jackie210726

liked

$Alibaba (BABA.US)$ To believe that BABA will be trading at lower than $160 3-5 years forward, you have to assume that its businesses will decline overall and its profitability will suddenly take a nose dive for a long period. I believe this narrative is somewhat being portrayed in media coverage given the fear over common prosperity and the crackdowns that have induced people to believe that BABA is having its profitability squeezed by the Chinese government.

18

5

jackie210726

liked

$Corning (GLW.US)$ Corning (GLW) – The glass and specialty materials maker fell 3.4% in the premarket after it reported that the automotive industry production slowdown impacted its quarterly results. Corning missed estimates by 2 cents a share, with quarterly earnings of 56 cents per share. Revenue also missed forecasts.

$Eli Lilly and Co (LLY.US)$ Eli Lilly (LLY) – The drugmaker’s shares gained 1% in premarket action despite a 4 cents a share quarterly earnings miss, with profit of $1.94 per share. Revenue beat forecasts, but Lilly spent more money during the quarter on research and development. The company also raised its full-year outlook.

$3M (MMM.US)$ 3M (MMM) – 3M reported quarterly earnings of $2.45 per share, compared to a consensus estimate of $2.20 a share. Revenue exceeded Street forecasts. 3M saw increased demand during the quarter for both its consumer and industrial segments.

$Eli Lilly and Co (LLY.US)$ Eli Lilly (LLY) – The drugmaker’s shares gained 1% in premarket action despite a 4 cents a share quarterly earnings miss, with profit of $1.94 per share. Revenue beat forecasts, but Lilly spent more money during the quarter on research and development. The company also raised its full-year outlook.

$3M (MMM.US)$ 3M (MMM) – 3M reported quarterly earnings of $2.45 per share, compared to a consensus estimate of $2.20 a share. Revenue exceeded Street forecasts. 3M saw increased demand during the quarter for both its consumer and industrial segments.

27

jackie210726

liked

Hey mooers![]()

![]()

Happy Friday! Weekly Sectors Fund Flow Board is here~![]()

![]()

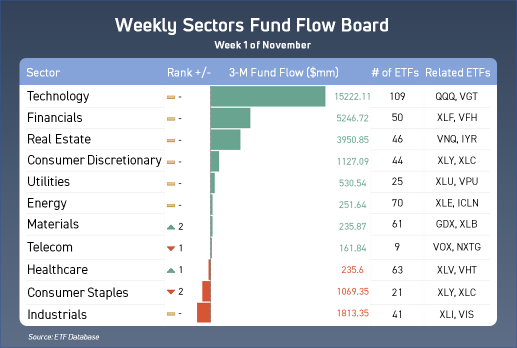

From this chart, you will be able to find out what sector ETFs have most fund inflow. Fund inflow is often considered as a bullish sign of the sector and related ETFs!

^Weekly Sectors Fund Flow Board: a sector ranking based on sector ETFs aggregate 3-month fund flows.

^3-month fund flows: a metric that can be used to gaugethe perceived popularity amongst investors of different sectors.

^The board includes the following information: change of rankings, 3-month fund flows, how many ETFs are in the sectors, and the related ETFs.

For this week, I covered the top two sector-realted ETFs with the highest total assets! Now, let's take a look at the board~You may find something to diversify your porfolio![]()

![]()

* Follow me to know what is hot on the market![]()

![]()

![]()

*Please leave your comments and thumbs up below!![]()

![]()

![]()

Latest News of Top Sectors:

In previouse two weeks, Tech, REITs, and FIN were the top 3 sectors with fund inflows. This week top 3 are same as past two weeks.

*Technology![]()

![]()

![]()

Technology stocks eased slightly Thursday afternoon, with the $The Technology Select Sector SPDR® Fund (XLK.US)$adding 1.3% in late trade while the $PHLX Semiconductor Index (.SOX.US)$was 2.9% higher.

$Qualcomm (QCOM.US)$gained almost 13% after the chipmaker reported non-GAAP earnings and revenue for its fiscal Q4 exceeding Wall Street expectations and also guided results for the current quarter above analyst estimates.

$NVIDIA (NVDA.US)$rallied to a record on Thursday, in the latest example of the company extending a 2021 advance that has seen the stock more than double.

Read more:Nvidia hits record high as stock surge nears 120% this year

*Financials![]()

![]()

Financial stocks extended their Thursday declines, with the NYSE Financial index dropping 1.5% in afternoon trading while the $Financial Select Sector SPDR Fund (XLF.US)$was off 1.7%.

$NerdWallet (NRDS.US)$was soaring late in its first day of trading, rising almost 68% after the financial information company overnight priced a $131 million initial public offering of 7.25 million shares at $18 apiece, the mid-point of its expected $17 to $19 range.

Read more:Personal finance site NerdWallet rises 87.11%

*Real Estate![]()

The $Real Estate Select Sector Spdr Fund (The) (XLRE.US)$was down 1.2% on Thursday.

