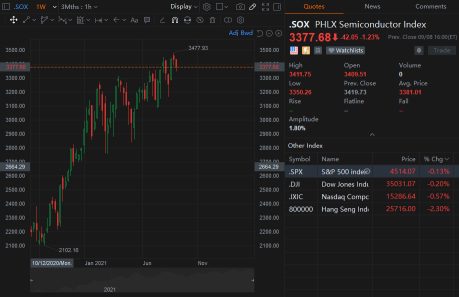

Since the market crash of March 2020, the benchmark Philadelphia Semiconductor Index $PHLX Semiconductor Index (.SOX.US)$ has surged more than 180%.

Some of the largest chip-makers, like $NVIDIA (NVDA.US)$ and $Advanced Micro Devices (AMD.US)$ also produced impressive returns that swelled their market capitalizations. $Taiwan Semiconductor (TSM.US)$ the world’s most advanced manufacturer of semiconductors, expects sales to rise more than 20% in 2021. The company, which also supplies chips to $Apple (AAPL.US)$ and a key partner to many of the world’s biggest car-makers.

Let's take a quick look at all related stocks, you will soon understand the current situation.

The supply side is facing capacity problem

First, the supply side are facing capacity problem. However, these chips makers are also making great benefit through it. They also took plenty of actions in order to solve the shortage problems.

Since 2020, $Advanced Micro Devices (AMD.US)$ has surged 110%

Since 2020, $NVIDIA (NVDA.US)$ has surged 290%

Since 2020, $Taiwan Semiconductor (TSM.US)$ has surged 130%

Since 2020, $Qualcomm (QCOM.US)$ has surged 57%

The rising demand

Let's see all the sectors that are strongly connected with semiconductors industy, what change their demand for chips?

Traditional car makers keep showing the unfulfilled demand for chips.

Ford limits production at multiple factories through July due to semiconductor shortages

EV(Electric Vehicle) brands like $Tesla (TSLA.US)$ , also posponed their product shipment schedule.

Tesla's China output halted for days in August on chip shortage

Smart phone: the rise of 5G brings more demand for advance semiconductors, and the shortage leads to higher price.

Global chip shortage could make Apple products even more expensive

PC: Pandemic last year encourage people to stay home, thus push up the demand of PC. Supply get insufficient relatively.

Worsening chip shortage will apparently limit supply of Windows 11 compatible PCs and laptops

How to invest semiconductor stocks?

The semiconductor industry is a typical cyclical industry that:

1. Sensitive to microeconomic & business cycle

2. Price fluctuate over certain periods, depending on supply & demand

3. Profitable during periods of prosperity and inactive during downturns

For example, The global economic recovery leads to strong demand for chips, while the pandemic continues to suppress the supply, resulting in a chip shortage phenomenon. As major companies keep hiking chip prices up, the semiconductor industry had entered a booming stage since the beginning of 2021.Overall, buying and selling cyclical stocks is about timing: buy at the rock bottom and sell at the peak.

Where does semiconductor industry stand and in which direction will it go?

As the stock price keeps breaking record highs, the market has recently become increasingly concerned that the semiconductor industry may have reached its peak. In August, Morgan Stanley issued a bearish global semiconductor industry report, which states that the chip industry is entering the late stage of the cycle. As the demand side starts to pull back and the supply side gradually increases, the semiconductor industry may reach its turning point in 2022.

On the contrary, many star institutions keep optimistic about the semiconductor industry. According to Credit Suisse, the peak of the rally will not appear until the second half of 2022 or 2023. Continued strong demand for technology products and the shortage of the chip supply tend to drive up the stock prices of semiconductor companies.

Global Top15 List

ICInsights, a leading semiconductor analyst firm, has released its Q3 revenue growth forecast for the world's leading semiconductor companies. In Q3, most of the companies are expected to achieve sales growth, with $Apple (AAPL.US)$ , $Qualcomm (QCOM.US)$ , $Taiwan Semiconductor (TSM.US)$ , Kioxia up by more than 10%, $Intel (INTC.US)$drop by 3%.

How to invest in semiconductor stocks? Which stocks should we add to the watchlist? Is now a good time to buy?

Rewards:

Click "Enter Now" to post before Sep 17, and based on the quality and originality,

5 mooers will win 2,000 points

10 mooers will win 1,000 points

Don't forget to click "Enter Now" to win!

You May Also Like:

Nvidia, AMD Benefit From New Products, Strong Gaming Cycle: BofA

Nvidia is up 71% this year, but Jefferies sees even more gains

Taiwan Semiconductor On Pace for Longest Winning Streak Since June 2020 -- Data Talk

Qualcomm Agrees To Work With Europe's Foundry Partners

Since the market crash of March 2020, the benchmark Philadelphia Semiconductor Index $PHLX Semiconductor Index (.SOX.US)$ has surged more than 180%.

