James Lim Kok Chang

reacted to

#感恩马股的回馈

#在对的时候还呆在股市

Over the past week, I've spent a lot of time reading the financial reports of different companies, and I'm also compiling some data on Malaysian stocks. After a busy few weeks, the 24Q1 quarterly summary has finally come to an end, so you can slow down 👣 adjustments.

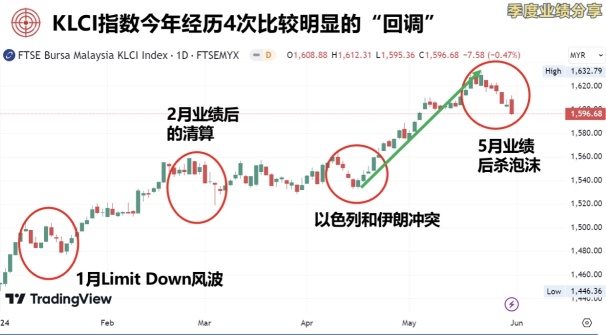

In the past, one month was rarely summed up, but May, when the 2024 Ninth National Games began, was really a month that needed to be recorded. Because this May was really crazy, it also gave some rewards to the shareholders who had been waiting for a long time in Malaysian stocks. Over the past 5 months, the index has experienced 4 significant pullbacks.

$FTSE Bursa Malaysia KLCI Index(.KLSE.MY$

The first was the limit down storm in January. After the pullback, the index sprinted close to 80 points from the bottom. Due to the increase quite a bit, the February earnings season began to be liquidated, but there was not much of a pullback.

The third pullback was the conflict between Israel and Iran in April. At that time, the index pulled back less than 2%, but many small and medium stocks pulled back by 10-20%. After the bottom was formed on April 16, the index rose close to 100 points over a month later, breaking through a 3-year high.

This wave of rising tide covered blue-chip stocks to small and medium-sized stocks, and Malaysian stocks ushered in an all-round rise 📈. Despite the correction that has been in the past week or so, all 13 major sectors in Malaysia have risen, and there has been no decline. This is a scene I haven't seen in the past 10 years, and it also keeps me stuck in Malaysian stocks...

#在对的时候还呆在股市

Over the past week, I've spent a lot of time reading the financial reports of different companies, and I'm also compiling some data on Malaysian stocks. After a busy few weeks, the 24Q1 quarterly summary has finally come to an end, so you can slow down 👣 adjustments.

In the past, one month was rarely summed up, but May, when the 2024 Ninth National Games began, was really a month that needed to be recorded. Because this May was really crazy, it also gave some rewards to the shareholders who had been waiting for a long time in Malaysian stocks. Over the past 5 months, the index has experienced 4 significant pullbacks.

$FTSE Bursa Malaysia KLCI Index(.KLSE.MY$

The first was the limit down storm in January. After the pullback, the index sprinted close to 80 points from the bottom. Due to the increase quite a bit, the February earnings season began to be liquidated, but there was not much of a pullback.

The third pullback was the conflict between Israel and Iran in April. At that time, the index pulled back less than 2%, but many small and medium stocks pulled back by 10-20%. After the bottom was formed on April 16, the index rose close to 100 points over a month later, breaking through a 3-year high.

This wave of rising tide covered blue-chip stocks to small and medium-sized stocks, and Malaysian stocks ushered in an all-round rise 📈. Despite the correction that has been in the past week or so, all 13 major sectors in Malaysia have risen, and there has been no decline. This is a scene I haven't seen in the past 10 years, and it also keeps me stuck in Malaysian stocks...

Translated

60

James Lim Kok Chang

reacted to

On May 27, INTA announced that it had obtained the fourth construction contract of the year, obtained RM199mil from SimeProp, and received an RM942.1 mil contract in the past two months.

