Heart n Eyes

voted

Hey mooers! Max here, wrapping up our exciting journey through the world of stock selection. ![]()

Can you believe how far we've come? Let's take a quick trip down memory lane:

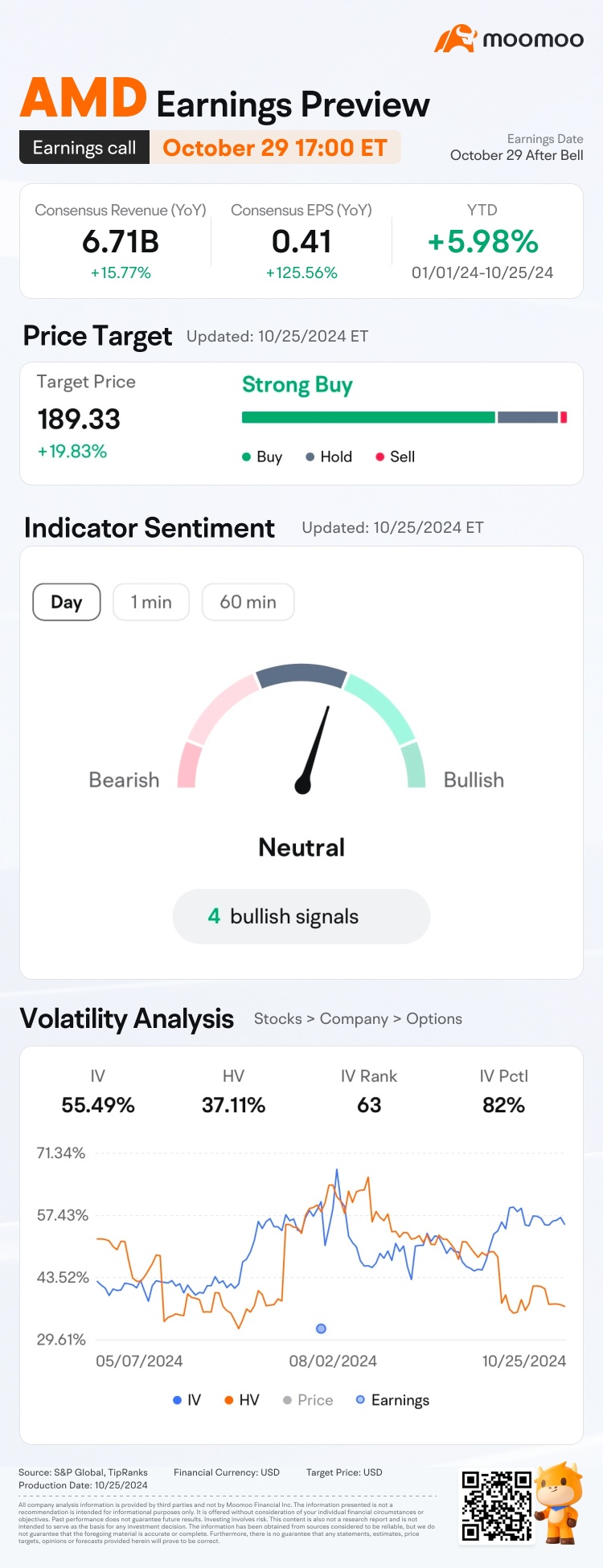

1. We started by peeking into the portfolios of big institutions with the Institutional Tracker.

2. Then we hunted for passive income with the High Dividend Yield screener.

3. We got a bird's-eye view of the market with the Heat Map.

4. We explored entire industri...

Can you believe how far we've come? Let's take a quick trip down memory lane:

1. We started by peeking into the portfolios of big institutions with the Institutional Tracker.

2. Then we hunted for passive income with the High Dividend Yield screener.

3. We got a bird's-eye view of the market with the Heat Map.

4. We explored entire industri...

115

38

23

Heart n Eyes

voted

Hi mooers!![]()

