JaketheVender

reacted to

Spoiler:

At the end of this post, there is a chance for you to win points!

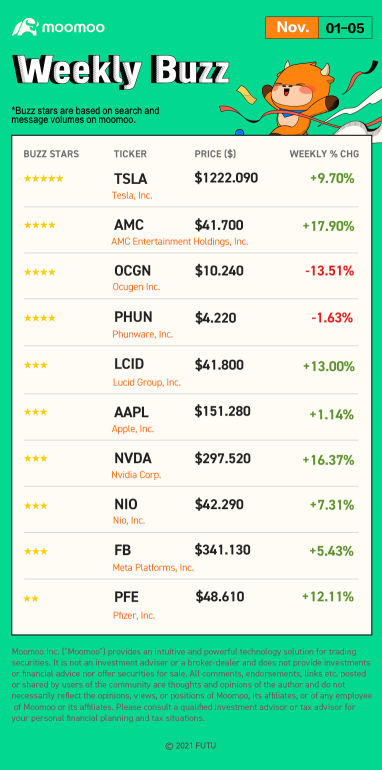

Happy Monday mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ: Buzzing Stocks List & Mooers Comments

Every major index moved higher last week. Here is the weekly buzzing stock list of last week:

1. TSLA - Buzzing Stars: ⭐⭐⭐⭐⭐

Shares of Tesla closed at $1222.090 last Friday with a weekly rise of 9.70% as it launched a pilot program in the Netherlands to share its Supercharger network with other electric car brands for a fee.

● Mooers comment

@Tuyea: To the moon

$Tesla (TSLA.US)$ time to liftoff again to $1300

@Jai Dev: Elon Musk Wins 'Approval' To Sell Tesla Stock

Elon has to sell some stock or it expires worthless which is why he is considering this. Nothing about the fundamentals of Tesla has changed besides them getting better. This changes nothing, im holding until 2030 min. Buy the dip.

2. AMC - Buzzing Stars: ⭐⭐⭐⭐

Movie theater rebound is in full swing. AMC's stock price closed at $41.700 with a weekly rise of 17.90%. Shares of AMC were rising almost 8% in the morning trading last Wednesday as meme stock support propelled the movie theater operator higher.

● Mooers comment

@XQJ-37: $AMC Entertainment (AMC.US)$

@Sikwitit: I’m a AMC junkie been going to them every other weekend since I was 13 collecting ticket stubs. It was my 1st investment in the stock market August 18th 2020 cause I thought maybe it would help save them from bankruptcy. I didn’t know anything else about everything else.

3. OCGN - Buzzing Stars:⭐⭐⭐⭐

OCGN lost 13.51% last week and finally closed at $10.240. Ocugen stock was waylaid by traders taking profits, stock price down 7.3% to $11.80 in last Thursday.

● Mooers comment

@APTTMH: $Ocugen (OCGN.US)$ is at a decent price considering WHO approving Covaxin and the opportunity for growth from supply and demand. $Pfizer (PFE.US)$ dipped in Dec. 2020 when vaccines were first given so I think Ocugen will followed suit.

4. PHUN - Buzzing Stars: ⭐⭐⭐⭐

PHUN stock closed at $4.220 last Friday with a weekly decline of 1.63%, despite the stock gaining 0.91% in pre-market trading last Thursday morning.

● Mooers comment

@EpicStocks: Made a Chart for Everyone. The crossover is Bullish

5. LCID - Buzzing Stars:⭐⭐⭐

This is the 11th Lucid Studio to open, which excites investors who are interested in the Lucid brand's future growth potential. The shares of LCID gained 13.00% last week and finally closed at $41.800.

● Mooers comment

@Devilton: $Lucid Group (LCID.US)$ $Rivian Automotive (RIVN.US)$ This Tue is IPO for Rivian, another new EV player in the share market with super huge potential. the 2 reasons why I think so are:

1. Although EV too, it is mainly in trucks and vans segment, so differentiate itself from Tesla and Lucid, hence no direct competition. And with its strong backing, should be taking majority of that pie.

2. It is back by Amazon and Ford, with orders already placed by Amazon for 50,000(I think) delivery trucks. I’m sure this is just the beginning. Read more..

6. AAPL - Buzzing Stars: ⭐⭐⭐

Apple appears to have planned for a big iPhone cycle ahead of the chip shortage issues. Its stock price closed at $151.280, with a weekly rise of 1.14%.

