Jshen Ng

voted

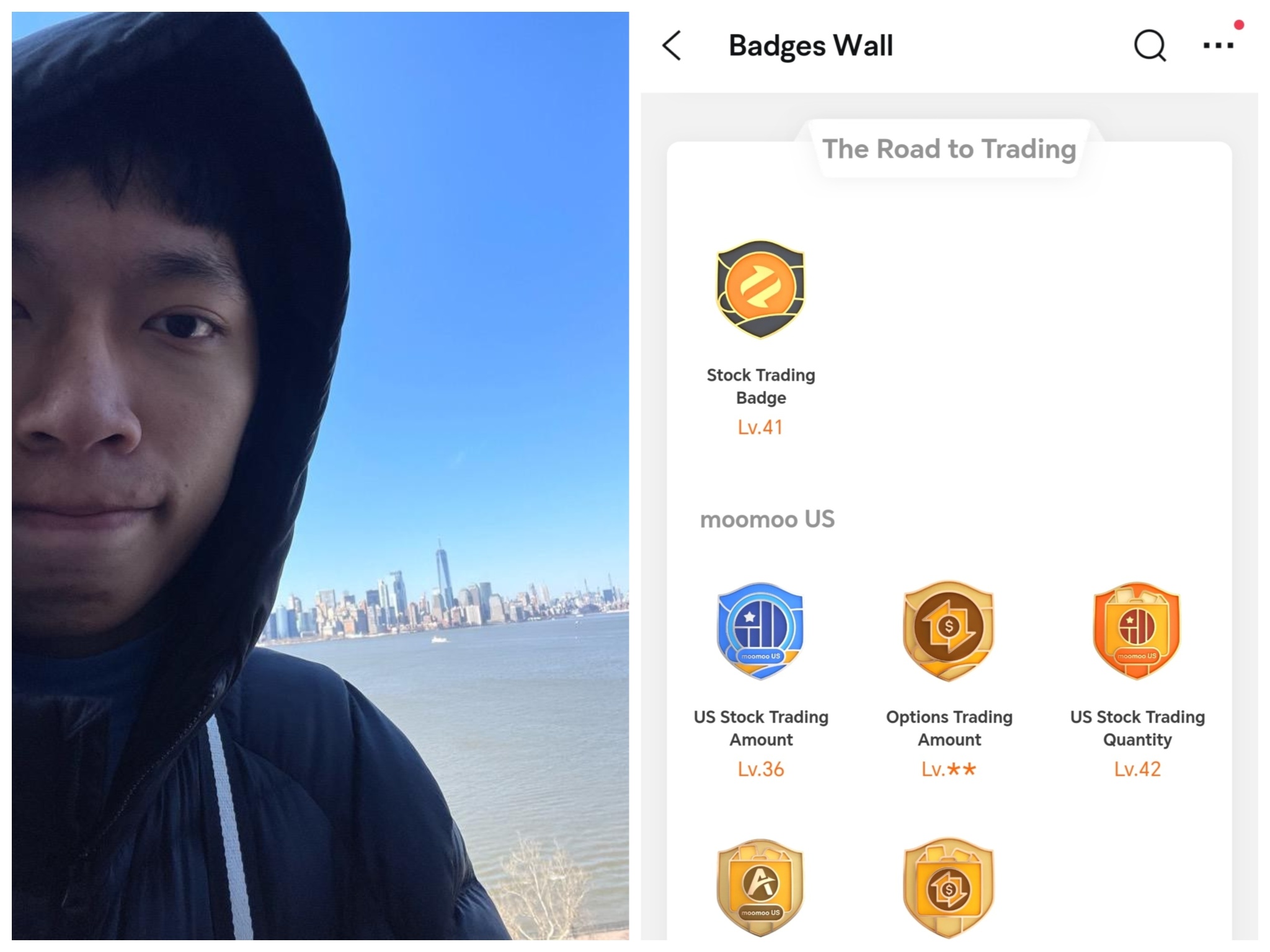

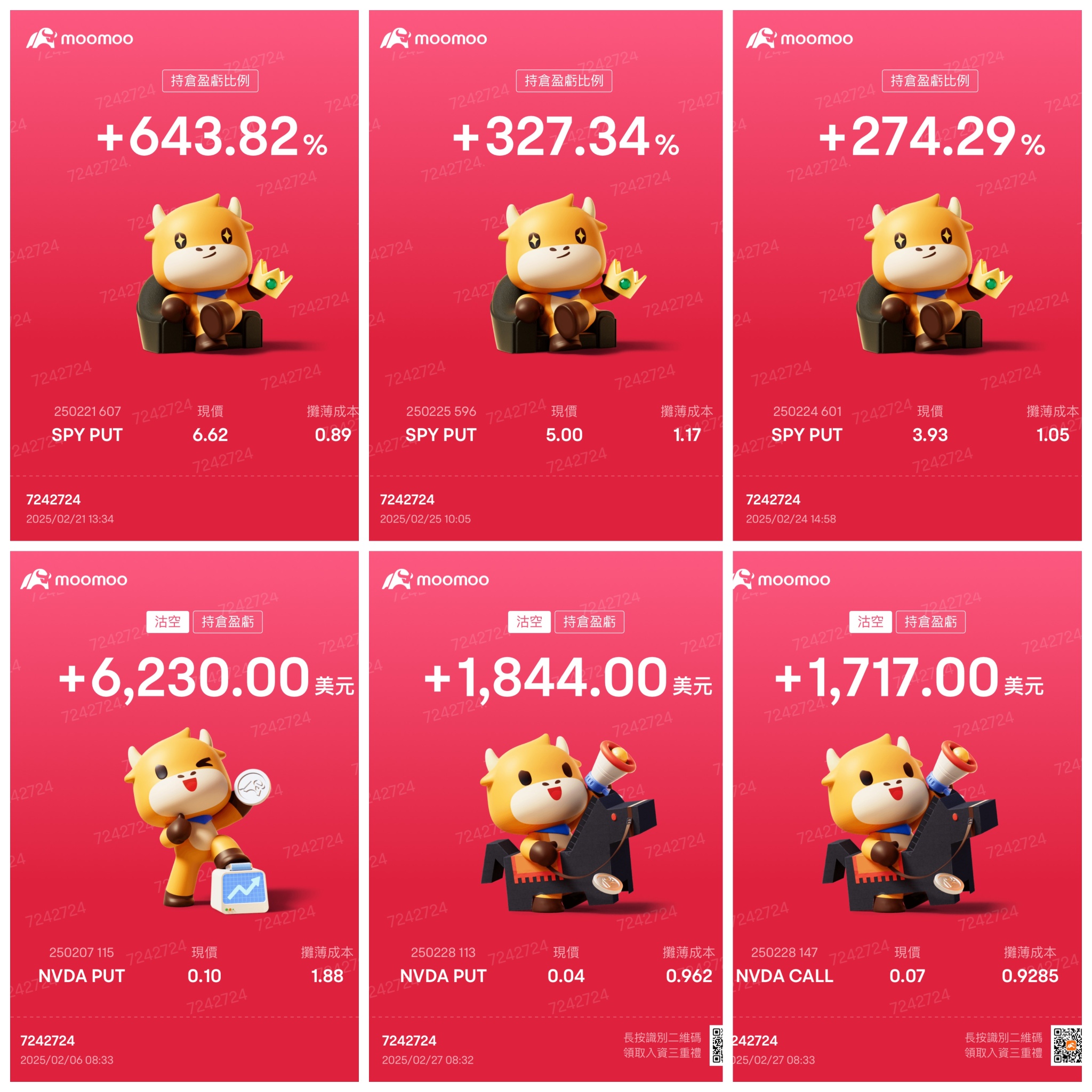

We're thrilled to bring you a special post on options trading with @7242724 (Yoyo) today.

Even though I'm still somewhat of a newbie in investing, I've already gained the kind of rich experience that ten years in traditional stock trading might not teach you. -- Said by @7242724

Dive into the p...

+5

326

274

29

Sumi Saujana IPO 讲解

1) - YouTube

Jshen 小红书 XHS

Encurtador de Link

Figure 1: IPO timetable of SumiSaujana Group Berhad

-Will be listed on the ACE market

Info of IPO

Enlarged no. of shares upon listing: 1443.6016 million

IPO price: RM0.24

Market capitalization: RM346.46 million

Estimated funds to raise from Public Issue: RM74.40 million

PE ratio = 20.21x (based on FYE2024)

Figure 2: Business model of SumiSaujana Group Ber...