$INTA(0192.MY$

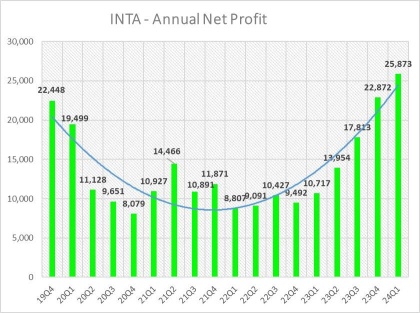

The 24Q1 results were announced on May 28. Profits have been growing for 5 consecutive quarters in QOQ. The RM7.052mil contract is also the second-highest in history, and the performance is outstanding.

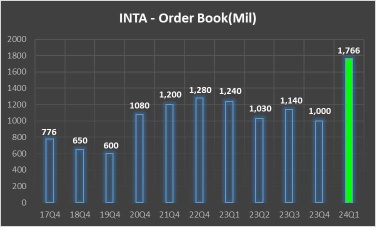

The most important thing for construction companies is to have enough construction contracts. Fewer construction contracts mean that future turnover will decline. INTA had fewer contracts in 2023, so it fell to a 4-year low. Although the 2023 results were excellent, the stock price did not improve without many new contracts.

Until the company frequently obtained contracts this year, the company's value finally blossomed, and the stock price showed strong performance this year. By the end of March, the company had a contract of RM1,766 mils, which is enough for INTA to keep busy until 2026. TA Securities Bank's target price is 62 points, and RHB-OSK also selected this company as the TOP 20 Small Cap 💎, which is expected to grow in value in the future.

$INTA(0192.MY$

The 24Q1 results were announced on May 28. Profits have been growing for 5 consecutive quarters in QOQ. The RM7.052mil contract is also the second-highest in history, and the performance is outstanding.

The most important thing for construction companies is to have enough construction contracts. Fewer construction contracts mean that future turnover will decline. INTA had fewer contracts in 2023, so it fell to a 4-year low. Although the 2023 results were excellent, the stock price did not improve without many new contracts.

Until the company frequently obtained contracts this year, the company's value finally blossomed, and the stock price showed strong performance this year. By the end of March, the company had a contract of RM1,766 mils, which is enough for INTA to keep busy until 2026. TA Securities Bank's target price is 62 points, and RHB-OSK also selected this company as the TOP 20 Small Cap 💎, which is expected to grow in value in the future.

Translated

60

James Lim Kok Chang

liked

Columns How long can Age of Discovery 2 go? Let's take a look at what Taiwan's Changrong and Wan Hai say.

