The FTC just opened an antitrust investigation of Microsoft into multiple business verticals

Pelosi sold ~$5 Million of Microsoft $Microsoft (MSFT.US)$ back in July

And was her largest "sell" since 2022

Wild.

Pelosi sold ~$5 Million of Microsoft $Microsoft (MSFT.US)$ back in July

And was her largest "sell" since 2022

Wild.

1

2

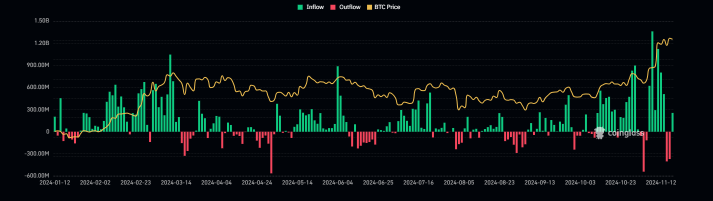

$Bitcoin (BTC.CC)$ 's meteoric rise continues, breaking through key resistance levels month after month.

As it stands above $94,000, we’re in uncharted territory 🚀. This volatility opens the door for advanced options strategies. Here’s my approach:

– Bull Call Spread: To capture upside momentum while limiting risk, I’m buying a near-the-money call option and selling a higher strike call. This reduces the net cost while profiting if Bitcoin ETFs continue climbing.

– P...

As it stands above $94,000, we’re in uncharted territory 🚀. This volatility opens the door for advanced options strategies. Here’s my approach:

– Bull Call Spread: To capture upside momentum while limiting risk, I’m buying a near-the-money call option and selling a higher strike call. This reduces the net cost while profiting if Bitcoin ETFs continue climbing.

– P...

$Bitcoin (BTC.CC)$

🔹 The SEC has approved options trading for BlackRock's iSharesBitcoin ETF ( $iShares Bitcoin Trust (IBIT.US)$ ).

🔹 These options allow traders to hedge and speculate on Bitcoin price movements.

🔹 Strict regulations include a 25,000-contract limit to ensure market stability.

🔹 Potential effects? Increased liquidity, reduced market manipulation, and broader adoption of Bitcoin ETFs

🔹 The SEC has approved options trading for BlackRock's iSharesBitcoin ETF ( $iShares Bitcoin Trust (IBIT.US)$ ).

🔹 These options allow traders to hedge and speculate on Bitcoin price movements.

🔹 Strict regulations include a 25,000-contract limit to ensure market stability.

🔹 Potential effects? Increased liquidity, reduced market manipulation, and broader adoption of Bitcoin ETFs

8

1

$Ethereum (ETH.CC)$ S1 Approvals soon.

Will be interesting to see whether the market will still react somewhat even though these things are known and confirmed.

$Ethereum (ETH.CC)$ Retraced all the price action & open interest that came from the ETF news initially.

So safe to say expectations & pricing in are pretty much near zero (or even bearish).

Makes for a nice assymetrical trade I feel like.

Will be interesting to see whether the market will still react somewhat even though these things are known and confirmed.

$Ethereum (ETH.CC)$ Retraced all the price action & open interest that came from the ETF news initially.

So safe to say expectations & pricing in are pretty much near zero (or even bearish).

Makes for a nice assymetrical trade I feel like.

6

This is one of the most obvious long term setups I've ever seen.

Short term:

• Mt. Gox selling

• Germans selling

Longer term:

• $Bitcoin (BTC.CC)$ & $Ethereum (ETH.CC)$ ETFs

• Election

• Major political shift re crypto

• $16b FTX payout to customers

Feels like a massive opportunity.

Short term:

• Mt. Gox selling

• Germans selling

Longer term:

• $Bitcoin (BTC.CC)$ & $Ethereum (ETH.CC)$ ETFs

• Election

• Major political shift re crypto

• $16b FTX payout to customers

Feels like a massive opportunity.

3

1

$NVIDIA (NVDA.US)$ and AI are currently overhyped and overpriced just like the dot com bubble etc. AI and NVDA will be around in 10 years. All I am saying is that at NVDA's current numbers its valuation doesn't make sense. It is priced the same as AAPL yet nowhere near them income wise.![]()

8

2

1

Currently $NVIDIA (NVDA.US)$ has a market cap of 2.62T, making it the 3rd largest market cap company in US. This follows $Microsoft (MSFT.US)$ at 3.19T and Apple at 2.91T. If Nvidia were to become #1 in market cap, which looks like that's going to happen soon, that would be about 22% increase in its stock price. But beyond that, how realistic is it for this company to keep growing up to 4T market cap and beyond? Are the prospects seriously...

5

2

3

Bernie Sanders this year said income over $1 billion should be taxed at 100%.

Do you agree?

$Nasdaq Composite Index (.IXIC.US)$ $SPDR S&P 500 ETF (SPY.US)$

Do you agree?

$Nasdaq Composite Index (.IXIC.US)$ $SPDR S&P 500 ETF (SPY.US)$

1

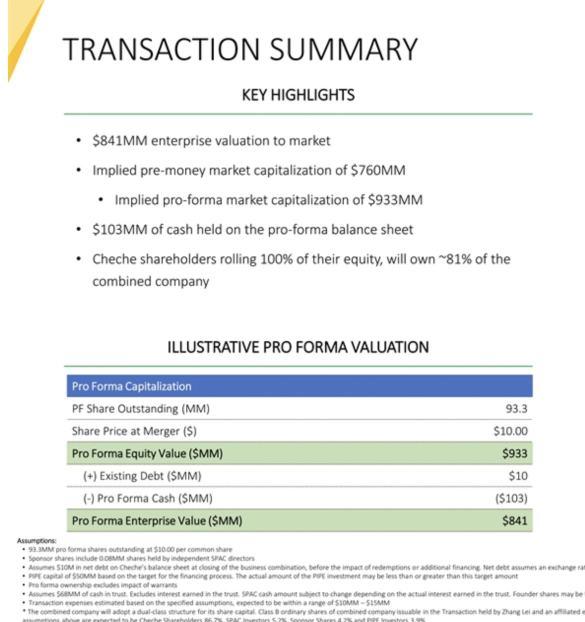

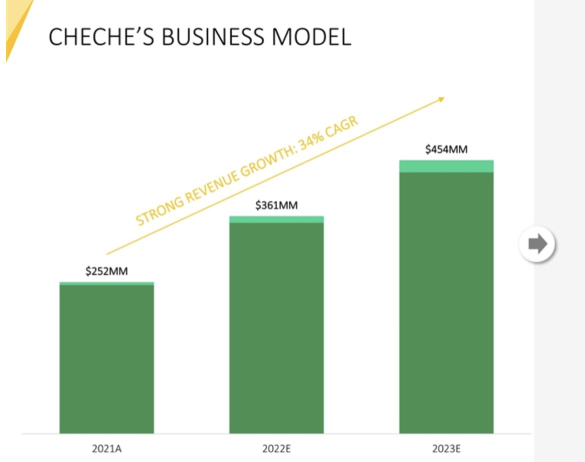

$Cheche Group (CCG.US)$ is worth $18.7bn right now with an estimated $0.45bn in revenues for 2023.

41x multiple for an insurance company.

41x multiple for an insurance company.

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)