Jncy

liked

According to the principle of value investing, people should pick stocks that appear to be trading for less than their book value. Which means buy when the stock price drops. There's another group of people who trade oppositely. They follow the market trend to buy and sell. The more a stock price has risen, the more they buy-in.

So which way is more "right"? The fact is, the reality is all grey areas. There are very few black and white answers. Don't rid yourself of ideology and narrowness. There are hundreds of ways to get rich if you stay open-minded. Different methods can be used in different scenarios.

Choose your stand plz~

Let's take a look at some examples:

@Carry only: $AMC Entertainment(AMC.US$

@UFTWY: What a year it has been $GameStop(GME.US$ $Virgin Galactic(SPCE.US$

@102497462: $XIAOMI-W(01810.HK$

@gooup8: The future beckons. With conviction,we hold

@Lily Swanberg: $AMC Entertainment(AMC.US$ welcome on board to the new ape nations who bought at 22!! We have add more last week!! United we can make history…

@Deezy_McCheezy: $AMC Entertainment(AMC.US$ I'll just twiddle my thumbs

Who has their new NFTs here????

@Smart Jerry:

@Warrens Buffet: $AMC Entertainment(AMC.US$

@demntia: Let's get ready for the fake squeeze $AMC Entertainment(AMC.US$

![]()

![]()

![]() Christmas is coming~

Christmas is coming~

@Peak Mountain: $NIO Inc(NIO.US$ we're going up......

@gooup8: $Society Pass(SOPA.US$

@Jayishere: Happy holidays retards!

This week, we'd like to invite you to comment below and tell about: How you choose your stand in everyday life? Or maybe you don't?

We will select 20 TOP COMMENTS by next Monday.

Winners will get 88 points by next week, with which you can exchange gifts at Reward Club.

*Comments within this week will be counted.

You may post:

A related meme in gif or jpeg

Your real-life experience

Other creative ways to show your sense of humor

Merry Christmas to all mooers! Have a lovely holiday!

Peace!![]()

![]()

![]()

So which way is more "right"? The fact is, the reality is all grey areas. There are very few black and white answers. Don't rid yourself of ideology and narrowness. There are hundreds of ways to get rich if you stay open-minded. Different methods can be used in different scenarios.

Choose your stand plz~

Let's take a look at some examples:

@Carry only: $AMC Entertainment(AMC.US$

@UFTWY: What a year it has been $GameStop(GME.US$ $Virgin Galactic(SPCE.US$

@102497462: $XIAOMI-W(01810.HK$

@gooup8: The future beckons. With conviction,we hold

@Lily Swanberg: $AMC Entertainment(AMC.US$ welcome on board to the new ape nations who bought at 22!! We have add more last week!! United we can make history…

@Deezy_McCheezy: $AMC Entertainment(AMC.US$ I'll just twiddle my thumbs

Who has their new NFTs here????

@Smart Jerry:

@Warrens Buffet: $AMC Entertainment(AMC.US$

@demntia: Let's get ready for the fake squeeze $AMC Entertainment(AMC.US$

@Peak Mountain: $NIO Inc(NIO.US$ we're going up......

@gooup8: $Society Pass(SOPA.US$

@Jayishere: Happy holidays retards!

This week, we'd like to invite you to comment below and tell about: How you choose your stand in everyday life? Or maybe you don't?

We will select 20 TOP COMMENTS by next Monday.

Winners will get 88 points by next week, with which you can exchange gifts at Reward Club.

*Comments within this week will be counted.

You may post:

A related meme in gif or jpeg

Your real-life experience

Other creative ways to show your sense of humor

Merry Christmas to all mooers! Have a lovely holiday!

Peace!

+10

79

45

Jncy

liked

My biggest trading mistakes have included letting losses run, not taking profits, hesitating on good trade setups, and being over-eager to trade (overtrading).

The worst mistake is following what everyone else is doing. This lead to me paying too much for stocks that are overvalued and watching them crash before my eyes. They offer little to no profit and I only invested in them because it is a “common” stock. “The trend is your friend” I thought. Boy was I wrong.After everyone left the stock I had no confidence to invest in anything else. I finally decided to invest in Ford and watched as i got $700 returns and I was like “What the heck”! I was so confused that this stock wasn’t a stock that many people recommended yet it bought more returns in one day than i had in 2 weeks with the other mainstream investments.