Some of the largest chip-makers, like $NVIDIA (NVDA.US)$ and $Advanced Micro Devices (AMD.US)$ also produced impressive returns that swelled their market capitalizations. $Taiwan Semiconductor (TSM.US)$ the world’s most advanced manufacturer of semiconductors, expects sales to rise more than 20% in 2021. The company, which also supplies chips to $Apple (AAPL.US)$ and a key partner to many of the world’s biggest car-makers.

Let's take a quick look at all related stocks, you will soon understand the current situation.

The supply side is facing capacity problem

First, the supply side are facing capacity problem. However, these chips makers are also making great benefit through it. They also took plenty of actions in order to solve the shortage problems.

Since 2020, $Advanced Micro Devices (AMD.US)$ has surged 110%

Since 2020, $NVIDIA (NVDA.US)$ has surged 290%

Since 2020, $Taiwan Semiconductor (TSM.US)$ has surged 130%

Since 2020, $Qualcomm (QCOM.US)$ has surged 57%

The rising demand

Let's see all the sectors that are strongly connected with semiconductors industy, what change their demand for chips?

Traditional car makers keep showing the unfulfilled demand for chips.

Ford limits production at multiple factories through July due to semiconductor shortages

EV(Electric Vehicle) brands like $Tesla (TSLA.US)$ , also posponed their product shipment schedule.

Tesla's China output halted for days in August on chip shortage

Smart phone: the rise of 5G brings more demand for advance semiconductors, and the shortage leads to higher price.

Global chip shortage could make Apple products even more expensive

PC: Pandemic last year encourage people to stay home, thus push up the demand of PC. Supply get insufficient relatively.

Worsening chip shortage will apparently limit supply of Windows 11 compatible PCs and laptops

How to invest semiconductor stocks?

The semiconductor industry is a typical cyclical industry that:

1. Sensitive to microeconomic & business cycle

2. Price fluctuate over certain periods, depending on supply & demand

3. Profitable during periods of prosperity and inactive during downturns

For example, The global economic recovery leads to strong demand for chips, while the pandemic continues to suppress the supply, resulting in a chip shortage phenomenon. As major companies keep hiking chip prices up, the semiconductor industry had entered a booming stage since the beginning of 2021.Overall, buying and selling cyclical stocks is about timing: buy at the rock bottom and sell at the peak.

Where does semiconductor industry stand and in which direction will it go?

As the stock price keeps breaking record highs, the market has recently become increasingly concerned that the semiconductor industry may have reached its peak. In August, Morgan Stanley issued a bearish global semiconductor industry report, which states that the chip industry is entering the late stage of the cycle. As the demand side starts to pull back and the supply side gradually increases, the semiconductor industry may reach its turning point in 2022.

On the contrary, many star institutions keep optimistic about the semiconductor industry. According to Credit Suisse, the peak of the rally will not appear until the second half of 2022 or 2023. Continued strong demand for technology products and the shortage of the chip supply tend to drive up the stock prices of semiconductor companies.

Global Top15 List

ICInsights, a leading semiconductor analyst firm, has released its Q3 revenue growth forecast for the world's leading semiconductor companies. In Q3, most of the companies are expected to achieve sales growth, with $Apple (AAPL.US)$ , $Qualcomm (QCOM.US)$ , $Taiwan Semiconductor (TSM.US)$ , Kioxia up by more than 10%, $Intel (INTC.US)$drop by 3%.

How to invest in semiconductor stocks? Which stocks should we add to the watchlist? Is now a good time to buy?

Rewards:

Click "Enter Now" to post before Sep 17, and based on the quality and originality,

5 mooers will win 2,000 points

10 mooers will win 1,000 points

Don't forget to click "Enter Now" to win!

You May Also Like:

Nvidia, AMD Benefit From New Products, Strong Gaming Cycle: BofA

Nvidia is up 71% this year, but Jefferies sees even more gains

Taiwan Semiconductor On Pace for Longest Winning Streak Since June 2020 -- Data Talk

Qualcomm Agrees To Work With Europe's Foundry Partners

+2

52

10

51

Gululu

liked

$NIO Inc (NIO.US)$ Dropping.... Dropping...

Translated

2

1

Gululu

liked

Gululu

commented on

$Petco Health and Wellness (WOOF.US)$ Get out of the market! Walk away!

Translated

3

38

Gululu

liked

1

1

Gululu

liked

$AMC Entertainment (AMC.US)$

buy in at 7.7 or no been waiting on a drop to buy in but isn't happening lol.

buy in at 7.7 or no been waiting on a drop to buy in but isn't happening lol.

4

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

Gululu PD White : bu