jasonlaivon

reacted to

And this is how I started.

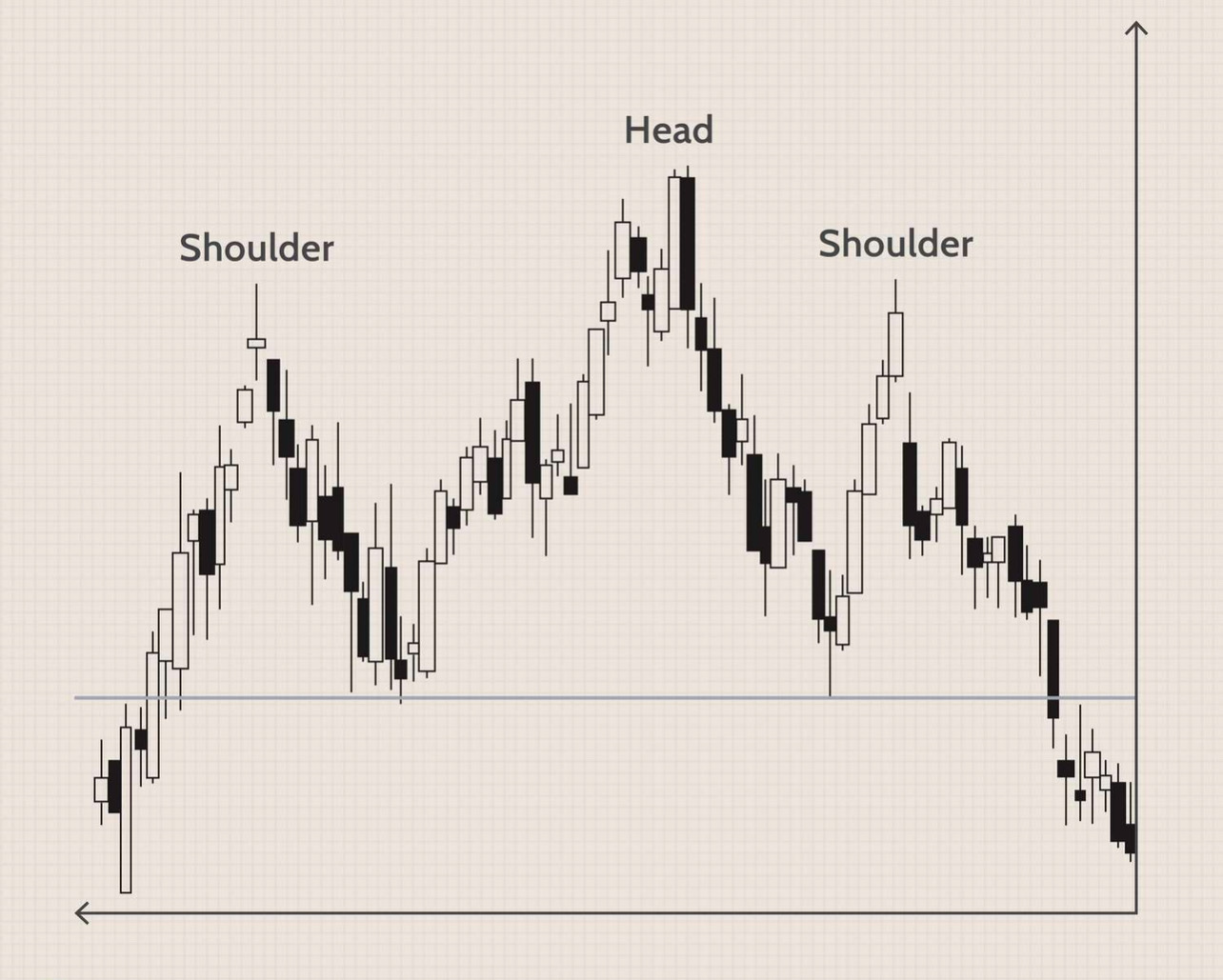

My journey🚙 started at the end of 2007. Learning how to trade while the economy was failing due to "The Real Estate Crisis" 📉 was somewhat easy

but hard in the long run. Easy on the part that in 2008 the market had crashed so it became a buying market even though many lost trust in it and had lost plenty of money 😡. Created lots of bad habits while trading that kept me from realizing my true trading potential 😮💨. Took me a while to understand, but never gave...

My journey🚙 started at the end of 2007. Learning how to trade while the economy was failing due to "The Real Estate Crisis" 📉 was somewhat easy

but hard in the long run. Easy on the part that in 2008 the market had crashed so it became a buying market even though many lost trust in it and had lost plenty of money 😡. Created lots of bad habits while trading that kept me from realizing my true trading potential 😮💨. Took me a while to understand, but never gave...