The worst mistake is following what everyone else is doing. This lead to me paying too much for stocks that are overvalued and watching them crash before my eyes. They offer little to no profit and I only invested in them because it is a “common” stock. “The trend is your friend” I thought. Boy was I wrong.After everyone left the stock I had no confidence to invest in anything else. I finally decided to invest in Ford and watched as i got $700 returns and I was like “What the heck”! I was so confused that this stock wasn’t a stock that many people recommended yet it bought more returns in one day than i had in 2 weeks with the other mainstream investments.

20

2

Jncy

liked

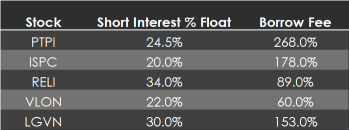

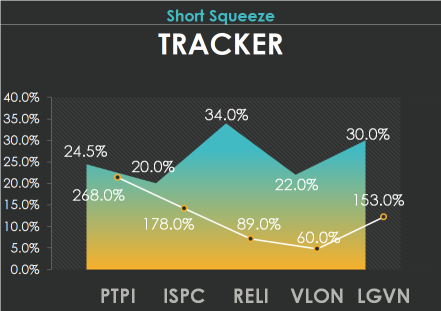

A short squeeze can occur when a heavily shorted stock rises in value instead of falling. Short sellers could be looking to close out their position and can face a loss if they have to buy back the shares they initially borrowed at a higher price. ![]()

![]()

![]()

Here is a look at Fintel's top five short squeeze candidates for the week of Dec. 20.![]()

![]()

![]()

$Petros Pharmaceuticals(PTPI.US$ $iSpecimen(ISPC.US$ $Reliance Global Group(RELI.US$ $Vallon Pharmaceuticals(VLON.US$ $Longeveron(LGVN.US$

Mooers, let's look for the next $GameStop(GME.US$or $AMC Entertainment(AMC.US$.![]()

![]()

![]()

Here is a look at Fintel's top five short squeeze candidates for the week of Dec. 20.

$Petros Pharmaceuticals(PTPI.US$ $iSpecimen(ISPC.US$ $Reliance Global Group(RELI.US$ $Vallon Pharmaceuticals(VLON.US$ $Longeveron(LGVN.US$

Mooers, let's look for the next $GameStop(GME.US$or $AMC Entertainment(AMC.US$.

69

18

Jncy

liked

moomoo annual ceremony is happening right now!

Check it out here:

2021 in Review: Grow Together to the Moon!

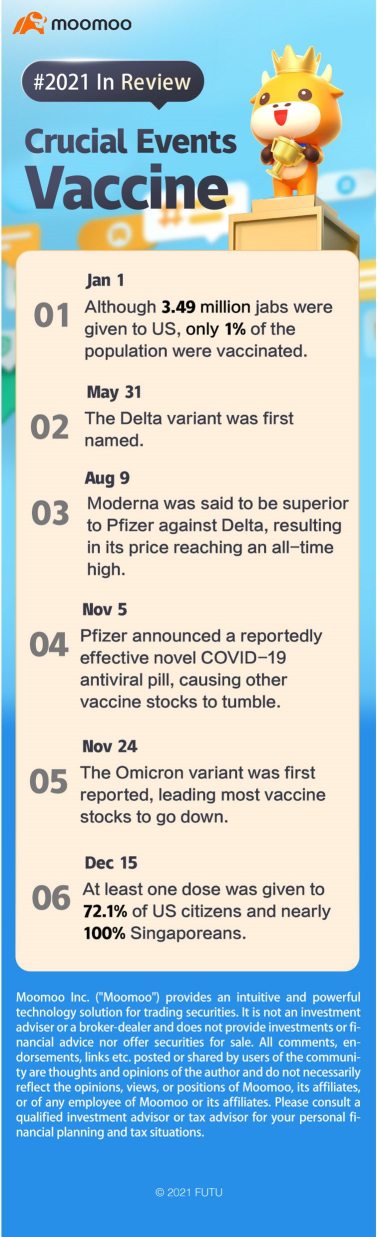

When can I get the vaccine? One of the most-searched questions on Google indicates people's biggest worry in 2021. However, it's an entirely different story for vaccine stocks holders. Sometimes they want the market sentiments to be different because they found that the line in the cases-versus-price graph increases exponentially.

