Katherinerce

liked

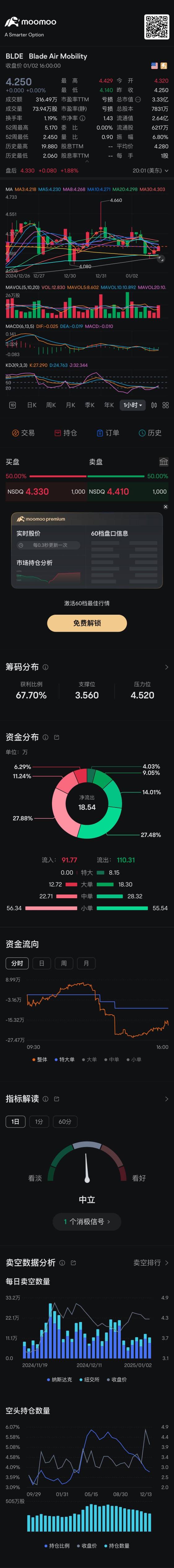

You can try to buy one position because the Macd and K DJ ready reserve crossover upwards, so tomorrow must rise in order to continue the golden cross running upwards, so the stop loss position is 4.12.

$Blade Air Mobility (BLDE.US)$

$Blade Air Mobility (BLDE.US)$

Translated

Expand

Expand 3

2

Katherinerce

liked

$QBTS 260116 1.00C$

Not planning to sell it.

Want to hold on and see the roller coaster of this year 🎢.

Not planning to sell it.

Want to hold on and see the roller coaster of this year 🎢.

Translated

16

3

Katherinerce

liked

7

Katherinerce

liked

6

Katherinerce

liked

5

4

Katherinerce

liked

20

Katherinerce

liked

This gotta be the most FML moment for the entire year of 2024.

After reading articles on Moomoo praising and singing the goods of ETFs, I decided to plunge in to $GraniteShares 2x Long NVDA Daily ETF (NVDL.US)$ as it was cheaper to own the underlying Nvidia stock. What’s more, the gains are magnified by 2!

However, Nvidia went into a slump after August and I quickly switch to $GraniteShares 2x Short NVDA Daily ETF (NVD.US)$ .

Then out of nowhere, trading was halted witho...

After reading articles on Moomoo praising and singing the goods of ETFs, I decided to plunge in to $GraniteShares 2x Long NVDA Daily ETF (NVDL.US)$ as it was cheaper to own the underlying Nvidia stock. What’s more, the gains are magnified by 2!

However, Nvidia went into a slump after August and I quickly switch to $GraniteShares 2x Short NVDA Daily ETF (NVD.US)$ .

Then out of nowhere, trading was halted witho...

+1

loading...

21

2

Katherinerce

liked

My 2024 recap: The most rewarding and fulfilling moments in my 2024 investment journey is signed-up Moomoo and started my investment journey with a positive return!! The return is nothing to shout about comparing many mooers but i am blessed with my progress and result. I aim to do better in 2025 for sure. Yay! ![]()

Compared to other trading apps in Malaysia, Moomoo truly excels and stands out as a top choice. Below are my top 3s

#1 I LIKE THIS THE MOST - Competitio...

Compared to other trading apps in Malaysia, Moomoo truly excels and stands out as a top choice. Below are my top 3s

#1 I LIKE THIS THE MOST - Competitio...

23

5

Katherinerce

liked

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)