The Santa Claus Rally isn't quite dead. At least not yet. Check out these charts...

Readers will see that while the S&P 500 closed out the week on a two-day losing streak, but that the last sale remained well above the lows of the Friday prior to last Friday. That was where the index experienced its upward change of trend on greatly increased trading volume. The daily MACD is still postured quite bearishly, but we'll see this week, just how key that support...

Readers will see that while the S&P 500 closed out the week on a two-day losing streak, but that the last sale remained well above the lows of the Friday prior to last Friday. That was where the index experienced its upward change of trend on greatly increased trading volume. The daily MACD is still postured quite bearishly, but we'll see this week, just how key that support...

9

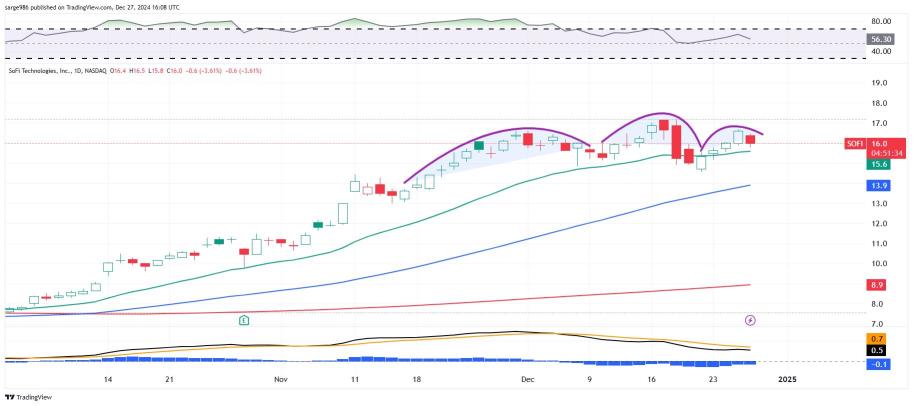

Caution! Possible Head & Shoulders pattern under development. Still love the CEO. Still long $SoFi Technologies (SOFI.US)$

4

1

Caution! Possible double top reversal pattern under development. I am still long $Rocket Lab (RKLB.US)$

6

1

Potentially breaking out from a downward sloping Raff Regression model. I am long $Humacyte (HUMA.US)$ .

10

The untrained eye might not see much in what happened across US financial markets on Thursday. The day started off in a sort of "sleep" mode. Many traders, even those that had not taken on a light holiday week schedule, still had candy canes dancing in their heads early on and it stayed that way until well into the afternoon. At the headline level, equities did not do much, but did manage to post a very slight "down" day, which broke the winning streak for these indices...

3

Is that head and shoulders pattern that formed in Bitcoin? Could be something of a warning. Be careful.

3

1

On Christmas morning, Bloomberg News reported that the Russian military cargo ship that sank in the Mediterranean Sea earlier this week was the target of a terrorist attack, according to Russian state-run media. The Ursa Major, Russia's largest cargo vessel, suffered a series of explosions on its right side, was lost on Monday, had a cargo capacity of 1,200 tons. 14 members of the 16-member crew were rescued. On Christmas afternoon, Bloomberg News reported that Russian forc...

1

Markets amid their extremely high-volume, triple-witching run to glory on Friday, may have set up a Santa Claus Rally. I'm serious. That said, I am not sure. Winners beat losers decisively at both the NYSE and the Nasdaq on Friday, as advancing volume took a commanding share of the action as aggregate trade soared. Is that meaningful? Dead-cat bounce? It is difficult to refer to the elevated level of trade as having real conviction behind it given that so much of it was ti...

9

Winners beat losers at the NYSE on Thursday by a rough 2 to 1 and at the Nasdaq by about 4 to 3. Advancing volume took a 39.7% share of composite NYSE-listed trade and a 46.3% share of composite Nasdaq-listed trade. However, aggregate trading volume receded from Wednesday's levels for names domiciled at both exchanges. As stocks generally moved sideways. You kids get where I am going with this?

With today being a triple witching event and also the final trading day ahead of...

With today being a triple witching event and also the final trading day ahead of...

7

1

Here is what hurt the market as soon as it was released. As far as year-end 2024 GDP is concerned, the FOMC's median expectation moved all the way up to growth of 2.5% from just 2% in September. In taking the committee's expectations for economic growth significantly higher, the committee also took their year-end median expectation for the unemployment rate down to 4.2% from 4.4% in September, while taking PCE inflation up to 2.4% from 2.3%, and Core PCE up to 2.8% ...

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)