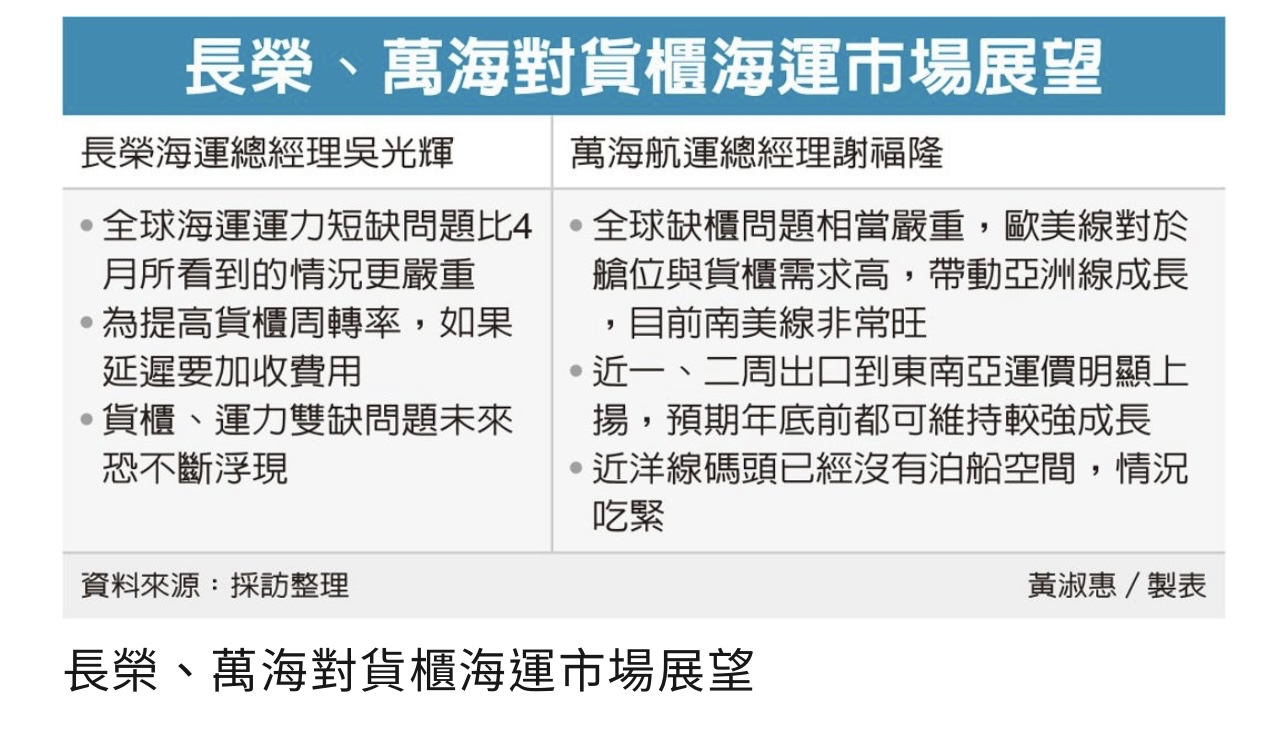

Beginning in April, freight rates for European and American routes began to rise, and China's transportation sector began to move somewhat. In May, Taiwan Container Sanxiong's stock price can rise 30-50% in a single month, and the rise in freight charges continues to rise.

The above chart shows the outlook of Evergreen and Wanhai Shipping management. The shortage of capacity in May was more delayed than in April. Moreover, the increase in demand for European and American routes has also driven Asian routes. This era of navigation has also burnt into Asia, including of course Malaysia 🇲🇾.

Among Malaysia's shipping businesses, HARBOUR and SYGROUP both broke through 1-year highs on May 27. Furthermore, the stock prices of FM and TASCO, two transportation-related stocks also broke through 1-year highs last week.

