jcasa

liked

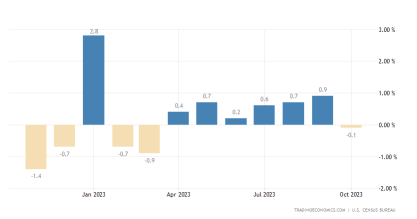

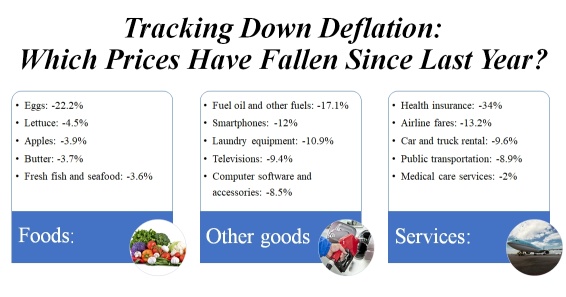

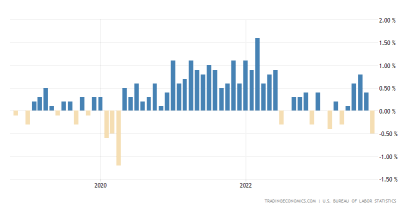

The release of US retail sales data and PPI on Wednesday further indicates that the economy is cooling down, with reduced inflationary pressure. While some may see a "Goldilocks" economy, others, such as Ark Invest's Cathie Wood and Walmart CEO, are cautioning about an upcoming period of deflation.

With the potential transition from inflation to deflation impending, many are questioning whether 2024 will be the year of significant change.

...

With the potential transition from inflation to deflation impending, many are questioning whether 2024 will be the year of significant change.

...

21

6

jcasa

liked

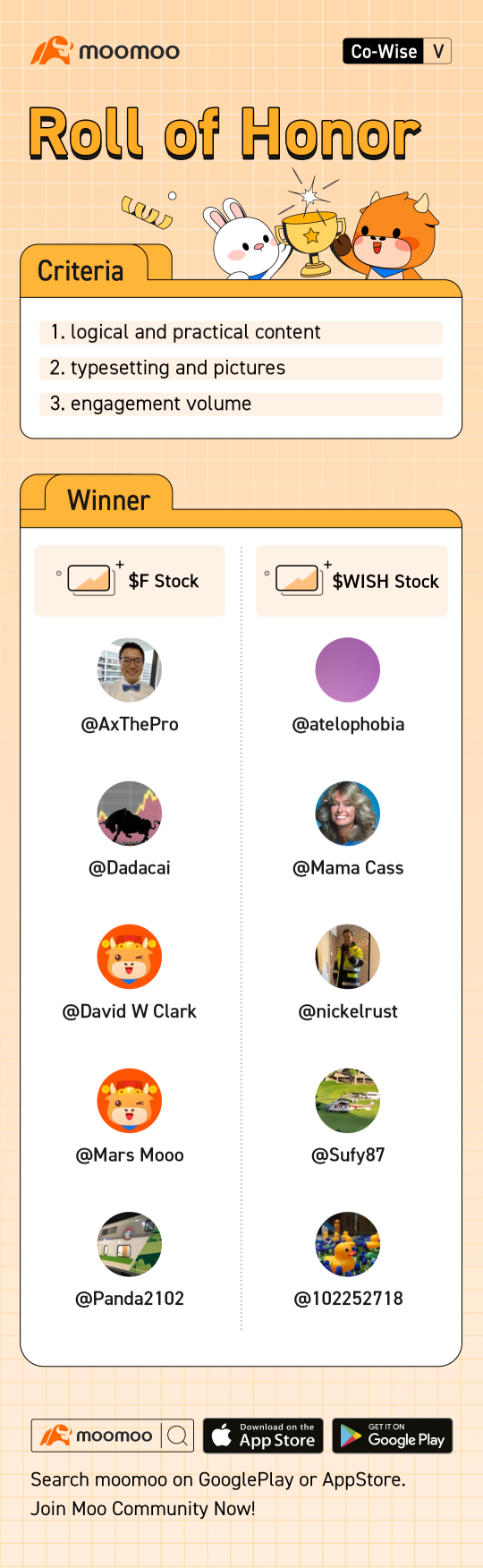

Once more, Co-Wise: moomoo Tutorial Contest Part 5, "How to build a portfolio with a windfall of $1 million?" ended successfully. Thanks for participating in the contest.![]() With the $1 million windfalls, everyone has a different asset allocation method and a unique way to build the best portfolio. The top three candidates to be put into the portfolio are stocks, ETFs, and cryptocurrencies. Asset allocation aims to maximize future returns and minimize risks.

