jianwei1983

commented on

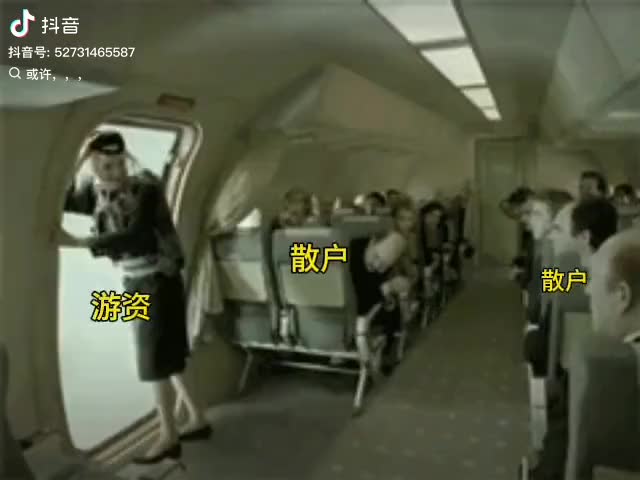

$HARTA (5168.MY)$ Did not notice, suddenly jumped into the water.

Translated

2

3

jianwei1983

liked

Translated

2

2

jianwei1983

liked

Last week, the markets were dominated by escalating trade tensions, with tariffs on steel and aluminum imports sparking fears of a global trade war. The European Union retaliated with counter-tariffs on $28 billion worth of U.S. goods, further spooking investors. Meanwhile, concerns over valuations and earnings continued to weigh on the tech sector, with $Adobe (ADBE.US)$ and $Intel (INTC.US)$ making headlines f...

+13

2073

359

23

jianwei1983

Set a live reminder and voted

$NVIDIA (NVDA.US)$

Jensen Huang, Founder and CEO of Nvidia, will deliver the keynote at GTC 2025. This event, scheduled for March 18 at 1:00 PM ET / March 19 at 1:00 AM SGT / March 19 at 4:00 AM AEST, will cover groundbreaking advancements in AI, digital twins, cloud technologies, and sustainable computing.

Huang's keynote will provide a visionary roadmap of Nvidia's role in shaping the AI-driven world. Subscribe to join the live NOW!

NVIDIA Stock Predicti...

Jensen Huang, Founder and CEO of Nvidia, will deliver the keynote at GTC 2025. This event, scheduled for March 18 at 1:00 PM ET / March 19 at 1:00 AM SGT / March 19 at 4:00 AM AEST, will cover groundbreaking advancements in AI, digital twins, cloud technologies, and sustainable computing.

Huang's keynote will provide a visionary roadmap of Nvidia's role in shaping the AI-driven world. Subscribe to join the live NOW!

NVIDIA Stock Predicti...

GTC Keynote With NVIDIA CEO Jensen Huang

Mar 19 01:00

431

331

65

jianwei1983

commented on

China's Yao Ming was told in two words by US politicians, and stocks were so weak that they fell into a bottomless abyss... China Yao Ming and Yao Ming Kang De are too bad...

Translated

2

jianwei1983

commented on

$NVIDIA (NVDA.US)$It wouldn't be surprising if Trump were assassinated. There are too many news reports.

Translated

5

2

jianwei1983

commented on

$HARTA (5168.MY)$ Bought many at 2.05, i think thos is bargain price and the support is strong😊

1

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

jianwei1983 : There is no minimum, only lower...![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)