1) - YouTube

Jshen 小红书 XHS

Encurtador de Link

Figure 1: IPO timetable of SumiSaujana Group Berhad

-Will be listed on the ACE market

Info of IPO

Enlarged no. of shares upon listing: 1443.6016 million

IPO price: RM0.24

Market capitalization: RM346.46 million

Estimated funds to raise from Public Issue: RM74.40 million

PE ratio = 20.21x (based on FYE2024)

Figure 2: Business model of SumiSaujana Group Ber...

+6

2

Jshen Ng

voted

Last week, the markets were dominated by escalating trade tensions, with tariffs on steel and aluminum imports sparking fears of a global trade war. The European Union retaliated with counter-tariffs on $28 billion worth of U.S. goods, further spooking investors. Meanwhile, concerns over valuations and earnings continued to weigh on the tech sector, with $Adobe (ADBE.US)$ and $Intel (INTC.US)$ making headlines f...

+13

2073

359

23

Jshen Ng

voted

Week 2's curtain falls, but the drama's just beginning!

Who's ruling our top 10 paper trading leaderboard this week?

Brace yourself for the big reveal! 📈💰

👏Congratulations to the top 10 trading titans!

@iamshf @103226286 @105405816 @ChangHorng @103178067 @105227245 @105386639 @Kenwoo @ALAN86 @Ckent2213

*The profit/loss (P/L) data is based on trading activity from March 10th to March 15th.

Last week, the standout performances of top traders revealed s...

Who's ruling our top 10 paper trading leaderboard this week?

Brace yourself for the big reveal! 📈💰

👏Congratulations to the top 10 trading titans!

@iamshf @103226286 @105405816 @ChangHorng @103178067 @105227245 @105386639 @Kenwoo @ALAN86 @Ckent2213

*The profit/loss (P/L) data is based on trading activity from March 10th to March 15th.

Last week, the standout performances of top traders revealed s...

+4

184

110

13

Jshen Ng

Set a live reminder

FOMC Press Conference is scheduled for March 19 at 2:30 PM ET /March 20 at 2:30 AM SGT /March 20 at 5:30 AM AEST. Subscribe to join the live NOW!

As the next FOMC meeting approaches on March 18-19, all eyes are on Fed Chair Jerome Powell’s remarks. Economists are split on the Fed’s path forward, with Goldman Sachs predicting core PCE inflation could hit 3% by December due to recent tariff hikes. Meanwhile, Manulife Investments forecasts 2-3 rate cuts in 2025, despite market...

As the next FOMC meeting approaches on March 18-19, all eyes are on Fed Chair Jerome Powell’s remarks. Economists are split on the Fed’s path forward, with Goldman Sachs predicting core PCE inflation could hit 3% by December due to recent tariff hikes. Meanwhile, Manulife Investments forecasts 2-3 rate cuts in 2025, despite market...

FOMC Press Conference, March 19, 2025

Mar 20 02:30

32

9

Hi Mobility IPO 讲解

1) - YouTube

Figure 1: IPO timetable of Hi Mobility Berhad

-Will be listed on the MAIN market

Info of IPO

Enlarged no. of shares upon listing: 500 million

IPO price: RM1.22

Market capitalization: RM610.00 million

Estimated funds to raise from Public Issue: RM115.90 million

PE ratio = 15.62x (based on FPE2025)

Figure 2: Business model of Hi Mobility Berhad

Source: Hi Mobility Berhad IPO prospectus

Figure ...

1) - YouTube

Figure 1: IPO timetable of Hi Mobility Berhad

-Will be listed on the MAIN market

Info of IPO

Enlarged no. of shares upon listing: 500 million

IPO price: RM1.22

Market capitalization: RM610.00 million

Estimated funds to raise from Public Issue: RM115.90 million

PE ratio = 15.62x (based on FPE2025)

Figure 2: Business model of Hi Mobility Berhad

Source: Hi Mobility Berhad IPO prospectus

Figure ...