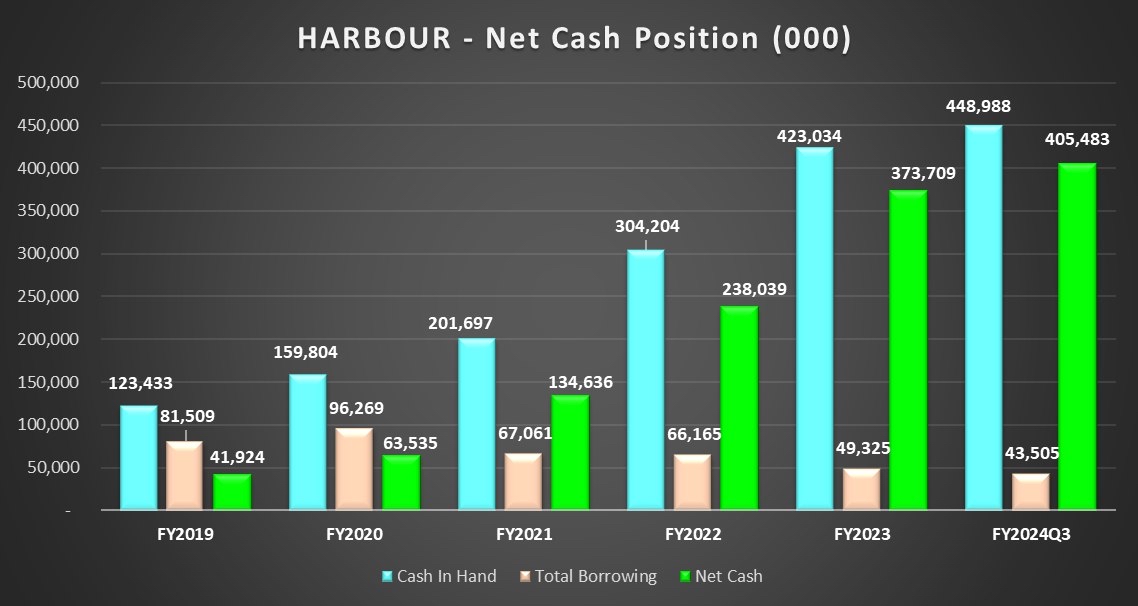

On May 28, HARBOUR results were released. The turnover grew by 17.4% year on year. Although net profit fell by 34.9% year over year, it was mainly due to the year-on-year decline in freight rates, but volume increased. However, the company's net profit QOQ grew by 39%, and the next quarter is expected to be even better.

The business of all divisions of the company is very positive, and the company will spend RM100 mil to buy two shipping container ships in May and June to replace the old ships. What is most rare is that when it comes to the end of the company's outlook, it is rare to be so optimistic when it comes to striving for a better tomorrow.

The company's cash reached a record high, so RM100 mil CAPEX was completely unburdened to buy a ship.

$HARBOUR(2062.MY$

...

The above chart shows the outlook of Evergreen and Wanhai Shipping management. The shortage of capacity in May was more delayed than in April. Moreover, the increase in demand for European and American routes has also driven Asian routes. This era of navigation has also burnt into Asia, including of course Malaysia 🇲🇾.

Among Malaysia's shipping businesses, HARBOUR and SYGROUP both broke through 1-year highs on May 27. Furthermore, the stock prices of FM and TASCO, two transportation-related stocks also broke through 1-year highs last week.

On May 28, HARBOUR results were released. The turnover grew by 17.4% year on year. Although net profit fell by 34.9% year over year, it was mainly due to the year-on-year decline in freight rates, but volume increased. However, the company's net profit QOQ grew by 39%, and the next quarter is expected to be even better.

The business of all divisions of the company is very positive, and the company will spend RM100 mil to buy two shipping container ships in May and June to replace the old ships. What is most rare is that when it comes to the end of the company's outlook, it is rare to be so optimistic when it comes to striving for a better tomorrow.

The company's cash reached a record high, so RM100 mil CAPEX was completely unburdened to buy a ship.

$HARBOUR(2062.MY$

...

Translated

+2

72

James Lim Kok Chang

reacted to

Columns MRDIY- FY24Q1 performed brilliantly, rising 22.6% in 3 weeks to defend the blue chip market's place!

As the saying goes, we can't earn wealth beyond our perception. At the beginning of MRDIY during the PRE IPO period, the moderators were not that optimistic. I think it's not easy for a company to continue to grow at such a large scale. As a result, the performance will talk about it, and I'm punched in the face!

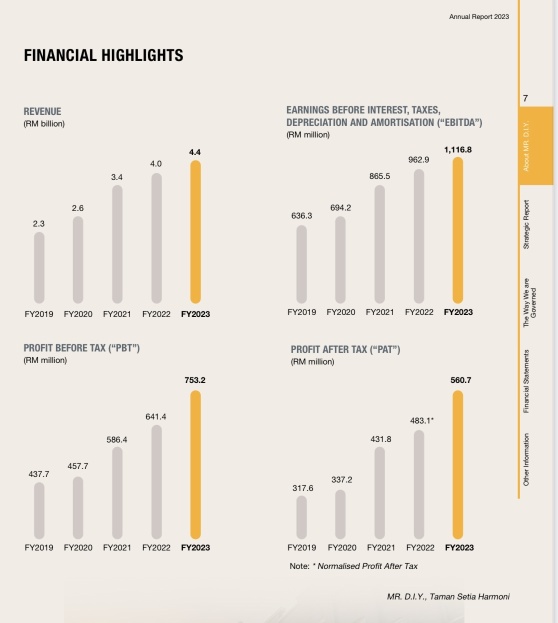

The company's growth over the past 5 years has continued to maintain dual growth. The main thing is that the company continues to open new stores and has done a good job in cost control. As the scale increases, MRDIY has greater bargaining power, and the net profit margin reached 12.9% in 2023 is very impressive.