With the $1 million windfalls, everyone has a different asset allocation method and a unique way to build the best portfolio. The top three candidates to be put into the portfolio are stocks, ETFs, and cryptocurrencies. Asset allocation aims to maximize future returns and minimize risks.![]() However, high returns come with high stakes. There is no best, only the most suitable portfolio for investors. Would you please follow me to review some of the high-quality posts from mooers?

However, high returns come with high stakes. There is no best, only the most suitable portfolio for investors. Would you please follow me to review some of the high-quality posts from mooers?

Here are the rewards for your active participation: 1 FREE $Ford Motor(F.US$ share for the five best posts, 1 FREE $ContextLogic(WISH.US$ share for the five outstanding posts, and 66 points for posts with a minimum of 30 words. Congratulations to all the winners!![]()

*The rewards will be distributed to winners within 15 working days. The ranking is sorted in alphabetical order.

Part Ⅰ: High-Quality Post Collection

![]() @AxThePro Balanced portfolio

@AxThePro Balanced portfolio

1 million is a huge sum to begin with, it is very important to have growth for this portfolio. At the same time, we also must make sure it is safe from significant losses. I’ll allocate my portfolio with 4-3-2-1 strategy. I am an agreesive investors, I do not believe in bonds, so I will allocate 100% in equity portfolio.

![]() @Dadacai My Portfolio If I Had A S$1 Million Windfall

@Dadacai My Portfolio If I Had A S$1 Million Windfall

If I had a $1 million windfall, I would put 90% of it in an S&P ETF like $Vanguard S&P 500 ETF(VOO.US$ , $SPDR S&P 500 ETF(SPY.US$ and $iShares Core S&P 500 ETF(IVV.US$ , and 5% in Treasury bills. The remaining 5% will be reserved for stocks that I think have the potential to become the next $Amazon(AMZN.US$ , $Tesla(TSLA.US$ , $Sea(SE.US$ , $Apple(AAPL.US$ and $Microsoft(MSFT.US$ .

![]() @David W Clark How would I invest $1,000,000

@David W Clark How would I invest $1,000,000

I'd put it in an account that at least pays as much interest as possible while researching for stocks, bonds, ETFs and other such ways to invest and grow. I may do this with a 45/45/10 split, Dividend Stocks/ Value Stocks / Cash.

![]() @Mars Mooo The Squid Game Multi-Portfolios Portfolio

@Mars Mooo The Squid Game Multi-Portfolios Portfolio

The Squid Game Multi-Portfolios portfolio is made up of 4 main portfolios, as follows:

40% weightage: Player 456 (Seong Gi-hun) Portfolio.

30% weightage: Player 218 (Cho Sang-woo) Portfolio.

20% weightage: Player 067 (Kang Sae-byeok) Portfolio.

10%: weightage: Liquid Portfolio.

![]() @Panda2102 Barbell strategy to build a portfolio with a $1m windfall

@Panda2102 Barbell strategy to build a portfolio with a $1m windfall

One portfolio (85-90%) holds extremely safe investments, while the other aggressive portfolio (10-15%) holds highly speculative or leveraged investments. Depending if you are in the Wealth Accumulation stage or Wealth Preservation stage of your life, you can tweak the two portfolio accordingly.

![]() @atelophobia Portfolio building

@atelophobia Portfolio building

Building a portfolio is aka finding the best equilibrium and striking a balance of allocation across the different classes. There is no right or wrong answer to how should one build a portfolio for the fact that Trading/Investment is an Art not a Sciene as such there is no scientific way to judge an artpiece as beauty lies in the eyes of beholder!

![]() @Mama Cass $1M Playmoney!

@Mama Cass $1M Playmoney!

If lucky enough to find or be given $1M to invest I'm afraid that at my age (55) I wouldn't go crazy with aggressive return seeking investments. Different age groups have different portfolio allocations. I'm a caviar kind of gal so I'm going to get a pro to take my million and make it pay off without loss.

![]() @nickelrust Buy. Hold. Sell. Repeat.

@nickelrust Buy. Hold. Sell. Repeat.

Me as a lower risk taker would opt for a safer option, to put the money into a basket of bluechip stocks and let it grow over a period of 3 to 5 years. With the current market still at its low, and globally economies are opening up and striving to stabilise and enter the real new normal.

![]() @Sufy87 It comes down to portfolio allocation and what you know best.

@Sufy87 It comes down to portfolio allocation and what you know best.

Personally, I would allocate 60% stocks, 20% into ETFs, 15% options, 5% cash. Stocks are basically what builds wealth. ETFs are basically to get exposure to segments of the economy. Options are just to hedge against some of my positions. Cash is always as "bullets" when opportunity arise.

![]() @102252718 What is your purpose to invest?

@102252718 What is your purpose to invest?

