3

Khoo Han Yi

voted

Columns Operation plan after the general election and during the Chinese concept financial reporting season.

$NASDAQ 100 Index (.NDX.US)$Under the dual stimulus of the settled election and a 25 basis point rate cut, the market rose by 5% this week to reach 21117 points, which is currently a bit high. Last week's rise was mainly driven by bank stocks, small cap stocks, semiconductors, and technology stocks, reaching the upper band of the Bollinger Bands. An expected short-term pullback is anticipated. Next week, the USA's CPI and PPI data will be released, with a high probability of meeting expectations and a low possibility of a market crash. The current prediction is that the current upward trend should continue until the Christmas market, but with Donald Trump's return to the White House in January next year, there may be a significant pullback in January. Therefore, during this period of policy vacuum, the US stocks are likely to experience an oscillating upward trend. In the short term, due to the crazy rise of US stocks last week, a brief pullback is expected this week, presenting a buying opportunity during the dip.

Regarding Chinese concept stocks, due to the potential policy risks since Trump took office, as well as the lackluster effect of the debt-for-equity policy announced on Friday in stimulating the stock market, leading to a 6% decline, many stocks have directly shifted trends to a downward trajectory this week. $TENCENT (00700.HK)$ $JD.com (JD.US)$ $Alibaba (BABA.US)$ $Bilibili (BILI.US)$ $Cisco (CSCO.US)$ $Occidental Petroleum (OXY.US)$ $Sea (SE.US)$As for Chinese concept stocks, due to the potential policy risks since Trump took office, and the issuance of debt conversion policy on Friday did not have the expected stimulating effect on the stock market, resulting in a sharp 6% drop on Friday, many stocks have directly changed trends to a downward trend next week

Regarding Chinese concept stocks, due to the potential policy risks since Trump took office, as well as the lackluster effect of the debt-for-equity policy announced on Friday in stimulating the stock market, leading to a 6% decline, many stocks have directly shifted trends to a downward trajectory this week. $TENCENT (00700.HK)$ $JD.com (JD.US)$ $Alibaba (BABA.US)$ $Bilibili (BILI.US)$ $Cisco (CSCO.US)$ $Occidental Petroleum (OXY.US)$ $Sea (SE.US)$As for Chinese concept stocks, due to the potential policy risks since Trump took office, and the issuance of debt conversion policy on Friday did not have the expected stimulating effect on the stock market, resulting in a sharp 6% drop on Friday, many stocks have directly changed trends to a downward trend next week

Translated

38

4

4

Khoo Han Yi

voted

Translated

3

Khoo Han Yi

voted

$Super Micro Computer (SMCI.US)$ Earnings call live broadcast is coming soon! Based on the recent market performance of SMCI, I have made predictions for 3 scenarios:

Best case scenario forecast

Probability:30%

In the best case scenario, SMCI can successfully turn the situation around through the following actions:

1. Quickly find and cooperate with a new audit firm, and rebuild market confidence through improved financial transparency.

2. Strengthen governance structure to ensure the independence and compliance of the management team and the board of directors, and improve internal controls.

3. Maintain technological innovation in AI servers and liquid cooling technology, seize current market demands, and continue to expand market share.

As these measures depend on the company's internal efforts, cooperation from external audit firms, and the stability of market demand, the probability is around 30%. This probability takes into account the significant impact of the current negative news on the company, but its technological advantages in the fields of AI and high-performance servers may still provide the company with a turnaround opportunity.

Worst-case scenario prediction

Probability:50%

In the worst-case scenario, the risks faced by SMCI are as follows:

1. Failure to effectively rectify financial and governance issues, leading to further escalation of audit issues, which may trigger in-depth investigations by regulatory institutions and more severe financial scrutiny.

2. Loss of customer and investor confidence, which may result in customers switching to competitors, leading to a decrease in company revenue and market share.

3. The continuous low stock price or further decline has led to financing difficulties, affecting future business expansion and technology...

Best case scenario forecast

Probability:30%

In the best case scenario, SMCI can successfully turn the situation around through the following actions:

1. Quickly find and cooperate with a new audit firm, and rebuild market confidence through improved financial transparency.

2. Strengthen governance structure to ensure the independence and compliance of the management team and the board of directors, and improve internal controls.

3. Maintain technological innovation in AI servers and liquid cooling technology, seize current market demands, and continue to expand market share.

