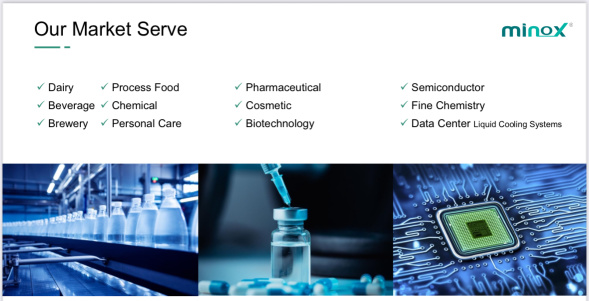

Recently, the second wave of rise in stocks related to data centers has appeared. However, I found that the market seems to have not yet discovered a potential beneficiary stock of a Data Center liquid cooling system. $MINOX (0288.MY)$

This company mainly supplies valves and piping fittings, with customers from the dining, semiconductor, and medical industries. The company recently announced a 2-for-1 free warrant offering, expected to be listed in early February.

Some people may think a P/E ratio of over 200 is too high, at that time due to the previous Indonesian general elections causing many local customers to refrain from allocating capital expenditures, resulting in the company's local business being affected, which has now returned to normal. In addition, the company's semiconductor and medical business contributions have also shown strong growth recently, expected to continue to grow, which would then bring the P/E ratio back down to over 10 times.

Currently, it is just to see when the company can obtain the Datacenter-related contracts (cooling systems require piping and fitting), if disclosed, it may act as a catalyst for Stocks.

Furthermore, the recent trend of stock prices is showing signs of potential breakthrough to a new short-term high, with the next resistance level looking at RM0.350.

$MINOX (0288.MY)$

This company mainly supplies valves and piping fittings, with customers from the dining, semiconductor, and medical industries. The company recently announced a 2-for-1 free warrant offering, expected to be listed in early February.

Some people may think a P/E ratio of over 200 is too high, at that time due to the previous Indonesian general elections causing many local customers to refrain from allocating capital expenditures, resulting in the company's local business being affected, which has now returned to normal. In addition, the company's semiconductor and medical business contributions have also shown strong growth recently, expected to continue to grow, which would then bring the P/E ratio back down to over 10 times.

Currently, it is just to see when the company can obtain the Datacenter-related contracts (cooling systems require piping and fitting), if disclosed, it may act as a catalyst for Stocks.

Furthermore, the recent trend of stock prices is showing signs of potential breakthrough to a new short-term high, with the next resistance level looking at RM0.350.

$MINOX (0288.MY)$

Translated

8

1

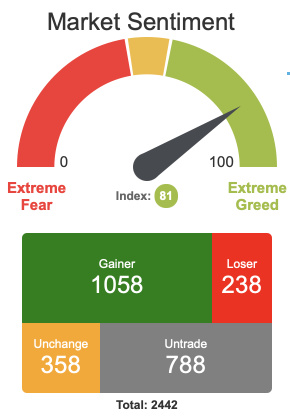

Just a few days ago on Black Monday, the market was in extreme panic, and everyone thought the stock disaster was coming. I told everyone that the market would soon hit bottom and bounce back.

In the past few days, the market has indeed rebounded. Those who did not participate in this wave of rises are experiencing the Fear of Missing Out (FOMO) and have been constantly looking for stocks to buy.

In the financial markets, greed and fear are human weaknesses. Once you understand these two things, you basically won't chase the rise and fall every time.

This market sentiment index is a very useful tool for observing what stage the market is currently in. On Monday, when the market was in extreme panic, the index fell to around 4-5. Four days later, there was a major reversal, rising to 88, also indicating that the market was getting excited, and soon there will be an adjustment.

The key is if this round of correction can make a Higher Low, then basically this round of selling wave can be declared over. On the other hand, if the index falls below the recent low point during the correction, then it is very likely that a new round of downward wave is coming, which applies to both the US stock market and the Malaysian stock market.

Of course, my personal opinion is that there should not be a major decline in the short term, at most it will consolidate for a period of time, and the market will have a new direction after the peak period of performance.

Congratulations to those who have been following my live broadcast on Facebook and participating in this rebound, if you haven't, it's okay, keep following me and I will share more when there is an opportunity.

In the past few days, the market has indeed rebounded. Those who did not participate in this wave of rises are experiencing the Fear of Missing Out (FOMO) and have been constantly looking for stocks to buy.