Everyone invest for a different reason. For me, I invest to grow my wealth pot for retirement and my child's education.

70-80% GROWTH STOCKS $TSLA $PLTR.

10% ETF $ARK Innovation ETF(ARKK.US$ $ARKF.

10% Crypto $ETH. $BTC.

Please click "How to build a portfolio with a windfall of $1 million?" for more engaging posts.![]() If you are inspired by any post from "How to build a strong portfolio?", please share your thoughts and join us for further discussion. Don't forget to leave your comments and tell mooers what you have learned.

If you are inspired by any post from "How to build a strong portfolio?", please share your thoughts and join us for further discussion. Don't forget to leave your comments and tell mooers what you have learned.![]()

Part Ⅱ: Voting on the “Mentor Moo” Title

It's time for voting! Let's vote for the candidates to see who will win the "Mentor Moo" title. Whose idea do you think is the best? When evaluating the posts, please take the following factors into account: logic, practical content, type settings, picture displays, and engagement.

By the end of the poll, the one with the most votes will win the "Mentor Moo" title. What a great honor! Come and vote for your favorite mentors. Your vote means a lot to them.

Diversification is a critical concept in portfolio management. Different levels of risk tolerance and holding time could directly affect the category selections of investors. Do you have any other portfolio-building methods? Share your portfolio with mooers to explore investment opportunities together.![]()

Disclaimer: All investment involves risk. Neither Futu Inc, nor Futu SG, nor moomoo endorses any particular investment strategy. You should carefully consider your investment goals and objectives when deciding on an investment strategy. Past performance is no guarantee of future results.

Here are the rewards for your active participation: 1 FREE $Ford Motor(F.US$ share for the five best posts, 1 FREE $ContextLogic(WISH.US$ share for the five outstanding posts, and 66 points for posts with a minimum of 30 words. Congratulations to all the winners!

*The rewards will be distributed to winners within 15 working days. The ranking is sorted in alphabetical order.

Part Ⅰ: High-Quality Post Collection

1 million is a huge sum to begin with, it is very important to have growth for this portfolio. At the same time, we also must make sure it is safe from significant losses. I’ll allocate my portfolio with 4-3-2-1 strategy. I am an agreesive investors, I do not believe in bonds, so I will allocate 100% in equity portfolio.

If I had a $1 million windfall, I would put 90% of it in an S&P ETF like $Vanguard S&P 500 ETF(VOO.US$ , $SPDR S&P 500 ETF(SPY.US$ and $iShares Core S&P 500 ETF(IVV.US$ , and 5% in Treasury bills. The remaining 5% will be reserved for stocks that I think have the potential to become the next $Amazon(AMZN.US$ , $Tesla(TSLA.US$ , $Sea(SE.US$ , $Apple(AAPL.US$ and $Microsoft(MSFT.US$ .

I'd put it in an account that at least pays as much interest as possible while researching for stocks, bonds, ETFs and other such ways to invest and grow. I may do this with a 45/45/10 split, Dividend Stocks/ Value Stocks / Cash.

The Squid Game Multi-Portfolios portfolio is made up of 4 main portfolios, as follows:

40% weightage: Player 456 (Seong Gi-hun) Portfolio.

30% weightage: Player 218 (Cho Sang-woo) Portfolio.

20% weightage: Player 067 (Kang Sae-byeok) Portfolio.

10%: weightage: Liquid Portfolio.

One portfolio (85-90%) holds extremely safe investments, while the other aggressive portfolio (10-15%) holds highly speculative or leveraged investments. Depending if you are in the Wealth Accumulation stage or Wealth Preservation stage of your life, you can tweak the two portfolio accordingly.

Building a portfolio is aka finding the best equilibrium and striking a balance of allocation across the different classes. There is no right or wrong answer to how should one build a portfolio for the fact that Trading/Investment is an Art not a Sciene as such there is no scientific way to judge an artpiece as beauty lies in the eyes of beholder!

If lucky enough to find or be given $1M to invest I'm afraid that at my age (55) I wouldn't go crazy with aggressive return seeking investments. Different age groups have different portfolio allocations. I'm a caviar kind of gal so I'm going to get a pro to take my million and make it pay off without loss.

Me as a lower risk taker would opt for a safer option, to put the money into a basket of bluechip stocks and let it grow over a period of 3 to 5 years. With the current market still at its low, and globally economies are opening up and striving to stabilise and enter the real new normal.

Personally, I would allocate 60% stocks, 20% into ETFs, 15% options, 5% cash. Stocks are basically what builds wealth. ETFs are basically to get exposure to segments of the economy. Options are just to hedge against some of my positions. Cash is always as "bullets" when opportunity arise.

Everyone invest for a different reason. For me, I invest to grow my wealth pot for retirement and my child's education.