● Mooers comment

@Matthew Bryson: Apple Shares Are Likely To Consolidate For The Next Couple Of Years

The iPhone maker $Apple (AAPL.US)$ generates large revenues and free cash flows and will most certainly continue to do so for the foreseeable future. This, however, could already be priced in the company's stock, which makes it susceptible to a price consolidation or slight correction in the short term. This is even more so due to the post-pandemic hefty 2021 revenue increases, which the company is unlikely to sustain in the next year or two. Read more...

7. NVDA - Buzzing Stars:⭐⭐⭐

After announcing its Omniverse Enterprise platform, which was a platform for connecting 3D worlds in a shared virtual universe. NVDA stock was up 16.37% to $297.520 last week.

● Mooers comment

@Perfume_girl: $NVIDIA (NVDA.US)$ trillion dollar market cap

@efficentupup: Nvidia's Market Value Surpasses Berkshire Hathaway For The First Time

On Tuesday, November 2, Nvidia's market value surpassed Berkshire Hathaway for the first time, ranking seventh in the United States.

As of Wednesday's close, Nvidia closed up 0.75%, with a total market value of 664.95 billion US dollars; from a trillion market value, Nvidia still needs to rise 50.38%. Read more...

8. NIO - Buzzing Stars:⭐⭐⭐

NIO saw its stock price close at $42.290 with a weekly rise of 7.31%. Nio received support from analysts as the investment firm reiterated its buy rating on the stock. The analyst also gave Nio a very generous price target of $67.00, which was one of the highest marks on Wall Street.

● Mooers comment

@CoolWaterCoolWater: NIO = No Oil.

9. FB - Buzzing Stars:⭐⭐⭐

FB stock increased 5.43% to $341.130 over the past week. CEO Mark Zuckerberg is building a "virtual world", formally called Oculus, which is based on technology found in the company's virtual reality headset.

● Mooers comment

@Investing 101: $Meta Platforms (FB.US)$We have closed above 337 resistance and right below 342 resistance which was slightly better than what I expected for the week. Thanks to smart money flooding in after we broke the downward resistance trendline. Read more...

10. PFE - Buzzing Stars: ⭐⭐

PFE shares were up 12.11% to $48.610 last week with Pfizer's drug reduced Covid hospitalizations by 89% in the clinical trial, a finding that has the potential to upend how the disease caused by the coronavirus is treated and alter the course of the pandemic.

● Mooers comment

@skytrade: $Pfizer (PFE.US)$Thank you

![]() Thanks for your reading!

Thanks for your reading!

![]() Awarding Moment

Awarding Moment

Before moving on to part three, congrats to the following mooers whose comments were selected as the top comments last week!

@HuatLady @treydongui @cowabanga @Moo Bull 102206726 @HuatEver @VCSuccess @Tupack H Mcsnacks @Sadeesh @HopeAlways @hexuan92 @Syuee @Jia Yung

We really appreciate your great insights! Read the top comments last week!

Notice: Reward will be sent to you this week. Please feel free to contact us if there is any problem.

Part Ⅲ: Weekly Topic

Time to be rewarded for your great insights and knowledge!

This week, we'd like to invite you to comment below and share your idea on:

"My first investment in the stock market."

We will select 20 TOP COMMENTS by next Monday.

Winners will get 200 points by next week, with which you can exchange gifts at Reward Club.

*Comments within this week will be counted.

Top Comment Technique:

● Fundamental / Technical / Capital Analyses

● Personal Trading Experience

● Any bright insights or knowledge

Previous of WeeklyBuzz

Weekly Buzz: "What is Metaverse?"

Weekly Buzz: "Have some PHUN."

Weekly Buzz: "Be optimistic but don't be too optimistic."

Disclaimer: Comments below are made available for informational purposes only. Before investing, please consult a licensed professional.

At the end of this post, there is a chance for you to win points!

Happy Monday mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ: Buzzing Stocks List & Mooers Comments

Every major index moved higher last week. Here is the weekly buzzing stock list of last week:

1. TSLA - Buzzing Stars: ⭐⭐⭐⭐⭐

Shares of Tesla closed at $1222.090 last Friday with a weekly rise of 9.70% as it launched a pilot program in the Netherlands to share its Supercharger network with other electric car brands for a fee.

