Huat Lah

liked

$Pinterest (PINS.US)$ I'm looking at Pinterest and trying to find out what is causing their recent loss in monthly active users. I'm wondering if anyone knows if I can find how many users they acquired (not just growth in mau).

12

1

Huat Lah

liked

Asian stocks set to climb; Treasuries may drop

Asian stocks looked set to climb Friday, bolstered by improving sentiment toward Chinese shares. Treasury futures suggested higher yields when cash trading resumes after a holiday.

Australian shares rose, while equity contracts for Japan and Hong Kong advanced. A gauge of U.S.-listed Chinese stocks jumped more than 5%, helped by Alibaba's blowout Singles' Day shopping festival. S&P 500 futures were in the green after the index snapped a two-day drop.

Next-Tesla tag sends Rivian above $100 billion without sales

$Rivian Automotive (RIVN.US)$ reached a market value of over $100 billion two days after its initial public offering, drawing comparisons to $Tesla (TSLA.US)$.

But there are stark differences: When Tesla went public in 2010, the Elon Musk-led firm disclosed $93 million in revenue and losses far below the $1 billion Rivian reported for the first half. What's more, Tesla's initial market capitalization was about $2 billion and didn’t reach $90 billion until 2020.

Musk throws fresh shade at Rivian a day after Rival's big IPO

Elon Musk doesn't exactly sound optimistic about the prospects of Rivian, even after the rival electric-vehicle maker's blockbuster IP0.

Tesla's chief executive officer said he hopes Rivian can boost production rates and get cash flow to break-even. But in a tweet Thursday he also noted that of hundreds of startups, "Tesla is the only American carmaker to reach high volume production & positive cash flow in past 100 years."

Elon Musk sells around $5 billion of Tesla stock

Tesla CEO Elon Musk sold nearly $5 billion in Tesla stocks, according to financial filings on Wednesday evening. He still holds more than 166 million shares. Filings showed Musk is selling a block of Tesla shares via a plan that he set in motion on Sept. 14 this year.

Before that sale plan was made public, he asked his 62.5 million Twitter followers to vote in an informal poll, telling them their vote would determine the future of his Tesla holdings. The filings reveal that, in fact, he knew some of his shares were slated for sale this week.

U.S.-listed Chinese stocks soar after record singles' day sales

Shares of Chinese companies listed in the U.S. rallied Thursday amid investor optimism after blowout Singles' Day sales.

The Nasdaq Golden Dragon Index jumped 5.1%, the most since Oct. 7, after $Alibaba (BABA.US)$ and $JD.com (JD.US)$'s Singles' Day shopping festival posted record sales.

U.S. shoppers outspend Chinese to restore luxury market, study shows

Global consumer spending on personal luxury goods, including the latest sneaker trend or design collaboration, is forecast to spike by 29% this year, to 283 billion euros ($325 billion). That's a return to 2019 levels and a turnaround from the gloom of the 2020 pandemic lockdowns that shuttered stores and halted international travel.

Consumers have shifted spending to high-quality furnishings, as many have been spending time at home instead of globe-trotting.

Disney's magical pricing power can't outpace inflation right now

$Disney (DIS.US)$ shares are negative this year and well behind the $S&P 500 Index (.SPX.US)$ return. The company's third-quarter earnings did not help, with streaming subscriber adds slowing while costs for content and its Parks business rise.

Disney has pricing power unlike most other firms, but it can't escape inflation in the short term as capital spending increases and margins come under pressure.

SARK launches as short interest in ARKK jumps to new record

The first exchange traded fund to take an inverse exposure to another ETF rose by 5.5 per cent on its first two days of trading, mirroring the day's fall in Cathie Wood's flagship $21bn $ARK Innovation ETF (ARKK.US)$.

Its trading volume of $843,000 on day one comes as short interest in ARKK has shot up to a new record of 17.3 per cent of its shares, with a market value of $3.7bn, currently being borrowed by investors betting on a sell-off, according to S3 Partners, a specialist data provider. This is up from just 2 per cent at the turn of the year and 15.3 per cent a month ago.

Source: Bloomberg, CNBC, Financial Times

Asian stocks looked set to climb Friday, bolstered by improving sentiment toward Chinese shares. Treasury futures suggested higher yields when cash trading resumes after a holiday.

