Looks like the price is getting away from me now. I haven't got them all back yet. That is my fault for selling some. If shorts can push this down to $135 I may be enticed to buy more

Anyway I don't need fancy theoretical TA to tell me there is support around $132.20 and resistance at the $145. 24 all time high.

RSI is on the up which should help clear 20 and 30 day EMA in this upswing. $CommBank (CBA.AU)$

Anyway I don't need fancy theoretical TA to tell me there is support around $132.20 and resistance at the $145. 24 all time high.

RSI is on the up which should help clear 20 and 30 day EMA in this upswing. $CommBank (CBA.AU)$

5

The following content is reposted from the Hong Kong version of moomoo, which is the futubull community. This is the australia community, but it feels like there are quite a few Australian Chinese trading stocks. Any insights on the recent layout of Chinese concept stocks and Hong Kong stocks, fellow papertrade enthusiasts are welcome to exchange ideas. @上海白砂糖 @满山猴我腚最红 @想干马嘉祺(Brother, are you really not considering changing your ID...?)

The Hong Kong stock market is surging, how far can this upward wave go?

My family is in Henan, and I have been in australia alone for several years. I'm not sure if I want to go back in the future, as there are many things in Shangqiu.

Speaking of this, it seems like the trend continues. But it depends on when the music stops. Making some profit is still making profit. Do the experts have any insights on the short term this time? In the long term, I think it's not urgent to bottom fish in the past two years. I can slowly build positions. Now I am considering whether to do short-term trading; My cousin bought a lot of leading Chinese concept stocks a while ago using the MartinGale strategy, and today she told me that the futubull market is all booming. I'm envious.

The Hong Kong stock market is surging, how far can this upward wave go?

My family is in Henan, and I have been in australia alone for several years. I'm not sure if I want to go back in the future, as there are many things in Shangqiu.

Speaking of this, it seems like the trend continues. But it depends on when the music stops. Making some profit is still making profit. Do the experts have any insights on the short term this time? In the long term, I think it's not urgent to bottom fish in the past two years. I can slowly build positions. Now I am considering whether to do short-term trading; My cousin bought a lot of leading Chinese concept stocks a while ago using the MartinGale strategy, and today she told me that the futubull market is all booming. I'm envious.

Translated

+2

10

1

2

One of the bull theories I've heard is the price is being driven by foreign investors. Well now with monetary easing in the USA, a weaker USD and more liquidity in the US, it makes American top tier stocks a more attractive investment. Do the foreigners take the gains, buy the cheaper USD and move into similar valued companies with better earnings potential? Thats a positive scenario, as the other theory for the 50 basis rate cut is the Fed is worried about a hard landing, which would be worse f...

2

$BHP Group Ltd (BHP.AU)$ No global economy allows it to suffer. Greater stimulus will come. They all do it every time. Falling house prices? Well let’s stimulate with lower rates, shovel in immigrants, lower LVR ratios, grants, you name it.

China will do larger stimulus packages is my bet, hence I put $100ks more into this and $Rio Tinto Ltd (RIO.AU)$ . Not at the bottom I’ll add, last 2 days caught me off guard.

China will do larger stimulus packages is my bet, hence I put $100ks more into this and $Rio Tinto Ltd (RIO.AU)$ . Not at the bottom I’ll add, last 2 days caught me off guard.

1

1

I rate moomoo's 24/5 trading feature a solid 5 out of 5 (Excellent)! ![]()

![]()

![]()

As an Australian investor, the time difference often made it challenging to trade US stocks during their active hours.

But with moomoo's 24/5 access, I can now trade anytime, whether it's during my morning coffee or late at night.

This flexibility has significantly enhanced my trading experience and efficiency!

As an Australian investor, the time difference often made it challenging to trade US stocks during their active hours.

But with moomoo's 24/5 access, I can now trade anytime, whether it's during my morning coffee or late at night.

This flexibility has significantly enhanced my trading experience and efficiency!

6

2

5 Biggest ✨AI Stocks✨ on the ASX 🤖

1. $WTC

2. $TNE $Technology One Ltd (TNE.AU)$

3. $HUB

4. $FCL

5. $BRN

Source: Investing News Network

Some other AI stocks

$AIM $ALU $APX $BTH $HUB $IMD $NXT $SEK $UNT $XRO $Appen Ltd (APX.AU)$ $WiseTech Global Ltd (WTC.AU)$

1. $WTC

2. $TNE $Technology One Ltd (TNE.AU)$

3. $HUB

4. $FCL

5. $BRN

Source: Investing News Network

Some other AI stocks

$AIM $ALU $APX $BTH $HUB $IMD $NXT $SEK $UNT $XRO $Appen Ltd (APX.AU)$ $WiseTech Global Ltd (WTC.AU)$

$BHP Group Ltd (BHP.AU)$ BHP's shares took a little dip in Sydney, down by 0.5%. Ouch!

