2024 can be considered a big year for contracts, with MCM contracts being issued one after another in Datacenter, government Infrastructure, and national Oil & Gas fields. Many companies' contracts have thus reached historic highs, but the construction sector is happy, while the stock prices of the Oil & Gas sector are sad.

This film will follow up with everyone about the 8 companies breaking historical record highs in contracts.

$GAMUDA (5398.MY)$ $DAYANG (5141.MY)$ $UZMA (7250.MY)$ $SLVEST (0215.MY)$ $MNHLDG (0245.MY)$

This film will follow up with everyone about the 8 companies breaking historical record highs in contracts.

$GAMUDA (5398.MY)$ $DAYANG (5141.MY)$ $UZMA (7250.MY)$ $SLVEST (0215.MY)$ $MNHLDG (0245.MY)$

Translated

From YouTube

3

1

The technology sector in Malaysia has been in a downturn for 3 years. Will 2025 finally bring a turning point? Which companies have seen the light, which companies have seized the dividends of AI? Which are the richest companies? Keep reading to find out!

$INARI (0166.MY)$ $MPI (3867.MY)$ $PENTA (7160.MY)$ $FRONTKN (0128.MY)$ $GREATEC (0208.MY)$ $MI (5286.MY)$ $KESM (9334.MY)$

$INARI (0166.MY)$ $MPI (3867.MY)$ $PENTA (7160.MY)$ $FRONTKN (0128.MY)$ $GREATEC (0208.MY)$ $MI (5286.MY)$ $KESM (9334.MY)$

Translated

From YouTube

10

2

5

QL has been listed on the Malaysian stock market for 24 years, maintaining the myth of continuous revenue growth. Will it continue to grow under the drive of FamilyMart and BMGREEN in the future?

$QL (7084.MY)$ $BMGREEN (0168.MY)$

$QL (7084.MY)$ $BMGREEN (0168.MY)$

Translated

From YouTube

10

Top 10 profitable Sarawak companies.

Malaysia's Budget2025 hits a new historical high, Sarawak included, with more than two-thirds allocated for development expenses. In addition, this video will also list 10 outstanding performance companies in Sarawak and discuss them one by one.

$SOP (5126.MY)$ $JTIASA (4383.MY)$ $TAANN (5012.MY)$ $DAYANG (5141.MY)$ $PENERGY (5133.MY)$ $HARBOUR (2062.MY)$ $SYGROUP (5173.MY)$ $IBRACO (5084.MY)$ $PANSAR (8419.MY)$ $TAS (5149.MY)$

Malaysia's Budget2025 hits a new historical high, Sarawak included, with more than two-thirds allocated for development expenses. In addition, this video will also list 10 outstanding performance companies in Sarawak and discuss them one by one.

$SOP (5126.MY)$ $JTIASA (4383.MY)$ $TAANN (5012.MY)$ $DAYANG (5141.MY)$ $PENERGY (5133.MY)$ $HARBOUR (2062.MY)$ $SYGROUP (5173.MY)$ $IBRACO (5084.MY)$ $PANSAR (8419.MY)$ $TAS (5149.MY)$

Translated

From YouTube

22

1

2

#familymartmalaysia

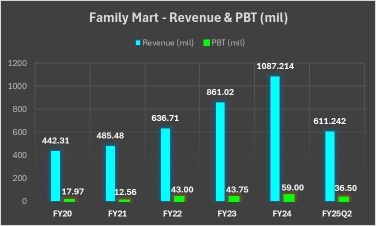

In 2016, QL introduced FamilyMart, and in the following years, the valuation has been steadily increasing, reaching nearly 70 times in 2020. In the next 4 years, it entered the stage of debt repayment, striving to make net income catch up with the valuation.

In October 2020, the stock price once hit a historical high of RM7.20, equivalent to RM4.80 now. After a long effort, QL's annual net income has grown from RM239 million in FY2020 to RM458 million now (TTM over the past 12 months). The valuation has also dropped from a peak of 70 times to around 39 times now.