Australian shares rose, while equity contracts for Japan and Hong Kong advanced. A gauge of U.S.-listed Chinese stocks jumped more than 5%, helped by Alibaba's blowout Singles' Day shopping festival. S&P 500 futures were in the green after the index snapped a two-day drop.

Next-Tesla tag sends Rivian above $100 billion without sales

$Rivian Automotive (RIVN.US)$ reached a market value of over $100 billion two days after its initial public offering, drawing comparisons to $Tesla (TSLA.US)$.

But there are stark differences: When Tesla went public in 2010, the Elon Musk-led firm disclosed $93 million in revenue and losses far below the $1 billion Rivian reported for the first half. What's more, Tesla's initial market capitalization was about $2 billion and didn’t reach $90 billion until 2020.

Musk throws fresh shade at Rivian a day after Rival's big IPO

Elon Musk doesn't exactly sound optimistic about the prospects of Rivian, even after the rival electric-vehicle maker's blockbuster IP0.

Tesla's chief executive officer said he hopes Rivian can boost production rates and get cash flow to break-even. But in a tweet Thursday he also noted that of hundreds of startups, "Tesla is the only American carmaker to reach high volume production & positive cash flow in past 100 years."

Elon Musk sells around $5 billion of Tesla stock

Tesla CEO Elon Musk sold nearly $5 billion in Tesla stocks, according to financial filings on Wednesday evening. He still holds more than 166 million shares. Filings showed Musk is selling a block of Tesla shares via a plan that he set in motion on Sept. 14 this year.

Before that sale plan was made public, he asked his 62.5 million Twitter followers to vote in an informal poll, telling them their vote would determine the future of his Tesla holdings. The filings reveal that, in fact, he knew some of his shares were slated for sale this week.

U.S.-listed Chinese stocks soar after record singles' day sales

Shares of Chinese companies listed in the U.S. rallied Thursday amid investor optimism after blowout Singles' Day sales.

The Nasdaq Golden Dragon Index jumped 5.1%, the most since Oct. 7, after $Alibaba (BABA.US)$ and $JD.com (JD.US)$'s Singles' Day shopping festival posted record sales.

U.S. shoppers outspend Chinese to restore luxury market, study shows

Global consumer spending on personal luxury goods, including the latest sneaker trend or design collaboration, is forecast to spike by 29% this year, to 283 billion euros ($325 billion). That's a return to 2019 levels and a turnaround from the gloom of the 2020 pandemic lockdowns that shuttered stores and halted international travel.

Consumers have shifted spending to high-quality furnishings, as many have been spending time at home instead of globe-trotting.

Disney's magical pricing power can't outpace inflation right now

$Disney (DIS.US)$ shares are negative this year and well behind the $S&P 500 Index (.SPX.US)$ return. The company's third-quarter earnings did not help, with streaming subscriber adds slowing while costs for content and its Parks business rise.

Disney has pricing power unlike most other firms, but it can't escape inflation in the short term as capital spending increases and margins come under pressure.

SARK launches as short interest in ARKK jumps to new record

The first exchange traded fund to take an inverse exposure to another ETF rose by 5.5 per cent on its first two days of trading, mirroring the day's fall in Cathie Wood's flagship $21bn $ARK Innovation ETF (ARKK.US)$.

Its trading volume of $843,000 on day one comes as short interest in ARKK has shot up to a new record of 17.3 per cent of its shares, with a market value of $3.7bn, currently being borrowed by investors betting on a sell-off, according to S3 Partners, a specialist data provider. This is up from just 2 per cent at the turn of the year and 15.3 per cent a month ago.

Source: Bloomberg, CNBC, Financial Times

88

2

Huat Lah

liked

$Tesla (TSLA.US)$At some point, numbers will matter, and people will ultimately realize there is such a thing as paying too much for growth. Today is different than the tech bubble of 2000 as companies like TSLA are generating tens of billions in revenue and billions in actual profits, but the valuations of companies such as TSLA are overinflated. The idea of operating a business is to make money, and the almighty dollar doesn't care if you're a tech company, a transportation company, or a restaurant. $1 of revenue will always equal $1 of revenue, and the same goes for net income and FCF. $VOLKSWAGEN A G (VWAGY.US)$has a market cap of $137.01 billion and decimates TSLA on the numbers. VWAGY trades at an FCF multiple of 4.6x while its revenue, net income, and FCF growth exceed TSLA's. When comparing TSLA to FB, an actual technology company, it isn't even in the same league, and it's almost comparing single-A ball to the Major Leagues. TSLA is a great company; they are doing all the right things and building an incredible ecosystem. They have a cult following that drives demand for its products, and what they have accomplished is remarkable. This doesn't change the fact that TSLA is one of the most overhyped stocks in the market, and the valuation is ridiculous.

