hong688

voted

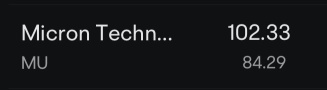

$Micron Technology (MU.US)$ want to do a small bet for coffee

1

4

hong688

voted

$Micron Technology (MU.US)$

Let’s get some facts to help educate retail investors. These are the stock price movements of semiconductor stocks after recent earning calls and the actual odds is 2/9:

NVDA: Dump![]()

AMD: Dump![]()

QCOM: Dump![]()

TSM: Dump![]()

ASML: Dump![]()

AMAT: Dump![]()

DELL: Dump![]()

LRCX: Pump![]()

Marvell: Pump![]()

Broadcom: not released yet

Micron is a good long-term stock but it is important to enter at the right time especially when pr...

Let’s get some facts to help educate retail investors. These are the stock price movements of semiconductor stocks after recent earning calls and the actual odds is 2/9:

NVDA: Dump

AMD: Dump

QCOM: Dump

TSM: Dump

ASML: Dump

AMAT: Dump

DELL: Dump

LRCX: Pump

Marvell: Pump

Broadcom: not released yet

Micron is a good long-term stock but it is important to enter at the right time especially when pr...

1

3

hong688

voted

$Futu Holdings Ltd (FUTU.US)$ indifferent, hold or sell after payout?

1

1

hong688

voted

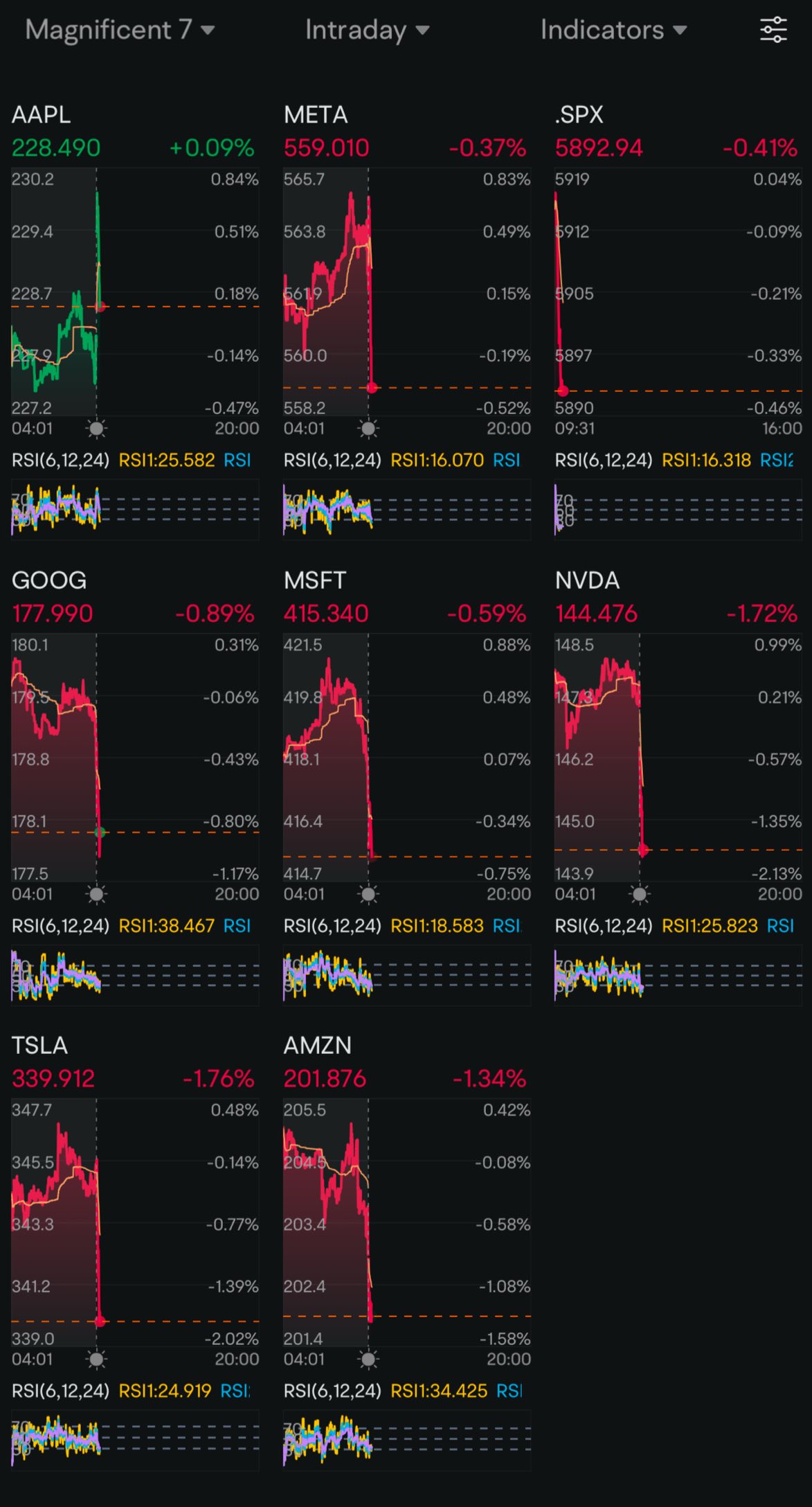

Today $S&P 500 Index (.SPX.US)$started sliding backwards with the Mag7 following the dip. $Apple (AAPL.US)$ started strong but the outlooks seems choppy today. ![]()

All eyes on $NVIDIA (NVDA.US)$ ER which will show profits beating estimates. But is it enough? Unless the new product shows more orders or gains. It may not be enough for the Market.![]()

$Tesla (TSLA.US)$ & $Amazon (AMZN.US)$ with the biggest dip so far over 1.7% and 1.3% respectively.![]()

Don’t panic and stay with your strategy....

