Hooooohooo

liked

Translated

1

1

Hooooohooo

liked

The market again hit records Tuesday, reacting mostly positively toward incoming President-Elect Trump's comments overnight that he would put a 25% tariff on our neighbors in Canada and Mexico and 35% on Chinese goods, our three largest trading partners.

According to Census Bureau data, there are price hikes in the goods on 41% of the U.S.'s total imports; there has been $1.6T trade so far in 2024. A blanket ...

According to Census Bureau data, there are price hikes in the goods on 41% of the U.S.'s total imports; there has been $1.6T trade so far in 2024. A blanket ...

31

9

12

Hooooohooo

reacted to

Hooooohooo

voted

Columns The next hot topic for ai is embodied Artificial Intelligence (Embodied Artificial Intelligence).

The asia vets concept emerged at the end of 2022 with OpenAI's high-profile debut, going through the hype of large model GPU computing power and its upstream and downstream, then transitioning to the electrical utilities concept. Currently, hot software applications such as apps and PLTR have shifted the market focus from hardware to software.

It is undeniable that the mainstream hot stocks in the market now are electrical utilities (especially SMR and competitive power plants) and software. However, long-term investors can start laying out embodied intelligence (EAI) that combines hardware and software.

Embodied Artificial Intelligence (EAI) integrates artificial intelligence into physical entities such as robots, giving them the ability to perceive, learn, and interact dynamically with the environment. The biggest difference compared to previous robots isAI systems no longer rely on pre-defined complex logic to manage specific scenarios (code accumulation), but have evolved to learning mechanisms now (feeding data training), enabling them to continuously adapt to the operating environment

The concept's current biggest application scenarios are automated driving and humanoid robots (Androids).

Core concept stocks:Tesla $Tesla (TSLA.US)$(Regulatory easing completely reversed) The leader in automated driving and humanoid robots is the next Apple. $Apple (AAPL.US)$! Next year, the stock most likely to compete with NVIDIA for the top spot in market cap.

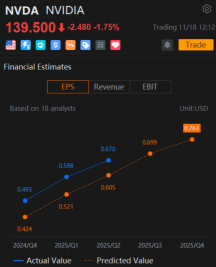

nvidia $NVIDIA (NVDA.US)$...

It is undeniable that the mainstream hot stocks in the market now are electrical utilities (especially SMR and competitive power plants) and software. However, long-term investors can start laying out embodied intelligence (EAI) that combines hardware and software.

Embodied Artificial Intelligence (EAI) integrates artificial intelligence into physical entities such as robots, giving them the ability to perceive, learn, and interact dynamically with the environment. The biggest difference compared to previous robots isAI systems no longer rely on pre-defined complex logic to manage specific scenarios (code accumulation), but have evolved to learning mechanisms now (feeding data training), enabling them to continuously adapt to the operating environment

The concept's current biggest application scenarios are automated driving and humanoid robots (Androids).

Core concept stocks:Tesla $Tesla (TSLA.US)$(Regulatory easing completely reversed) The leader in automated driving and humanoid robots is the next Apple. $Apple (AAPL.US)$! Next year, the stock most likely to compete with NVIDIA for the top spot in market cap.

nvidia $NVIDIA (NVDA.US)$...

Translated

19

4

Hooooohooo

Set a live reminder

$PDD Holdings (PDD.US)$

PDD Holdings Q3 2024 earnings conference call is scheduled for November 21 at 7:30 AM EDT /November 21 at 8:30 PM SGT /November 21 at 11:30 PM AEST. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from PDD Holdings' Q3 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what management has to say!

Disclaimer:

This presentation i...

PDD Holdings Q3 2024 earnings conference call is scheduled for November 21 at 7:30 AM EDT /November 21 at 8:30 PM SGT /November 21 at 11:30 PM AEST. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from PDD Holdings' Q3 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what management has to say!

Disclaimer:

This presentation i...

PDD Holdings Q3 2024 earnings conference call

Nov 21 06:30

6

Hooooohooo

Set a live reminder

$NVIDIA (NVDA.US)$

NVIDIA Q3 FY2025 earnings conference call is scheduled for November 20 at 5:00 PM EDT /November 21 at 6:00 AM SGT /November 21 at 9:00 AM AEDT. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from NVIDIA's Q3 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what management has to say!

Disclaimer:

This presentation is for information a...

NVIDIA Q3 FY2025 earnings conference call is scheduled for November 20 at 5:00 PM EDT /November 21 at 6:00 AM SGT /November 21 at 9:00 AM AEDT. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from NVIDIA's Q3 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what management has to say!