As Paul Gabrail from Everything Money loves to point out, look at $Cisco (CSCO.US)$and $Intel (INTC.US)$. These were two of the largest companies in the world during the dot com era. They both generated billions in revenue and billions in net income. Neither of these companies has traded near their all-time highs in the last two decades because their stocks got overinflated during the dot com bubble. In 2000 CSCO generated $18.93 billion in revenue and $2.67 billion in net income. This increased to $49.82 billion of revenue and $10.59 billion of net income in the TTM, yet shares of CSCO are still significantly lower than where they traded in 2000. INTC has the same story. There is such a thing as paying too much for growth, and sometimes good companies get overinflated, and it can take decades to grow into the previous valuation. I think TSLA is a fantastic company, but its stock is tremendously overvalued. Not only are their metrics not best in class for automotive companies, but they are also continuously diluting shareholders. If anyone wants to try to convince me otherwise, I am happy to engage in conversation, but please provide facts for me to read and evaluate.

As Paul Gabrail from Everything Money loves to point out, look at $Cisco (CSCO.US)$and $Intel (INTC.US)$. These were two of the largest companies in the world during the dot com era. They both generated billions in revenue and billions in net income. Neither of these companies has traded near their all-time highs in the last two decades because their stocks got overinflated during the dot com bubble. In 2000 CSCO generated $18.93 billion in revenue and $2.67 billion in net income. This increased to $49.82 billion of revenue and $10.59 billion of net income in the TTM, yet shares of CSCO are still significantly lower than where they traded in 2000. INTC has the same story. There is such a thing as paying too much for growth, and sometimes good companies get overinflated, and it can take decades to grow into the previous valuation. I think TSLA is a fantastic company, but its stock is tremendously overvalued. Not only are their metrics not best in class for automotive companies, but they are also continuously diluting shareholders. If anyone wants to try to convince me otherwise, I am happy to engage in conversation, but please provide facts for me to read and evaluate.

15

2

Huat Lah

liked

One of the golden rule of investing that I came across is the sure win strategy webminar conducted by a certain self proclaimed guru. The rule is simple, if the company announced increased profits this quarter compared to previous quarter or preceding quarters and if the stock trades at below PE 10, the share price will sure go up. Man, is this sure win strategy really works without evaluating its fundamental? Is there any ways to strike and buy the sure win lottery ticket?

Is this strategy plausible, credible and believable? In fact, an estimation in the earnings expectations is complicated with more companies more attuned to playing the earnings game, trying to beat the earning expectations by those research bankers and analyts: using either earning management accounting or either operation discretion such as timing of capital on project outlays etc..

The problem with this game is that the marketss will eventually catch on it and adjust the expectation. Using earnings is also a highly speculative strategy for short term. It is very hard to find a companies which has increasing earnings as business goes in cycle and has its own seasonality. Growth companies spend money on capex and its usually affect earnings. Even great companies such as $Coca-Cola (KO.US)$ $NESTLE SA (NSRGF.US)$ $Carlsberg A/S Sponsored ADR Class B (CABGY.US)$ do not have increasing profit every quarter. It may be perfect for short term strategy but as mentioned the market will catch up to its underlying intrinsic value.

Know and understand the statistics or ratio etc. is definitely helpful in trading. But always be prudence and sceptical as there are thousands of investing rules out there. As Joel Greeblatt said before, "if you don't lose big money, most of the remaining alternative are good ones." Good luck to everyone out there and happy Halloween. 🍀👻🎃🦇🤞

Is this strategy plausible, credible and believable? In fact, an estimation in the earnings expectations is complicated with more companies more attuned to playing the earnings game, trying to beat the earning expectations by those research bankers and analyts: using either earning management accounting or either operation discretion such as timing of capital on project outlays etc..

The problem with this game is that the marketss will eventually catch on it and adjust the expectation. Using earnings is also a highly speculative strategy for short term. It is very hard to find a companies which has increasing earnings as business goes in cycle and has its own seasonality. Growth companies spend money on capex and its usually affect earnings. Even great companies such as $Coca-Cola (KO.US)$ $NESTLE SA (NSRGF.US)$ $Carlsberg A/S Sponsored ADR Class B (CABGY.US)$ do not have increasing profit every quarter. It may be perfect for short term strategy but as mentioned the market will catch up to its underlying intrinsic value.

