Jwinn

voted

Jwinn

voted

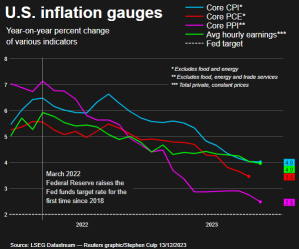

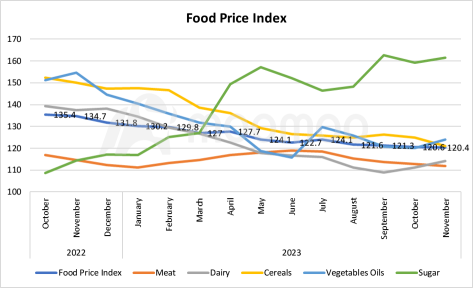

Inflation, a key economic indicator, is often a topic of interest and concern. As of November, inflation remained stable at 3.1%, showing a slight decrease of 0.1% from the previous month. Looking back to June 2022, inflation reached its peak at a concerning 9.1%. This significant drop to the current rate signals a noteworthy improvement.

In order to truly understand inflation, here’s a quick primer on everything you need to know about inflation.

![]() What Is I...

What Is I...

In order to truly understand inflation, here’s a quick primer on everything you need to know about inflation.

+2

11

Jwinn

voted

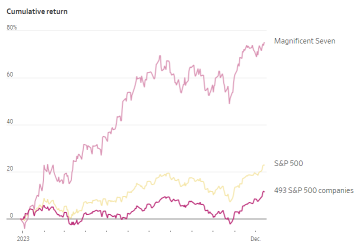

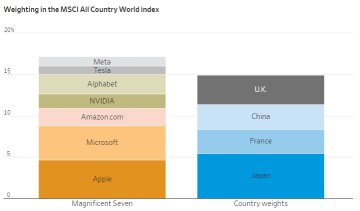

Outperformance of the Magnificent Seven: $Apple (AAPL.US)$ , $Microsoft (MSFT.US)$ , $Alphabet-A (GOOGL.US)$ , $Amazon (AMZN.US)$ , $NVIDIA (NVDA.US)$ , $Tesla (TSLA.US)$ , and $Meta Platforms (META.US)$ collectively surged 75% in 2023, overshadowing the remaining 493 companies in the S&P 500, which rose only 12%.

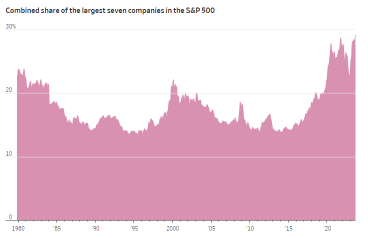

Market Concentration Concerns: The Magnificent Seven now represents about 30% of the S&P 500’s market value, ...

Market Concentration Concerns: The Magnificent Seven now represents about 30% of the S&P 500’s market value, ...

+2

6

1

Jwinn

liked

The final USA CPI data for 2023 is about to be released!

The market is all waiting quietly for the Federal Reserve of the USA.

The final monetary policy meeting for 2023.

After the release of the November CPI data for the USA today

The Federal Reserve will announce the monetary policy decision the next day.

And release updated economic projections.

This time the dot plot of the Fed is especially important.

Because it highlights the expected interest rate cuts in 2024.

The Fed can only start cutting interest rates in two situations.

One is when the economy continues to slow down and the unemployment rate rises more than expected (hard landing).

The other is when the economy performs well but inflation cools more than expected (soft landing).

Which type of landing do you prefer?

Tonight we will wait together for the CPI data of the USA.

Macro determines the trend, let's observe.

$Nasdaq (NDAQ.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Dow Jones Industrial Average (.DJI.US)$

======= I am the dividing line =======

Welcome to join the last sharing session of Youdao's wealth creation in 2023

https://us06web.zoom.us/meeting/register/tZAscO6orDIvGNUq90iPgbydBLMCUMytNH2z

The market is all waiting quietly for the Federal Reserve of the USA.

The final monetary policy meeting for 2023.

After the release of the November CPI data for the USA today

The Federal Reserve will announce the monetary policy decision the next day.

And release updated economic projections.

This time the dot plot of the Fed is especially important.

Because it highlights the expected interest rate cuts in 2024.

The Fed can only start cutting interest rates in two situations.

One is when the economy continues to slow down and the unemployment rate rises more than expected (hard landing).

The other is when the economy performs well but inflation cools more than expected (soft landing).

Which type of landing do you prefer?

Tonight we will wait together for the CPI data of the USA.

Macro determines the trend, let's observe.

$Nasdaq (NDAQ.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Dow Jones Industrial Average (.DJI.US)$

======= I am the dividing line =======

Welcome to join the last sharing session of Youdao's wealth creation in 2023

https://us06web.zoom.us/meeting/register/tZAscO6orDIvGNUq90iPgbydBLMCUMytNH2z

Translated

13

Jwinn

liked

The Bureau of Labor Statistics will release the US November CPI at 8:30 ET on Tuesday. Bloomberg data shows YoY CPI inflation will fall to 3.1% (vs. 3.2% prior), with annual core inflation remaining at 4.0%. On a month-on-month basis, headline CPI inflation may remain unchanged, and core CPI may register a 0.3% increase.

■ Year-ahead inflation expectations fell to lowest since 2021

In the latest University of Michigan consumer ...

■ Year-ahead inflation expectations fell to lowest since 2021

In the latest University of Michigan consumer ...

+3

24

22

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)