happy Puppy

liked

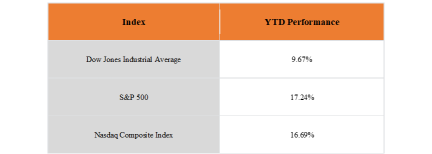

The market has been closely monitoring Nvidia's earnings, with hopes of a positive impact on the tech-heavy $Nasdaq Composite Index (.IXIC.US)$. In contrast, the $Dow Jones Industrial Average (.DJI.US)$, which is more focused on industrial sectors, hit a new record high during intraday trading on August 29, 2024.

Year-to-date, the DJI index has gained about 9.67% as of the closing price on August 29. While this may seem like a decent return, it's...

Year-to-date, the DJI index has gained about 9.67% as of the closing price on August 29. While this may seem like a decent return, it's...

+1

38

6

45

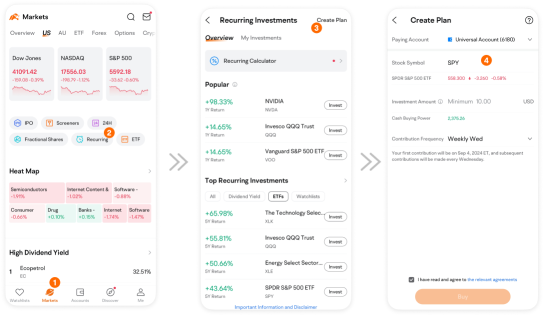

Investing is a long term business. First you need to know how long you going to be in this business. To setup this business, you need to have capital and you need to use your capital wisely.

Let say you have $10,000 and what you want to own? Allocate 3-5 stocks and you do not need to buy all at one time. Why? You need to look for good stock and undervalue ones. Is there any now?

There are still good and undervalue stocks. One example is GOOGL, Morningstar fair value is $154....

Let say you have $10,000 and what you want to own? Allocate 3-5 stocks and you do not need to buy all at one time. Why? You need to look for good stock and undervalue ones. Is there any now?

There are still good and undervalue stocks. One example is GOOGL, Morningstar fair value is $154....

happy Puppy

voted

66 points for all mooers who vote for this!

COP26, UN's annual climate change conference has just concluded. The conference once again put spotlights on Environmental, Social & Governance (ESG), a hot trend in investing.

Finding companies with strong stocks and growth needn't be a trade-off with environmental, social and governance values. Companies like $Microsoft (MSFT.US)$ , $NVIDIA (NVDA.US)$ , $Salesforce (CRM.US)$ etc. mix profitability with ethical and social responsibility.

What’s your opinion on ESG?

Do you think ESG stocks have growth potential?

COP26, UN's annual climate change conference has just concluded. The conference once again put spotlights on Environmental, Social & Governance (ESG), a hot trend in investing.

Finding companies with strong stocks and growth needn't be a trade-off with environmental, social and governance values. Companies like $Microsoft (MSFT.US)$ , $NVIDIA (NVDA.US)$ , $Salesforce (CRM.US)$ etc. mix profitability with ethical and social responsibility.

What’s your opinion on ESG?

Do you think ESG stocks have growth potential?

48

10

6

happy Puppy

liked

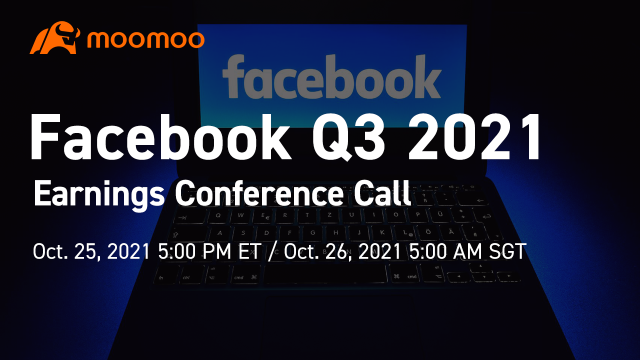

Facebook Q3 2021 Earnings Conference Call is scheduled on Oct 25 at 5:00 PM ET / Oct 26 at 5:00 AM SGT. Subscribe to join the live earnings conference. $Meta Platforms (FB.US)$

Revenue and Net Income

Under the previous Income Statement, FB's Q2 2021 revenue was USD 29.08 billion, up 55.60% YoY. The net Income of FB in Q2 was USD 10.39 billion, showing a positive trend of growth.

Earnings Preview

The Financial Estimates show that 39 analysts have made an average estimate of USD 29.58 billion in Q3 revenue. 39 analysts estimated that FB's Q3 EPS is USD 3.19.

...

Revenue and Net Income

Under the previous Income Statement, FB's Q2 2021 revenue was USD 29.08 billion, up 55.60% YoY. The net Income of FB in Q2 was USD 10.39 billion, showing a positive trend of growth.

Earnings Preview

The Financial Estimates show that 39 analysts have made an average estimate of USD 29.58 billion in Q3 revenue. 39 analysts estimated that FB's Q3 EPS is USD 3.19.