Instead of getting vaccinated, investors stared at news channels. They tried to find the next catalyst for a strong momentum of growth. Are they speculating? Yes, they are. Maybe you'd like to join them if you look at the cost-benefit ratio or the daily performance of the trending vaccine stocks.

Anyway, I sincerely hope that the vaccines will be enough for every mooer![]() . Sufficient supply also indicates healthy cash flows... Oh, I mean, the virus might stop spreading if most of us are vaccinated.

. Sufficient supply also indicates healthy cash flows... Oh, I mean, the virus might stop spreading if most of us are vaccinated.

We also hope that the vaccine stocks could become value stocks with solid business models and stable cash flows one day. In that case, there will be no need for us to be on tenterhooks all day, waiting for monthly job reports or the infection numbers anymore.

Well, unless you enjoy the extreme volatility of the sudden outbreaks and are confident that you can profit from the biotech stocks shortly.

Did you get the vaccine?

Do you think the word "Vaccine" here qualifies to be the word of the year?

If you've got better ideas, please comment below to let us know.

You May Also Like:

Word of the Year: Apes

Word of the Year: Musk

Check it out here:

2021 in Review: Grow Together to the Moon!

When can I get the vaccine? One of the most-searched questions on Google indicates people's biggest worry in 2021. However, it's an entirely different story for vaccine stocks holders. Sometimes they want the market sentiments to be different because they found that the line in the cases-versus-price graph increases exponentially.

Instead of getting vaccinated, investors stared at news channels. They tried to find the next catalyst for a strong momentum of growth. Are they speculating? Yes, they are. Maybe you'd like to join them if you look at the cost-benefit ratio or the daily performance of the trending vaccine stocks.

Anyway, I sincerely hope that the vaccines will be enough for every mooer

We also hope that the vaccine stocks could become value stocks with solid business models and stable cash flows one day. In that case, there will be no need for us to be on tenterhooks all day, waiting for monthly job reports or the infection numbers anymore.

Well, unless you enjoy the extreme volatility of the sudden outbreaks and are confident that you can profit from the biotech stocks shortly.

Did you get the vaccine?

Do you think the word "Vaccine" here qualifies to be the word of the year?

If you've got better ideas, please comment below to let us know.

You May Also Like:

Word of the Year: Apes

Word of the Year: Musk

118

15

Jncy

liked

$NIO Inc(NIO.US$

Investors are getting more skeptical about putting their money into shares of China-based companies after SEC recently decided to tighten its grip on foreign companies listed in U.S. The SEC will accomplish this by implementing a law requiring companies to submit their accounts reports and other documentation for audit. If they fail to comply, they face the risk of being banned from trading on U.S. stock markets.

TCW Group forecast "most" U S listed China stocks will be delist by 2024. Meanwhile, Nio's rivals are gaining a foothold in China, with XPeng catching the attention of Cathie Woods' attention.

Investors are getting more skeptical about putting their money into shares of China-based companies after SEC recently decided to tighten its grip on foreign companies listed in U.S. The SEC will accomplish this by implementing a law requiring companies to submit their accounts reports and other documentation for audit. If they fail to comply, they face the risk of being banned from trading on U.S. stock markets.

TCW Group forecast "most" U S listed China stocks will be delist by 2024. Meanwhile, Nio's rivals are gaining a foothold in China, with XPeng catching the attention of Cathie Woods' attention.

31

7

Jncy

liked

Hello, mooers! ![]()

This week the stock market blew out possible again with rapid slash and rally. After a week full of excitement, it's time to discover some famous companies with the market attention!

【Rule】![]()

Look at the charts below and tell the name of corresponding stocks. (i.e. Tesla, Apple, AMC)

【Validity period】![]()

Please leave your comments by Monday Dec. 20, 9:00 AM ET / 10:00 PM SGT.

![]() 【Rewards】

【Rewards】![]()

The first and the last mooer who give correct answers within the validity period will win 288 points each!