Over the past 5 years, FamilyMart's profit growth has nearly quadrupled, reaching 16.3% of revenue in 2024, and increasing to 17.5% in the first half of FY25. The convenience store model of FM has entered a mature growth phase, and it is expected that the revenue in the coming years will gradually grow to account for 20% of the company.

In the past few years, QL management has also been actively exploring green energy business in its subsidiary BMGRREE. This will be the growth engine for the next 2 - 3 years. Furthermore, QL's latest market cap ranking is 30th in the Malaysian stock market, and in 6 months, it will face competition from AMBANK, which is currently ranked 28th in market cap.

In today's cash-driven society, QL's corporate spirit and consistent stability over the past 20 years make it a unique presence. I hope it...

In 2016, QL introduced FamilyMart, and in the following years, the valuation has been steadily increasing, reaching nearly 70 times in 2020. In the next 4 years, it entered the stage of debt repayment, striving to make net income catch up with the valuation.

In October 2020, the stock price once hit a historical high of RM7.20, equivalent to RM4.80 now. After a long effort, QL's annual net income has grown from RM239 million in FY2020 to RM458 million now (TTM over the past 12 months). The valuation has also dropped from a peak of 70 times to around 39 times now.

Over the past 5 years, FamilyMart's profit growth has nearly quadrupled, reaching 16.3% of revenue in 2024, and increasing to 17.5% in the first half of FY25. The convenience store model of FM has entered a mature growth phase, and it is expected that the revenue in the coming years will gradually grow to account for 20% of the company.

In the past few years, QL management has also been actively exploring green energy business in its subsidiary BMGRREE. This will be the growth engine for the next 2 - 3 years. Furthermore, QL's latest market cap ranking is 30th in the Malaysian stock market, and in 6 months, it will face competition from AMBANK, which is currently ranked 28th in market cap.

In today's cash-driven society, QL's corporate spirit and consistent stability over the past 20 years make it a unique presence. I hope it...

Translated

26

#Which oil & gas stocks in Malaysia will benefit?

According to The Edge report, insiders share that PETRONAS will distribute RM8 - 10 billion worth of MCM contracts over a 5-year period. It is expected to have 15 - 16 packages, with 6 listed companies expected to secure contracts.

On October 30th, DELEUM has already secured 2 oil & gas MCM contracts, who will be awarded contracts next?

$DELEUM (5132.MY)$

$DAYANG (5141.MY)$

$PENERGY (5133.MY)$

$T7GLOBAL (7228.MY)$

$CARIMIN (5257.MY)$

According to The Edge report, insiders share that PETRONAS will distribute RM8 - 10 billion worth of MCM contracts over a 5-year period. It is expected to have 15 - 16 packages, with 6 listed companies expected to secure contracts.

On October 30th, DELEUM has already secured 2 oil & gas MCM contracts, who will be awarded contracts next?

$DELEUM (5132.MY)$

$DAYANG (5141.MY)$

$PENERGY (5133.MY)$

$T7GLOBAL (7228.MY)$

$CARIMIN (5257.MY)$

Translated

From YouTube

25

2

2

Petros to allocate RM40 billion for capital expenditure over the next five years.

There were previous reports that PETRONAS would be distributing contracts worth RM70-90 billion, and companies awarded these contracts will have $T7GLOBAL (7228.MY)$ $DELEUM (5132.MY)$ $DAYANG (5141.MY)$ $PENERGY (5133.MY)$ $SAPNRG (5218.MY)$ $CARIMIN (5257.MY)$

DELEUM has already been the first to receive two contracts awarded by the national oil company on October 30th, and it is believed that other oil & gas companies will also gradually receive them. Although the margins for the MCM contracts are not high, they are expected to provide consistent income to these oil & gas companies.

PETROS's headquarters are in Sarawak, and there is a high probability that future CAPEX will be awarded to companies in Sarawak. The main oil & gas companies from Sarawak are DAYANG and PENERGY. $KKB (9466.MY)$ There may also be indirect benefits.

To gain a better understanding of the development in Sarawak, everyone can watch the following video for more information.