33

12

1

jasonlaivon

commented on

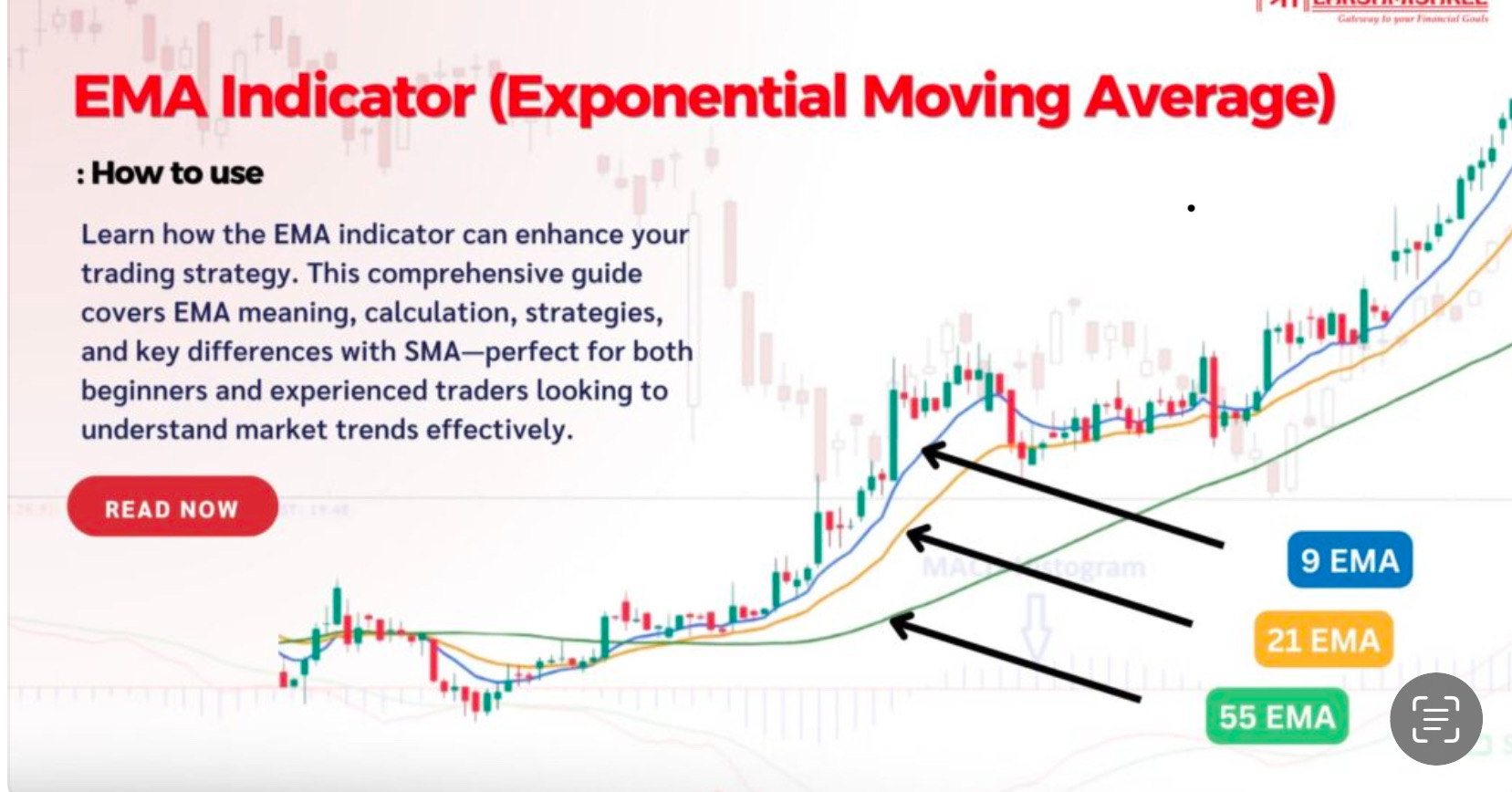

期权时,我被它潜在的高收益深深吸引。各种各样的交易策略,听起来都像是通往财富自由的捷径。然而,随着学习的深入和实际操作的开展,我渐渐发现,期权交易远比想象中复杂。

最直观的感受是,期权的风险远高于股票。杠杆效应不仅能放大收益,同时也会放大亏损。我曾因一次错误的判断,在短短几天内就损失了一部分本金。这种刺激与恐惧交织的体验,让我对期权市场又爱又恨。

除了高风险,期权交易的知识体系也是一大挑战。从基本概念到复杂策略,需要学习的内容非常庞杂。我花了大量时间阅读书籍、观看视频,但依然感觉自己掌握得很有限。

在实际交易中,我发现心理的考验甚至超过了知识本身。面对市场波动,我常常感到焦虑和恐慌。有时,即使清楚自己的策略是正确的,也会因害怕亏损而提前平仓,错失了更大的收益。这让我深刻认识到,交易的成功不仅需要理论知识,更需要强大的心理素质和自律精神。

经过一个月的探索,我逐渐意识到,期权交易是一门需要长期学习和实践的学科。它不仅考验投资者的知识储备,还挑战着投资者的心理韧性。我开始更加注重风险控制,不再盲目追求高收益。同时,我明白,成功的期权交易者必须具备扎实的理论基础、严谨的...

