jonny420

liked

The Q3 US stock earnings season is coming after experiencing market retracements in August and September. With the increasing talk of interest rate pause, will the US stock earnings also give investors more confidence? Let’s witness together!![]()

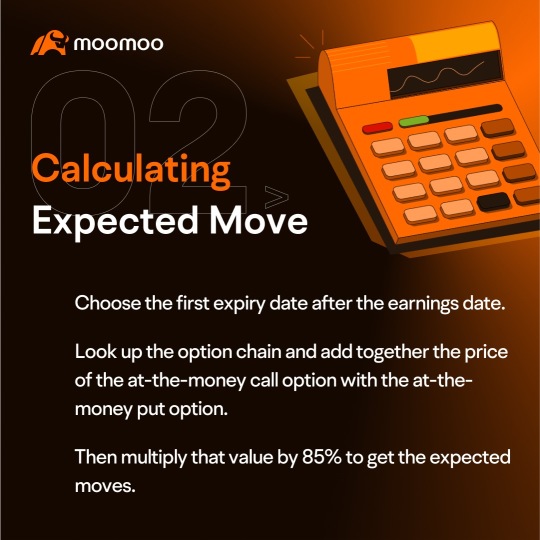

For retail investors, earnings reports can lead to substantial fluctuations in stock prices. It's crucial to maintain a calm mindset during volatility and employ scientific strategies...

For retail investors, earnings reports can lead to substantial fluctuations in stock prices. It's crucial to maintain a calm mindset during volatility and employ scientific strategies...

+4

71

8

27

jonny420

voted

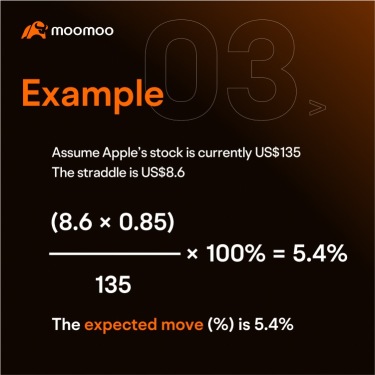

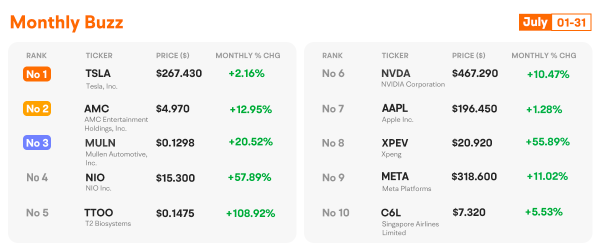

According to some traders, it seems like July has brought an early Christmas for the market. The Nasdaq is displaying notable gains, and the Dow closed higher for 13 straight sessions through 26th, July. Moreover, corporate earnings continue to pour in, especially from various tech companies on the horizon. This influx of earnings might be seen as a big test for the ongoing tech-stock rally.

In this edition of the Monthly Journal, we will dive deep into the c...

In this edition of the Monthly Journal, we will dive deep into the c...

+9

72

38

20

jonny420

liked and commented on

jonny420

reacted to

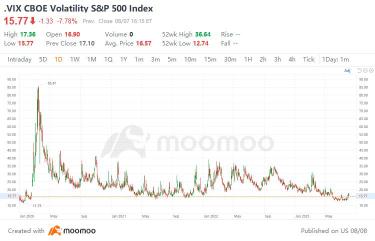

Since June, the $CBOE Volatility S&P 500 Index (.VIX.US)$ has been hovering at lower levels, indicating unruffled market confidence. As of August 7th, the index was recorded at 15.77, slightly above the "irrational exuberance" level of 15. Some concerns are emerging that the present phase of market stability could be a harbinger of more tumultuous times, often refer...

27

2

16

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)