There were previous reports that PETRONAS would be distributing contracts worth RM70-90 billion, and companies awarded these contracts will have $T7GLOBAL (7228.MY)$ $DELEUM (5132.MY)$ $DAYANG (5141.MY)$ $PENERGY (5133.MY)$ $SAPNRG (5218.MY)$ $CARIMIN (5257.MY)$

DELEUM has already been the first to receive two contracts awarded by the national oil company on October 30th, and it is believed that other oil & gas companies will also gradually receive them. Although the margins for the MCM contracts are not high, they are expected to provide consistent income to these oil & gas companies.

PETROS's headquarters are in Sarawak, and there is a high probability that future CAPEX will be awarded to companies in Sarawak. The main oil & gas companies from Sarawak are DAYANG and PENERGY. $KKB (9466.MY)$ There may also be indirect benefits.

To gain a better understanding of the development in Sarawak, everyone can watch the following video for more information.

Translated

From YouTube

45

10

8

Columns The planting industry is soaring against the wind, with the leading SDG breaking a two-year high.

$SDG (5285.MY)$

#Steady growth is better than rapid growth.

In the past few weeks, sentiment in the Malaysian stock market has been low, and now everyone is focused on the USA presidential election. However, with CPO prices breaking a two-year high, the long-forgotten planting stocks are once again attracting hot money.

In the first half of 2022, the planting industry sector was driven by the Russia-Ukraine war, leading to historically high CPO prices boosting palm oil stocks. Unfortunately, the cycle was very short-lived, rising for two quarters before entering a decline. In 2023, the planting industry sector's profits declined year-on-year, and planting stocks are in a consolidation period.

In the first half of 2024, many high-quality planting stocks have achieved year-on-year profit growth. Combined with Indonesia's declining production capacity due to weather issues, the Indonesian government is promoting B35 diesel while moving towards B40 in 2025.

Global palm oil inventory is at a 3-year low, supported by various factors pushing CPO prices to break through a 2-year high. However, palm oil prices rising too quickly may not be a good thing; when the Malaysian Ringgit rose too fast before, the pullback was severe.

For the planting industry, assuming that the CPO price can stabilize at RM4,500 or above, a gradual rise would be healthier. The planting area in Malaysia is limited to 6.5 million hectares, so increasing production efficiency and enhancing automation to reduce reliance on foreign labor is urgent.

In recent years, palm oil production capacity has reached a bottleneck, while demand for palm oil production capacity is gradually increasing, which is bullish for the palm oil sector. However, various challenges such as eco-friendly issues, minimum wages, fertilizer transportation...

#Steady growth is better than rapid growth.

In the past few weeks, sentiment in the Malaysian stock market has been low, and now everyone is focused on the USA presidential election. However, with CPO prices breaking a two-year high, the long-forgotten planting stocks are once again attracting hot money.

In the first half of 2022, the planting industry sector was driven by the Russia-Ukraine war, leading to historically high CPO prices boosting palm oil stocks. Unfortunately, the cycle was very short-lived, rising for two quarters before entering a decline. In 2023, the planting industry sector's profits declined year-on-year, and planting stocks are in a consolidation period.

In the first half of 2024, many high-quality planting stocks have achieved year-on-year profit growth. Combined with Indonesia's declining production capacity due to weather issues, the Indonesian government is promoting B35 diesel while moving towards B40 in 2025.

Global palm oil inventory is at a 3-year low, supported by various factors pushing CPO prices to break through a 2-year high. However, palm oil prices rising too quickly may not be a good thing; when the Malaysian Ringgit rose too fast before, the pullback was severe.

For the planting industry, assuming that the CPO price can stabilize at RM4,500 or above, a gradual rise would be healthier. The planting area in Malaysia is limited to 6.5 million hectares, so increasing production efficiency and enhancing automation to reduce reliance on foreign labor is urgent.

In recent years, palm oil production capacity has reached a bottleneck, while demand for palm oil production capacity is gradually increasing, which is bullish for the palm oil sector. However, various challenges such as eco-friendly issues, minimum wages, fertilizer transportation...

Translated

From YouTube

65

16

2

Columns Newly listed IPO - Life Water

26

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)