JustinVenus

liked

In August, I faced some of my toughest moments in trading. My Eco World warrants, bought at an average price of 0.5858, saw daily losses that would shake even the most experienced investor. But despite the red days, I held on.

$ECOWLD-WB (8206WB.MY)$

$ECOWLD (8206.MY)$

I didn’t sell a single warrant.

Today, those same warrants have climbed to 0.825, and the journey has taught me a valuable lesson: winning is about staying disciplined and resilient.

Trading isn’t ...

$ECOWLD-WB (8206WB.MY)$

$ECOWLD (8206.MY)$

I didn’t sell a single warrant.

Today, those same warrants have climbed to 0.825, and the journey has taught me a valuable lesson: winning is about staying disciplined and resilient.

Trading isn’t ...

+4

21

7

1

JustinVenus

reacted to

Discovering this app has been quite the journey for me. I decided to invest RM560,000, with RM510,000 from my EPF withdrawal and an additional RM50,000 from my savings, thanks to the support of a generous benefactor—my sugar daddy. With a keen interest in the data centre trend, I believed in the potential of Eco World $ECOWLD (8206.MY)$ and leveraged my position with Warrant B $ECOWLD-WB (8206WB.MY)$

Unexpectedly, within just two ...

Unexpectedly, within just two ...

+5

139

51

89

JustinVenus

reacted to

I want to take a moment to thank Mooers for never being judgmental about me investing my sugar daddy's money in the stock market. Despite the losses and the hate messages I've received, I appreciate the supportive community here.

My money is also hard-earned. It's not like money just comes once I undress. I have to do my job well, and I've accumulated almost a decade of experience to reach RM1.5 million in my EPF.

I’m here to share the knowledge I ...

My money is also hard-earned. It's not like money just comes once I undress. I have to do my job well, and I've accumulated almost a decade of experience to reach RM1.5 million in my EPF.

I’m here to share the knowledge I ...

8

5

3

JustinVenus

liked

As an investor who prides herself on thorough research and careful analysis, I recently experienced both the success of a well-timed investment and the frustration of a missed opportunity. I managed to generate a realized gain of RM500,000 from trading Eco World shares and warrants, but I also lost RM20,000 in brokerage fees simply because I wa...

+2

4

5

JustinVenus

reacted to and commented on

At 28 years old, I’m living proof that unconventional paths can lead to financial wins. While most of my peers are climbing corporate ladders or freelancing to pay the bills, I found myself exploring a different route—one that involved lavish dinners, designer gifts, and, unexpectedly, a knack for investment. Here’s how I turned RM500,000 from my EPF (Employee Provident Fund) into what I proudly call my Toyota Camry Moment.

The Set...

The Set...

loading...

58

13

7

JustinVenus

liked

Palm oil prices rose sharply, but don't be too happy too soon Analyst: It may fall back in December.

Data shows a possible sharp drop in December. Don't get too excited about the sharp rise in palm oil prices.

(Kuala Lumpur, 12th) Despite the recent surge in palm oil prices to over RM 5000 per ton, motivating some investment banks to be bullish on the prospects of planting industry stocks, some brokerages still view the palm oil outlook cautiously and point out that palm oil prices may significantly decline by the end of this year, hence temporarily maintaining a 'neutral' rating.

Datuk Securities analyst pointed out that palm oil prices have now exceeded RM 5000 per ton, about 15% higher than last month, possibly due to reduced supply and trade tensions between China and the USA.

Palm oil production declined due to seasonal factors, coupled with inventory declines and Indonesia's implementation of a higher proportion of B40 biodiesel mandates next year, the market expects palm oil supply to decrease, pushing up prices.

At the same time, the analyst estimated that China may panic buy soybeans before Trump is re-elected as President of the USA and increases tariffs on Chinese goods, which may have led to the recent rise in palm oil prices.

However, we believe that the potential trade friction between China and the USA in the future months will not significantly affect China's soybean import volume. During Trump's previous term in office, the policy of taxing China took 6 months from announcement to implementation, so any new related policies will only have an impact next year.

Significant decline in exports in early November.

He also cited data from Intertek and Amspec on China's palm oil exports in the first ten days of November, which significantly dropped by about 15% compared to the previous month, indicating local...

(Kuala Lumpur, 12th) Despite the recent surge in palm oil prices to over RM 5000 per ton, motivating some investment banks to be bullish on the prospects of planting industry stocks, some brokerages still view the palm oil outlook cautiously and point out that palm oil prices may significantly decline by the end of this year, hence temporarily maintaining a 'neutral' rating.