Know and understand the statistics or ratio etc. is definitely helpful in trading. But always be prudence and sceptical as there are thousands of investing rules out there. As Joel Greeblatt said before, "if you don't lose big money, most of the remaining alternative are good ones." Good luck to everyone out there and happy Halloween. 🍀👻🎃🦇🤞

20

1

Huat Lah

liked

Jazzie, a U.S. resident who left her job in April to pursue entrepreneurial efforts.

"Especially in the last two years, working in two or three supermarkets at the same time was routine for me," she said. "I had to work more than 60 hours a week, and I felt really tired."

As she ventured out on her own, Jazzie found her busy entrepreneurial life inspired her to find ways to make her hard-earned money work for her.

So Jazzie also spent more time and energy on investing but struggled with where to begin, that is until she found moomoo.

"Moomoo is like a trustworthy old friend that provides you with all-around information to help you make the wisest and most well-thought-out decisions," Jazzie said.

More importantly, because of her busy entrepreneurial life, Jazzie started to think more clearly and urgently about investing, and she also had more time to learn and practice investing.

Jazzie said she first had a clear sense of how powerful investing can be when her dad told her at her twentieth birthday that if she kept investing $2,000 every year, she would have a significant amount of money by the time she was 25.

"I wasn't that motivated at the time, but I was deeply touched," she said. "Later on, especially now, when I'm 25 and no longer have the support of my parents, I have to work harder to make money and have to rely on myself as an entrepreneur. I started thinking about how to make my money work for me. In that case, I could achieve financial freedom and retire a little earlier and focus on the things I truly love."

So Jazzie took to investing.

"Hopefully, someday in the future, I will become a senior investor," she said. "I hate living a life where I have to sit behind a desk all the time. After starting my own business, I can work remotely from home, but I'd rather not be on the computer all day and be on call all the time.

I hope I can enjoy life to the fullest and stop running around, trying to make money. Therefore, I will work hard to learn more about investing and practice until I achieve my ultimate goal of financial freedom."

But as she continued learning how to invest, she found a valuable tool with moomoo after a friend's recommendation.

"For me, moomoo makes all investment information more open and transparent," Jazzie said. "Everyone can invest and make what they think is the best choice on a level playing field."

Especially for investors like Jazzie and still learning the ins and outs, moomoo is user-friendly in terms of its functions and user experience.

When needing to research investment varieties and targets, Jazzie found that the research materials on moomoo are comprehensive and easy to understand and provide her with the information she needs. For continuous advanced learning, and at the same time, the functions are easy to use and convenient.

"One of the things that attracted me the most is moomoo's AI monitoring and predicting function, as well as customizable reminders," Jazzie said. "Moomoo is like an especially trustworthy old friend that provides you with a full range of information to help you make the wisest, most well-thoughted decisions."

Jazzie has seen exceptional results with that trusted partner in hand, with over 17 percent returns (Past result is in no way a predictor of future gains. Your results will vary.) last year.

"I'm happy with that, and I didn't pay too much attention to returns when I was operating because I know that markets are volatile, and you never know what's going to happen next," Jazzie said. "When returns go up, of course, I am happy, but when they go down, I would tell myself, now could be a time to buy-in. I keep reminding myself to stay cautiously optimistic and, as a newbie, to invest with caution and not put too much pressure on myself."

Now, having accumulated some investment experience, Jazzie has also started to recommend moomoo to her friends who are interested in investing.

"Moomoo is a stock trading platform that makes investing easier," she said. "Here, users can obtain the most comprehensive investment information. With moomoo, even a newbie who doesn't know anything can grow into a seasoned investor through hard work."

Disclaimer: The above content represents the personal sharing and opinions of the guest, and does not constitute any recommendation, purchase, sale or holding of the above-mentioned stocks or investment strategies by Futu. All investment involves risk. Prices of investment products may go up as well as down. Please understand the product risks and seek for professional advice before making any investment decisions.

"Especially in the last two years, working in two or three supermarkets at the same time was routine for me," she said. "I had to work more than 60 hours a week, and I felt really tired."

