Kayleigh

voted

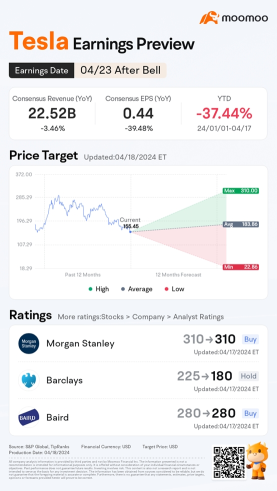

Tesla is releasing its Q1 2024 earnings after the market closes on April 23.

Since its Q4 earnings release, shares of $Tesla (TSLA.US)$ have seen a decrease of 29%.![]() Overall earnings estimates have been revised lower since the company's last earnings release. How will the market react to the upcoming results? Make your guess now!

Overall earnings estimates have been revised lower since the company's last earnings release. How will the market react to the upcoming results? Make your guess now! ![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range ...

Since its Q4 earnings release, shares of $Tesla (TSLA.US)$ have seen a decrease of 29%.

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range ...

144

371

34

Kayleigh

voted

Spoiler:

At the end of this post, there is a chance for you to win points!

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ Buzzing Stocks List & Mooers Comments

The Jones Index fell for the third consecuti...

At the end of this post, there is a chance for you to win points!

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ Buzzing Stocks List & Mooers Comments

The Jones Index fell for the third consecuti...

+2

48

59

15

Kayleigh

liked

I stick to the old adage: BUY low, SELL HIGH

The last couple of years it was very difficult to get good stocks at low prices, but now the opportunities to buy high quality stocks are coming down from the clouds. I will be buying stocks like $Block (SQ.US)$ and $PayPal (PYPL.US)$

As a modest investor I’ve learned to wait for the right time, and not panic if my entry level pricing goes a little lower. if I picked the right stock then it will bounce higher.

The last couple of years it was very difficult to get good stocks at low prices, but now the opportunities to buy high quality stocks are coming down from the clouds. I will be buying stocks like $Block (SQ.US)$ and $PayPal (PYPL.US)$

As a modest investor I’ve learned to wait for the right time, and not panic if my entry level pricing goes a little lower. if I picked the right stock then it will bounce higher.

7

Kayleigh

liked

●Futu Singapore (“Futu SG”) is the first digital brokerage to receive approvals-in-principle for all SGX memberships, with this feat achieved in less than a year since it entered the Singapore market.

●Futu SG expects to convert these approvals-in-principle soon, to allow the company and its clients to benefit from an expansion of service offerings, and enha...

●Futu SG expects to convert these approvals-in-principle soon, to allow the company and its clients to benefit from an expansion of service offerings, and enha...

69

21

30

Kayleigh

voted

It's a tradition for the Chinese worldwide to send new-year greetings to relatives and friends during the Chinese New Year. From what I observe, those who send the most heartfelt new-year greetings typically receive the most red hongbao.

Agree or not?

Time to upskill, buddy! Pick some of the following CNY greetings and impress your relatives right now!

We've prepared a small lucky hongbao for all of you at the end of this...

Agree or not?

Time to upskill, buddy! Pick some of the following CNY greetings and impress your relatives right now!

We've prepared a small lucky hongbao for all of you at the end of this...

114

121

13

Kayleigh

reacted to

Moomoo Courses offer many courses to help mooers fully prepare themselves before making an informed decision, but are you familiar with it? Have you ever used it? Here is a Map to help you learn more about Courses. Let's get started!

Part 1![]() Where to find it?

Where to find it?

Go to the Moo page and tap on Courses. You will see the homepage of Courses.

Part 2![]() Discover the homepage

Discover the homepage

Numerous contents are categorized into several well-curated section...

Part 1

Go to the Moo page and tap on Courses. You will see the homepage of Courses.

Part 2

Numerous contents are categorized into several well-curated section...

