_jesica

liked

12

5

_jesica

liked

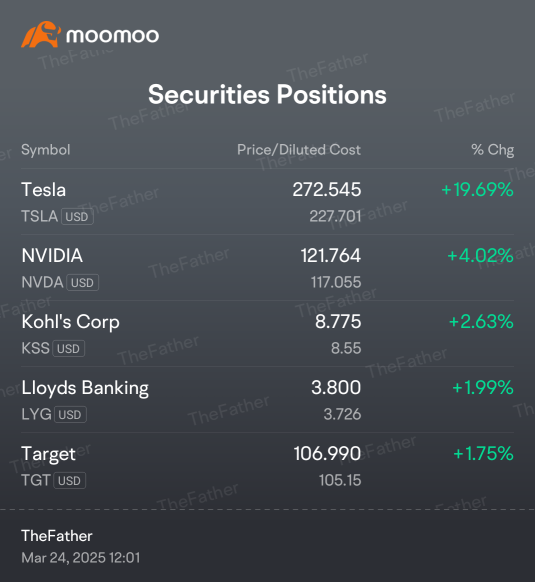

Pain staking searches will always produce results. Patience is a virtue. Combining both makes for powerful decision-making

1. My strategy is to find an item that has immediate results in order to sell and recuperate the initial investment by selling 50% of the initial shares purchased. (SureBet!)

2. Leaving the remaining 50% to hit as a limit sale at the obnoxious goal minus 20% for a safer bet. (Long-TermSpecial)

The Father of Stocks: Laying the groundwork ...

1. My strategy is to find an item that has immediate results in order to sell and recuperate the initial investment by selling 50% of the initial shares purchased. (SureBet!)

2. Leaving the remaining 50% to hit as a limit sale at the obnoxious goal minus 20% for a safer bet. (Long-TermSpecial)

The Father of Stocks: Laying the groundwork ...

18

2

_jesica

liked

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $Defiance Daily Target 2X Long MSTR ETF (MSTX.US)$ $ProShares UltraPro Short QQQ ETF (SQQQ.US)$ Short-Term Trading Strategy Summary

1. Trump’s speeches lead to market declines (uncertainty over his policies).

2. Buy the dip after a sharp drop, short after a strong rally (contrarian trading based on market sentiment).

3. Stay out of the market if the direction is unclear (avoid unnecessary risks).

4. Overall trend is still downward, and the market has not bottom...

1. Trump’s speeches lead to market declines (uncertainty over his policies).

2. Buy the dip after a sharp drop, short after a strong rally (contrarian trading based on market sentiment).

3. Stay out of the market if the direction is unclear (avoid unnecessary risks).

4. Overall trend is still downward, and the market has not bottom...

7

_jesica

liked

Week 3 Day 6

After Trump's victory, the defeated short sellers of Tesla (TSLA.US) are quietly brewing the next wave of "short selling."

The above is not entirely correct. Longs are also accumulating and they may have been protected today.

Question: Is $Tesla (TSLA.US)$ Holding 236 and Subsequently 233 to Protect Calls?

Yes, the evidence strongly suggests that TSLA is being pinned at 236 to favor the dominant call positions. Here’s why:

...

After Trump's victory, the defeated short sellers of Tesla (TSLA.US) are quietly brewing the next wave of "short selling."

The above is not entirely correct. Longs are also accumulating and they may have been protected today.

Question: Is $Tesla (TSLA.US)$ Holding 236 and Subsequently 233 to Protect Calls?

Yes, the evidence strongly suggests that TSLA is being pinned at 236 to favor the dominant call positions. Here’s why:

...

+3

11

12

_jesica

liked

_jesica

liked

$Intel (INTC.US)$

Intel Corporation (NASDAQ: INTC) is attracting significant attention from market analysts and investors alike, as the stock shows clear signs of breaking out from a solid base. While many traders continue to chase free-falling stocks, hoping to catch a bottom, the better risk/reward setup lies in buying hard assets and stocks building a strong base—and Intel is a prime example.

Intel’s Bullish Base:...

Intel Corporation (NASDAQ: INTC) is attracting significant attention from market analysts and investors alike, as the stock shows clear signs of breaking out from a solid base. While many traders continue to chase free-falling stocks, hoping to catch a bottom, the better risk/reward setup lies in buying hard assets and stocks building a strong base—and Intel is a prime example.

Intel’s Bullish Base:...

20

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)