70-80% GROWTH STOCKS $TSLA $PLTR.

10% ETF $ARK Innovation ETF(ARKK.US$ $ARKF.

10% Crypto $ETH. $BTC.

Please click "How to build a portfolio with a windfall of $1 million?" for more engaging posts.

Part Ⅱ: Voting on the “Mentor Moo” Title

It's time for voting! Let's vote for the candidates to see who will win the "Mentor Moo" title. Whose idea do you think is the best? When evaluating the posts, please take the following factors into account: logic, practical content, type settings, picture displays, and engagement.

By the end of the poll, the one with the most votes will win the "Mentor Moo" title. What a great honor! Come and vote for your favorite mentors. Your vote means a lot to them.

Diversification is a critical concept in portfolio management. Different levels of risk tolerance and holding time could directly affect the category selections of investors. Do you have any other portfolio-building methods? Share your portfolio with mooers to explore investment opportunities together.

Disclaimer: All investment involves risk. Neither Futu Inc, nor Futu SG, nor moomoo endorses any particular investment strategy. You should carefully consider your investment goals and objectives when deciding on an investment strategy. Past performance is no guarantee of future results.

153

32

jcasa

liked

$SPDR S&P 500 ETF(SPY.US$ I honestly believe, that professional investors (maybe even companies) are playing the novice and FOMO investors.

Investing used to be boring. You got every month your subscription of Value Line, did a bit of reading and decided, nothing to see here and went back to bed.

Since Covid hell broke loose. Novice Investors had nothing to do all day long and invested their stimulus checks in stocks. Since they had no idea, they invested in names they did recognized because the CEO had a loud mouth and in stocks which went up.... it goes up so it must be a good stock... right? And when a majority of investors think that way, the stock INDEED goes up.

This phenomena was not lost on professional investors and they smelled blood.

Usually you had to wait for years to make some money, but now hordes of novice investors walked into the lion's den for slaughter.

Professional investors kept their mouth shut and allow the train to gather even more speed... after all FOMO will get a lot more intense towards the end.

If you on the train, do not expect when you disembark, that you can claim all your luggage at the next station. Over night, when you were sleeping bad things did happen. The $Dow Jones Industrial Average(.DJI.US$ is about to open 1000 points down... you did not even check your stocks in the morning and around lunch the DOW is down 2000 points and counting. Panic stricken you get your phone and place a market order, which obviously will be executed instantly and you got a whole dollar for all of your life savings.

Towards closing the DOW recovers and you regret that you sold your stock a bit too quickly. To get back on this train you buy, hoping to make up for your mistake earlier in the day.

But next day it is all the same again...

Anyway this how it happen in April 2000.

There are several ways to avoid losing your shirt.

1. Remain poor

2. sell everything now and miss another 6 month of bull market

3. Stay invested and panic as I described above

4. Do nothing stay invested and wait the next 10 years for your investments to recover to a value it had before the crash.

5. become a psychic, sell one day before the crash and sell short (on margin) all the high fliers you did own before.

Take your pick.

Everybody can invest in a bull market... it is easy... but just wait...

Investing used to be boring. You got every month your subscription of Value Line, did a bit of reading and decided, nothing to see here and went back to bed.

Since Covid hell broke loose. Novice Investors had nothing to do all day long and invested their stimulus checks in stocks. Since they had no idea, they invested in names they did recognized because the CEO had a loud mouth and in stocks which went up.... it goes up so it must be a good stock... right? And when a majority of investors think that way, the stock INDEED goes up.

This phenomena was not lost on professional investors and they smelled blood.

Usually you had to wait for years to make some money, but now hordes of novice investors walked into the lion's den for slaughter.

Professional investors kept their mouth shut and allow the train to gather even more speed... after all FOMO will get a lot more intense towards the end.

If you on the train, do not expect when you disembark, that you can claim all your luggage at the next station. Over night, when you were sleeping bad things did happen. The $Dow Jones Industrial Average(.DJI.US$ is about to open 1000 points down... you did not even check your stocks in the morning and around lunch the DOW is down 2000 points and counting. Panic stricken you get your phone and place a market order, which obviously will be executed instantly and you got a whole dollar for all of your life savings.

Towards closing the DOW recovers and you regret that you sold your stock a bit too quickly. To get back on this train you buy, hoping to make up for your mistake earlier in the day.

But next day it is all the same again...

Anyway this how it happen in April 2000.

There are several ways to avoid losing your shirt.

1. Remain poor

2. sell everything now and miss another 6 month of bull market

3. Stay invested and panic as I described above

4. Do nothing stay invested and wait the next 10 years for your investments to recover to a value it had before the crash.

5. become a psychic, sell one day before the crash and sell short (on margin) all the high fliers you did own before.