● Mooers comment

@Tuyea: To the moon

$Tesla (TSLA.US)$ time to liftoff again to $1300

@Jai Dev: Elon Musk Wins 'Approval' To Sell Tesla Stock

Elon has to sell some stock or it expires worthless which is why he is considering this. Nothing about the fundamentals of Tesla has changed besides them getting better. This changes nothing, im holding until 2030 min. Buy the dip.

2. AMC - Buzzing Stars: ⭐⭐⭐⭐

Movie theater rebound is in full swing. AMC's stock price closed at $41.700 with a weekly rise of 17.90%. Shares of AMC were rising almost 8% in the morning trading last Wednesday as meme stock support propelled the movie theater operator higher.

● Mooers comment

@XQJ-37: $AMC Entertainment (AMC.US)$

@Sikwitit: I’m a AMC junkie been going to them every other weekend since I was 13 collecting ticket stubs. It was my 1st investment in the stock market August 18th 2020 cause I thought maybe it would help save them from bankruptcy. I didn’t know anything else about everything else.

3. OCGN - Buzzing Stars:⭐⭐⭐⭐

OCGN lost 13.51% last week and finally closed at $10.240. Ocugen stock was waylaid by traders taking profits, stock price down 7.3% to $11.80 in last Thursday.

● Mooers comment

@APTTMH: $Ocugen (OCGN.US)$ is at a decent price considering WHO approving Covaxin and the opportunity for growth from supply and demand. $Pfizer (PFE.US)$ dipped in Dec. 2020 when vaccines were first given so I think Ocugen will followed suit.

4. PHUN - Buzzing Stars: ⭐⭐⭐⭐

PHUN stock closed at $4.220 last Friday with a weekly decline of 1.63%, despite the stock gaining 0.91% in pre-market trading last Thursday morning.

● Mooers comment

@EpicStocks: Made a Chart for Everyone. The crossover is Bullish

5. LCID - Buzzing Stars:⭐⭐⭐

This is the 11th Lucid Studio to open, which excites investors who are interested in the Lucid brand's future growth potential. The shares of LCID gained 13.00% last week and finally closed at $41.800.

● Mooers comment

@Devilton: $Lucid Group (LCID.US)$ $Rivian Automotive (RIVN.US)$ This Tue is IPO for Rivian, another new EV player in the share market with super huge potential. the 2 reasons why I think so are:

1. Although EV too, it is mainly in trucks and vans segment, so differentiate itself from Tesla and Lucid, hence no direct competition. And with its strong backing, should be taking majority of that pie.

2. It is back by Amazon and Ford, with orders already placed by Amazon for 50,000(I think) delivery trucks. I’m sure this is just the beginning. Read more..

6. AAPL - Buzzing Stars: ⭐⭐⭐

Apple appears to have planned for a big iPhone cycle ahead of the chip shortage issues. Its stock price closed at $151.280, with a weekly rise of 1.14%.

● Mooers comment

@Matthew Bryson: Apple Shares Are Likely To Consolidate For The Next Couple Of Years

The iPhone maker $Apple (AAPL.US)$ generates large revenues and free cash flows and will most certainly continue to do so for the foreseeable future. This, however, could already be priced in the company's stock, which makes it susceptible to a price consolidation or slight correction in the short term. This is even more so due to the post-pandemic hefty 2021 revenue increases, which the company is unlikely to sustain in the next year or two. Read more...

7. NVDA - Buzzing Stars:⭐⭐⭐

After announcing its Omniverse Enterprise platform, which was a platform for connecting 3D worlds in a shared virtual universe. NVDA stock was up 16.37% to $297.520 last week.

● Mooers comment

@Perfume_girl: $NVIDIA (NVDA.US)$ trillion dollar market cap

@efficentupup: Nvidia's Market Value Surpasses Berkshire Hathaway For The First Time

On Tuesday, November 2, Nvidia's market value surpassed Berkshire Hathaway for the first time, ranking seventh in the United States.

As of Wednesday's close, Nvidia closed up 0.75%, with a total market value of 664.95 billion US dollars; from a trillion market value, Nvidia still needs to rise 50.38%. Read more...

8. NIO - Buzzing Stars:⭐⭐⭐

NIO saw its stock price close at $42.290 with a weekly rise of 7.31%. Nio received support from analysts as the investment firm reiterated its buy rating on the stock. The analyst also gave Nio a very generous price target of $67.00, which was one of the highest marks on Wall Street.

● Mooers comment

@CoolWaterCoolWater: NIO = No Oil.