Miss the first place?

Feel free to leave your comment about any of the stocks below, and 3 mooers will win extra 288 points each! (Based on quality and originality)

Comment now to win!!!

Chart 1: Keywords - The comapny is a membership warehouse club with hundreds of locations worldwide, the company has an ROE of 26.1% in the past 4 years.

Chart 2: Keywords -The company is a global financial institution that serves people, small and medium-sized enterprises, major organizations, and governments.

Chart 3: Keywords - A global multinational automobile manufacturer.

Good Luck, and have a nice weekend!![]()

This week the stock market blew out possible again with rapid slash and rally. After a week full of excitement, it's time to discover some famous companies with the market attention!

【Rule】

Look at the charts below and tell the name of corresponding stocks. (i.e. Tesla, Apple, AMC)

【Validity period】

Please leave your comments by Monday Dec. 20, 9:00 AM ET / 10:00 PM SGT.

The first and the last mooer who give correct answers within the validity period will win 288 points each!

Miss the first place?

Feel free to leave your comment about any of the stocks below, and 3 mooers will win extra 288 points each! (Based on quality and originality)

Comment now to win!!!

Chart 1: Keywords - The comapny is a membership warehouse club with hundreds of locations worldwide, the company has an ROE of 26.1% in the past 4 years.

Chart 2: Keywords -The company is a global financial institution that serves people, small and medium-sized enterprises, major organizations, and governments.

Chart 3: Keywords - A global multinational automobile manufacturer.

Good Luck, and have a nice weekend!

211

67

Jncy

liked

12

6

Jncy

liked

Against the backdrop of the global covid-19 pandemic, 2021 has brought new challenges and opportunities to this year's trading. We responded with laughter and tears. ![]() This post compiles six stories that present a vivid picture of mooers' investing experiences. We sincerely hope that you will enjoy the stories!

This post compiles six stories that present a vivid picture of mooers' investing experiences. We sincerely hope that you will enjoy the stories!

Spoiler: There's a chance to get a bonus if you read till the end.

![]() "Never forget why you started, so your mission can be completed."

"Never forget why you started, so your mission can be completed."

Every incredible adventure started with a baby step. When we look back to the very beginning of our trading journey, we ask ourselves why we got started in the first place? Realistically speaking, money is what we all are after, but what made us brave enough to take the first step? Here is one of the most satisfying answers.

"She Has Inspired Me" said by @HuatLady. His trading journey started with his 21 birthday gift – a $100 saving bank account book from his parents.

"I was touched because that was her virtuous desire for me to be independent, and to make effective decisions, not only for the trading field but throughout my life for a better Future."

![]() Making profits is not the ultimate goal of investing. What you can learn in the process will get you further in life.

Making profits is not the ultimate goal of investing. What you can learn in the process will get you further in life.

"The only way to overcome bad luck is working hard."

Novices deserve a bit of "beginner's luck." "Did I have beginner's luck when I first started trading?" @cowabangawas quite confident at first because of the money he made in the market. After that, there're setbacks, and there's luck again.

"As I trade along, the results are certainly compelling! I dare say I have one of the finest beginner's luck out there for my first few wins at the market provided trading returns in folds. It was truly an amazing experience given the confidence it spurs in you. But like what the market veterans would say 'the market giveth, the market taketh'..."

![]() The truth is that luck is the combination of skills and opportunities. Many things that look like luck at first blush are part of a cycle.

The truth is that luck is the combination of skills and opportunities. Many things that look like luck at first blush are part of a cycle.

After investing for some time, many mooers might feel anxious and regretful. Some of us can't stop thinking about what we should've done when we were younger and what could've been achieved if we'd chosen differently. @aoimizushared his advice with the younger ones at "I hate finance ... but I'm here"

"I support young people who want to begin their investment journey early. As mentioned in a previous post (Gen Z and debt), I'd put aside my part-time job earnings as the capital for investments. I'd be more proactive in scanning the news and be updated on the overall environment. I'd become more curious about the companies that make the products I use, and study them more closely."

@小虎发大财wrote something about his words to himself if he can travel back in time at his post "I started my investment journey in 2017."

