Justin Kimi

reacted to

Justin Kimi

liked

#感恩马股的回馈

#在对的时候还呆在股市

Over the past week, I've spent a lot of time reading the financial reports of different companies, and I'm also compiling some data on Malaysian stocks. After a busy few weeks, the 24Q1 quarterly summary has finally come to an end, so you can slow down 👣 adjustments.

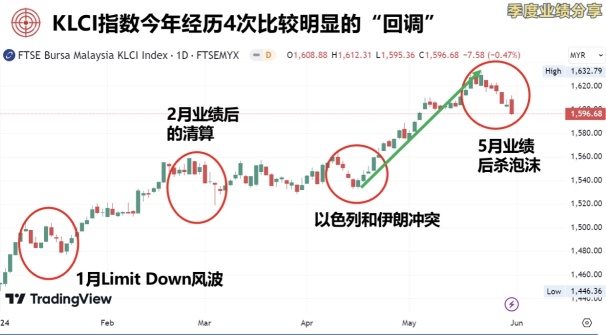

In the past, one month was rarely summed up, but May, when the 2024 Ninth National Games began, was really a month that needed to be recorded. Because this May was really crazy, it also gave some rewards to the shareholders who had been waiting for a long time in Malaysian stocks. Over the past 5 months, the index has experienced 4 significant pullbacks.

$FTSE Bursa Malaysia KLCI Index (.KLSE.MY)$

The first was the limit down storm in January. After the pullback, the index sprinted close to 80 points from the bottom. Due to the increase quite a bit, the February earnings season began to be liquidated, but there was not much of a pullback.

The third pullback was the conflict between Israel and Iran in April. At that time, the index pulled back less than 2%, but many small and medium stocks pulled back by 10-20%. After the bottom was formed on April 16, the index rose close to 100 points over a month later, breaking through a 3-year high.

This wave of rising tide covered blue-chip stocks to small and medium-sized stocks, and Malaysian stocks ushered in an all-round rise 📈. Despite the correction that has been in the past week or so, all 13 major sectors in Malaysia have risen, and there has been no decline. This is a scene I haven't seen in the past 10 years, and it also keeps me stuck in Malaysian stocks...

#在对的时候还呆在股市

Over the past week, I've spent a lot of time reading the financial reports of different companies, and I'm also compiling some data on Malaysian stocks. After a busy few weeks, the 24Q1 quarterly summary has finally come to an end, so you can slow down 👣 adjustments.

In the past, one month was rarely summed up, but May, when the 2024 Ninth National Games began, was really a month that needed to be recorded. Because this May was really crazy, it also gave some rewards to the shareholders who had been waiting for a long time in Malaysian stocks. Over the past 5 months, the index has experienced 4 significant pullbacks.

$FTSE Bursa Malaysia KLCI Index (.KLSE.MY)$

The first was the limit down storm in January. After the pullback, the index sprinted close to 80 points from the bottom. Due to the increase quite a bit, the February earnings season began to be liquidated, but there was not much of a pullback.

The third pullback was the conflict between Israel and Iran in April. At that time, the index pulled back less than 2%, but many small and medium stocks pulled back by 10-20%. After the bottom was formed on April 16, the index rose close to 100 points over a month later, breaking through a 3-year high.

This wave of rising tide covered blue-chip stocks to small and medium-sized stocks, and Malaysian stocks ushered in an all-round rise 📈. Despite the correction that has been in the past week or so, all 13 major sectors in Malaysia have risen, and there has been no decline. This is a scene I haven't seen in the past 10 years, and it also keeps me stuck in Malaysian stocks...

Translated

60

Justin Kimi

liked

This time I went to Beijing, China to participate in an exchange group, hoping to take the opportunity to understand the overall direction of China's economic development. I also went to the Badaling Great Wall to be a hero, although the process was tiring, it was also very worthwhile.

The stock market is now experiencing significant fluctuations and many challenges, but the Great Wall was built thousands of years ago, without advanced technology. I believe that no matter how tough the stock market is, it is not as difficult as building the Great Wall. Let's be warriors in the stock market together. Stay strong!

The stock market is now experiencing significant fluctuations and many challenges, but the Great Wall was built thousands of years ago, without advanced technology. I believe that no matter how tough the stock market is, it is not as difficult as building the Great Wall. Let's be warriors in the stock market together. Stay strong!

Translated

73

Justin Kimi

liked

$Tesla (TSLA.US)$ share price has been hit and hammered down by a magnitude of around 15% after the lower-than-expected quarterly results.

While there are various types of comments that slam the performance of the largest EV maker , i opine that we should break apart Tesla’s figure so that we can have a clearer view on it’s performance.

The Positives

🚗 Third highest revenue record.

🚗 R&D expenditure continue to scale up, computing facilities doubled compared to Q2,

🚗Strong free...

While there are various types of comments that slam the performance of the largest EV maker , i opine that we should break apart Tesla’s figure so that we can have a clearer view on it’s performance.

The Positives

🚗 Third highest revenue record.