In the financial markets, greed and fear are human weaknesses. Once you understand these two things, you basically won't chase the rise and fall every time.

This market sentiment index is a very useful tool for observing what stage the market is currently in. On Monday, when the market was in extreme panic, the index fell to around 4-5. Four days later, there was a major reversal, rising to 88, also indicating that the market was getting excited, and soon there will be an adjustment.

The key is if this round of correction can make a Higher Low, then basically this round of selling wave can be declared over. On the other hand, if the index falls below the recent low point during the correction, then it is very likely that a new round of downward wave is coming, which applies to both the US stock market and the Malaysian stock market.

Of course, my personal opinion is that there should not be a major decline in the short term, at most it will consolidate for a period of time, and the market will have a new direction after the peak period of performance.

Congratulations to those who have been following my live broadcast on Facebook and participating in this rebound, if you haven't, it's okay, keep following me and I will share more when there is an opportunity.

Translated

17

1

Jayden Pang MW

liked and commented on

Although the gaming rules have changed...

But there are still loopholes...

This loophole should be able to achieve 300% in a month.

Can go and study it...

![]()

![]()

![]()

But there are still loopholes...

This loophole should be able to achieve 300% in a month.

Can go and study it...

Translated

2

1

Jayden Pang MW

reacted to

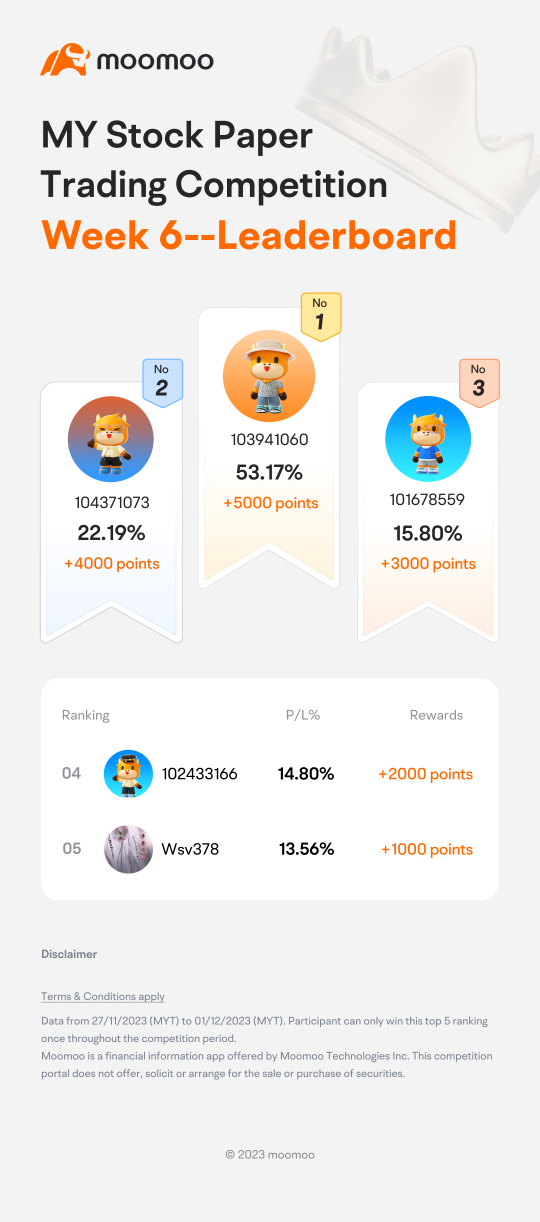

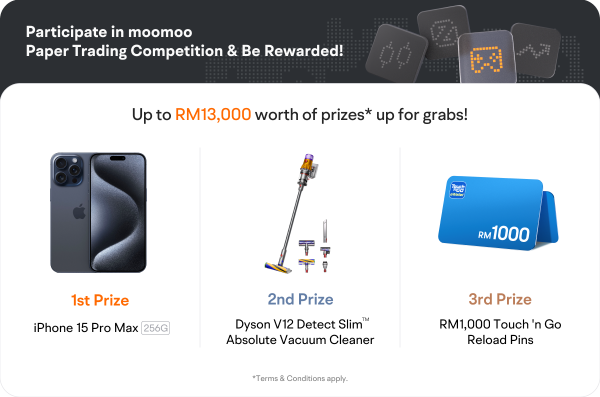

Hi mooers! The MY Stock Paper Trading Competition officially ended on 01/12/2023 (ET)!![]()

This competition received enthusiastic participation from mooers, with a total of 4778 mooers signing up!