9. FB - Buzzing Stars:⭐⭐⭐

FB stock increased 5.43% to $341.130 over the past week. CEO Mark Zuckerberg is building a "virtual world", formally called Oculus, which is based on technology found in the company's virtual reality headset.

● Mooers comment

@Investing 101: $Meta Platforms (FB.US)$We have closed above 337 resistance and right below 342 resistance which was slightly better than what I expected for the week. Thanks to smart money flooding in after we broke the downward resistance trendline. Read more...

10. PFE - Buzzing Stars: ⭐⭐

PFE shares were up 12.11% to $48.610 last week with Pfizer's drug reduced Covid hospitalizations by 89% in the clinical trial, a finding that has the potential to upend how the disease caused by the coronavirus is treated and alter the course of the pandemic.

● Mooers comment

@skytrade: $Pfizer (PFE.US)$Thank you

Before moving on to part three, congrats to the following mooers whose comments were selected as the top comments last week!

@HuatLady @treydongui @cowabanga @Moo Bull 102206726 @HuatEver @VCSuccess @Tupack H Mcsnacks @Sadeesh @HopeAlways @hexuan92 @Syuee @Jia Yung

We really appreciate your great insights! Read the top comments last week!

Notice: Reward will be sent to you this week. Please feel free to contact us if there is any problem.

Part Ⅲ: Weekly Topic

Time to be rewarded for your great insights and knowledge!

This week, we'd like to invite you to comment below and share your idea on:

"My first investment in the stock market."

We will select 20 TOP COMMENTS by next Monday.

Winners will get 200 points by next week, with which you can exchange gifts at Reward Club.

*Comments within this week will be counted.

Top Comment Technique:

● Fundamental / Technical / Capital Analyses

● Personal Trading Experience

● Any bright insights or knowledge

Previous of WeeklyBuzz

Weekly Buzz: "What is Metaverse?"

Weekly Buzz: "Have some PHUN."

Weekly Buzz: "Be optimistic but don't be too optimistic."

Disclaimer: Comments below are made available for informational purposes only. Before investing, please consult a licensed professional.

+7

117

46

JaketheVender

liked and commented on

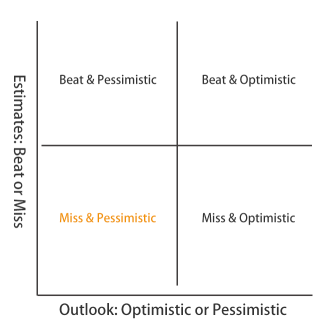

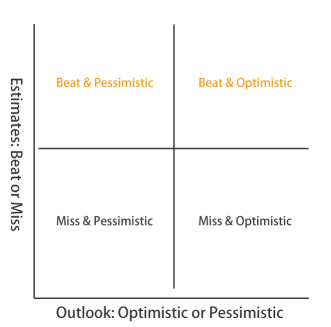

On October 26, $Robinhood (HOOD.US)$ released its Q3 earnings that beats the estimates, and the management gives a pessimistic outlook, followed by a 10% drop in pre-market. Let's see the highlights that might affect its stock price.

Financial Highlights

Q3 revenue $364.9 million, up 35% year-on-year but drop from $565 million in Q2, missed Wall Street estimates of $423.9 million.

Q3 EPS -2.06 vs. -1.37 estimates.

Among transaction-based revenues:

-Options increased 29% to $164 million, compared with $127 million in Q3 2020.

-Cryptocurrencies increased 860% to $51 million, compared to $5 million in Q3 2020.

-Equities decreased 27% to $50 million, compared with $69 million in Q3 2020.

Operating & Business Highlights

-Monthly Active Users (MAU) increased 76% YoY to 18.9 million vs. 21.3 million in Q2.

-Net Cumulative Funded Accounts increased 97% YoY to 22.4 million vs. 22.5 million in Q2.

-Assets Under Custody (AUC) increased 115%YoY to $95 billion vs. $102 billion in Q2.

-Average Revenues Per User (ARPU) $65, down 36% YoY, vs. $112 in Q2.

Outlook

-The company's annual revenue forecast of less than $1.8 billion vs. $2.03 billion estimates.

-Expect new funded accounts for the fourth quarter will be roughly in line with the 660,000 -opened in Q3 2021.

-Crypto activity declined from record highs in the prior quarter, leading to considerably fewer new accounts.

-Expect to recognize over a weighted-average period of 2.56 years.

