HannoSolo

voted

Which EV would you rather buy?

$Lucid Group (LCID.US)$ $NIO Inc (NIO.US)$ $Tesla (TSLA.US)$ $Rivian Automotive (RIVN.US)$

$Lucid Group (LCID.US)$ $NIO Inc (NIO.US)$ $Tesla (TSLA.US)$ $Rivian Automotive (RIVN.US)$

1

2

HannoSolo

voted

Shares of Chinese electric vehicle (EV) maker Li Auto have more than doubled from last year’s low and are tipped for further gains even as a slowing economy and price war hamper its rivals.

The automaker unexpectedly reported profits for the past two quarters by churning out a regular lineup of new models and keeping costs contained. Analysts remain bullish: $Citigroup (C.US)$ predicts the firm’s shares will climb another 88 per cent by year...

The automaker unexpectedly reported profits for the past two quarters by churning out a regular lineup of new models and keeping costs contained. Analysts remain bullish: $Citigroup (C.US)$ predicts the firm’s shares will climb another 88 per cent by year...

7

4

1

HannoSolo

voted

$PDD Holdings (PDD.US)$ $Alibaba (BABA.US)$ $NIO Inc (NIO.US)$ $XPeng (XPEV.US)$ $JD.com (JD.US)$ $Futu Holdings Ltd (FUTU.US)$ China stopping outflow of capital to buy US stocks.... could this mean more money is pumping on China stocks? Could Alibaba, JD, Nio, Xpeng, Li whom are China ADR benefit from the capital shift? China's ADR stock blooming and pull the US ADR along. What do you think?

1

7

HannoSolo

voted

What is the best startup electric car company after $Lucid Group (LCID.US)$ ?

$NIO Inc (NIO.US)$ $Rivian Automotive (RIVN.US)$ $XPeng (XPEV.US)$ $Polestar Automotive (PSNY.US)$

$NIO Inc (NIO.US)$ $Rivian Automotive (RIVN.US)$ $XPeng (XPEV.US)$ $Polestar Automotive (PSNY.US)$

1

2

HannoSolo

voted

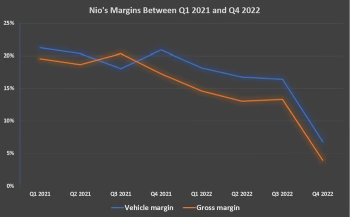

[Rewards] NIO Q4 sales were up, while gross margin contracted and losses widening

Claim your Earnings Season offer by winning Rewards Points and discovering Investment Opportunities!

KEY Figures:

● NIO Q4 total revenues were $2,329.0 million, representing an increase of 62.2% YoY (year-over-year).

● The vehicle deliveries were 40,052 in Q4, up 60% YoY. The total deliveries were 122,486 in 2022, representing an increase of 34.0% from 2021.

● Excluding share-based ...

Claim your Earnings Season offer by winning Rewards Points and discovering Investment Opportunities!

KEY Figures:

● NIO Q4 total revenues were $2,329.0 million, representing an increase of 62.2% YoY (year-over-year).

● The vehicle deliveries were 40,052 in Q4, up 60% YoY. The total deliveries were 122,486 in 2022, representing an increase of 34.0% from 2021.

● Excluding share-based ...

45

42

3

HannoSolo

voted

For the first time in more than a year, owners of traditional gas-powered cars saved more money at the pump than those driving their electric counterparts, according to a consulting firm.

As inflated gas prices came down at the end of last years, the fuel cost for most Internal Combustion Engine (ICE) vehicles was comparatively cheaper in the final quarter of 2022 than charging an electric vehicle (EV),...

As inflated gas prices came down at the end of last years, the fuel cost for most Internal Combustion Engine (ICE) vehicles was comparatively cheaper in the final quarter of 2022 than charging an electric vehicle (EV),...

10

3

1

HannoSolo

voted

Spoiler:

![]() At the end of this post, there is a chance for you to win points!

At the end of this post, there is a chance for you to win points!

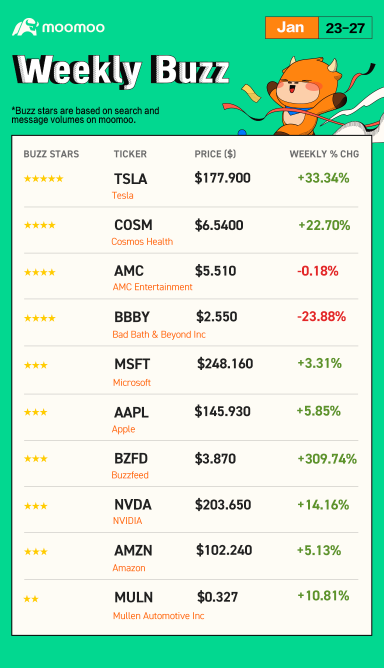

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on the moomoo platform based on search and message volumes of last week (Nano caps are excluded).

Make Your Choices

Buzzing Stocks List & Mooers Comments

It was one of the best weeks for US equity investors as all the major indices ended ...

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on the moomoo platform based on search and message volumes of last week (Nano caps are excluded).

Make Your Choices

Buzzing Stocks List & Mooers Comments

It was one of the best weeks for US equity investors as all the major indices ended ...

+3

59

52

20

HannoSolo

voted

No position in either company - but what company is most likely to 10x in the next few years?

$Tesla (TSLA.US)$: $388B to $3.88T

$Lucid Group (LCID.US)$ : $13B to $133B

Also, $LCID is sitting at a $13B market cap after producing 7K cars and it has a 34K backlog not including the 100K order to the Saudis.

$Tesla (TSLA.US)$ $Lucid Group (LCID.US)$

$Tesla (TSLA.US)$: $388B to $3.88T

$Lucid Group (LCID.US)$ : $13B to $133B

Also, $LCID is sitting at a $13B market cap after producing 7K cars and it has a 34K backlog not including the 100K order to the Saudis.

$Tesla (TSLA.US)$ $Lucid Group (LCID.US)$

1

1

HannoSolo

voted

Spoiler:

At the end of this post, there is a chance for you to win points!

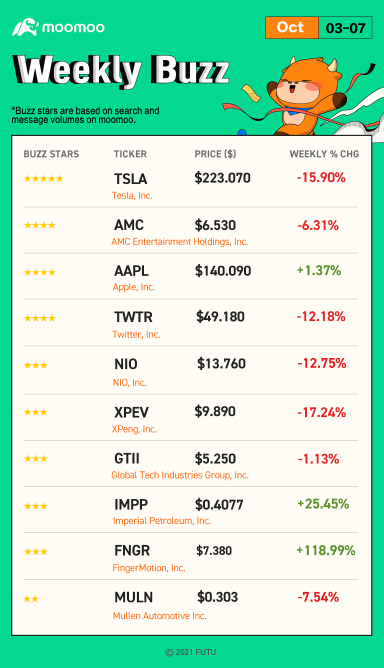

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Make Your Choices

Buzzing Stocks List & Mooers Comments

Although the US market had one of the best starts in recent times, it gave away most...

At the end of this post, there is a chance for you to win points!

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Make Your Choices

Buzzing Stocks List & Mooers Comments

Although the US market had one of the best starts in recent times, it gave away most...

42

56

18

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)