$MRDIY(5296.MY$

The company had grown to 1,255 stores by the end of 2023, and 175 new stores were opened in 2023. More than 90%, or 1,159, are MR.DIY, and the rest are MR.TOY, MR. DOLLAR, etc.

Since May is an evaluation month for blue-chip stocks every six months, blue-chip stocks with a market capitalization falling to 33 will be replaced by new stocks, so there is a good chance that SUNWAY will be listed in this round. On April 19, there was a reversal after the company's stock price fell to RM1.46. In the past, it had been rising for 6 days, rising 📈 22.6% in 3 weeks. The market capitalization soared RM13.8 billion to RM16.9 billion, and soared RM3.1 billion to maintain the status of the top 30 blue-chip stocks. This is the so-called battle to defend the top 30 blue-chip stocks.

It may be a coincidence,...

The company's growth over the past 5 years has continued to maintain dual growth. The main thing is that the company continues to open new stores and has done a good job in cost control. As the scale increases, MRDIY has greater bargaining power, and the net profit margin reached 12.9% in 2023 is very impressive.

$MRDIY(5296.MY$

The company had grown to 1,255 stores by the end of 2023, and 175 new stores were opened in 2023. More than 90%, or 1,159, are MR.DIY, and the rest are MR.TOY, MR. DOLLAR, etc.

Since May is an evaluation month for blue-chip stocks every six months, blue-chip stocks with a market capitalization falling to 33 will be replaced by new stocks, so there is a good chance that SUNWAY will be listed in this round. On April 19, there was a reversal after the company's stock price fell to RM1.46. In the past, it had been rising for 6 days, rising 📈 22.6% in 3 weeks. The market capitalization soared RM13.8 billion to RM16.9 billion, and soared RM3.1 billion to maintain the status of the top 30 blue-chip stocks. This is the so-called battle to defend the top 30 blue-chip stocks.

It may be a coincidence,...

Translated

71

James Lim Kok Chang

liked

Columns Genting Singapore 🇸🇬 Excellent Q1 performance, parent company GENTING breathes a sigh of relief 😮💨

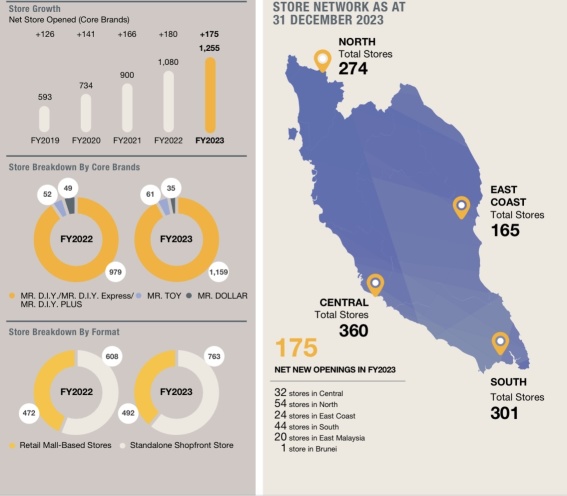

2023Q4 Genting Singapore 🇸🇬's earnings were not ideal due to unfavorable earnings. After that, the stock price fell by more than 20%, and the parent company also declined after the announcement of the Singapore results. Today's sales and net profit, which have reached new highs in recent years, are mainly due to the fact that Singapore and China were visa-free in February to drive profits.

Listed companies in Singapore only announce their results once every six months, but some companies voluntarily announce quarterly results. However, it will be very brief, usually only a few pages. The following is an explanation of Genting Singapore's Q1 performance.

$Genting Sing(G13.SG$

$GENTING(3182.MY$

According to the results announced in February, GenTing's profit was poor due to negative performance. Singapore has performed well this quarter, and GENM is not expected to be bad either. We can't predict stock prices, but net profit QOQ and YOY growth shouldn't be difficult; we'll know by the end of the month!