Take your pick.

Everybody can invest in a bull market... it is easy... but just wait...

36

12

jcasa

liked

Hello mooers:

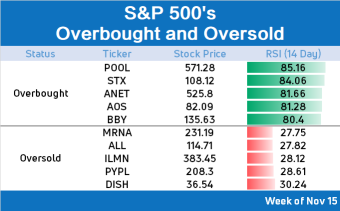

An overbought stock is believed to await a correction or pullback, while an oversold stock has the potential for a price bounce.

We selected a few stocks that contain potential investment opportunities with RSI indicator to find out what the most overbought and oversold companies in S&P 500 today are.

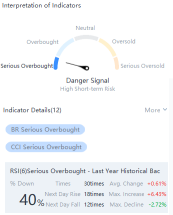

Overbought& Oversold definition

A stock would usually be considered overbought when the RSI > 70 and oversold when RSI < 30.![]()

![]()

![]()

According to the theory created by J. Welles Wilder Jr, when the RSI < 30, it is a bullish sign (buy signal), and when RSI > 70, it is a bearish sign (sell signal).![]()

![]()

![]()

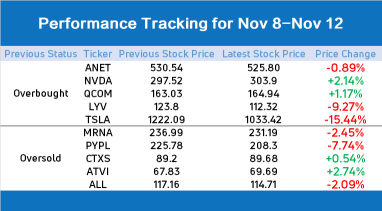

Performance Tracking of Previous Column (10/25)

There are 5 out of 10 selected stocksthat followed the suggested movement provided by the RSI indicator.

What happen?

Shares of Tesla Inc closed lower on Friday, snapping an 11-week winning streak after filings showed CEO Elon Musk sold another block of company stock worth about US$700 million, taking advantage of a meteoric rally that vaulted the electric-car maker's value to over US$1 trillion.

The second round of hefty stock sales this week came just days after the world's richest person and Tesla's top shareholder tweeted that he would sell 10 per cent of his shares if users of the social media platform approved the move.

The electric-car maker's stock closed down 2.8 per cent at US$1,033.42 on Friday. The shares are up more than 46% this year following a sharp rally in October.

Overbought

$Pool Corp(POOL.US$

$Seagate Technology(STX.US$

$Arista Networks(ANET.US$

$A.O. Smith(AOS.US$

$Best Buy(BBY.US$

Oversold

$Moderna(MRNA.US$

$Allstate(ALL.US$

$Illumina(ILMN.US$

$PayPal(PYPL.US$

$Dish Network(DISH.US$

We collect stocks from S&P 500 as it contains most of valuable companies.

Want to screen the market by yourself? Read:How to use a stock screener

Want to learn more about technical trading? Read: Technical Analysis 101:Introduction to technical indicators

An overbought stock is believed to await a correction or pullback, while an oversold stock has the potential for a price bounce.

We selected a few stocks that contain potential investment opportunities with RSI indicator to find out what the most overbought and oversold companies in S&P 500 today are.

Overbought& Oversold definition

A stock would usually be considered overbought when the RSI > 70 and oversold when RSI < 30.

According to the theory created by J. Welles Wilder Jr, when the RSI < 30, it is a bullish sign (buy signal), and when RSI > 70, it is a bearish sign (sell signal).

Performance Tracking of Previous Column (10/25)

There are 5 out of 10 selected stocksthat followed the suggested movement provided by the RSI indicator.

What happen?

Shares of Tesla Inc closed lower on Friday, snapping an 11-week winning streak after filings showed CEO Elon Musk sold another block of company stock worth about US$700 million, taking advantage of a meteoric rally that vaulted the electric-car maker's value to over US$1 trillion.

The second round of hefty stock sales this week came just days after the world's richest person and Tesla's top shareholder tweeted that he would sell 10 per cent of his shares if users of the social media platform approved the move.

The electric-car maker's stock closed down 2.8 per cent at US$1,033.42 on Friday. The shares are up more than 46% this year following a sharp rally in October.

Overbought

$Pool Corp(POOL.US$

$Seagate Technology(STX.US$

$Arista Networks(ANET.US$

$A.O. Smith(AOS.US$

$Best Buy(BBY.US$

Oversold

$Moderna(MRNA.US$

$Allstate(ALL.US$

$Illumina(ILMN.US$

$PayPal(PYPL.US$

$Dish Network(DISH.US$

We collect stocks from S&P 500 as it contains most of valuable companies.

Want to screen the market by yourself? Read:How to use a stock screener

Want to learn more about technical trading? Read: Technical Analysis 101:Introduction to technical indicators

+9

39

jcasa

liked

$Alibaba(BABA.US$ 🌏🌍🌎💰🐮❤🗽

🔥😦 STATE INVESTMENT FUND OF SAUDI ARABIA ACQUIRES 674,748 SHARES IN ALIBABA

🇷🇺💰

AliExpress Russia ($ BABA): Local business turnover increased by 136% yoy.