As she ventured out on her own, Jazzie found her busy entrepreneurial life inspired her to find ways to make her hard-earned money work for her.

So Jazzie also spent more time and energy on investing but struggled with where to begin, that is until she found moomoo.

"Moomoo is like a trustworthy old friend that provides you with all-around information to help you make the wisest and most well-thought-out decisions," Jazzie said.

More importantly, because of her busy entrepreneurial life, Jazzie started to think more clearly and urgently about investing, and she also had more time to learn and practice investing.

Jazzie said she first had a clear sense of how powerful investing can be when her dad told her at her twentieth birthday that if she kept investing $2,000 every year, she would have a significant amount of money by the time she was 25.

"I wasn't that motivated at the time, but I was deeply touched," she said. "Later on, especially now, when I'm 25 and no longer have the support of my parents, I have to work harder to make money and have to rely on myself as an entrepreneur. I started thinking about how to make my money work for me. In that case, I could achieve financial freedom and retire a little earlier and focus on the things I truly love."

So Jazzie took to investing.

"Hopefully, someday in the future, I will become a senior investor," she said. "I hate living a life where I have to sit behind a desk all the time. After starting my own business, I can work remotely from home, but I'd rather not be on the computer all day and be on call all the time.

I hope I can enjoy life to the fullest and stop running around, trying to make money. Therefore, I will work hard to learn more about investing and practice until I achieve my ultimate goal of financial freedom."

But as she continued learning how to invest, she found a valuable tool with moomoo after a friend's recommendation.

"For me, moomoo makes all investment information more open and transparent," Jazzie said. "Everyone can invest and make what they think is the best choice on a level playing field."

Especially for investors like Jazzie and still learning the ins and outs, moomoo is user-friendly in terms of its functions and user experience.

When needing to research investment varieties and targets, Jazzie found that the research materials on moomoo are comprehensive and easy to understand and provide her with the information she needs. For continuous advanced learning, and at the same time, the functions are easy to use and convenient.

"One of the things that attracted me the most is moomoo's AI monitoring and predicting function, as well as customizable reminders," Jazzie said. "Moomoo is like an especially trustworthy old friend that provides you with a full range of information to help you make the wisest, most well-thoughted decisions."

Jazzie has seen exceptional results with that trusted partner in hand, with over 17 percent returns (Past result is in no way a predictor of future gains. Your results will vary.) last year.

"I'm happy with that, and I didn't pay too much attention to returns when I was operating because I know that markets are volatile, and you never know what's going to happen next," Jazzie said. "When returns go up, of course, I am happy, but when they go down, I would tell myself, now could be a time to buy-in. I keep reminding myself to stay cautiously optimistic and, as a newbie, to invest with caution and not put too much pressure on myself."

Now, having accumulated some investment experience, Jazzie has also started to recommend moomoo to her friends who are interested in investing.

"Moomoo is a stock trading platform that makes investing easier," she said. "Here, users can obtain the most comprehensive investment information. With moomoo, even a newbie who doesn't know anything can grow into a seasoned investor through hard work."

Disclaimer: The above content represents the personal sharing and opinions of the guest, and does not constitute any recommendation, purchase, sale or holding of the above-mentioned stocks or investment strategies by Futu. All investment involves risk. Prices of investment products may go up as well as down. Please understand the product risks and seek for professional advice before making any investment decisions.

240

10

Huat Lah

liked

$Portillo’s Inc. (PTLO.US)$ wow wow wow this one is definitely no junk. Rain down the hotdogs go go go!

3

1

Huat Lah

liked

$DoorDash (DASH.US)$ JMP Securities: Raise the target price of DoorDash (DASH.N) from $210 to $230.

$Snap Inc (SNAP.US)$ Credit Suisse: Raise the target price of Snap (SNAP.N) from US$110 to US$111.

$Goldman Sachs (GS.US)$ Jefferies: Raise the target price of Goldman Sachs (GS.N) from $450 to $479.

$JPMorgan (JPM.US)$ Investment bank Berenberg: Raise the target price of JPMorgan Chase (JPM.N) from US$110 to US$125.

$Disney (DIS.US)$ Barclays: Downgrade Walt Disney (DIS.N) rating from overweight to flat, with a target price of US$175.

$Pinterest (PINS.US)$ Credit Suisse: Reduced the target price of Pinterest (PINS.N) from US$82 to US$62.