As these measures depend on the company's internal efforts, cooperation from external audit firms, and the stability of market demand, the probability is around 30%. This probability takes into account the significant impact of the current negative news on the company, but its technological advantages in the fields of AI and high-performance servers may still provide the company with a turnaround opportunity.

Worst-case scenario prediction

Probability:50%

In the worst-case scenario, the risks faced by SMCI are as follows:

1. Failure to effectively rectify financial and governance issues, leading to further escalation of audit issues, which may trigger in-depth investigations by regulatory institutions and more severe financial scrutiny.

2. Loss of customer and investor confidence, which may result in customers switching to competitors, leading to a decrease in company revenue and market share.

3. The continuous low stock price or further decline has led to financing difficulties, affecting future business expansion and technology...

Translated

18

1

Khoo Han Yi

voted

Hi, mooers!

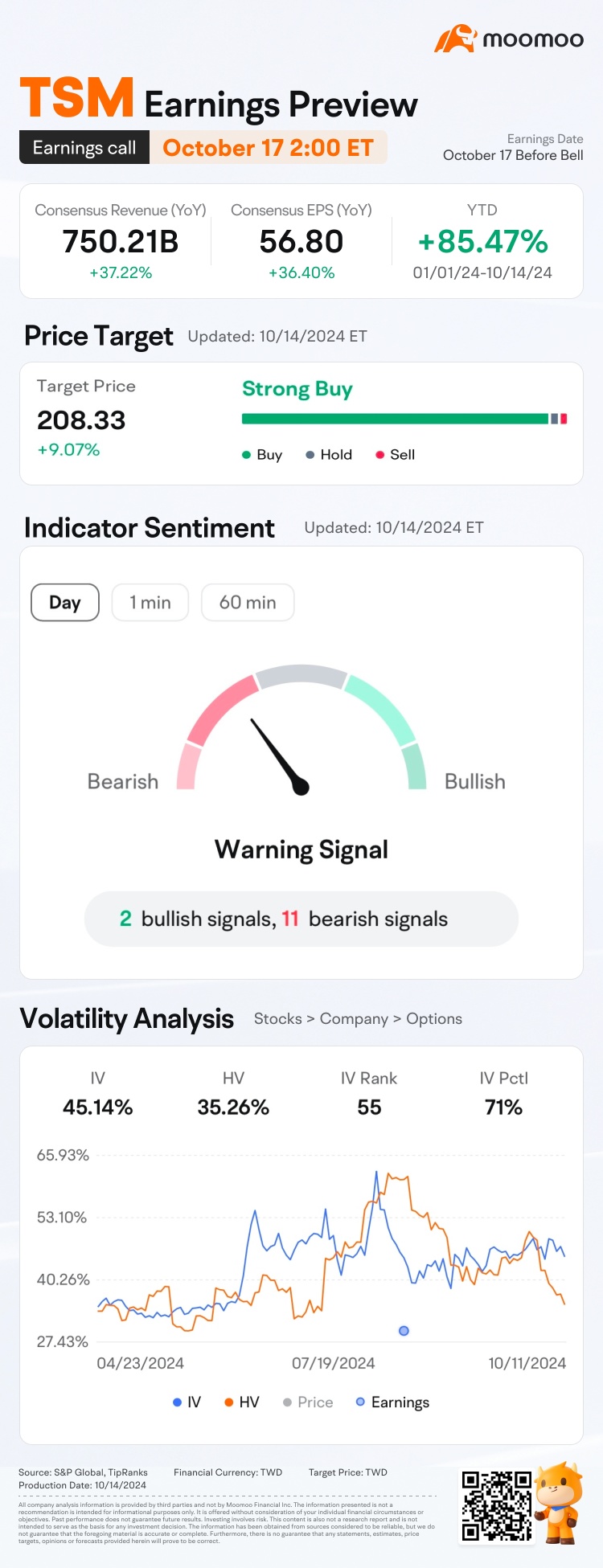

$Taiwan Semiconductor (TSM.US)$ is releasing its Q3 2024 earnings on October 17 before the bell. Unlock insights with TSM Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 2024 earnings release, shares of $Taiwan Semiconductor (TSM.US)$ have seen an increase of 11.42%.![]() How will the market react to the upcoming results? Make your guess now!

How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 ...

$Taiwan Semiconductor (TSM.US)$ is releasing its Q3 2024 earnings on October 17 before the bell. Unlock insights with TSM Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 2024 earnings release, shares of $Taiwan Semiconductor (TSM.US)$ have seen an increase of 11.42%.