Listed companies in Singapore only announce their results once every six months, but some companies voluntarily announce quarterly results. However, it will be very brief, usually only a few pages. The following is an explanation of Genting Singapore's Q1 performance.

$Genting Sing(G13.SG$

$GENTING(3182.MY$

According to the results announced in February, GenTing's profit was poor due to negative performance. Singapore has performed well this quarter, and GENM is not expected to be bad either. We can't predict stock prices, but net profit QOQ and YOY growth shouldn't be difficult; we'll know by the end of the month!

Translated

69

1

James Lim Kok Chang

liked

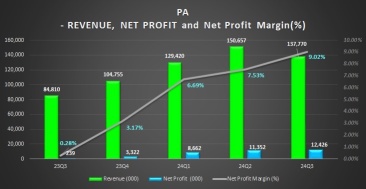

PA is an aluminum product manufacturer with manufacturing capacity to produce aluminum billets and end product stamping. The major customer is First Solar from the US. There are also quite a few investors who worry that PA is too dependent on a single major customer. This is a potential risk. The situation is similar to MAGNI.

However, since getting First Solar in 2018, the company has extended it for the 3rd time, and each time it is bigger than the previous contract. In January of this year, the company obtained an extension of the FirstSolar contract for a period of 18 months of RM1,076 mils. Therefore, performance is expected to grow steadily over the next 5 to 6 quarters.

Since the company only earned RM239k in the same period last year, surrendering RM12.436 mils of profit in the latest quarter increased the company by 5,099.2%. Although there is a foreign exchange profit of RM2.9 mil, there are also RM1.8 mil ESOS expenses, and when deducted, there is also PAT of RM11.5 mil or more.

The company's new production capacity was upgraded in March, mainly to meet the record high contract obtained in January. It is expected that next quarter, with the contribution of new production capacity, turnover and profit will rise to the next level.

$PA(7225.MY$

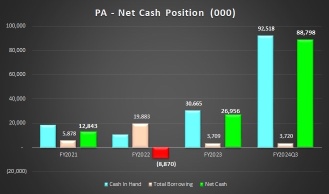

The company's net cash reached a new high in the latest quarter, reaching RM88.8 mil. Mainly due to increased profits, reduced inventory, and the collection of accounts receivable.

Company shares...

However, since getting First Solar in 2018, the company has extended it for the 3rd time, and each time it is bigger than the previous contract. In January of this year, the company obtained an extension of the FirstSolar contract for a period of 18 months of RM1,076 mils. Therefore, performance is expected to grow steadily over the next 5 to 6 quarters.

Since the company only earned RM239k in the same period last year, surrendering RM12.436 mils of profit in the latest quarter increased the company by 5,099.2%. Although there is a foreign exchange profit of RM2.9 mil, there are also RM1.8 mil ESOS expenses, and when deducted, there is also PAT of RM11.5 mil or more.

The company's new production capacity was upgraded in March, mainly to meet the record high contract obtained in January. It is expected that next quarter, with the contribution of new production capacity, turnover and profit will rise to the next level.

$PA(7225.MY$

The company's net cash reached a new high in the latest quarter, reaching RM88.8 mil. Mainly due to increased profits, reduced inventory, and the collection of accounts receivable.

Company shares...

Translated

93

James Lim Kok Chang

liked

Today, the glove stock once again became the most beautiful boy in the game.

The main reason was that the US escalated the trade war to a higher level.

Yesterday evening,

The US President's Office announced the latest round of import tariff lists for Chinese products, which has drastically raised import tariffs on specific products from China. The products involved are as follows:

1. Steel and aluminum (2024, increase from 0-7.5% to 25%)

2. Semiconductors (increase from 25% to 50% in 2025)

3. Electric vehicles (2024, increase from 25% to 100%)

4. Lithium-ion batteries (increase from 7.5% to 25% in 2024)

5. Electric vehicle battery components (increase from 7.5% to 25% in 2024)

6. Solar cells (2024, increase from 25% to 50%)

10. Medical syringes and needles (increase from 0% to 50% in 2024)

7. Personal protective equipment, including certain respirators and masks (in 2024, increase from 0-7.5% to 25%)

8. Rubber medical and surgical gloves (2026, increase from 7.5% to 25%)

This measure,

Nominally, in addition to encouraging the localization of American products,

It is also expected that it will allow American importers,

Shifting the source of product imports to Southeast Asia/South American countries.