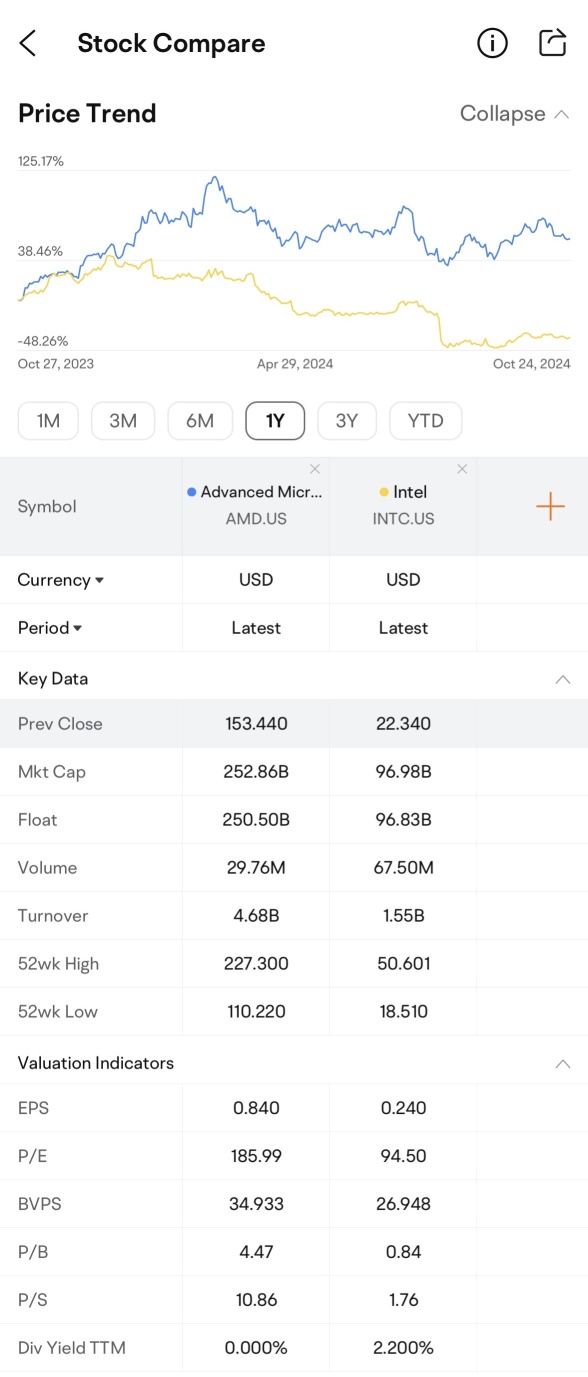

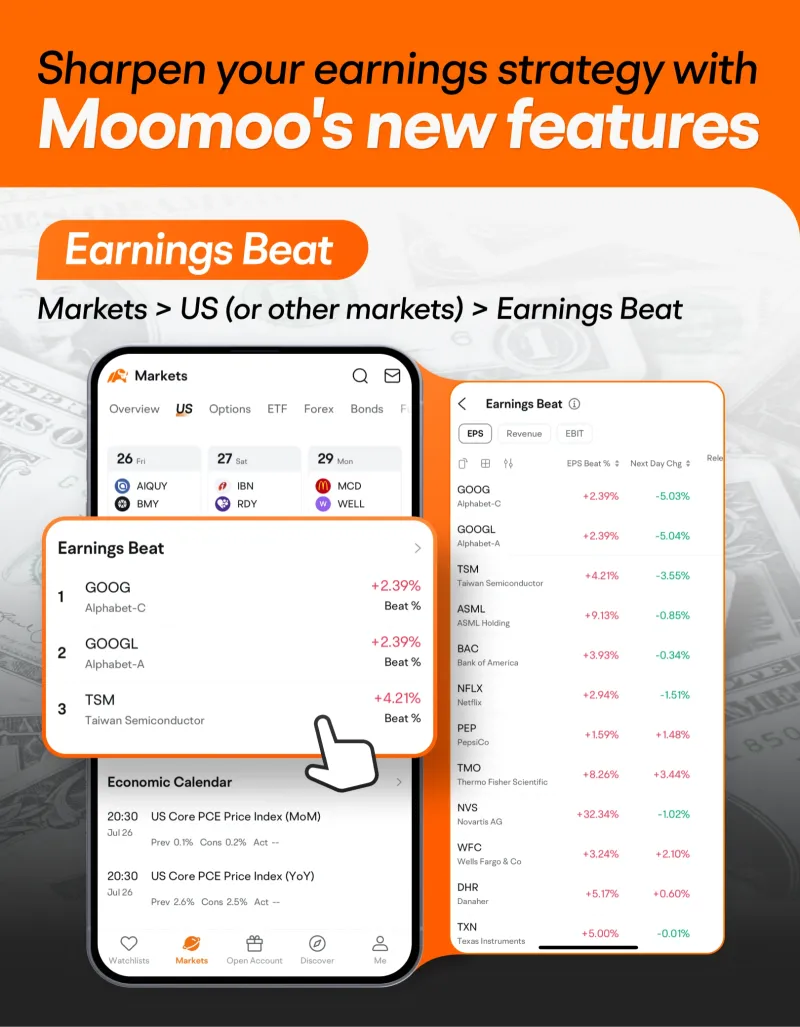

$Advanced Micro Devices (AMD.US)$ and $Intel (INTC.US)$ are both scheduled to release their Q3 earnings this week, with AMD's earnings on October 29 after bell and INTC's earnings on October 31 after bell.