Rewards

● An equal share of 5,000 ...

Expand

Expand 134

212

16

Khoo Han Yi

voted

Hi, mooers!

Ever wonder how to make your idle money work smarter? Are you looking for ways to boost your idle funds while keeping them readily available?![]()

You might want to get familiar with Cash Plus!![]()

Here's a snapshot of what Cash Plus offers:

1. Daily returns: Enjoy returns of up to 3.5% p.a.*, even on non-trading days.

2. Ultra-low threshold: Dive in with as little as RM0.01 without any cap.

3. Flexible redemption: Cash out for stoc...

Ever wonder how to make your idle money work smarter? Are you looking for ways to boost your idle funds while keeping them readily available?

You might want to get familiar with Cash Plus!

Here's a snapshot of what Cash Plus offers:

1. Daily returns: Enjoy returns of up to 3.5% p.a.*, even on non-trading days.

2. Ultra-low threshold: Dive in with as little as RM0.01 without any cap.

3. Flexible redemption: Cash out for stoc...

226

371

19

Khoo Han Yi

voted

Hi mooers!

Join the Q2 Earnings Challenge and share 30,000 points! Tap to learn more!

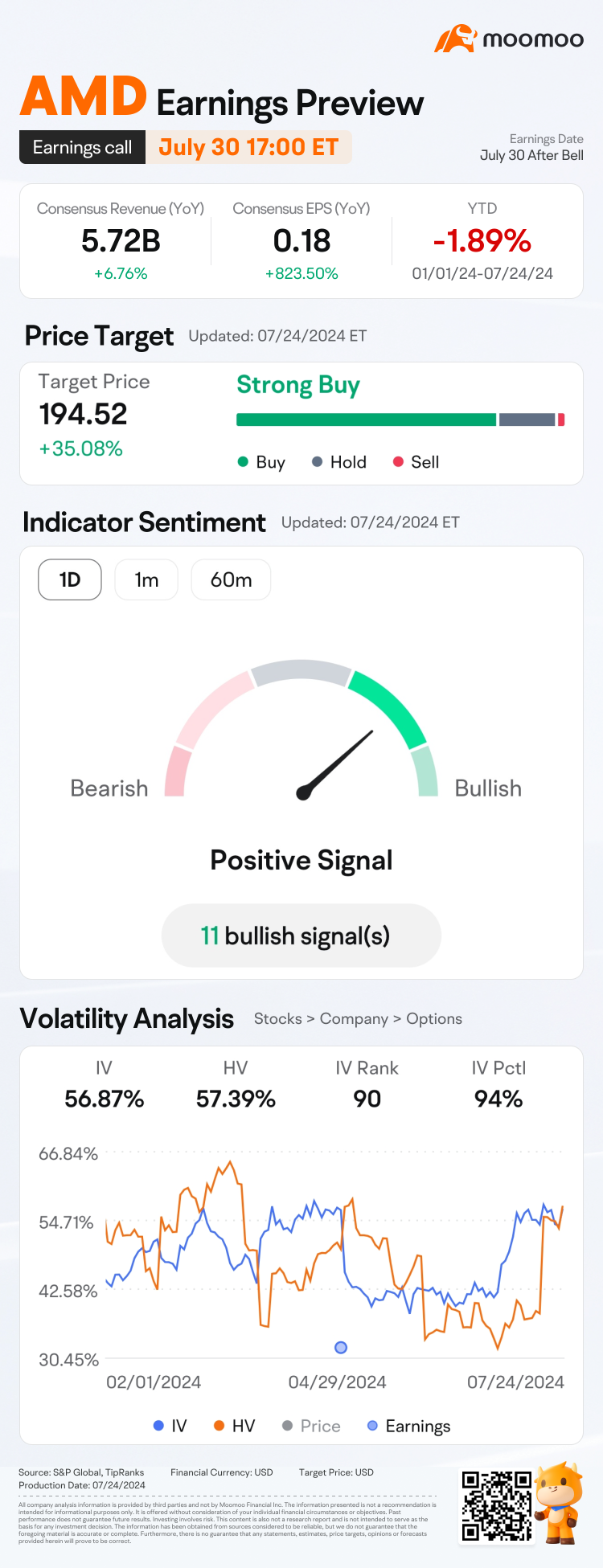

$Advanced Micro Devices (AMD.US)$ and $Microsoft (MSFT.US)$ are releasing their Q2 earnings on July 30 after the bell.