Are you looking forward to the competition prize? Let’s announce the winners together!![]()

Week 6 Leaderboard

In the last week of the competition stage, these mooers achieve the best results that week and win generous points rewards!

Week 6: 27/11/2023 (E...

This competition received enthusiastic participation from mooers, with a total of 4778 mooers signing up!

Are you looking forward to the competition prize? Let’s announce the winners together!

Week 6 Leaderboard

In the last week of the competition stage, these mooers achieve the best results that week and win generous points rewards!

Week 6: 27/11/2023 (E...

+1

19

2

8

The recent rise in U.S. stocks has made people doubt their life choices, while Malaysian stocks have only seen a few low-trading stocks hit the daily limit up. Overall market sentiment is still not very good, indicating a lack of consensus on market themes. Hopefully this round of U.S. stocks can drive the Malaysian market higher.

On the other hand, the decline in the U.S. ten-year bond yields has improved market sentiment, with the belief that the Fed will cut interest rates in June next year. However, looking at it from another perspective, the decline in the 10-year yields also indicates an increased demand for bonds, suggesting concerns about an upcoming economic downturn.

But it's good for the stock market in the short term, as the further tightening pressure has been reduced. I personally believe that the U.S. stocks will see a small bull market (Malaysian stocks might have to wait, as the peak earnings season is approaching.). I still hold my previous view, I believe the stock market will be very good in the next two years, but there might be a major pullback before that, possibly happening in 2024 Q1 at the earliest, or Q2 at the latest, followed by a redistribution of wealth.

Don't go all-in on this round of increases, remember to take profit when things are going well and prepare for the next round of declines.

On the other hand, the decline in the U.S. ten-year bond yields has improved market sentiment, with the belief that the Fed will cut interest rates in June next year. However, looking at it from another perspective, the decline in the 10-year yields also indicates an increased demand for bonds, suggesting concerns about an upcoming economic downturn.

But it's good for the stock market in the short term, as the further tightening pressure has been reduced. I personally believe that the U.S. stocks will see a small bull market (Malaysian stocks might have to wait, as the peak earnings season is approaching.). I still hold my previous view, I believe the stock market will be very good in the next two years, but there might be a major pullback before that, possibly happening in 2024 Q1 at the earliest, or Q2 at the latest, followed by a redistribution of wealth.

Don't go all-in on this round of increases, remember to take profit when things are going well and prepare for the next round of declines.

