JeIIy

liked

Hey, mooers. How time flies. It's coming to the end of 2023, it has been a year full of upheavals in global stock market. Nevertheless, changes can lead to chances in trading. How was your trading journey in the past 11 months? Did you make any gains in the volatile market? Beyond trading, did anything special happen in your life this year? Let's review your trades and overall performance in 2023 together before we start fresh in 2024.

![]() You may share:

You may share:

![]() What ...

What ...

145

91

24

JeIIy

commented on

Hey moo-ers,

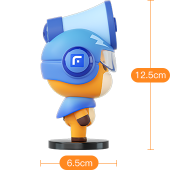

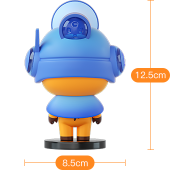

Calling all fans of our moomoo figurines, we’ve got an exciting launch coming up for you! Redeem our latest figurine - Ambassador Figurine as it drops on Rewards Club this Friday (9 Dec) at 10:00 am![]()

Drop a comment if you’re planning to redeem it this Friday at our lauch!![]() Limited quantities available, so be sure to grab it while stocks last!

Limited quantities available, so be sure to grab it while stocks last!

$Futu Holdings Ltd(FUTU.US)$

Calling all fans of our moomoo figurines, we’ve got an exciting launch coming up for you! Redeem our latest figurine - Ambassador Figurine as it drops on Rewards Club this Friday (9 Dec) at 10:00 am

Drop a comment if you’re planning to redeem it this Friday at our lauch!

$Futu Holdings Ltd(FUTU.US)$

82

79

13

JeIIy

liked

Columns Apple Q3 earnings review: Earnings exceed market expectations; bullish on iPhone performance in 2H22

If you like this article, please hit the thumbs up button and subscribe to 'wise shark' to get the latest information from research report.![]()

Against the backdrop of rising global macroeconomic uncertainty and continued supply chain tensions due to the epidemic, $Apple (AAPL.US)$'s earnings growth slowed this quarter due to the negative impact of supply-side and FX fluctuations. However, revenue a...

Against the backdrop of rising global macroeconomic uncertainty and continued supply chain tensions due to the epidemic, $Apple (AAPL.US)$'s earnings growth slowed this quarter due to the negative impact of supply-side and FX fluctuations. However, revenue a...

10

16

JeIIy

liked

Chinese New Year is a tradition for Chinese people. Even in the epidemic, we should be happy. With loved ones around, happiness is everywhere. I hope everyone cherishes the present, enjoys life peacefully, happily 🈵🈵, everyone is healthy, and good luck continues 🎉🍍💰 @Celine baby @Coffee Drip @CollectiveWisdom @HopeAlways @Hui06 @Investing with moomoo @Kelly Chong 93 @Mars Mooo @Mcsnacks H Tupack @Meta Moo @milky milk123 @Money--Max @moo_Live @Moomoo Breakfast @Mooers Lab @moomoo Event @Moomoo News @Moomoo Recap @moomoo Rewards @moomoo Singapore @Moomoopedia SG @Popular on moomoo @Racheal辣椒 @SiawLing @Stoc-King @Team moomoo @The Boxing Ring @Yogiyogi @Yumi Jong @102246527 @70507434Please all moomoo...

Translated

+5

28

18

1

JeIIy

liked

JeIIy

liked

JeIIy

liked

I started my investment journey in Aug 2021. Been there in both Moomoo and Tiger promotions. Moomoo's app GUI and typesetting won me over with the ease of use. The multitude of functions such as Options Trading, Level 2 quotes and Stock Analysis aided me tremendously in my trading journey. Allow me to recap my five months of learning journey:

****************************************

Chapter 1: Noob Start in Local and My 1st Option Trade - Aug 2021

My initial strategy is to invest into local market: (1) Invest in Bank and REITS.

"Could be better" Trade: FOMO into dividend bank stock $OCBC Bank (O39.SG)$ and been bag-holding till now. Did not know that after ex-dividend, the stock will usually tank equivalent to dividend amount.

In the same month, I learnt about Options Trading. I made my 1st CSP on $Coinbase (COIN.US)$, and closing early to make a tidy profit. I also learnt that I do not need to maintain full securities to cover CSP as Moomoo allows Margin account to cover the principal.

Transaction

Note: Moomoo is great to support both Cash Secured Puts (CSP) and Covered Calls (CC) which will allow the possible implementation of Wheel Strategy.

******************************************

Chapter 2: Options and it's danger - Sep to Oct 2021

Revised Strategy: (1) Invest in Bank & REITS (2) Income through Selling Puts

I intensified on Options trading specifically on selling puts to generate income. Although CSP provides premium as income stream, there is a risk of unlimited downside if the underlying stock price goes down quickly. This happened to me when $Adobe (ADBE.US)$ tanked from 600+ to 500+.

Learning Point: Be cognisant of unlimited downside risk for selling puts. Learn how to roll down and out if needed. Disclaimer: DYODD

***************************************

Chapter 3: Discovering joy of Scalp Trading - Nov 2021

Enhanced Strategy: (1) Invest in Bank & REITS; (2) Income through Selling Puts; (3) Scalp Trading

I started day trading in Nov. I learnt about basics of technical analysis and uses candlesticks, EMA and VWAP for Scalp trade. In Nov, I made a total of 131 trades with ~1.65 mil in turnover![]() . However, I only made 0.18% in profits which is good enough for me.