Click to see the original report>>

What's your thought on HOOD Q3 earnings? Which way will the stock price go? Feel free to leave your comment below.

Financial Highlights

Q3 revenue $364.9 million, up 35% year-on-year but drop from $565 million in Q2, missed Wall Street estimates of $423.9 million.

Q3 EPS -2.06 vs. -1.37 estimates.

Among transaction-based revenues:

-Options increased 29% to $164 million, compared with $127 million in Q3 2020.

-Cryptocurrencies increased 860% to $51 million, compared to $5 million in Q3 2020.

-Equities decreased 27% to $50 million, compared with $69 million in Q3 2020.

Operating & Business Highlights

-Monthly Active Users (MAU) increased 76% YoY to 18.9 million vs. 21.3 million in Q2.

-Net Cumulative Funded Accounts increased 97% YoY to 22.4 million vs. 22.5 million in Q2.

-Assets Under Custody (AUC) increased 115%YoY to $95 billion vs. $102 billion in Q2.

-Average Revenues Per User (ARPU) $65, down 36% YoY, vs. $112 in Q2.

Outlook

-The company's annual revenue forecast of less than $1.8 billion vs. $2.03 billion estimates.

-Expect new funded accounts for the fourth quarter will be roughly in line with the 660,000 -opened in Q3 2021.

-Crypto activity declined from record highs in the prior quarter, leading to considerably fewer new accounts.

-Expect to recognize over a weighted-average period of 2.56 years.

Click to see the original report>>

What's your thought on HOOD Q3 earnings? Which way will the stock price go? Feel free to leave your comment below.

20

6

JaketheVender

liked and commented on

Gen Z investors have greater access to the stock market than earlier generations. Social media buzz and reviews from influencers have gained popularity among SG's Gen Z investors where many have turned to seeking for investing information. The quick format of videos on social media apps allows for complex information to be explained in an easy and engaging manner, which makes it very appealing to the younger investors. While investing education on social media is useful, it would be wise not to overlook the traditional measures of a stock which include market cap, P/E ratio, P/S ratio and EPS. Knowing company fundamentals would still be important for making investment decisions even in a bullish market as investors can never predict for sure when the bull market will end. While small cap stocks are popular among the Gen Z investors for their low capital and spectacular gains within a shorter time frame, these stocks tend to be more unpredictable and trading on momentum rather than actual fundamentals. Financial literacy would be a useful commodity to possess in the new investing era. Investing is one of the best ways to accrue monetary gains over the long term and achieve one's financial goals, but investors should not approach investing with the mindset of getting rich fast. The most dependable way to build wealth is to take a long term approach which prioritises buying and holding high quality stocks for the long haul. The stock market can gain and lose value in unpredictable manner and the best way to cope with market volatility and price fluctuations is patience. Long term investors could generate wealth without spending overwhelming amounts of time sweating over their stock portfolios.

$American Express (AXP.US)$

$Apple (AAPL.US)$

$Ford Motor (F.US)$

$GE Aerospace (GE.US)$

$Lemonade (LMND.US)$

$Microsoft (MSFT.US)$

$NIO Inc (NIO.US)$

$Palantir (PLTR.US)$

$Pfizer (PFE.US)$

$Block (SQ.US)$

$Tesla (TSLA.US)$

$Disney (DIS.US)$

$American Express (AXP.US)$

$Apple (AAPL.US)$

$Ford Motor (F.US)$

$GE Aerospace (GE.US)$

$Lemonade (LMND.US)$

$Microsoft (MSFT.US)$

$NIO Inc (NIO.US)$

$Palantir (PLTR.US)$

$Pfizer (PFE.US)$

$Block (SQ.US)$

$Tesla (TSLA.US)$

$Disney (DIS.US)$

72

59

JaketheVender

liked and commented on

On October 26, $Alphabet-C (GOOG.US)$ released its Q3 earnings that beats the estimates, following a 0.45% drop in post market. Let's see the highlights that might affect its stock price.

Financial Highlights

Q3 revenue $65.1 bln, up 41%YoY, beating the $63.5 bln estimates

Q3 netincome$18.9 billion,up 68% YoY

Operating margin 32% vs.24% in Q3 2020

Operating & Business Highlights

-The revenue of Google Service (Google Search, YouTube ads, Google Network) and Google Cloud are $59.9 bln and $4.9 bln. The proportion of Cloud revenue remains almost unchanged (7.5%) year-on-year.