😎🍋🇨🇳

Sales of goods on the AliExpress Russia platform during the sales period from November 1 to November 12, 2021 amounted to ₽33.3 billion. In total, more than 25.6 million orders were made, and the daily audience exceeded 12.5 million people. The turnover of Russian sellers on the marketplace has grown 2.4 times.

🔥😦 STATE INVESTMENT FUND OF SAUDI ARABIA ACQUIRES 674,748 SHARES IN ALIBABA

🇷🇺💰

AliExpress Russia ($ BABA): Local business turnover increased by 136% yoy.

😎🍋🇨🇳

Sales of goods on the AliExpress Russia platform during the sales period from November 1 to November 12, 2021 amounted to ₽33.3 billion. In total, more than 25.6 million orders were made, and the daily audience exceeded 12.5 million people. The turnover of Russian sellers on the marketplace has grown 2.4 times.

8

jcasa

liked

By Danilo

Hey, mooers! Here are things you need to know before the opening bell:

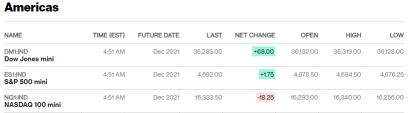

- Stock futures dipped in early morning trading after the major U.S. market indexes reached record highs on Friday following a better-than-expected October jobs report.

- Twitter users said Mr. Musk should sell 10% of his Tesla stock, a stake valued at about $21 billion, after the CEO polled them and pledged to abide by the outcome of the vote.

Market Snapshot

Stock futures dipped in early morning trading after the major U.S. market indexes reached record highs on Friday following a better-than-expected October jobs report.

Futures on the $Dow Jones Industrial Average(.DJI.US$ gained 68 points. $S&P 500 Index(.SPX.US$ futures were flat and $NASDAQ 100 Index(.NDX.US$ futures traded in mildly negative territory.

Market Temperature

Read more: Market Temperature (11/08)

Top News

Stocks finish at new highs after jobs data

U.S. stocks rose to records after Labor Department data showed job growth rebounded in October following a summer slowdown.

Biden gets down payment on agenda; obstacles loom for spending bill

The White House will tout the benefits of the bipartisan infrastructure legislation amid inflation pressures and an uncertain fate for the $2 trillion spending bill.

What's harder to find than microchips? The equipment that makes them

The world is hungry for semiconductors, and not all of them need to be made with cutting-edge technology. The race is on to find older machines that can still crank out chips.

Infrastructure law seen having small, positive impact on growth

The roughly $1 trillion infrastructure package will modestly help the economy in the short run while priming the country for slightly stronger growth in coming decades, economists say.

Elon Musk's Twitter poll results favor Tesla stock sale

Twitter users said Mr. Musk should sell 10% of his Tesla stock, a stake valued at about $21 billion, after the CEO polled them and pledged to abide by the outcome of the vote. $Tesla(TSLA.US$

Berkshire Hathaway's net earnings fall 66%

Warren Buffett's conglomerate said its third-quarter net earnings fell to $10.34 billion, after paper gains from the company's vast portfolio of stock investments declined from a year earlier. $Berkshire Hathaway-A(BRK.A.US$

Amazon cloud's new boss girds to defend turf it pioneered

Adam Selipsky is leading the cloud-computing unit as Microsoft and Google challenge its dominance in infrastructure services with end-user software programs. $Amazon(AMZN.US$

Read More

Elon Musk's SpaceX now expects to launch Crew-3 on Wednesday after 2nd delay

The electric vehicles aren't as green as you think

What is the real reason for Elon Musk to sell Tesla shares?

Most active stock options for Nov 8

Warren Buffett has spent more on buybacks of BRK stock than adding to position in Apple

Key Events This Week

Source: CNBC, Dow Jones Newswires, Bloomberg

Hey, mooers! Here are things you need to know before the opening bell:

- Stock futures dipped in early morning trading after the major U.S. market indexes reached record highs on Friday following a better-than-expected October jobs report.

- Twitter users said Mr. Musk should sell 10% of his Tesla stock, a stake valued at about $21 billion, after the CEO polled them and pledged to abide by the outcome of the vote.

Market Snapshot

Stock futures dipped in early morning trading after the major U.S. market indexes reached record highs on Friday following a better-than-expected October jobs report.

Futures on the $Dow Jones Industrial Average(.DJI.US$ gained 68 points. $S&P 500 Index(.SPX.US$ futures were flat and $NASDAQ 100 Index(.NDX.US$ futures traded in mildly negative territory.