"I entered the market without any knowledge and purely by rumors, ended up suffering a loss.From there onwards, i started reading and watching video on youtube to educate myself, even till now hungry for knowledge. If I can return back time, i will tell myself to start off investment way earlier."

Regrets are common in trade because they occur both when you make a move or do absolutely nothing. How to deal with "regrets" when you want to start with "if only"? @Powerhouseresponded with "Really? Then you are not playing big enough!!"

"Investment is like this. You lost some here; you better wake up your idea to earn more somewhere else...Play within your means. That is how I consoled myself. Lose, never mind, just don't lose your mind and spirit. Miss the boat, try the other boat beside it!"

![]() "The minute you appreciate what you have, joyfulness overcomes suffering."

"The minute you appreciate what you have, joyfulness overcomes suffering."

2021 may not be the best in your life, but it couldn't be worse than 2020. Could it? We survived 2020, so when we start to appreciate what we have, 2021 could be a year full of joyfulness.

Do you agree with @Syueeat her post "Birds of a Feather, Flock Together!"?

"I believe in following the practice of gratitude, giving and sharing with the less fortunate. Not everyone is as lucky to have a roof over their heads, clothes to cover their bodies and food to fill their stomachs...Happiness keeps you sweet. Trials keep you strong. Sorrows keep you human. Failure keeps you humble. Success keeps you glowing. FAMILY keeps you GOING."

![]() Moo community is committed to accompanying you throughout your trading journey and offering as much support as we can.

Moo community is committed to accompanying you throughout your trading journey and offering as much support as we can.

2021 might be the start of the trading journey for many mooers. We've seen many mooers saying that moomoo is what gets them started in trading. That is AWESOME!

@aoimizusaid in one of his posts, "There is a sense of camaraderie in the moomoo community, making me feel that this is not a lonely journey and I can always ask for help". This is exactly what moomoo wants to bring to all of you! We will always be there for you. Wish you all a very happy 2022 ahead!

![]() Bonus

Bonus![]()

What's the most inspiring investing story you've heard this year? Comment under this post and tell us the story now! We will select the 1st, 10th, 20th, 30th, 40th...(multiples of 10) comments to give away 88 points each!

Duration: Now- Dec 28, 2021 11:59 PM SGT

![]()

![]()

![]() moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

Spoiler: There's a chance to get a bonus if you read till the end.

Every incredible adventure started with a baby step. When we look back to the very beginning of our trading journey, we ask ourselves why we got started in the first place? Realistically speaking, money is what we all are after, but what made us brave enough to take the first step? Here is one of the most satisfying answers.

"She Has Inspired Me" said by @HuatLady. His trading journey started with his 21 birthday gift – a $100 saving bank account book from his parents.

"I was touched because that was her virtuous desire for me to be independent, and to make effective decisions, not only for the trading field but throughout my life for a better Future."

"The only way to overcome bad luck is working hard."

Novices deserve a bit of "beginner's luck." "Did I have beginner's luck when I first started trading?" @cowabangawas quite confident at first because of the money he made in the market. After that, there're setbacks, and there's luck again.

"As I trade along, the results are certainly compelling! I dare say I have one of the finest beginner's luck out there for my first few wins at the market provided trading returns in folds. It was truly an amazing experience given the confidence it spurs in you. But like what the market veterans would say 'the market giveth, the market taketh'..."

After investing for some time, many mooers might feel anxious and regretful. Some of us can't stop thinking about what we should've done when we were younger and what could've been achieved if we'd chosen differently. @aoimizushared his advice with the younger ones at "I hate finance ... but I'm here"

"I support young people who want to begin their investment journey early. As mentioned in a previous post (Gen Z and debt), I'd put aside my part-time job earnings as the capital for investments. I'd be more proactive in scanning the news and be updated on the overall environment. I'd become more curious about the companies that make the products I use, and study them more closely."

@小虎发大财wrote something about his words to himself if he can travel back in time at his post "I started my investment journey in 2017."

"I entered the market without any knowledge and purely by rumors, ended up suffering a loss.From there onwards, i started reading and watching video on youtube to educate myself, even till now hungry for knowledge. If I can return back time, i will tell myself to start off investment way earlier."