-In Q3, the company repurchased and subsequently retired 4.6 million aggregate shares.

Outlook

-Sundar Pichai, CEO of Alphabet and Google, said: “Five years ago, I laid out our vision to become an AI-first company. This quarter’s results show how our investments there are enabling us to build more helpful products."

-Given the gradual recovery in results through the back half of 2020, the benefit from lapping prior year performance diminished in Q3 versus Q2 and will diminish further in Q4.

-Within other revenues in the fourth quarter, the company expect the ongoing drivers of revenue growth to the Hardware due to the benefit from the holiday selling season and inclusion of Fitbit, as well as YouTube subscriptions.

- The company expects robust headcount growth in Q4 for both Google Services and Google Cloud.

Click to see the original earnings report>>

What's your thought on GOOG Q3 earnings? Is now a good time to buy or sell? Which way will the stock price go?

We can't wait to see your comments.

Financial Highlights

Q3 revenue $65.1 bln, up 41%YoY, beating the $63.5 bln estimates

Q3 netincome$18.9 billion,up 68% YoY

Operating margin 32% vs.24% in Q3 2020

Operating & Business Highlights

-The revenue of Google Service (Google Search, YouTube ads, Google Network) and Google Cloud are $59.9 bln and $4.9 bln. The proportion of Cloud revenue remains almost unchanged (7.5%) year-on-year.

-In Q3, the company repurchased and subsequently retired 4.6 million aggregate shares.

Outlook

-Sundar Pichai, CEO of Alphabet and Google, said: “Five years ago, I laid out our vision to become an AI-first company. This quarter’s results show how our investments there are enabling us to build more helpful products."

-Given the gradual recovery in results through the back half of 2020, the benefit from lapping prior year performance diminished in Q3 versus Q2 and will diminish further in Q4.

-Within other revenues in the fourth quarter, the company expect the ongoing drivers of revenue growth to the Hardware due to the benefit from the holiday selling season and inclusion of Fitbit, as well as YouTube subscriptions.

- The company expects robust headcount growth in Q4 for both Google Services and Google Cloud.

Click to see the original earnings report>>

What's your thought on GOOG Q3 earnings? Is now a good time to buy or sell? Which way will the stock price go?

We can't wait to see your comments.

15

2

JaketheVender

liked and commented on

The biggest market surge in the major indexes $Dow Jones Industrial Average (.DJI.US)$, $Nasdaq Composite Index (.IXIC.US)$, $S&P 500 Index (.SPX.US)$ since June seems to suggest that the red hot bull may be exhausted. There are questions about the longevity of the bull market in stocks with talks of tapering by the Fed and rising inflation. Still, the bull market appears resilient and the bull run may be far from over. Rather than trying to predict the eventual end of the bull, it may be more worthwhile to maintain a long term focus on our investment to generate long term wealth. While many would suggest buying the dips in this bull market as a smart way to buy good stocks at a lower price, it is never easy to perfectly time the market. One possible strategy to invest in this bull market is by adopting the principle of Dollar Cost Averaging for high quality stocks $Apple (AAPL.US)$, $Amazon (AMZN.US)$, $Alibaba (BABA.US)$, $Bank of America (BAC.US)$, $Meta Platforms (FB.US)$, $Microsoft (MSFT.US)$, $Netflix (NFLX.US)$ $NVIDIA (NVDA.US)$, $Tesla (TSLA.US)$. By investing the same dollar amounts at specific time intervals, this can help us stay vested in the bull market while allowing our stock portfolios to withstand any market pullbacks or volatility.

84

70

JaketheVender

reacted to

1) Now that moomoo has a SG User Guide and a US Starter Guide, can we also have a HK and CNH Market Guide for those interested in trading in the respective markets?

2) Currently, there are multiple videos in each course. It would be great if we can copy the url of individual video tutorials instead of the course. This will make it easy to share specific videos.

3) Can the titles of courses be made searchable? For instance, if I search for “How to Trade on Margin” (terrific video by the way), it would be helpful if it can show up in the results under “Course”.

4) Now that we can paper trade futures, where can we find information on the rules and functions supported?

5) Can a video tutorial be created for the new product Money Plus?

@Team moomoo @PM George

2) Currently, there are multiple videos in each course. It would be great if we can copy the url of individual video tutorials instead of the course. This will make it easy to share specific videos.