Copper prices hit an all-time high in May, but they've been sliding ever since, almost a fifth gone! 😔

Mostly because everyone's worried about China's demand slowing down.

But hey, long-term wise, consumption is still expected to rise.

Henry from BHP even said it'll double in the next two decades.

So, fingers crossed! 🤞

Copper prices hit an all-time high in May, but they've been sliding ever since, almost a fifth gone! 😔

Mostly because everyone's worried about China's demand slowing down.

But hey, long-term wise, consumption is still expected to rise.

Henry from BHP even said it'll double in the next two decades.

So, fingers crossed! 🤞

2

I sold my $BHP Group Ltd (BHP.AU)$ , which has really gone nowhere for a few years, apart from dividend yield, and bought some $URNM.AX, as I have been burnt too many times buying single names.

2

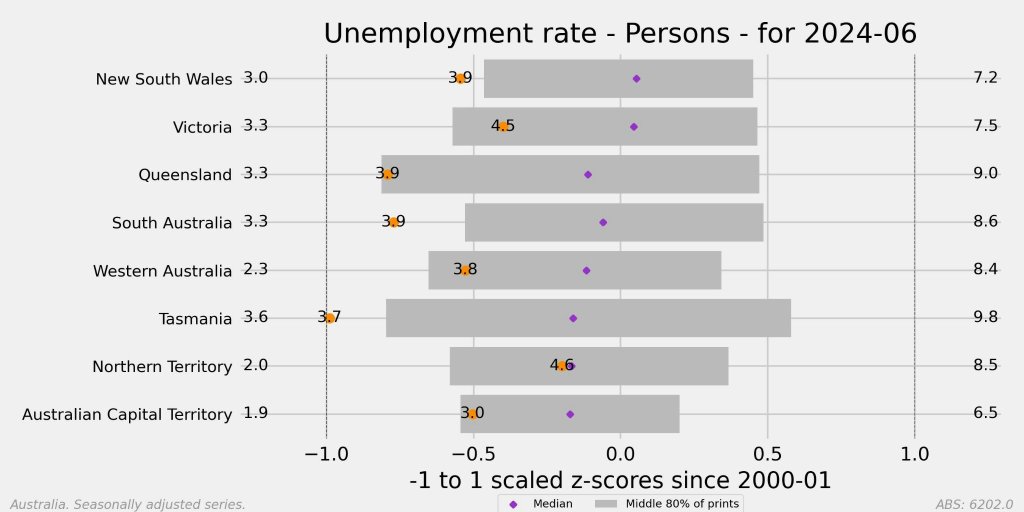

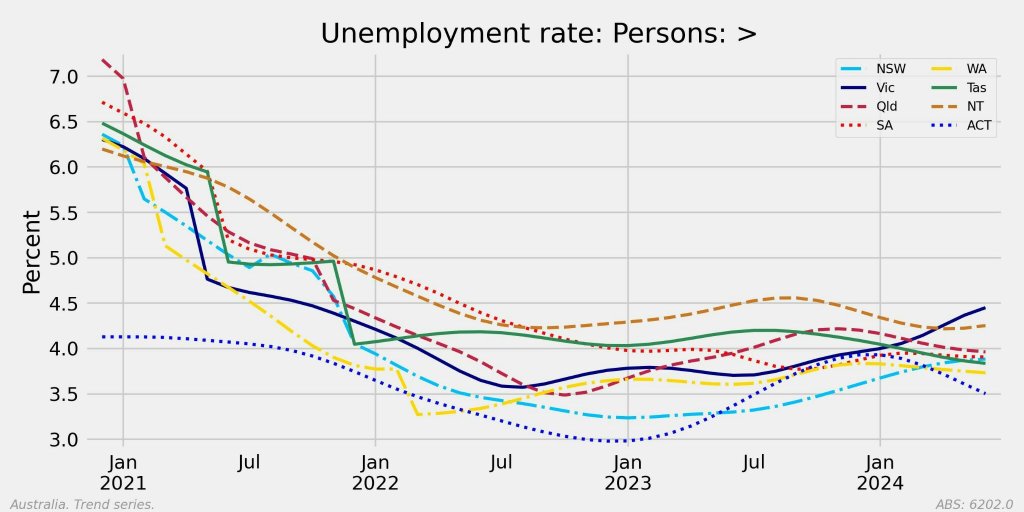

Unemployment rate: NSW, Tas and SA performing surprisingly well by historical standards. ACT, Qld and WA also doing well by historical standards.

Citi thinks $Rio Tinto Ltd (RIO.AU)$ should buy Arcadium Lithium

Well, shares in Arcadium have halved since January…

$Arcadium Lithium PLC (LTM.AU)$

Well, shares in Arcadium have halved since January…

$Arcadium Lithium PLC (LTM.AU)$

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)