$Moderna (MRNA.US)$ US Financial Research and Analysis Center: Upgrade Moderna (MRNA.O) rating from hold to buy, and the target price to $385.

$Baidu (BIDU.US)$ Citi: Lowered the target price of Baidu (BIDU.O) from US$264 to US$254.

$Snap Inc (SNAP.US)$ Credit Suisse: Raise the target price of Snap (SNAP.N) from US$110 to US$111.

$Goldman Sachs (GS.US)$ Jefferies: Raise the target price of Goldman Sachs (GS.N) from $450 to $479.

$JPMorgan (JPM.US)$ Investment bank Berenberg: Raise the target price of JPMorgan Chase (JPM.N) from US$110 to US$125.

$Disney (DIS.US)$ Barclays: Downgrade Walt Disney (DIS.N) rating from overweight to flat, with a target price of US$175.

$Pinterest (PINS.US)$ Credit Suisse: Reduced the target price of Pinterest (PINS.N) from US$82 to US$62.

$Moderna (MRNA.US)$ US Financial Research and Analysis Center: Upgrade Moderna (MRNA.O) rating from hold to buy, and the target price to $385.

$Baidu (BIDU.US)$ Citi: Lowered the target price of Baidu (BIDU.O) from US$264 to US$254.

34

2

Huat Lah

liked

Hey mooers, welcome to Technical DNA's column ![]()

![]()

![]() . I'm using technical indicators to seek good investment opportunities. Today I'm going to introduce an extremely useful indicator, the MACD divergence

. I'm using technical indicators to seek good investment opportunities. Today I'm going to introduce an extremely useful indicator, the MACD divergence ![]()

![]()

![]() . Follow me pls to know more about indicators!

. Follow me pls to know more about indicators! ![]()

![]()

![]()

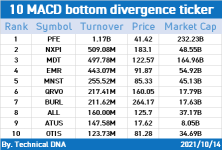

What is MACD divergence?

The 'MACD divergence' is a situation where the price creates higher tops and the MACD creates a raw of lower tops, or the price creates a lower bottom and the MACD creates higher bottoms, MACD divergence after a significant uptrend indicates that the buyers are losing power and MACD divergence after downtrend indicates the sellers losing power.

Therefore, the indicator 'MACD bottom divergence' aims to find stocks that are likely to go up in the future.

Tips: As shown in the pic, the indicator could be useful in short-term investment, so don't hold the stocks too long if you buy them on the indicator. Sell them in time when you make a profit!

Learn More: How to trade using MACD indicator?

Technical DNA collects 10 most-traded bottom divergence tickers from stocks with market cap of more than $2B, aiming to help investors look for good investment opportunities.

$Pfizer (PFE.US)$ $NXP Semiconductors (NXPI.US)$ $Medtronic (MDT.US)$ $Emerson Electric (EMR.US)$ $Monster Beverage (MNST.US)$

Btw I'm collecting feedbacks so please leave your comments here if you have any suggestions, and I will continue to improve!![]()

![]()

![]()

What is MACD divergence?

The 'MACD divergence' is a situation where the price creates higher tops and the MACD creates a raw of lower tops, or the price creates a lower bottom and the MACD creates higher bottoms, MACD divergence after a significant uptrend indicates that the buyers are losing power and MACD divergence after downtrend indicates the sellers losing power.

Therefore, the indicator 'MACD bottom divergence' aims to find stocks that are likely to go up in the future.

Tips: As shown in the pic, the indicator could be useful in short-term investment, so don't hold the stocks too long if you buy them on the indicator. Sell them in time when you make a profit!

Learn More: How to trade using MACD indicator?

Technical DNA collects 10 most-traded bottom divergence tickers from stocks with market cap of more than $2B, aiming to help investors look for good investment opportunities.

$Pfizer (PFE.US)$ $NXP Semiconductors (NXPI.US)$ $Medtronic (MDT.US)$ $Emerson Electric (EMR.US)$ $Monster Beverage (MNST.US)$

Btw I'm collecting feedbacks so please leave your comments here if you have any suggestions, and I will continue to improve!

16

2

Huat Lah

liked

$Disney (DIS.US)$ The analyst will cut expectations for Disney’s direct-to-consumer (DTC) revenue by $1.6 billion in fiscal 2024 to reflect the hypothesis of lower average revenue per user, and expects Hotstar subscribers to account for more than 45% of Disney+ subscribers.

17

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)