最直观的感受是,期权的风险远高于股票。杠杆效应不仅能放大收益,同时也会放大亏损。我曾因一次错误的判断,在短短几天内就损失了一部分本金。这种刺激与恐惧交织的体验,让我对期权市场又爱又恨。

除了高风险,期权交易的知识体系也是一大挑战。从基本概念到复杂策略,需要学习的内容非常庞杂。我花了大量时间阅读书籍、观看视频,但依然感觉自己掌握得很有限。

在实际交易中,我发现心理的考验甚至超过了知识本身。面对市场波动,我常常感到焦虑和恐慌。有时,即使清楚自己的策略是正确的,也会因害怕亏损而提前平仓,错失了更大的收益。这让我深刻认识到,交易的成功不仅需要理论知识,更需要强大的心理素质和自律精神。

经过一个月的探索,我逐渐意识到,期权交易是一门需要长期学习和实践的学科。它不仅考验投资者的知识储备,还挑战着投资者的心理韧性。我开始更加注重风险控制,不再盲目追求高收益。同时,我明白,成功的期权交易者必须具备扎实的理论基础、严谨的...

16

1

1

jasonlaivon

reacted to

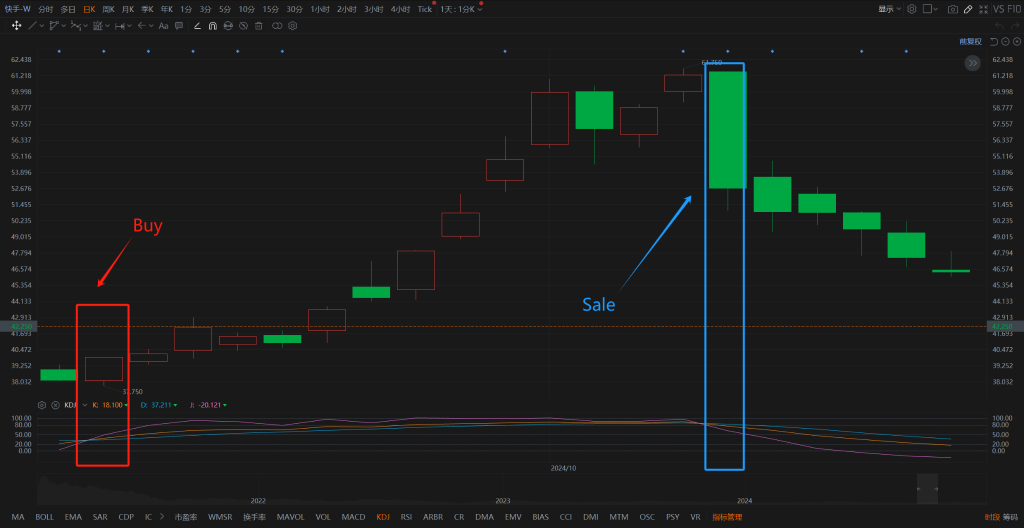

Columns KDJ

Today, let's continue discussing a new indicator: KDJ.

First, we need to understand the components of the KDJ indicator:

K Line: The fast line, which reflects short-term market price changes. It is typically calculated using the Stochastic Oscillator. The K line is derived from a series of price ranges, showing the current price relative to the highest and lowest prices in the recent period.

D Line: The slow line, which is a smoothed version of the K line and reflects the market's medium-t...

First, we need to understand the components of the KDJ indicator:

K Line: The fast line, which reflects short-term market price changes. It is typically calculated using the Stochastic Oscillator. The K line is derived from a series of price ranges, showing the current price relative to the highest and lowest prices in the recent period.

D Line: The slow line, which is a smoothed version of the K line and reflects the market's medium-t...

10

jasonlaivon

reacted to

20

1

jasonlaivon

liked and commented on

$SPDR S&P 500 ETF (SPY.US)$ if i buy a call it will drop fast. 😁

7

4

jasonlaivon

reacted to

$SPDR S&P 500 ETF (SPY.US)$ I hope I wake up in the morning and she be up 20 $

3

2

$SPDR S&P 500 ETF (SPY.US)$

sold before that long red stick happen…

expired today put….sick

win $10 instead of $141

sold before that long red stick happen…

expired today put….sick

win $10 instead of $141

2

jasonlaivon

liked and commented on

$SPDR S&P 500 ETF (SPY.US)$

today is either 500 or 535. my call and puts are both ready.

today is either 500 or 535. my call and puts are both ready.

1

1

jasonlaivon

liked and commented on

$Nike (NKE.US)$ tonight will fly

4

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)