Market Temperature

Read more: Market Temperature (11/08)

Top News

Stocks finish at new highs after jobs data

U.S. stocks rose to records after Labor Department data showed job growth rebounded in October following a summer slowdown.

Biden gets down payment on agenda; obstacles loom for spending bill

The White House will tout the benefits of the bipartisan infrastructure legislation amid inflation pressures and an uncertain fate for the $2 trillion spending bill.

What's harder to find than microchips? The equipment that makes them

The world is hungry for semiconductors, and not all of them need to be made with cutting-edge technology. The race is on to find older machines that can still crank out chips.

Infrastructure law seen having small, positive impact on growth

The roughly $1 trillion infrastructure package will modestly help the economy in the short run while priming the country for slightly stronger growth in coming decades, economists say.

Elon Musk's Twitter poll results favor Tesla stock sale

Twitter users said Mr. Musk should sell 10% of his Tesla stock, a stake valued at about $21 billion, after the CEO polled them and pledged to abide by the outcome of the vote. $Tesla(TSLA.US$

Berkshire Hathaway's net earnings fall 66%

Warren Buffett's conglomerate said its third-quarter net earnings fell to $10.34 billion, after paper gains from the company's vast portfolio of stock investments declined from a year earlier. $Berkshire Hathaway-A(BRK.A.US$

Amazon cloud's new boss girds to defend turf it pioneered

Adam Selipsky is leading the cloud-computing unit as Microsoft and Google challenge its dominance in infrastructure services with end-user software programs. $Amazon(AMZN.US$

Read More

Elon Musk's SpaceX now expects to launch Crew-3 on Wednesday after 2nd delay

The electric vehicles aren't as green as you think

What is the real reason for Elon Musk to sell Tesla shares?

Most active stock options for Nov 8

Warren Buffett has spent more on buybacks of BRK stock than adding to position in Apple

Key Events This Week

Source: CNBC, Dow Jones Newswires, Bloomberg

+1

44

3

jcasa

liked

Stocks selloff to extend to Asia as yields spike

A global equity selloff looked set to spill into Asia Wednesday after U.S. stocks saw their worst day since May and bond yields spiked on concerns about inflation. The dollar rallied.

Futures declined about 1% in Japan and Australia, and were also lower in Hong Kong. Mounting concern over the debt-ceiling impasse in Washington added to investor angst. $S&P 500 Index(.SPX.US$contracts steadied in Asia trading after the benchmark closed 2% lower -- the most since May.

Highest flying tech stocks fall hardest in rate-fueled rout

The surge in yields batters growth stocks that have been trading at lofty levels. That's helped fuel a 2.9% drop in the $NASDAQ 100 Index(.NDX.US$on Tuesday, led by companies like $Microsoft(MSFT.US$and $Alphabet-A(GOOGL.US$, as Treasury rates jumped for a fourth-straight day.

The faster-growing companies are more sensitive to interest rates than others because their stock valuations hinge on revenue and profit that's not expected to emerge for years.

Peloton extends drop as Amazon debuts rival fitness service

$Peloton Interactive(PTON.US$dropped as much as 5.5% on Tuesday following news that $Amazon(AMZN.US$is providing a service called Halo Fitness to rival offerings from Peloton and $Apple(AAPL.US$.

Amazon's Halo membership includes “hundreds of workouts” through an app and can track body composition and sleep patterns, according to the company's website. Amazon is selling a Halo Band that works with the fitness service.

Ford fortifies EV bet with four new factories in Tennessee and Kentucky

$Ford Motor(F.US$plans to build its first new U.S. assembly plant in decades, along with three battery factories, to fortify its push into electric vehicles as the industry accelerates green-tech investments.

Ford expects to spend $7 billion on the project—the largest manufacturing investment in its history—and collaborate with South Korean battery maker SK Innovation to construct the battery facilities.

Alibaba apps are starting to support Tencent's WeChat Pay

For years, China's major internet platforms have operated as walled gardens, blocking links from rivals or not allowing users to purchase goods using competitors payments products.

Regulators are now forcing companies like $TENCENT(00700.HK$and $Alibaba(BABA.US$to change some of their anti-competitive behavior across their apps. Tencent has started unblocking links to rivals’ content on WeChat. And Alibaba is now integrating Tencent's WeChat Pay on some of its apps.

Tesla CEO Elon Musk says U.S. government should avoid regulating crypto

$Tesla(TSLA.US$ chief Elon Musk on Tuesday said the U.S. government should steer clear of trying to regulate the crypto market. "It is not possible to, I think, destroy crypto, but it is possible for governments to slow down its advancement," Musk said at the Code Conference in Beverly Hills, California.