3) Can the titles of courses be made searchable? For instance, if I search for “How to Trade on Margin” (terrific video by the way), it would be helpful if it can show up in the results under “Course”.

4) Now that we can paper trade futures, where can we find information on the rules and functions supported?

5) Can a video tutorial be created for the new product Money Plus?

@Team moomoo @PM George

29

10

JaketheVender

liked

I believe the current bull market will continue into the new year, although with some volatility. Investors need to look for bargains on stock that is trading near its lows for potential gains thru the end of the year and follow the market, if market pulls back you pull back assets.

2

1

JaketheVender

liked and commented on

Nobody can actually predict when a bull run will end. Not you, not me or even Legendary Buffett. What is more important is that we must Ensure that our investment portfolio include some quality shares that can withstand the torment of a bearish season. However, with the evolution of EV, (electric vechicle) holding a share in the automaker buisness can be a safe wager.

With the global concern for zero waste and the avoidance of the harmful effects of carbon dioxide emissions, EV will certainly take over gasoline driven vechicles in the near future. This move is further enhanced by the steep increase in gasoline prices of late.

Will $Tesla (TSLA.US)$ be the “KING” of the future EV evolution since it has Long been an established brand? Obviously, Tesla is facing competitive challenges from other renowned automakers like $Ford Motor (F.US)$, $NIO Inc (NIO.US)$, $Toyota Motor (TM.US)$ or a lesser known, but up and coming company like $Rivian Automotive (RIVN.US)$, with its promise of a better battery pack.

Ultimately, the end users must decide whether $Tesla (TSLA.US)$ is a value for dollar buy, as compared to some other cheaper EV Brand’s.

Of course the safety features incorporated is also an important selling point.

Irregardless of whether the bull run has ended or will be ending, it is wise to hold Tesla’s shares because it is an iconic brand. Other shares that are worth investing for Long term benefits are:

$Apple (AAPL.US)$

$Alibaba (BABA.US)$

$Amazon (AMZN.US)$

$Netflix (NFLX.US)$

I am positive that the above shares mentioned are realistic quality investment that can reap the harvest that a bull run can bring, or weather the harsh realities of a bear run.

With the global concern for zero waste and the avoidance of the harmful effects of carbon dioxide emissions, EV will certainly take over gasoline driven vechicles in the near future. This move is further enhanced by the steep increase in gasoline prices of late.

Will $Tesla (TSLA.US)$ be the “KING” of the future EV evolution since it has Long been an established brand? Obviously, Tesla is facing competitive challenges from other renowned automakers like $Ford Motor (F.US)$, $NIO Inc (NIO.US)$, $Toyota Motor (TM.US)$ or a lesser known, but up and coming company like $Rivian Automotive (RIVN.US)$, with its promise of a better battery pack.

Ultimately, the end users must decide whether $Tesla (TSLA.US)$ is a value for dollar buy, as compared to some other cheaper EV Brand’s.

Of course the safety features incorporated is also an important selling point.

Irregardless of whether the bull run has ended or will be ending, it is wise to hold Tesla’s shares because it is an iconic brand. Other shares that are worth investing for Long term benefits are:

$Apple (AAPL.US)$

$Alibaba (BABA.US)$

$Amazon (AMZN.US)$

$Netflix (NFLX.US)$

I am positive that the above shares mentioned are realistic quality investment that can reap the harvest that a bull run can bring, or weather the harsh realities of a bear run.

16

11

JaketheVender

liked

$Virgin Galactic (SPCE.US)$

$Palantir (PLTR.US)$

$Nano Dimension (NNDM.US)$

$Bit Brother (BTB.US)$

$Aurora Cannabis (ACB.US)$

$Village Farms International (VFF.US)$

$Tilray Brands (TLRY.US)$

$Canopy Growth (CGC.US)$

$Bitcoin (BTC.CC)$

$Ethereum (ETH.CC)$

$Mind Medicine (MNMD.US)$

$COMPASS Pathways (CMPS.US)$

$Palantir (PLTR.US)$

$Nano Dimension (NNDM.US)$

$Bit Brother (BTB.US)$

$Aurora Cannabis (ACB.US)$

$Village Farms International (VFF.US)$

$Tilray Brands (TLRY.US)$

$Canopy Growth (CGC.US)$

$Bitcoin (BTC.CC)$

$Ethereum (ETH.CC)$

$Mind Medicine (MNMD.US)$

$COMPASS Pathways (CMPS.US)$

20

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)