$Zillow-C (Z.US)$'s roughly $1.15 billion pile of mortgage bonds tied to its home-buying business has been thrust into the spotlight, after the real-estate giant on Tuesday called it quits on its iBuying home-flipping business.

Source: Dow Jones Newswires, MT Newswires

Happy Friday! Weekly Sectors Fund Flow Board is here~

From this chart, you will be able to find out what sector ETFs have most fund inflow. Fund inflow is often considered as a bullish sign of the sector and related ETFs!

^Weekly Sectors Fund Flow Board: a sector ranking based on sector ETFs aggregate 3-month fund flows.

^3-month fund flows: a metric that can be used to gaugethe perceived popularity amongst investors of different sectors.

^The board includes the following information: change of rankings, 3-month fund flows, how many ETFs are in the sectors, and the related ETFs.

For this week, I covered the top two sector-realted ETFs with the highest total assets! Now, let's take a look at the board~You may find something to diversify your porfolio

* Follow me to know what is hot on the market

*Please leave your comments and thumbs up below!

Latest News of Top Sectors:

In previouse two weeks, Tech, REITs, and FIN were the top 3 sectors with fund inflows. This week top 3 are same as past two weeks.

*Technology

Technology stocks eased slightly Thursday afternoon, with the $The Technology Select Sector SPDR® Fund (XLK.US)$adding 1.3% in late trade while the $PHLX Semiconductor Index (.SOX.US)$was 2.9% higher.

$Qualcomm (QCOM.US)$gained almost 13% after the chipmaker reported non-GAAP earnings and revenue for its fiscal Q4 exceeding Wall Street expectations and also guided results for the current quarter above analyst estimates.

$NVIDIA (NVDA.US)$rallied to a record on Thursday, in the latest example of the company extending a 2021 advance that has seen the stock more than double.

Read more:Nvidia hits record high as stock surge nears 120% this year

*Financials

Financial stocks extended their Thursday declines, with the NYSE Financial index dropping 1.5% in afternoon trading while the $Financial Select Sector SPDR Fund (XLF.US)$was off 1.7%.

$NerdWallet (NRDS.US)$was soaring late in its first day of trading, rising almost 68% after the financial information company overnight priced a $131 million initial public offering of 7.25 million shares at $18 apiece, the mid-point of its expected $17 to $19 range.

Read more:Personal finance site NerdWallet rises 87.11%

*Real Estate

The $Real Estate Select Sector Spdr Fund (The) (XLRE.US)$was down 1.2% on Thursday.

$Zillow-C (Z.US)$'s roughly $1.15 billion pile of mortgage bonds tied to its home-buying business has been thrust into the spotlight, after the real-estate giant on Tuesday called it quits on its iBuying home-flipping business.

Source: Dow Jones Newswires, MT Newswires

92

10

jackie210726

liked

19

2

jackie210726

liked

$ReWalk Robotics (RWLK.US)$ I'm just chilling here. Waiting to exit. Honestly no idea what's happening in this cold stock. Don't mind me, for those who believe it in, all the best.

3

jackie210726

liked

$Exela Technologies (XELA.US)$ NB this stock easy to borrow cheap to short not looking good

8

1

jackie210726

liked

The ultimate point of a stop loss is to limit one's losses. With today's high volumes of trading and free flow of information, market volatility now comes more into play than perhaps ever before. As my stock investment is based on longer timelines and company fundamentals, I am not overly concerned with short term volatility and price fluctuations. One losing investment in my stock portfolio is $Alibaba (BABA.US)$ which I would not hesitate to hold. The stock price of $Alibaba (BABA.US)$ has been hammered due to China's regulatory crackdown on the tech sector. Nevertheless, $Alibaba (BABA.US)$ remains a fundamentally strong company as its core operating businesses continue to grow at increasing rates. Despite its strong growth rates, $Alibaba (BABA.US)$ is still trading at very low valuations, below its intrinsic value, making it an attractive long term investment. Though $Alibaba (BABA.US)$ has suffered from multiple setbacks for the past year arising from Chinese regulatory pressures, its core businesses continue to deliver. Not only that, its other businesses including international retail, logistics and cloud computing, which is seen an increasing challenge to US tech giants $Amazon (AMZN.US)$ and $Microsoft (MSFT.US)$, are all expanding at impressive rates. Despite the decline in stock price, $Alibaba (BABA.US)$ is a fundamentally solid company that continues to perform well across all its business segments. Furthermore, its recent investments will not only mitigate its regulatory risks but expand its total potential market in the future. The recent increased investment of $Alibaba (BABA.US)$ from the legendary investor, Charlie Munger shows that with a little patience, it is worthwhile to take some short term pain for long term gain. As such, $Alibaba (BABA.US)$ not only remains in my stock portfolio but I have raised my stakes in this Chinese tech stalwart.

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

75

73

jackie210726

commented on

Monday, August 16, 2021

By Mia

![]() You found me! Today's password is :"Short Sale Analysis"

You found me! Today's password is :"Short Sale Analysis"

By Mia

+2

59

423

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)