Join this Positive Yield Challenge with global traders and compete for a share of $100,000 in cash rewards! Tap this link to begin>>

to win competition , which market got huge oppotunity?

Despite the possibility of a slowdown in the US economic growth, coupled with stubborn inflation data delaying the pace of rate cuts by the Federal Reserve, market participants remain bullish on the Malaysian stock market continuing to prosper, thus maintaining the year-end target at 1665 points, with 3 major themes worth focusing on. $FTSE Bursa Malaysia KLCI Index (.KLSE.MY)$By the end of the year, the target is at 1665 points, with 3 major themes deserving attention.

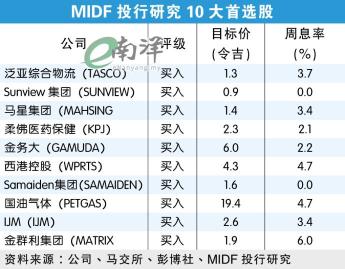

MIDF Investment Bank research analysts point out that global stock market trends are influenced by several factors, including geopolitical tensions, a slowdown in US economic data, and uncertainty about when the Federal Reserve will cut interest rates.

Analysts point out that as the economic leader, the United States' every trend and development will be emulated and magnified, especially the first quarter's economic growth performance, causing concerns in the market about whether the Federal Reserve will further delay its rate cuts.

Analysts stated that based on the earlier forecasts, the Federal Reserve will begin to cut interest rates in the second half of this year, with a total of 3 rate cuts for the year. However, due to the current trends, they were forced to revise the forecast to delay the rate cuts until the end of this year and there may only be 1 cut this year.

Nevertheless, analysts remain bullish on Malaysia's economic prospects, while maintaining the FTSE Bursa Malaysia KLCI at 1665 points for the year, as well as maintaining expectations for corporate net profit growth.

Continuing to be bullish on the 12 Malaysian plans

Additionally, analysts continue to be bullish on 3 investment themes that are believed to continue driving Malaysian stock market strength.

Firstly, the trade sector is expected to continue recovering, as logistics and port-related stocks will benefit from the rebound in foreign trade trends.

"In addition, we expect...

MIDF Investment Bank research analysts point out that global stock market trends are influenced by several factors, including geopolitical tensions, a slowdown in US economic data, and uncertainty about when the Federal Reserve will cut interest rates.

Analysts point out that as the economic leader, the United States' every trend and development will be emulated and magnified, especially the first quarter's economic growth performance, causing concerns in the market about whether the Federal Reserve will further delay its rate cuts.

Analysts stated that based on the earlier forecasts, the Federal Reserve will begin to cut interest rates in the second half of this year, with a total of 3 rate cuts for the year. However, due to the current trends, they were forced to revise the forecast to delay the rate cuts until the end of this year and there may only be 1 cut this year.

Nevertheless, analysts remain bullish on Malaysia's economic prospects, while maintaining the FTSE Bursa Malaysia KLCI at 1665 points for the year, as well as maintaining expectations for corporate net profit growth.

Continuing to be bullish on the 12 Malaysian plans

Additionally, analysts continue to be bullish on 3 investment themes that are believed to continue driving Malaysian stock market strength.

Firstly, the trade sector is expected to continue recovering, as logistics and port-related stocks will benefit from the rebound in foreign trade trends.

"In addition, we expect...

Translated

2

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)