🚗 R&D expenditure continue to scale up, computing facilities doubled compared to Q2,

🚗Strong free...

95

8

Justin Kimi

liked

[Summary]

In the semiconductor sector, stocks performed exceptionally well from 2020 to 2021, with outstanding performance and stock price trends outperforming the market. Several semiconductor technology companies in Malaysia have set new record high stock prices.

After entering the interest rate hike cycle in 2022, the semiconductor destocking cycle has been going on for nearly a year and a half. Now, the semiconductor giants in the USA have gradually turned optimistic, and the demand for phones and computers has already rebounded from the bottom.

In November 2023, among the listed technology companies in Malaysia, although most companies' performance is still mediocre with cautious outlooks, some high flyers have begun to release strong performance outlooks, with the spotlight on broadcasting belonging to INARI.

[Mentor]

Zeff Tan, Chief Mentor of SHARIX in Malaysia, stock market researcher

[Join Us]

Specially tailored for moomoo users! Don't miss out on November 30th at 7.00pm! Want to know the latest developments in the semiconductor industry? Quickly invite your fellow stock friends to learn together!

[Disclaimer]

All views expressed in the live broadcasts and videos are independent opinions from SHARIX. moomoo and its affiliates are not responsible for their content and views.

In the semiconductor sector, stocks performed exceptionally well from 2020 to 2021, with outstanding performance and stock price trends outperforming the market. Several semiconductor technology companies in Malaysia have set new record high stock prices.

After entering the interest rate hike cycle in 2022, the semiconductor destocking cycle has been going on for nearly a year and a half. Now, the semiconductor giants in the USA have gradually turned optimistic, and the demand for phones and computers has already rebounded from the bottom.

In November 2023, among the listed technology companies in Malaysia, although most companies' performance is still mediocre with cautious outlooks, some high flyers have begun to release strong performance outlooks, with the spotlight on broadcasting belonging to INARI.

[Mentor]

Zeff Tan, Chief Mentor of SHARIX in Malaysia, stock market researcher

[Join Us]

Specially tailored for moomoo users! Don't miss out on November 30th at 7.00pm! Want to know the latest developments in the semiconductor industry? Quickly invite your fellow stock friends to learn together!

[Disclaimer]

All views expressed in the live broadcasts and videos are independent opinions from SHARIX. moomoo and its affiliates are not responsible for their content and views.

Translated

INARI 业绩深度解读 ; 是时候投资半导体股票了吗?

Nov 30 05:00

110

1

Justin Kimi

liked

Since joining, we have received everyone's attention, let's continue to work hard in 2024!

Translated

46

Justin Kimi

liked

Follow Zeff to learn about Inari

Translated

67

1

Justin Kimi

liked

[Brief] Malaysian semiconductor stocks decoupled from the US technology sector in 2023, mainly due to the fact that demand has not recovered, and they have not directly benefited from Nvidia and the AI chip industry chain.

After entering 2024, many semiconductor companies have indicated that the destocking cycle is coming to an end. Besides automotive semiconductors, other types of semiconductors have shown signs of recovery.

In February 2024, with MPI delivering better-than-expected financial results and positive outlook, another giant INARI is also expected to perform well. The financial report will be released on February 26th.

From the current market capital flow perspective, the theme rotation seems to have reached the technology sector.

On 28th February 2024, this auspicious day, let's listen to Zeff's in-depth sharing of INARI's performance report and the latest news in the industry! See you there!

[Mentor] Zeff Tan, Chief Mentor of MALAYSIA SHARIX, Stock Market Researcher [Join Us] Tailored for moomoo users! 28th February, 8.00pm, don't miss it! Want to know the latest developments in the semiconductor industry? Quickly invite stock friends around you to learn together!

[Disclaimer] All views expressed in the live broadcast and videos are the independent opinions of SHARIX. moomoo and its affiliated companies are not responsible for the content and opinions.

After entering 2024, many semiconductor companies have indicated that the destocking cycle is coming to an end. Besides automotive semiconductors, other types of semiconductors have shown signs of recovery.

In February 2024, with MPI delivering better-than-expected financial results and positive outlook, another giant INARI is also expected to perform well. The financial report will be released on February 26th.

From the current market capital flow perspective, the theme rotation seems to have reached the technology sector.

On 28th February 2024, this auspicious day, let's listen to Zeff's in-depth sharing of INARI's performance report and the latest news in the industry! See you there!

[Mentor] Zeff Tan, Chief Mentor of MALAYSIA SHARIX, Stock Market Researcher [Join Us] Tailored for moomoo users! 28th February, 8.00pm, don't miss it! Want to know the latest developments in the semiconductor industry? Quickly invite stock friends around you to learn together!

[Disclaimer] All views expressed in the live broadcast and videos are the independent opinions of SHARIX. moomoo and its affiliated companies are not responsible for the content and opinions.

Translated

INARI 业绩深度解读 ,马股半导体将重获青睐 ?

Feb 28 06:00

434

75

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)