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the winner who makes the biggest %gains in intraday trading on July 31 (e.g., If 50 mooers make a correct guess, each of them will get 100 points.)

(Vote will close at...

Join the Q2 Earnings Challenge and share 30,000 points! Tap to learn more!

$Advanced Micro Devices (AMD.US)$ and $Microsoft (MSFT.US)$ are releasing their Q2 earnings on July 30 after the bell.

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the winner who makes the biggest %gains in intraday trading on July 31 (e.g., If 50 mooers make a correct guess, each of them will get 100 points.)

(Vote will close at...

87

83

41

Khoo Han Yi

voted

Hi, mooers!

Join the Q2 Earnings Challenge and share 30,000 points! Tap to learn more!

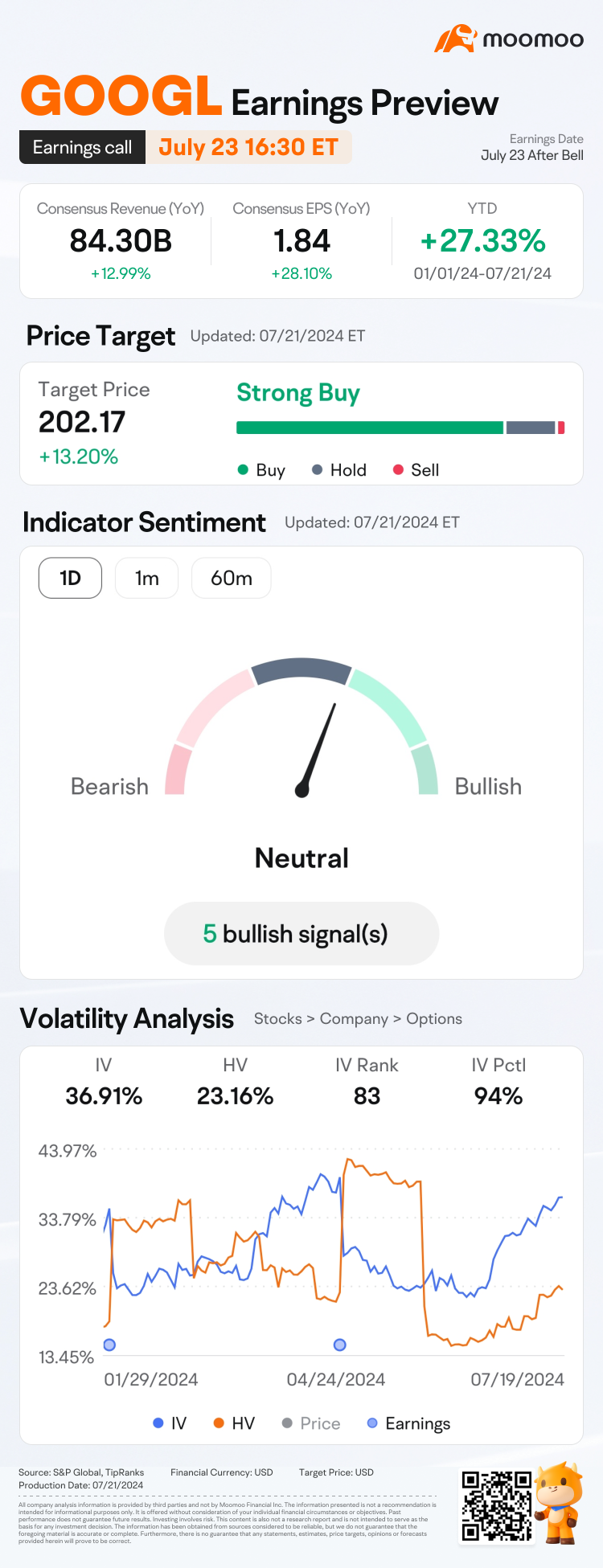

$Alphabet-A (GOOGL.US)$ is releasing its Q2 earnings on July 23 after the bell. Unlock insights with GOOGL Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Alphabet-A (GOOGL.US)$ have seen an increase of 11.77%.![]() How will the market react to the upcoming resul...

How will the market react to the upcoming resul...

Join the Q2 Earnings Challenge and share 30,000 points! Tap to learn more!

$Alphabet-A (GOOGL.US)$ is releasing its Q2 earnings on July 23 after the bell. Unlock insights with GOOGL Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Alphabet-A (GOOGL.US)$ have seen an increase of 11.77%.

Expand

Expand 79

153

17

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)