+4

407

136

93

Kayleigh

liked

Once more, Co-Wise: moomoo Tutorial Contest Part 8, "Why do you stick to long-term investment?" ended successfully. Thanks for participating in the contest.

@moobooconcluded that a long-term investment requires the most detailed due diligence and fundamental analysis. @Dadacaiacknowledged that it's a strategy that allows you to make big bucks and sleep well at night.

![]() Is the long-term investing strategy effective?

Is the long-term investing strategy effective?

Of course. We all ...

@moobooconcluded that a long-term investment requires the most detailed due diligence and fundamental analysis. @Dadacaiacknowledged that it's a strategy that allows you to make big bucks and sleep well at night.

Of course. We all ...

75

26

25

Kayleigh

liked

Columns Futu Responds to Media Report

HONG KONG, December 17, 2021 -- Futu Holdings Limited (“Futu” or the “Company”) (Nasdaq:FUTU), a leading tech-driven online brokerage and wealth management platform, today responds to the media speculations regarding potential PRC regulatory policies that may have a material adverse impact on the Company’s business operation. As a Nasdaq-listed company, Futu is committed to timely disclose recent developments that may have a material adverse impact on the Company’s business operation, including regulatory developments.

Futu always maintains active communication with different competent PRC regulatory authorities in its ordinary course of business.To date, the Company has not received (nor is it aware of) any notice, guidance or order from any PRC regulatory authorities which is expected to have a material adverse impact on its business operation or financial conditions. The Company has been operating steadily and will continue to serve existing and new clients.

In terms of serving the PRC clients, Futu has been a biding by the same rules and regulations and adopting the similar industry practices and business models as other brokers who hold the same type of licenses in Hong Kong. No further innovations or breakthroughs have been made by Futu with respect to the business model. There is no such “internet broker-dealer”category or definition under relevant legal framework and nowadays almost all broker-dealers are using internet (through App and/or website) to serve their clients. Futu will keep monitoring regulatory developments and continue to fully cooperate with relevant regulatory authorities.

During the recent period, the Company noticed that some individuals and institutions have been spreading false or fake information about Futu on social media with the purpose of profiting from short-selling. We have gathered relevant information and further reported to relevant regulators. We also reserve our right to take legal action.

We believe that the regulatory authorities in mainland China and Hong Kong have always attached great importance to protecting investors, maintaining a healthy and stable financial market, and prudently formulating policies and guiding the industry. We caution the media and the public to distinguish false and fake information and avoid being taken advantage of.

About Futu Holdings Limited

Futu Holdings Limited (Nasdaq: FUTU) is an advanced technology company transforming the investing experience by offering a fully digitized brokerage and wealth management platform. The Company primarily serves the emerging affluent population, pursuing a massive opportunity tofacilitate a once-in-a-generation shift in the wealth management industry and build a digital gateway into broader financial services. The Company provides investing services through its proprietary digital platform, Futubull and moomoo, each a highly integrated application accessible through anymobile device, tablet or desktop. The Company's primary fee-generating services include trade execution and margin financing which allow its clients to trade securities, such as stocks, warrants, options, futures and exchange-tradedfunds, or ETFs, across different markets. Futu has also embedded social media tools to create a network centered around its users and provide connectivity tousers, investors, companies, analysts, media and key opinion leaders.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the "safe harbor"provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as"will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates" and similar statements. Among otherthings, the quotations from the management team of the Company, contain forward-looking statements. Futu may also make written or oral forward-looking statements in its periodic reports to the SEC, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about Futu's beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors couldcause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: Futu's goal and strategies; Futu's expansion plans; Futu's future business development, financial condition and results of operations; Futu's expectations regarding demand for, and market acceptance of, its credit products; Futu's expectations regarding keeping and strengthening its relationships with borrowers, institutional funding partners, merchandise suppliers and other parties it collaborate with; general economic and business conditions; and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in Futu's filings with the SEC. All information provided in this press release and in the attachments is as of the date of this press release, and Futu does not undertake any obligation toupdate any forward-looking statement, except as required under applicable law.