The two companies are competing heavily over the CPU & AI chip market. As of October 25, $Advanced Micro Devices (AMD.US)$'s stocks price has seen an increase of 5.98% this year, whereas $Intel (INTC.US)$'s stock price has dropped 5...

$Advanced Micro Devices (AMD.US)$ and $Intel (INTC.US)$ are both scheduled to release their Q3 earnings this week, with AMD's earnings on October 29 after bell and INTC's earnings on October 31 after bell.

The two companies are competing heavily over the CPU & AI chip market. As of October 25, $Advanced Micro Devices (AMD.US)$'s stocks price has seen an increase of 5.98% this year, whereas $Intel (INTC.US)$'s stock price has dropped 5...

+1

38

25

9

Heart n Eyes

voted

As the cherry blossoms bloom, we're excited to unveil new horizons for our Singapore users in the Japanese stock market! 🗾🎌

Quick Vote 🗳️

Dive into Japan’s Markets 📊

Discover the diversity and opportunity within Japan's dynamic market landscape, from tech giants to traditional sectors! Feel free to share:

- What fascinates you about investing in Japan?

- Which sectors or companies catch your eye?

Share your thoughts and connect wi...

Quick Vote 🗳️

Dive into Japan’s Markets 📊

Discover the diversity and opportunity within Japan's dynamic market landscape, from tech giants to traditional sectors! Feel free to share:

- What fascinates you about investing in Japan?

- Which sectors or companies catch your eye?

Share your thoughts and connect wi...

40

40

8

Heart n Eyes

voted

The stock market had a mixed day as we head into a long holiday weekend and the end of a busy spring break. The $NASDAQ (NASDAQ.US)$ and $SPDR S&P 500 ETF (SPY.US)$ both dropped a bit, while the $iShares Russell 2000 ETF (IWM.US)$, which tracks smaller companies, saw some gains but didn't keep up its momentum throughout the day. Interestingly, the Russell 2000's rally earlier in the day helped the Nasdaq see more stocks reaching new highs, but this excitement cooled off mid...