Conceptually,

The beneficiaries of the Malaysian stock market are as follows:

1. Aluminum product manufacturer (extrusion/casting)

$LBALUM(9326.MY$ $PA(7225.MY$ $PMETAL(8869.MY$

...

The main reason was that the US escalated the trade war to a higher level.

Yesterday evening,

The US President's Office announced the latest round of import tariff lists for Chinese products, which has drastically raised import tariffs on specific products from China. The products involved are as follows:

1. Steel and aluminum (2024, increase from 0-7.5% to 25%)

2. Semiconductors (increase from 25% to 50% in 2025)

3. Electric vehicles (2024, increase from 25% to 100%)

4. Lithium-ion batteries (increase from 7.5% to 25% in 2024)

5. Electric vehicle battery components (increase from 7.5% to 25% in 2024)

6. Solar cells (2024, increase from 25% to 50%)

10. Medical syringes and needles (increase from 0% to 50% in 2024)

7. Personal protective equipment, including certain respirators and masks (in 2024, increase from 0-7.5% to 25%)

8. Rubber medical and surgical gloves (2026, increase from 7.5% to 25%)

This measure,

Nominally, in addition to encouraging the localization of American products,

It is also expected that it will allow American importers,

Shifting the source of product imports to Southeast Asia/South American countries.

Conceptually,

The beneficiaries of the Malaysian stock market are as follows:

1. Aluminum product manufacturer (extrusion/casting)

$LBALUM(9326.MY$ $PA(7225.MY$ $PMETAL(8869.MY$

...

Translated

111

3

James Lim Kok Chang

liked

As of May 16 at 12.30 p.m., all Malaysian stock indices were winning. The top 4 are suddenly traditional utilities, industry, energy, and construction. However, in May, healthcare (gloves) 🧤, industry, technology, and consumption are all raging.

The next two weeks will be performance judgment day, and you will be free to decide who is swimming naked when the time comes.

The next two weeks will be performance judgment day, and you will be free to decide who is swimming naked when the time comes.

Translated

59

James Lim Kok Chang

liked

There has always been a saying in the stock market that the Five Poor, the Six Terrible, and the Seven Turns Out. However, the author still believes that a brief downgrade/pullback for good companies is inevitable, so they will not deliberately open positions in May.