...

Facebook Q3 2021 Earnings Conference Call

Oct 26 05:00

17

5

happy Puppy

liked

Hey mooers![]()

![]()

![]() Happy Friday! Weekly Sectors Fund Flow Board is here~ I got lots of positive feedback from the last post, and I hope this board could help you guys get more insight into the market

Happy Friday! Weekly Sectors Fund Flow Board is here~ I got lots of positive feedback from the last post, and I hope this board could help you guys get more insight into the market![]()

![]()

From this chart, you will be able to find out what sector ETFs have most fund inflow. Fund inflow is often considered as a bullish sign of the sector and related ETFs!

^Weekly Sectors Fund Flow Board: a sector ranking based on sector ETFs aggregate 3-month fund flows.

^3-month fund flows: a metric that can be used to gauge the perceived popularity amongst investors of different sectors.

^The board includes the following information: change of rankings, 3-month fund flows, how many ETFs are in the sectors, and the related ETFs.

For this week, I covered the top two YTD sector-related ETFs (non-leveraged)! Now, let's take a look at the board~You may find something to diversify your porfolio![]()

![]()

* Follow me to know what is hot on the market![]()

![]()

![]()

*I am collecting feedbacks on the board above.![]()

How do you think about this board? Please leave your comments and![]() thumbs up

thumbs up![]() below!

below!

Latest News of Top Sectors:

Last week, Tech, REITs, and Utilities were the top 3 sectors with fund inflows. This week we have Tech, REITs, and FIN as the top 3 sectors with the most 3-month fund inflows.

*Techonology

Tech up after mixed earnings reports

The sector looked set to slide Friday after Intel indicated that the global chip shortage was taking a toll on sales growth potential.

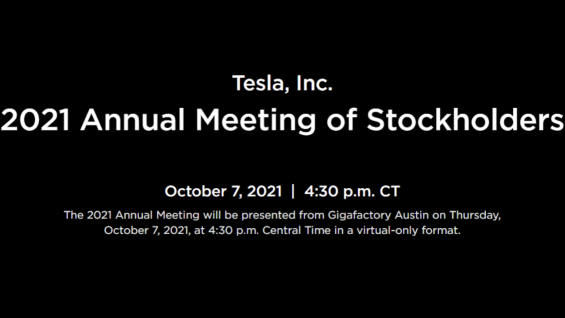

$Tesla (TSLA.US)$shares rallied, testing all-time highs after the electric-car maker posted a robust quarterly profit and said issues with chip supply chains were not affecting its production schedule. $WeWork (WE.US)$shares rose on their first day of trading, capping a journey to a listing that included the implosion of its initial public offering in 2019, and ended with the launch of SPAC $BowX Acquisition Corp (BOWX.US)$. Investors piled into shares of the SPAC taking former President Donald Trump's new social-media platform public. The value of $Digital World Acquisition Corp (DWAC.US)$quadrupled during Thursday's trading session.

*Real Estate

U.S. home sales jumped 7% in September

U.S. home sales surged in September with their strongest showing since January, ending a monthslong stretch when housing market activity slowed from its frenzied pace and high prices crowded out many buyers. Overall, existing-home sales rose 7% in September from the prior month to a seasonally adjusted annual rate of 6.29 million, the National Association of Realtors said Thursday.

*Financials

Financials up with treasury yields

Shares of banks and other financial institutions rose alongside Treasury yields. The yield on the two-year Treasury closed at the highest level in more than a year, while the yield on the 10-year Treasury note closed at the highest since May.

Source: Dow Jones Newswires

$Amplify Transformational Data Sharing ETF (BLOK.US)$ $Nuveen Short-Term Reit Etf (NURE.US)$ $First Trust Exchange-Traded Fund VI First Trust Nasdaq Bank ETF (FTXO.US)$

From this chart, you will be able to find out what sector ETFs have most fund inflow. Fund inflow is often considered as a bullish sign of the sector and related ETFs!

^Weekly Sectors Fund Flow Board: a sector ranking based on sector ETFs aggregate 3-month fund flows.

^3-month fund flows: a metric that can be used to gauge the perceived popularity amongst investors of different sectors.

^The board includes the following information: change of rankings, 3-month fund flows, how many ETFs are in the sectors, and the related ETFs.

For this week, I covered the top two YTD sector-related ETFs (non-leveraged)! Now, let's take a look at the board~You may find something to diversify your porfolio

* Follow me to know what is hot on the market

*I am collecting feedbacks on the board above.

How do you think about this board? Please leave your comments and

Latest News of Top Sectors:

Last week, Tech, REITs, and Utilities were the top 3 sectors with fund inflows. This week we have Tech, REITs, and FIN as the top 3 sectors with the most 3-month fund inflows.

*Techonology

Tech up after mixed earnings reports

The sector looked set to slide Friday after Intel indicated that the global chip shortage was taking a toll on sales growth potential.