Disclaimer:

This presentation is for information a...

NVIDIA Q3 FY2025 earnings conference call

Nov 20 16:00

37

5

12

Hooooohooo

voted

1. PDD Holdings: $PDD Holdings (PDD.US)$ Some may think the financial report will cause a drop, but looking at the distribution of call and put options, it's clear that most people are optimistic.

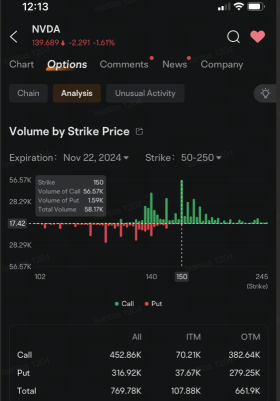

2. Nvidia: $NVIDIA (NVDA.US)$ Continue to increase positions, not predicting financial reports, not predicting stock prices, mainly for arbitrage, and add some put options for a perfect strategy.

3. NIO Xiaopeng: $NIO Inc (NIO.US)$ $XPeng (XPEV.US)$ Occasionally playing in the short term is fine, but it's better not to play long term, it's exhausting and costly.

2. Nvidia: $NVIDIA (NVDA.US)$ Continue to increase positions, not predicting financial reports, not predicting stock prices, mainly for arbitrage, and add some put options for a perfect strategy.

3. NIO Xiaopeng: $NIO Inc (NIO.US)$ $XPeng (XPEV.US)$ Occasionally playing in the short term is fine, but it's better not to play long term, it's exhausting and costly.

Translated

3

1

Hooooohooo

voted

$NVIDIA (NVDA.US)$ institutional investors and speculators are pouring millions of dollars in the options market days ahead of earnings results that could test how long the AI-favorite could keep beating analysts' estimates.

The biggest among unusual options activities seen so far Monday involved a multi-leg trade that had an active buyer paying a $3.86 million premium for put options that gives him or her...

The biggest among unusual options activities seen so far Monday involved a multi-leg trade that had an active buyer paying a $3.86 million premium for put options that gives him or her...

42

15

47

Hooooohooo

voted

Columns Operation plan after the general election and during the Chinese concept financial reporting season.

$NASDAQ 100 Index (.NDX.US)$Under the dual stimulus of the settled election and a 25 basis point rate cut, the market rose by 5% this week to reach 21117 points, which is currently a bit high. Last week's rise was mainly driven by bank stocks, small cap stocks, semiconductors, and technology stocks, reaching the upper band of the Bollinger Bands. An expected short-term pullback is anticipated. Next week, the USA's CPI and PPI data will be released, with a high probability of meeting expectations and a low possibility of a market crash. The current prediction is that the current upward trend should continue until the Christmas market, but with Donald Trump's return to the White House in January next year, there may be a significant pullback in January. Therefore, during this period of policy vacuum, the US stocks are likely to experience an oscillating upward trend. In the short term, due to the crazy rise of US stocks last week, a brief pullback is expected this week, presenting a buying opportunity during the dip.

Regarding Chinese concept stocks, due to the potential policy risks since Trump took office, as well as the lackluster effect of the debt-for-equity policy announced on Friday in stimulating the stock market, leading to a 6% decline, many stocks have directly shifted trends to a downward trajectory this week. $TENCENT (00700.HK)$ $JD.com (JD.US)$ $Alibaba (BABA.US)$ $Bilibili (BILI.US)$ $Cisco (CSCO.US)$ $Occidental Petroleum (OXY.US)$ $Sea (SE.US)$As for Chinese concept stocks, due to the potential policy risks since Trump took office, and the issuance of debt conversion policy on Friday did not have the expected stimulating effect on the stock market, resulting in a sharp 6% drop on Friday, many stocks have directly changed trends to a downward trend next week

Regarding Chinese concept stocks, due to the potential policy risks since Trump took office, as well as the lackluster effect of the debt-for-equity policy announced on Friday in stimulating the stock market, leading to a 6% decline, many stocks have directly shifted trends to a downward trajectory this week. $TENCENT (00700.HK)$ $JD.com (JD.US)$ $Alibaba (BABA.US)$ $Bilibili (BILI.US)$ $Cisco (CSCO.US)$ $Occidental Petroleum (OXY.US)$ $Sea (SE.US)$As for Chinese concept stocks, due to the potential policy risks since Trump took office, and the issuance of debt conversion policy on Friday did not have the expected stimulating effect on the stock market, resulting in a sharp 6% drop on Friday, many stocks have directly changed trends to a downward trend next week

Translated

38

4

4

Hooooohooo

voted

Translated

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)