Soaring pea costs set to hit plant-based meat producers

Plant-based meat companies that rely on the pea as a key ingredient are set to be hit by the severe drought in Canada this year that has led to soaring crop prices, a leading supplier has warned. Prices of peas in Canada have more than doubled.

Following $Beyond Meat(BYND.US$, food companies including $Tyson Foods(TSN.US$and $NESTLE SA(NSRGF.US$have turned to peas as their key ingredient for their plant-based meat. Nestlé this year also launched a plant milk made from yellow peas.

China's pet care spend set for dramatic increase, says Goldman

Goldman Sachs is urging investors to take a bet on China’s $30bn pet market and the prospect that the country’s city-dwelling youth will opt for well-fed cats and dogs over a new baby boom.

The US investment bank has laid out its case for the Chinese pet care market in a report that forecasts a stellar 19% compound annual growth in pet food spending between now and 2030 as, among other factors, the diet of China‘s nearly 200m cats and dogs shifts from leftovers to packaged pet food.

Source: Bloomberg, WSJ, CNBC, Financial Times

A global equity selloff looked set to spill into Asia Wednesday after U.S. stocks saw their worst day since May and bond yields spiked on concerns about inflation. The dollar rallied.

Futures declined about 1% in Japan and Australia, and were also lower in Hong Kong. Mounting concern over the debt-ceiling impasse in Washington added to investor angst. $S&P 500 Index(.SPX.US$contracts steadied in Asia trading after the benchmark closed 2% lower -- the most since May.

Highest flying tech stocks fall hardest in rate-fueled rout

The surge in yields batters growth stocks that have been trading at lofty levels. That's helped fuel a 2.9% drop in the $NASDAQ 100 Index(.NDX.US$on Tuesday, led by companies like $Microsoft(MSFT.US$and $Alphabet-A(GOOGL.US$, as Treasury rates jumped for a fourth-straight day.

The faster-growing companies are more sensitive to interest rates than others because their stock valuations hinge on revenue and profit that's not expected to emerge for years.

Peloton extends drop as Amazon debuts rival fitness service

$Peloton Interactive(PTON.US$dropped as much as 5.5% on Tuesday following news that $Amazon(AMZN.US$is providing a service called Halo Fitness to rival offerings from Peloton and $Apple(AAPL.US$.

Amazon's Halo membership includes “hundreds of workouts” through an app and can track body composition and sleep patterns, according to the company's website. Amazon is selling a Halo Band that works with the fitness service.

Ford fortifies EV bet with four new factories in Tennessee and Kentucky

$Ford Motor(F.US$plans to build its first new U.S. assembly plant in decades, along with three battery factories, to fortify its push into electric vehicles as the industry accelerates green-tech investments.

Ford expects to spend $7 billion on the project—the largest manufacturing investment in its history—and collaborate with South Korean battery maker SK Innovation to construct the battery facilities.

Alibaba apps are starting to support Tencent's WeChat Pay

For years, China's major internet platforms have operated as walled gardens, blocking links from rivals or not allowing users to purchase goods using competitors payments products.

Regulators are now forcing companies like $TENCENT(00700.HK$and $Alibaba(BABA.US$to change some of their anti-competitive behavior across their apps. Tencent has started unblocking links to rivals’ content on WeChat. And Alibaba is now integrating Tencent's WeChat Pay on some of its apps.

Tesla CEO Elon Musk says U.S. government should avoid regulating crypto

$Tesla(TSLA.US$ chief Elon Musk on Tuesday said the U.S. government should steer clear of trying to regulate the crypto market. "It is not possible to, I think, destroy crypto, but it is possible for governments to slow down its advancement," Musk said at the Code Conference in Beverly Hills, California.

Soaring pea costs set to hit plant-based meat producers

Plant-based meat companies that rely on the pea as a key ingredient are set to be hit by the severe drought in Canada this year that has led to soaring crop prices, a leading supplier has warned. Prices of peas in Canada have more than doubled.

Following $Beyond Meat(BYND.US$, food companies including $Tyson Foods(TSN.US$and $NESTLE SA(NSRGF.US$have turned to peas as their key ingredient for their plant-based meat. Nestlé this year also launched a plant milk made from yellow peas.

China's pet care spend set for dramatic increase, says Goldman

Goldman Sachs is urging investors to take a bet on China’s $30bn pet market and the prospect that the country’s city-dwelling youth will opt for well-fed cats and dogs over a new baby boom.

The US investment bank has laid out its case for the Chinese pet care market in a report that forecasts a stellar 19% compound annual growth in pet food spending between now and 2030 as, among other factors, the diet of China‘s nearly 200m cats and dogs shifts from leftovers to packaged pet food.

Source: Bloomberg, WSJ, CNBC, Financial Times

55

2

jcasa

liked

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)