. However, I only made 0.18% in profits which is good enough for me. ![]()

Transaction Stats

Good Trade: $BioNTech (BNTX.US)$ Took the scalp trade on 3 green 🕯. Exited quickly after 3 mins trade

Learning Points: Separate investment and trading, Curb emotions, do not FOMO, set Stop Limits for both profits and losses, Accept losses gracefully.

***************************************

Chapter 4: Leaps into the future - Dec 2021

Tweaked Strategy: (1) Invest in Bank & REITS; (2) Income through Selling Puts; (3) Scalp Trading and (4) Control future with LEAPS

The last month of 2021 saw extreme volatilities in equity market. My long-term portfolio shrank by 15%. I added another option strategy: LEAPS into my investment plan. LEAPS entails buying long option calls deep into future (1 year or more). I added two stocks that I feel that will rise by Jan 2023: $Palantir (PLTR.US)$ $SoFi Technologies (SOFI.US)$

Tips: Buy ITM LEAPS when the underlying stock price is low or reached certain pressure lines. Disclaimer: DYODD

***************************************

In Summary

It has been a rewarding and fruitful learning journey in investing. Although I missed out the initial QE ride last year, the painful lessons I learnt now in 2021 will be useful for my future trades. I will continue to fine-tune my investment strategy to improve my expertise in 2022.

Many thanks to Moomoo for the great contents such as News, Courses, Seminars etc and not forgetting the selfless sharing of experiences by fellow Moo-ers!!

"Looking forward from Moomoo":

(1) Advanced options strategy such as Iron Condor and Credit Spreads

(2) Crypto Trading![]()

****************************************

Chapter 1: Noob Start in Local and My 1st Option Trade - Aug 2021

My initial strategy is to invest into local market: (1) Invest in Bank and REITS.

"Could be better" Trade: FOMO into dividend bank stock $OCBC Bank (O39.SG)$ and been bag-holding till now. Did not know that after ex-dividend, the stock will usually tank equivalent to dividend amount.

In the same month, I learnt about Options Trading. I made my 1st CSP on $Coinbase (COIN.US)$, and closing early to make a tidy profit. I also learnt that I do not need to maintain full securities to cover CSP as Moomoo allows Margin account to cover the principal.

Transaction

Note: Moomoo is great to support both Cash Secured Puts (CSP) and Covered Calls (CC) which will allow the possible implementation of Wheel Strategy.

******************************************

Chapter 2: Options and it's danger - Sep to Oct 2021

Revised Strategy: (1) Invest in Bank & REITS (2) Income through Selling Puts

I intensified on Options trading specifically on selling puts to generate income. Although CSP provides premium as income stream, there is a risk of unlimited downside if the underlying stock price goes down quickly. This happened to me when $Adobe (ADBE.US)$ tanked from 600+ to 500+.

Learning Point: Be cognisant of unlimited downside risk for selling puts. Learn how to roll down and out if needed. Disclaimer: DYODD

***************************************

Chapter 3: Discovering joy of Scalp Trading - Nov 2021

Enhanced Strategy: (1) Invest in Bank & REITS; (2) Income through Selling Puts; (3) Scalp Trading

I started day trading in Nov. I learnt about basics of technical analysis and uses candlesticks, EMA and VWAP for Scalp trade. In Nov, I made a total of 131 trades with ~1.65 mil in turnover

Transaction Stats

Good Trade: $BioNTech (BNTX.US)$ Took the scalp trade on 3 green 🕯. Exited quickly after 3 mins trade

Learning Points: Separate investment and trading, Curb emotions, do not FOMO, set Stop Limits for both profits and losses, Accept losses gracefully.

***************************************

Chapter 4: Leaps into the future - Dec 2021

Tweaked Strategy: (1) Invest in Bank & REITS; (2) Income through Selling Puts; (3) Scalp Trading and (4) Control future with LEAPS

The last month of 2021 saw extreme volatilities in equity market. My long-term portfolio shrank by 15%. I added another option strategy: LEAPS into my investment plan. LEAPS entails buying long option calls deep into future (1 year or more). I added two stocks that I feel that will rise by Jan 2023: $Palantir (PLTR.US)$ $SoFi Technologies (SOFI.US)$

Tips: Buy ITM LEAPS when the underlying stock price is low or reached certain pressure lines. Disclaimer: DYODD

***************************************

In Summary

It has been a rewarding and fruitful learning journey in investing. Although I missed out the initial QE ride last year, the painful lessons I learnt now in 2021 will be useful for my future trades. I will continue to fine-tune my investment strategy to improve my expertise in 2022.

Many thanks to Moomoo for the great contents such as News, Courses, Seminars etc and not forgetting the selfless sharing of experiences by fellow Moo-ers!!

"Looking forward from Moomoo":

(1) Advanced options strategy such as Iron Condor and Credit Spreads

(2) Crypto Trading

+2

loading...

64

2

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)