Translated

4

2

Jayden Pang MW

reacted to

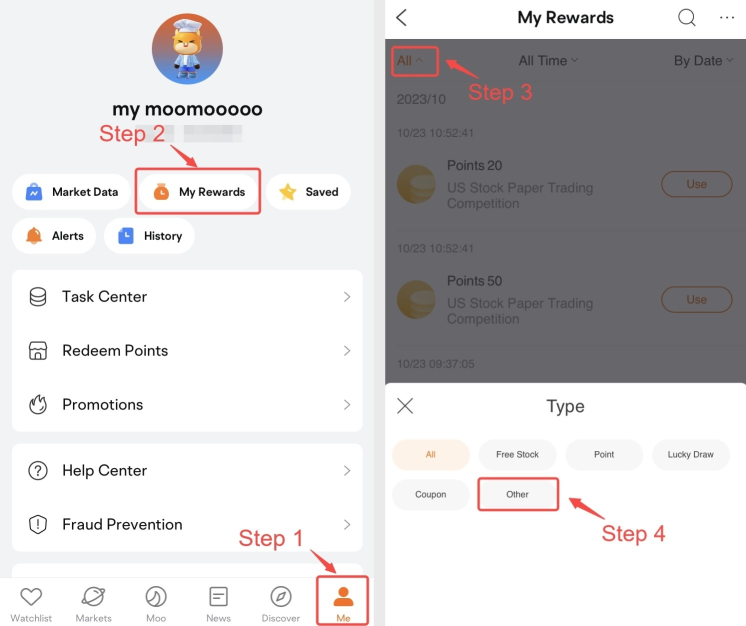

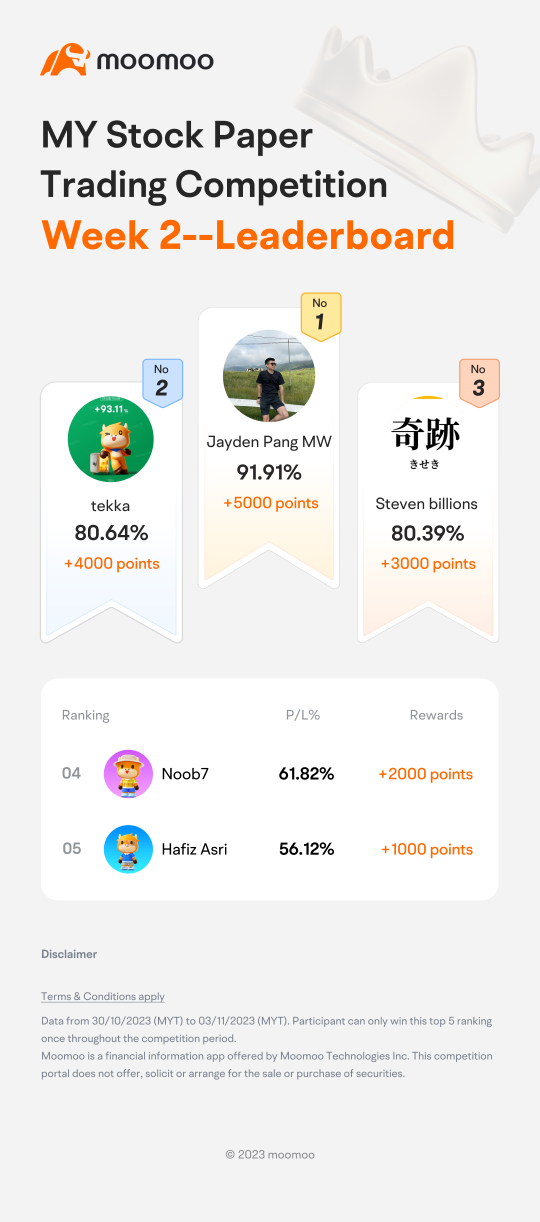

Hi mooers! The MY Stock Paper Trading Competition has been going on for a week, let’s see which users are ahead!![]()

Week 2 Leaderboard

Period: 30/10/2023 (MYT) to 03/11/2023 (MYT).

Congratulations to all users who made it to the weekly leaderboard!![]()

@Jayden Pang MW @tekka @Steven billions @Noob7 @Hafiz Asri

What is your favourite MY stock in papertrading?

Share your P/L (Profits/Losses) orders & insights of your favourite MY s...

Week 2 Leaderboard

Period: 30/10/2023 (MYT) to 03/11/2023 (MYT).

Congratulations to all users who made it to the weekly leaderboard!

@Jayden Pang MW @tekka @Steven billions @Noob7 @Hafiz Asri

What is your favourite MY stock in papertrading?

Share your P/L (Profits/Losses) orders & insights of your favourite MY s...

17

2

Jayden Pang MW

liked

Recently, several stocks in the trades $SASBADI (5252.MY)$ 、 $IFCAMSC (0023.MY)$ and $DCHCARE (0283.MY)$Either stopped out when unable to break through resistance and encountered selling pressure, or got washed out in the middle of the trading session.

Normally, when encountering this situation (Stop-loss in three consecutive tradesIf my portfolio continues to decline by more than 10%, I will switch to a conservative mode and reduce the number or value of my trades. Coincidentally, the small cap index seems to be showing signs of reversal recently, and a short-term consolidation would be beneficial. Additionally, the KLCI futures for September are trading at a discount of around 20 points compared to the spot price, which suggests a bearish outlook for the market in September.

However, I am optimistic about the stock market at the end of the year, especially after the upcoming 12th Malaysia Plan review meeting and the fiscal budget in October.

Normally, when encountering this situation (Stop-loss in three consecutive tradesIf my portfolio continues to decline by more than 10%, I will switch to a conservative mode and reduce the number or value of my trades. Coincidentally, the small cap index seems to be showing signs of reversal recently, and a short-term consolidation would be beneficial. Additionally, the KLCI futures for September are trading at a discount of around 20 points compared to the spot price, which suggests a bearish outlook for the market in September.

However, I am optimistic about the stock market at the end of the year, especially after the upcoming 12th Malaysia Plan review meeting and the fiscal budget in October.

Translated

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)