10

1

Heart n Eyes

voted

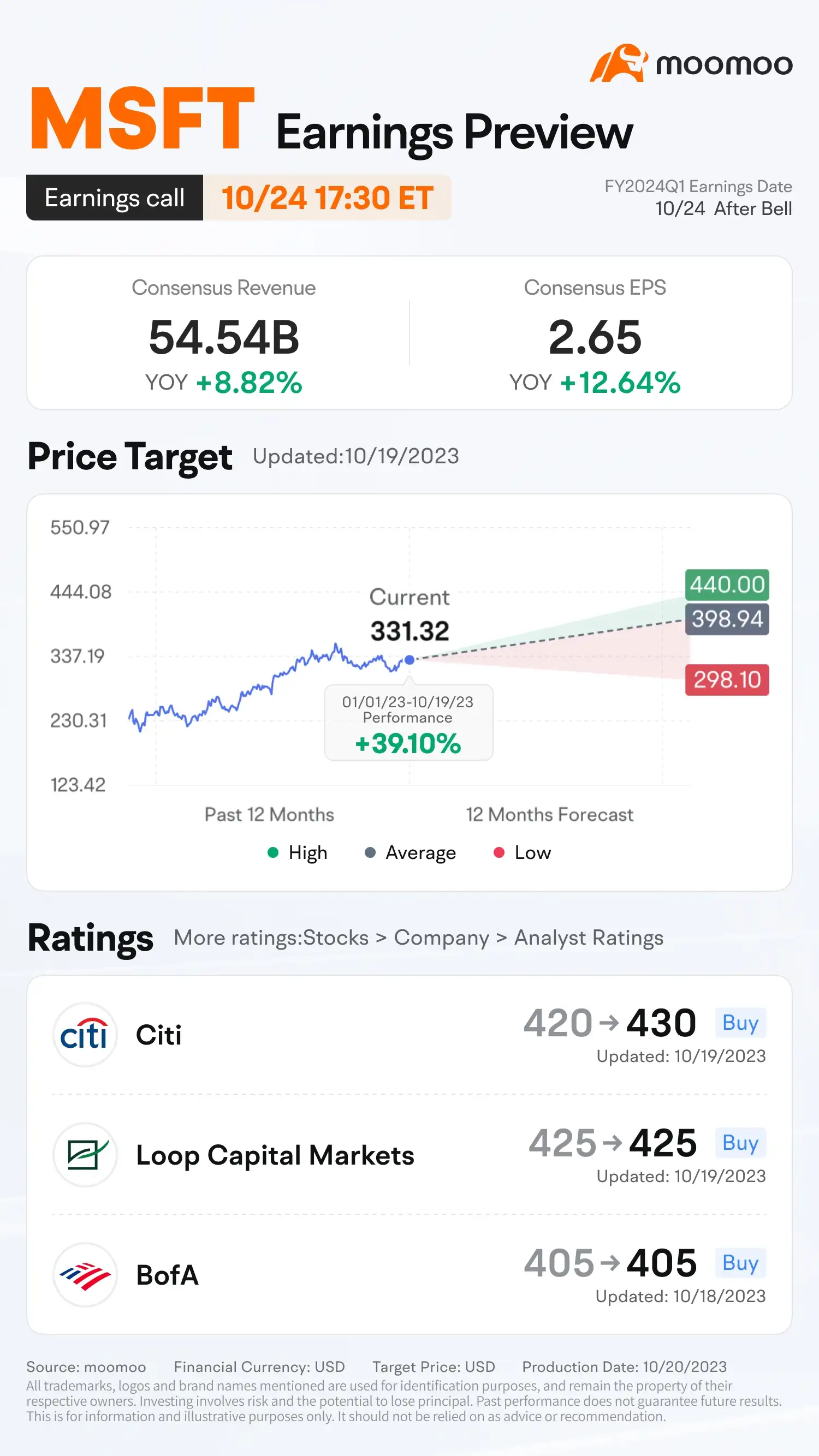

Microsoft is releasing its Q1 FY 2024 earnings on October 24, after the U.S. stock market close. How will the market react to the company's quarterly results? Vote your answer to participate!

Rewards

● An equal share of 1,000 points: For mooers who correctly guess the price range of $Microsoft (MSFT.US)$'s opening price at 9:30 AM ET Oct 25 (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

(V...

Rewards

● An equal share of 1,000 points: For mooers who correctly guess the price range of $Microsoft (MSFT.US)$'s opening price at 9:30 AM ET Oct 25 (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

(V...

47

27

2

Heart n Eyes

voted

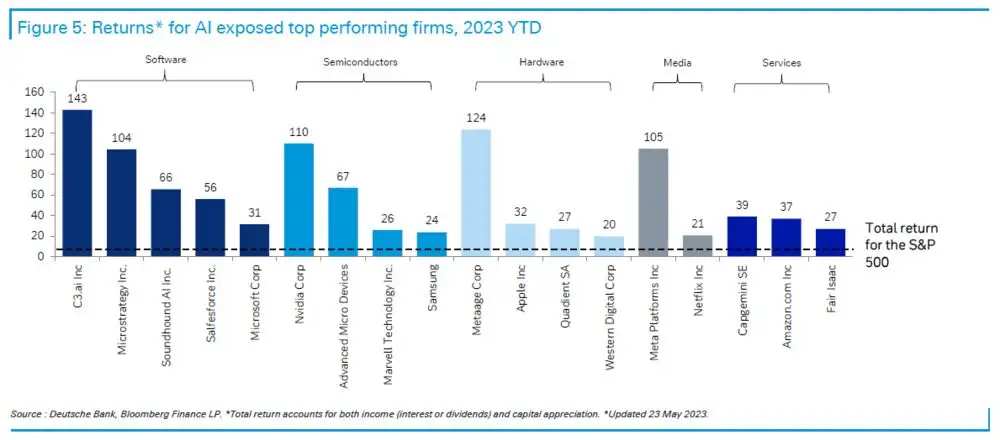

AI Weekly Review![]() :

:

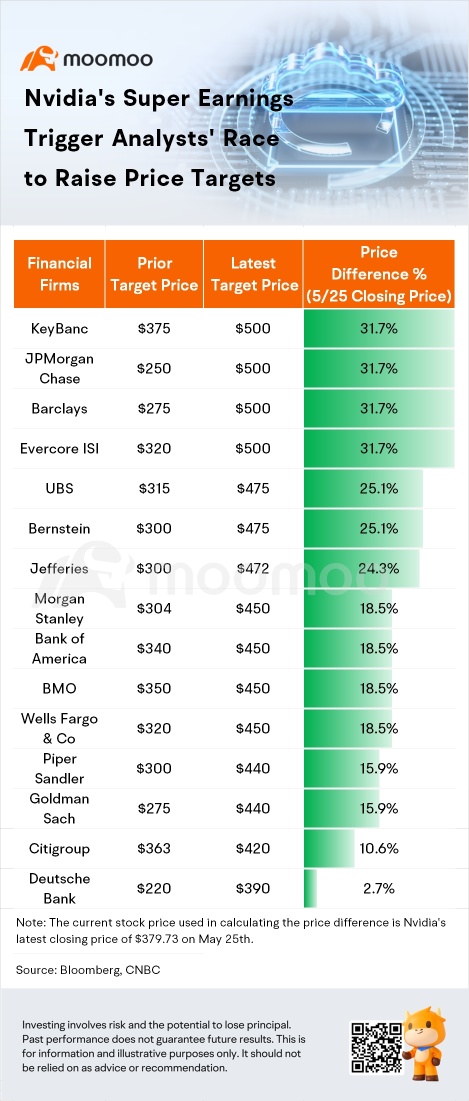

1.Nvidia's data center demand was underestimated, and Wall Street raised its target price.

2.The Philadelphia Semiconductor Index soared to its highest level in 14 months.

3.Nvidia's big move ignited the gaming sector, a new round of industry outbreak is imminent?

4.Is it too early to call the AI stock craze a bubble as retail investors are still holding back?

5.Looking ahead to this week's financial report lin...

1.Nvidia's data center demand was underestimated, and Wall Street raised its target price.

2.The Philadelphia Semiconductor Index soared to its highest level in 14 months.

3.Nvidia's big move ignited the gaming sector, a new round of industry outbreak is imminent?

4.Is it too early to call the AI stock craze a bubble as retail investors are still holding back?

5.Looking ahead to this week's financial report lin...

+1

57

10

8

Heart n Eyes

voted

Dear mooers,

There are only a few days before the New Year's bell rings. New year, new hope!

For most investors, 2022 is a roller coaster ride. As we approach the end of 2022, all three major US stock indexes are on track to break their 3-year winning streaks and have their worst year since 2008. Let's look at the performance of the —an indicator of US stock performance this year:

* S&P 500 index focuses on the larg...

There are only a few days before the New Year's bell rings. New year, new hope!

For most investors, 2022 is a roller coaster ride. As we approach the end of 2022, all three major US stock indexes are on track to break their 3-year winning streaks and have their worst year since 2008. Let's look at the performance of the —an indicator of US stock performance this year:

* S&P 500 index focuses on the larg...

120

483

23

It is a year of learning - how to manage my emotion to cut loss and to be patient in waiting for the right setup to trade. I have yet to find the best methodology for myself and am reflecting if options trading is suitable for me.

Best of year : Options and shares trading in BYD and OXY.

Worst of year : BABA, TSLA and META options where I did not stick to rules to cut loss early and suffer high % losses.

My investment portfolio is in red - I will slowly accu...

Best of year : Options and shares trading in BYD and OXY.

Worst of year : BABA, TSLA and META options where I did not stick to rules to cut loss early and suffer high % losses.

My investment portfolio is in red - I will slowly accu...

Heart n Eyes

voted

Hey mooers,

After learning how to look for divergences between price and volume in the previous post, it's time to learn how to use on-balance volume (OBV) to confirm the underlying trend.

Traders often use the OBV to look for trend confirmations or try to correctly identify the strength and the direction of the ongoing trend. The OBV line's slope is also helpful. A trend accompanied by an OBV line with a steeper slope ...

After learning how to look for divergences between price and volume in the previous post, it's time to learn how to use on-balance volume (OBV) to confirm the underlying trend.

Traders often use the OBV to look for trend confirmations or try to correctly identify the strength and the direction of the ongoing trend. The OBV line's slope is also helpful. A trend accompanied by an OBV line with a steeper slope ...

58

19

17

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)