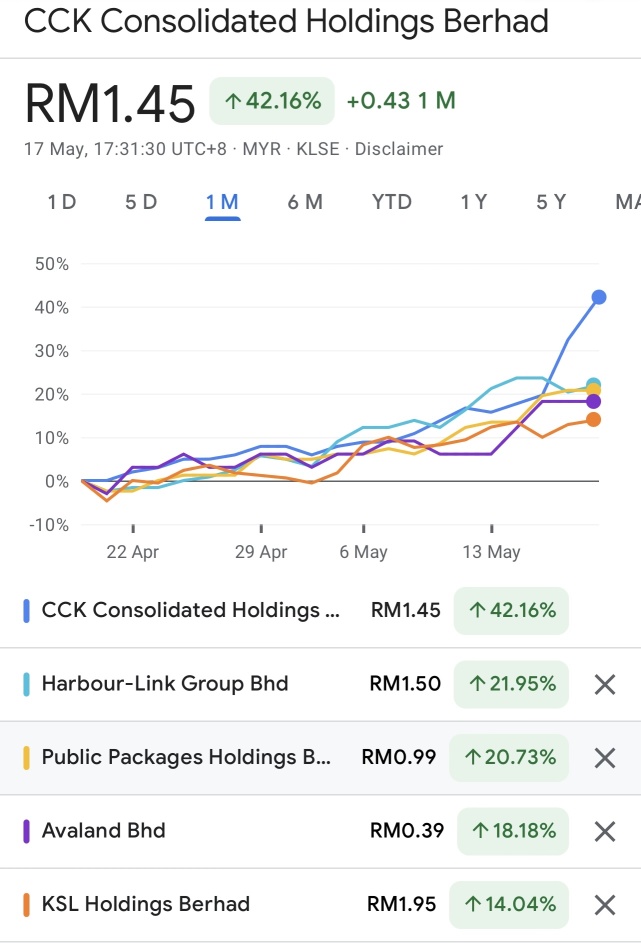

How hot is May 🔥 Naturally, everyone feels that it is not unusual for some popular stocks to rise 30-50% in the past month. However, this wave of bullish momentum has also benefited some single-digit PE companies that have been underestimated for a long time.

$CCK(7035.MY$

CCK is a frozen retail food company from SARAWAK in East Malaysia. The company's branches grew from 72 in 2022 to 75. Sales in all countries grew steadily, and sales from Japan grew by almost 100% in 2023.

Although there was a one-time profit in Q3 2022 and Q4 2023, after deduction, the company continued to grow for two consecutive years. CCK has been in Single Digit Pe for a long time in the past 2 years, and is far behind its peers. Malaysian stocks are booming this time, and the value of CCK has finally blossomed due to the influx of hot money. The stock price has risen 42% in the past month.

Furthermore, the shipping company Harbor has been making huge profits in freight rates for the past 3 years, although profits in the past few quarters have been affected by falling freight rates 📉. Recently, however, business has begun to improve, and profit Qoq has recovered. Coupled with soaring shipping costs in Europe and the US, GDP recovery and export growth in Q1, HARBOUR, which involves transportation and integrated logistics, was also seen by the market, and its stock price has risen 22% over the past month.

$HARBOUR(2062.MY$

...

How hot is May 🔥 Naturally, everyone feels that it is not unusual for some popular stocks to rise 30-50% in the past month. However, this wave of bullish momentum has also benefited some single-digit PE companies that have been underestimated for a long time.

$CCK(7035.MY$

CCK is a frozen retail food company from SARAWAK in East Malaysia. The company's branches grew from 72 in 2022 to 75. Sales in all countries grew steadily, and sales from Japan grew by almost 100% in 2023.

Although there was a one-time profit in Q3 2022 and Q4 2023, after deduction, the company continued to grow for two consecutive years. CCK has been in Single Digit Pe for a long time in the past 2 years, and is far behind its peers. Malaysian stocks are booming this time, and the value of CCK has finally blossomed due to the influx of hot money. The stock price has risen 42% in the past month.

Furthermore, the shipping company Harbor has been making huge profits in freight rates for the past 3 years, although profits in the past few quarters have been affected by falling freight rates 📉. Recently, however, business has begun to improve, and profit Qoq has recovered. Coupled with soaring shipping costs in Europe and the US, GDP recovery and export growth in Q1, HARBOUR, which involves transportation and integrated logistics, was also seen by the market, and its stock price has risen 22% over the past month.

$HARBOUR(2062.MY$

...

Translated

104

James Lim Kok Chang

liked

This time, the author went to Beijing, China to participate in an exchange group, hoping to take the opportunity to understand the general direction of China's economic development. I also took the opportunity to become a good man at Badaling Great Wall. Although the process was a bit tiring, it was worth it.

The current stock market is very volatile, and there are many challenges, but the Great Wall of China could have been completed thousands of years ago without advanced technology. I believe that no matter how difficult it is for the stock market, it will be difficult to build the Great Wall of China. Let's be stock market warriors together. Mutual encouragement!

The current stock market is very volatile, and there are many challenges, but the Great Wall of China could have been completed thousands of years ago without advanced technology. I believe that no matter how difficult it is for the stock market, it will be difficult to build the Great Wall of China. Let's be stock market warriors together. Mutual encouragement!

Translated

73

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)