For investor inquiries, please contact:

Investor Relations

Futu Holdings Limited

ir@futuholdings.com

Futu always maintains active communication with different competent PRC regulatory authorities in its ordinary course of business.To date, the Company has not received (nor is it aware of) any notice, guidance or order from any PRC regulatory authorities which is expected to have a material adverse impact on its business operation or financial conditions. The Company has been operating steadily and will continue to serve existing and new clients.

In terms of serving the PRC clients, Futu has been a biding by the same rules and regulations and adopting the similar industry practices and business models as other brokers who hold the same type of licenses in Hong Kong. No further innovations or breakthroughs have been made by Futu with respect to the business model. There is no such “internet broker-dealer”category or definition under relevant legal framework and nowadays almost all broker-dealers are using internet (through App and/or website) to serve their clients. Futu will keep monitoring regulatory developments and continue to fully cooperate with relevant regulatory authorities.

During the recent period, the Company noticed that some individuals and institutions have been spreading false or fake information about Futu on social media with the purpose of profiting from short-selling. We have gathered relevant information and further reported to relevant regulators. We also reserve our right to take legal action.

We believe that the regulatory authorities in mainland China and Hong Kong have always attached great importance to protecting investors, maintaining a healthy and stable financial market, and prudently formulating policies and guiding the industry. We caution the media and the public to distinguish false and fake information and avoid being taken advantage of.

About Futu Holdings Limited

Futu Holdings Limited (Nasdaq: FUTU) is an advanced technology company transforming the investing experience by offering a fully digitized brokerage and wealth management platform. The Company primarily serves the emerging affluent population, pursuing a massive opportunity tofacilitate a once-in-a-generation shift in the wealth management industry and build a digital gateway into broader financial services. The Company provides investing services through its proprietary digital platform, Futubull and moomoo, each a highly integrated application accessible through anymobile device, tablet or desktop. The Company's primary fee-generating services include trade execution and margin financing which allow its clients to trade securities, such as stocks, warrants, options, futures and exchange-tradedfunds, or ETFs, across different markets. Futu has also embedded social media tools to create a network centered around its users and provide connectivity tousers, investors, companies, analysts, media and key opinion leaders.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the "safe harbor"provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as"will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates" and similar statements. Among otherthings, the quotations from the management team of the Company, contain forward-looking statements. Futu may also make written or oral forward-looking statements in its periodic reports to the SEC, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about Futu's beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors couldcause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: Futu's goal and strategies; Futu's expansion plans; Futu's future business development, financial condition and results of operations; Futu's expectations regarding demand for, and market acceptance of, its credit products; Futu's expectations regarding keeping and strengthening its relationships with borrowers, institutional funding partners, merchandise suppliers and other parties it collaborate with; general economic and business conditions; and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in Futu's filings with the SEC. All information provided in this press release and in the attachments is as of the date of this press release, and Futu does not undertake any obligation toupdate any forward-looking statement, except as required under applicable law.

For investor inquiries, please contact:

Investor Relations

Futu Holdings Limited

ir@futuholdings.com

63

11

55

Kayleigh

reacted to

Columns Moomoo to Launch in Australia: Will Offer Australian Investors One-Stop Online Investment Services

Sydney, Dec. 20, 2021 – On December 20, 2021, moomoo, a leading one-stop digital investment platform, announced that it will be launching in Australia. The company will provide Australian investors with premium online investment services. Moomoo has been on a path of exponential international growth and Australia marks its third expansion overseas after a successful launch in US and Singapore. The company made the announcement after its affiliated company secured an Australian Financial Services License granted by the Australian Securities and Investments Commission (ASIC) through an acquisition

As a tech-driven digital investment platform, moomoo’s mission is to make investing easier and more social. After building a strong community of investors and winning awards in the US and Singapore, the company is excited about bringing its services to Australian investors to help them take advantage of all investing opportunities.