+6

4

2

Jshen Ng

Set a live reminder and voted

$NVIDIA (NVDA.US)$

Jensen Huang, Founder and CEO of Nvidia, will deliver the keynote at GTC 2025. This event, scheduled for March 18 at 1:00 PM ET / March 19 at 1:00 AM SGT / March 19 at 4:00 AM AEST, will cover groundbreaking advancements in AI, digital twins, cloud technologies, and sustainable computing.

Huang's keynote will provide a visionary roadmap of Nvidia's role in shaping the AI-driven world. Subscribe to join the live NOW!

NVIDIA Stock Predicti...

Jensen Huang, Founder and CEO of Nvidia, will deliver the keynote at GTC 2025. This event, scheduled for March 18 at 1:00 PM ET / March 19 at 1:00 AM SGT / March 19 at 4:00 AM AEST, will cover groundbreaking advancements in AI, digital twins, cloud technologies, and sustainable computing.

Huang's keynote will provide a visionary roadmap of Nvidia's role in shaping the AI-driven world. Subscribe to join the live NOW!

NVIDIA Stock Predicti...

GTC Keynote With NVIDIA CEO Jensen Huang

Mar 19 01:00

431

331

65

Jshen Ng

voted

Hey mooer! Attention AI enthusiasts, $NVIDIA (NVDA.US)$ GTC 2025 is coming! 🚀

NVIDIA GTC 2025 is returning to San Jose from March 17-21, bringing together industry leaders to explore the future of quantum computing and AI. This premier event offers a unique opportunity to dive deep into cutting-edge technologies that are shaping our future.

Highlights:

– Keynote speech by NVIDIA CEO Jensen Huang (March 18, 10:00 a.m. PT) on the topic "Driving t...

NVIDIA GTC 2025 is returning to San Jose from March 17-21, bringing together industry leaders to explore the future of quantum computing and AI. This premier event offers a unique opportunity to dive deep into cutting-edge technologies that are shaping our future.

Highlights:

– Keynote speech by NVIDIA CEO Jensen Huang (March 18, 10:00 a.m. PT) on the topic "Driving t...

GTC Keynote With NVIDIA CEO Jensen Huang

Mar 19 01:00

368

341

61

Chemlite IPO 讲解

1) - YouTube

Figure 1: IPO timetable of Chemlite Innovation Berhad

-Will be listed on the ACE market

Info of IPO

Enlarged no. of shares upon listing: 600 million

IPO price: RM0.25

Market capitalization: RM150.00 million

Estimated funds to raise from Public Issue: RM30.00 million

PE ratio = 16.19x (based on FYE2024)

Figure 2: Business model of Chemlite Innovation Berhad

Source: Chemlite Inno...

1) - YouTube

Figure 1: IPO timetable of Chemlite Innovation Berhad

-Will be listed on the ACE market

Info of IPO

Enlarged no. of shares upon listing: 600 million

IPO price: RM0.25

Market capitalization: RM150.00 million

Estimated funds to raise from Public Issue: RM30.00 million

PE ratio = 16.19x (based on FYE2024)

Figure 2: Business model of Chemlite Innovation Berhad

Source: Chemlite Inno...

+6

18

Wawasan Dengkil IPO 讲解

1) - YouTube

Figure 1: IPO timetable of Wawasan Dengkil Holdings Berhad

-Will be listed on the ACE market

Info of IPO

Enlarged no. of shares upon listing: 540.12 million

IPO price: RM0.25

Market capitalization: RM135.03 million

Estimated funds to raise from Public Issue: RM27.006 million

PE ratio = 11.92x (based on FYE2024)

Figure 2: Business model of Wawasan Dengkil Holdings Berhad

So...

1) - YouTube

Figure 1: IPO timetable of Wawasan Dengkil Holdings Berhad

-Will be listed on the ACE market

Info of IPO

Enlarged no. of shares upon listing: 540.12 million

IPO price: RM0.25

Market capitalization: RM135.03 million

Estimated funds to raise from Public Issue: RM27.006 million

PE ratio = 11.92x (based on FYE2024)

Figure 2: Business model of Wawasan Dengkil Holdings Berhad

So...

+8

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)