All eyes on $NVIDIA (NVDA.US)$ ER which will show profits beating estimates. But is it enough? Unless the new product shows more orders or gains. It may not be enough for the Market.

$Tesla (TSLA.US)$ & $Amazon (AMZN.US)$ with the biggest dip so far over 1.7% and 1.3% respectively.

Don’t panic and stay with your strategy....

+1

17

1

hong688

voted

Hi, mooers!

It's Knight Moo from the Moo Chess Set.![]() Guess what? I'm now into mountain climbing. This chessboard warrior is now adventuring up real mountains!

Guess what? I'm now into mountain climbing. This chessboard warrior is now adventuring up real mountains!

From castle spires to mountain peaks, my quest for adventure never ends.![]() The thrill of new elevations and the refreshing breezes up high are truly Moo-velous! It's similar to smart investing: you weigh the risks carefully and enjoy the spectacular views when you reach your goals.

The thrill of new elevations and the refreshing breezes up high are truly Moo-velous! It's similar to smart investing: you weigh the risks carefully and enjoy the spectacular views when you reach your goals.

Fe...

It's Knight Moo from the Moo Chess Set.

From castle spires to mountain peaks, my quest for adventure never ends.

Fe...

19

3

hong688

voted

Columns Operation plan after the general election and during the Chinese concept financial reporting season.

$NASDAQ 100 Index (.NDX.US)$Under the dual stimulus of the settled election and a 25 basis point rate cut, the market rose by 5% this week to reach 21117 points, which is currently a bit high. Last week's rise was mainly driven by bank stocks, small cap stocks, semiconductors, and technology stocks, reaching the upper band of the Bollinger Bands. An expected short-term pullback is anticipated. Next week, the USA's CPI and PPI data will be released, with a high probability of meeting expectations and a low possibility of a market crash. The current prediction is that the current upward trend should continue until the Christmas market, but with Donald Trump's return to the White House in January next year, there may be a significant pullback in January. Therefore, during this period of policy vacuum, the US stocks are likely to experience an oscillating upward trend. In the short term, due to the crazy rise of US stocks last week, a brief pullback is expected this week, presenting a buying opportunity during the dip.

Regarding Chinese concept stocks, due to the potential policy risks since Trump took office, as well as the lackluster effect of the debt-for-equity policy announced on Friday in stimulating the stock market, leading to a 6% decline, many stocks have directly shifted trends to a downward trajectory this week. $TENCENT (00700.HK)$ $JD.com (JD.US)$ $Alibaba (BABA.US)$ $Bilibili (BILI.US)$ $Cisco (CSCO.US)$ $Occidental Petroleum (OXY.US)$ $Sea (SE.US)$As for Chinese concept stocks, due to the potential policy risks since Trump took office, and the issuance of debt conversion policy on Friday did not have the expected stimulating effect on the stock market, resulting in a sharp 6% drop on Friday, many stocks have directly changed trends to a downward trend next week

Regarding Chinese concept stocks, due to the potential policy risks since Trump took office, as well as the lackluster effect of the debt-for-equity policy announced on Friday in stimulating the stock market, leading to a 6% decline, many stocks have directly shifted trends to a downward trajectory this week. $TENCENT (00700.HK)$ $JD.com (JD.US)$ $Alibaba (BABA.US)$ $Bilibili (BILI.US)$ $Cisco (CSCO.US)$ $Occidental Petroleum (OXY.US)$ $Sea (SE.US)$As for Chinese concept stocks, due to the potential policy risks since Trump took office, and the issuance of debt conversion policy on Friday did not have the expected stimulating effect on the stock market, resulting in a sharp 6% drop on Friday, many stocks have directly changed trends to a downward trend next week

Translated

38

4

4

hong688

liked

hong688

liked

US Market Key Charts (S&P, US Dollar, Gold)

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[NEUTRAL]We turn neutral as price is currently between 5740 resistance level and 5710 support level. We lean towards a bearish scenario as we expect price to drift lower towards 5710 support level. Technical indicators are displaying a bearish scenario as well.

Alternatively: A 4 hour c...

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[NEUTRAL]We turn neutral as price is currently between 5740 resistance level and 5710 support level. We lean towards a bearish scenario as we expect price to drift lower towards 5710 support level. Technical indicators are displaying a bearish scenario as well.

Alternatively: A 4 hour c...

40

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)