Datuk Securities analyst pointed out that palm oil prices have now exceeded RM 5000 per ton, about 15% higher than last month, possibly due to reduced supply and trade tensions between China and the USA.

Palm oil production declined due to seasonal factors, coupled with inventory declines and Indonesia's implementation of a higher proportion of B40 biodiesel mandates next year, the market expects palm oil supply to decrease, pushing up prices.

At the same time, the analyst estimated that China may panic buy soybeans before Trump is re-elected as President of the USA and increases tariffs on Chinese goods, which may have led to the recent rise in palm oil prices.

However, we believe that the potential trade friction between China and the USA in the future months will not significantly affect China's soybean import volume. During Trump's previous term in office, the policy of taxing China took 6 months from announcement to implementation, so any new related policies will only have an impact next year.

Significant decline in exports in early November.

He also cited data from Intertek and Amspec on China's palm oil exports in the first ten days of November, which significantly dropped by about 15% compared to the previous month, indicating local...

Translated

22

1

7

JustinVenus

liked

How I Trade Using Moving Averages (MA) and Donchian Channels (DC)

In my trading strategy, I rely heavily on Moving Averages (MA) and Donchian Channels (DC) to make informed decisions. Here’s how I utilize these indicators:

Moving Averages (MA)

Moving Averages help smooth out price data to identify trends. I use three types of MAs:

- MA20 (20-day moving average): Indicates short-term trends.

- MA60 (60-day moving average): Indicates medium-term trends.

- MA250 (250-day moving ave...

In my trading strategy, I rely heavily on Moving Averages (MA) and Donchian Channels (DC) to make informed decisions. Here’s how I utilize these indicators:

Moving Averages (MA)

Moving Averages help smooth out price data to identify trends. I use three types of MAs:

- MA20 (20-day moving average): Indicates short-term trends.

- MA60 (60-day moving average): Indicates medium-term trends.

- MA250 (250-day moving ave...

31

12

12

JustinVenus

liked

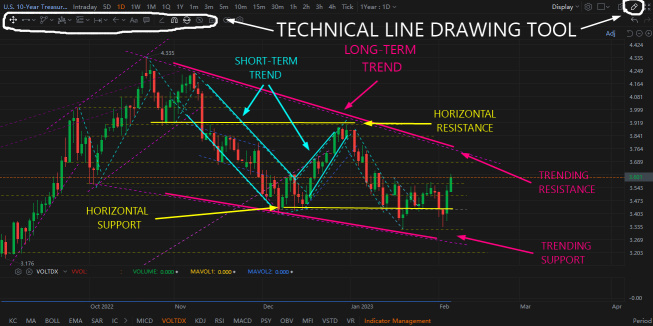

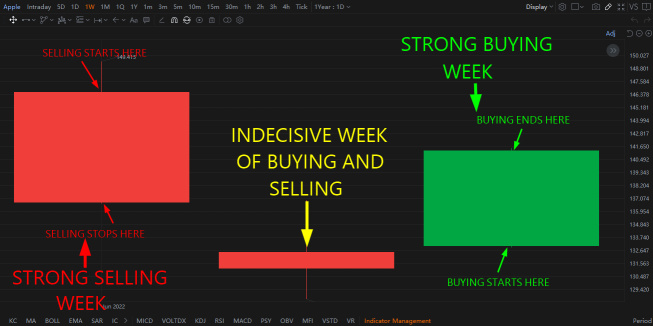

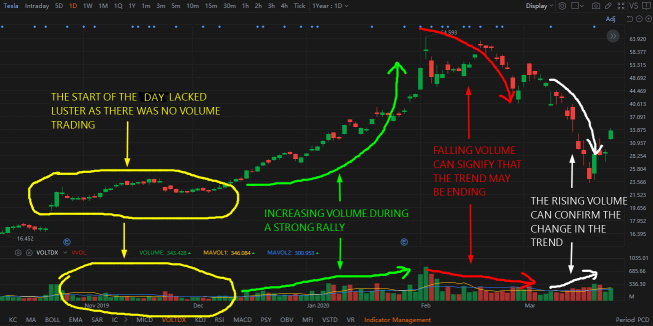

There are so many aspect to technical analysis(TA) that it can be very overwhelming and intimidating to anybody that is new to investing. With hundreds of different technical indicators and strategies it can be difficult to decide where to start learning technical analysis.

The most important aspects of technical analysis are actually the most basic fundamentals of TA. They are the first thing you should learn in TA. Price action, volume, and the overall tr...

The most important aspects of technical analysis are actually the most basic fundamentals of TA. They are the first thing you should learn in TA. Price action, volume, and the overall tr...

+2

224

68

69

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)