Moomoo stands out from other platforms by offering:

- a free online account-opening experience that can be completed in just minutes;

- a combination of powerful technologies spanning stock trading and market data;

- an interactive online community of 17 million investors worldwide;

- tools that enable the community to share their investing insights anytime, anywhere.

Investors can now trade stocks on the platform and access free real-time quotes, in-depth market analysis, and comprehensive financial news coverage.

Moomoo has quickly become a popular tech-driven brokerage platform among local investors since its launch in the US and Singapore. In the US, moomoo has resonated with sophisticated and retail investors alike, with powerful yet user-friendly tools capable of guiding even professional traders toward more informed decisions. In this year, moomoo won the “Best Active Trading App 2021” by Investing Simple, a leading US financial website, and was also nominated for the Benzinga 2021 awards for “Best Trading Technology” and “Best Investment Research Tech”.

Moomoo has attracted over 220,000 registered users and more than 100,000 paying clients in less than three months since entering the Singapore market. Within just six months of its launch, moomoo’s market share of retail investors in Singapore neared 15%. As of Q3, moomoo has become one of the fastest growing one-stop investment platforms in Singapore, constantly holding a place among the top three financial apps as measured by download volume.

Australia marks moomoo’s next stop. Drawing on its successes in the US and Singapore, moomoo is expected to open up a brand-new market in Australia and bring a unique investment experience to local investors.

About Moomoo

Moomoo positions itself as the next-generation one-stop investment platform that integrates investment transactions, up-to-date news, real-time market data, and an active trading community. Moomoo's mission is to provide investors of all levels with an intuitive and powerful investing platform. Moomoo leverages deep technological R&D capabilities and future-focused operating model to constantly improve the user experience and drive industry-wide innovation. For more information, please visit the official website www.moomoo.com/au.

As a tech-driven digital investment platform, moomoo’s mission is to make investing easier and more social. After building a strong community of investors and winning awards in the US and Singapore, the company is excited about bringing its services to Australian investors to help them take advantage of all investing opportunities.

Moomoo stands out from other platforms by offering:

- a free online account-opening experience that can be completed in just minutes;

- a combination of powerful technologies spanning stock trading and market data;

- an interactive online community of 17 million investors worldwide;

- tools that enable the community to share their investing insights anytime, anywhere.

Investors can now trade stocks on the platform and access free real-time quotes, in-depth market analysis, and comprehensive financial news coverage.

Moomoo has quickly become a popular tech-driven brokerage platform among local investors since its launch in the US and Singapore. In the US, moomoo has resonated with sophisticated and retail investors alike, with powerful yet user-friendly tools capable of guiding even professional traders toward more informed decisions. In this year, moomoo won the “Best Active Trading App 2021” by Investing Simple, a leading US financial website, and was also nominated for the Benzinga 2021 awards for “Best Trading Technology” and “Best Investment Research Tech”.

Moomoo has attracted over 220,000 registered users and more than 100,000 paying clients in less than three months since entering the Singapore market. Within just six months of its launch, moomoo’s market share of retail investors in Singapore neared 15%. As of Q3, moomoo has become one of the fastest growing one-stop investment platforms in Singapore, constantly holding a place among the top three financial apps as measured by download volume.

Australia marks moomoo’s next stop. Drawing on its successes in the US and Singapore, moomoo is expected to open up a brand-new market in Australia and bring a unique investment experience to local investors.

About Moomoo

Moomoo positions itself as the next-generation one-stop investment platform that integrates investment transactions, up-to-date news, real-time market data, and an active trading community. Moomoo's mission is to provide investors of all levels with an intuitive and powerful investing platform. Moomoo leverages deep technological R&D capabilities and future-focused operating model to constantly improve the user experience and drive industry-wide innovation. For more information, please visit the official website www.moomoo.com/au.

154

42

67

Kayleigh

liked

$Futu Holdings Ltd (FUTU.US)$ Patiently waiting for $50 again so I can add $Futu Holdings Ltd (FUTU.US)$

7

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)