Regrets are common in trade because they occur both when you make a move or do absolutely nothing. How to deal with "regrets" when you want to start with "if only"? @Powerhouseresponded with "Really? Then you are not playing big enough!!"

"Investment is like this. You lost some here; you better wake up your idea to earn more somewhere else...Play within your means. That is how I consoled myself. Lose, never mind, just don't lose your mind and spirit. Miss the boat, try the other boat beside it!"

2021 may not be the best in your life, but it couldn't be worse than 2020. Could it? We survived 2020, so when we start to appreciate what we have, 2021 could be a year full of joyfulness.

Do you agree with @Syueeat her post "Birds of a Feather, Flock Together!"?

"I believe in following the practice of gratitude, giving and sharing with the less fortunate. Not everyone is as lucky to have a roof over their heads, clothes to cover their bodies and food to fill their stomachs...Happiness keeps you sweet. Trials keep you strong. Sorrows keep you human. Failure keeps you humble. Success keeps you glowing. FAMILY keeps you GOING."

2021 might be the start of the trading journey for many mooers. We've seen many mooers saying that moomoo is what gets them started in trading. That is AWESOME!

@aoimizusaid in one of his posts, "There is a sense of camaraderie in the moomoo community, making me feel that this is not a lonely journey and I can always ask for help". This is exactly what moomoo wants to bring to all of you! We will always be there for you. Wish you all a very happy 2022 ahead!

What's the most inspiring investing story you've heard this year? Comment under this post and tell us the story now! We will select the 1st, 10th, 20th, 30th, 40th...(multiples of 10) comments to give away 88 points each!

Duration: Now- Dec 28, 2021 11:59 PM SGT

+2

195

31

Jncy

liked

Elon Musk has consistently supported $Dogecoin(DOGE.CC$ , a meme-inspired cryptocurrency. He's invested in it, along with $Bitcoin(BTC.CC$ and $Ethereum(ETH.CC$ .

Musk sees dogecoin as the best cryptocurrency to transact with.

"Fundamentally, bitcoin is not a good substitute for transactional currency,"

Musk told Time Magazine after being named Time's 2021 Person of the Year.

"Even though it was created as a silly joke, dogecoin is better suited for transactions."

The price of Bitcoin soon took a dive after the interview.

Any thought on Musk's word? Will his opinion push you to buy/sell any related cryptocurrency?

Musk sees dogecoin as the best cryptocurrency to transact with.

"Fundamentally, bitcoin is not a good substitute for transactional currency,"

Musk told Time Magazine after being named Time's 2021 Person of the Year.

"Even though it was created as a silly joke, dogecoin is better suited for transactions."

The price of Bitcoin soon took a dive after the interview.

Any thought on Musk's word? Will his opinion push you to buy/sell any related cryptocurrency?

137

12

Jncy

liked

This year's inflows into ETFs worldwide crossed the $1 trillion mark for the first time at the end of November, surpassing last year's total of $735.7 billion, according to Morningstar data. That wave of money, along with rising markets, pushed global ETF assets to nearly $9.5 trillion, more than double where the industry stood at the end of 2018.

Most of that money has gone into low-cost U.S. funds that track indexes run by Vanguard Group, $Blackrock(BLK.US$ and $State Street(STT.US$ which together control more than three-quarters of all U.S. ETF assets.

Technically they're not the same concept, but the $1 trillion landmarks still remind me of $Tesla(TSLA.US$ hitting a $1 trillion market cap on Oct.25. It showed how influential the company is.

Are you part of the one trillion? Would you tell me about the reason that you buy or not buy ETF?

moomoo Courses:

ETF Basics

ETF Strategies

Most of that money has gone into low-cost U.S. funds that track indexes run by Vanguard Group, $Blackrock(BLK.US$ and $State Street(STT.US$ which together control more than three-quarters of all U.S. ETF assets.

Technically they're not the same concept, but the $1 trillion landmarks still remind me of $Tesla(TSLA.US$ hitting a $1 trillion market cap on Oct.25. It showed how influential the company is.

Are you part of the one trillion? Would you tell me about the reason that you buy or not buy ETF?

moomoo Courses:

ETF Basics

ETF Strategies

137

10

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)