$Tesla (TSLA.US)$shares rallied, testing all-time highs after the electric-car maker posted a robust quarterly profit and said issues with chip supply chains were not affecting its production schedule. $WeWork (WE.US)$shares rose on their first day of trading, capping a journey to a listing that included the implosion of its initial public offering in 2019, and ended with the launch of SPAC $BowX Acquisition Corp (BOWX.US)$. Investors piled into shares of the SPAC taking former President Donald Trump's new social-media platform public. The value of $Digital World Acquisition Corp (DWAC.US)$quadrupled during Thursday's trading session.

*Real Estate

U.S. home sales jumped 7% in September

U.S. home sales surged in September with their strongest showing since January, ending a monthslong stretch when housing market activity slowed from its frenzied pace and high prices crowded out many buyers. Overall, existing-home sales rose 7% in September from the prior month to a seasonally adjusted annual rate of 6.29 million, the National Association of Realtors said Thursday.

*Financials

Financials up with treasury yields

Shares of banks and other financial institutions rose alongside Treasury yields. The yield on the two-year Treasury closed at the highest level in more than a year, while the yield on the 10-year Treasury note closed at the highest since May.

Source: Dow Jones Newswires

$Amplify Transformational Data Sharing ETF (BLOK.US)$ $Nuveen Short-Term Reit Etf (NURE.US)$ $First Trust Exchange-Traded Fund VI First Trust Nasdaq Bank ETF (FTXO.US)$

77

6

31

happy Puppy

liked

My beginner's luck with my first trading of US stocks on moomoo started with the free $Apple (AAPL.US)$ share that I have received from joining the innovative and interactive trading platform. As Roman philosopher Seneca once put it "Luck is a matter of preparation opportunity meeting." I must say my luck was activated when I chanced upon the advertisement of $Futu Holdings Ltd (FUTU.US)$ moomoo on the MRT station, which got me curious to try to find out more about this online investment brokerage as I was enticed by the cute sounding name that reminds me of a nursery rhyme and the striking cow mascot that resonates well with a bullish market. The very catchy name and auspicious looking mascot certainly got me intrigued to seek more about moomoo. I eventually decided to open the moomoo account with an initial deposit after having succumbed to the temptation of the free $Apple (AAPL.US)$ share, which was not necessary a bad thing after all. This started my investing journey of US stocks on the moomoo platform. Luck does play a role in investing that is often misunderstood and unappreciated by many. Even the success story of the legendary investor, Warren Buffett hints that other than skill, foresight and discipline, luck has been an instrumental factor in building his long term wealth. The free $Apple (AAPL.US)$ share from moomoo not only led me to learn more about the world's most valuable company and how it is the largest holding of Warren Buffett's portfolio, but more importantly to discover about the value investing model favoured by Buffett himself. Inspired by his success story and wisdom, I began to use the Dollar Cost Averaging strategy to buy more of $Apple (AAPL.US)$ shares which has since become my largest stock holding and subsequently added other fundamentally strong counters $Alibaba (BABA.US)$, $Bank of America (BAC.US)$, $Microsoft (MSFT.US)$, $NVIDIA (NVDA.US)$ to build up a long term stock portfolio for myself, with the investment goal of achieving long term gains. While investing certainly requires lots of skill and patience, luck can often be a triump card. Joining moomoo to start trading on US stocks may be the one lucky event that gets me embarked on my investment journey on a new trading platform. It makes me realise that luck plays an important role in investing and in life. Indeed, life is full of luck, even when we just cannot see it. In investing, there is no one single approach that will always render a successful outcome. Other than lots of skill, discipline and patience, I must add that lots of luck will also be needed for successful investing. While pop singer, Kylie Minogue has years ago sung about how she should be so lucky in love, I am still secretly hoping how I should be so lucky in investing!

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

56

70

10

$Yum! Brands (YUM.US)$ The price looks good for the business and seem undervalue.

2

happy Puppy

commented on

TSM Q3 2021 Earnings Conference Call is scheduled on Oct 14 at 2:00 AM ET / at 14:00 PM SGT. Subscribe to join the live earnings conference.

Revenue and Net Income

Under the previous Income Statement, TSM's Q2 FY22 revenue was TWD 372.11 billion (USD 13.29 billion), up 19.8% YoY, and its net income in Q2 was TWD 134.48 billion (USD 4.78 billion).

Earnings Preview

The Financial Estimates show that 5 analysts have made an average estimate of USD 14.824B in Q3 revenue. And 4 analysts estimated that TSM's Q3 EPS is USD 1.038....

Revenue and Net Income

Under the previous Income Statement, TSM's Q2 FY22 revenue was TWD 372.11 billion (USD 13.29 billion), up 19.8% YoY, and its net income in Q2 was TWD 134.48 billion (USD 4.78 billion).

Earnings Preview

The Financial Estimates show that 5 analysts have made an average estimate of USD 14.824B in Q3 revenue. And 4 analysts estimated that TSM's Q3 EPS is USD 1.038....

TSM Q3 2021 Earnings Conference Call

Oct 14 14:00

20

8

21

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)