kingtutkingben

voted

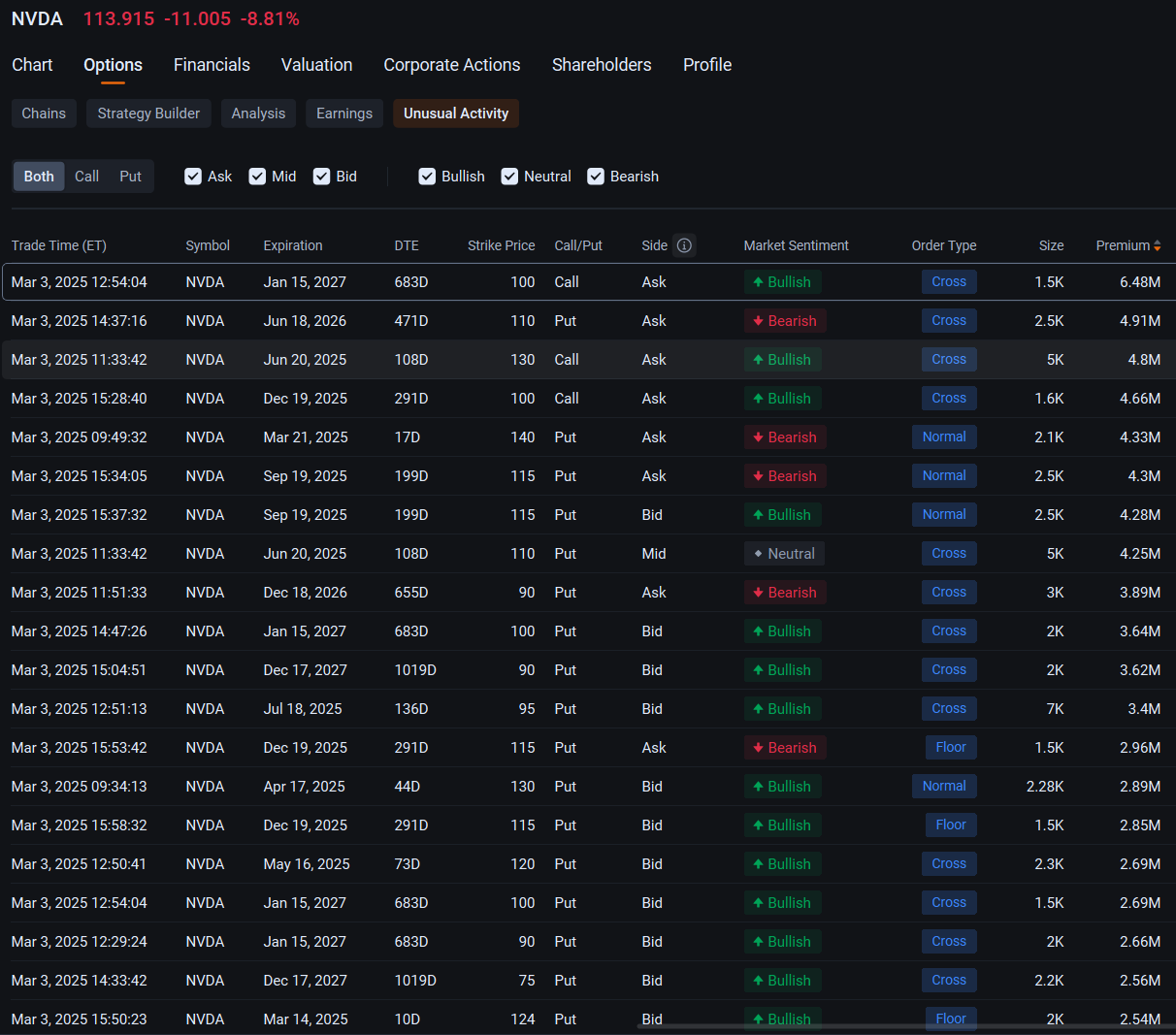

$NVIDIA (NVDA.US)$ bulls piled onto bullish block trades of options Monday, undeterred by the stock slump that sent the chip giant’s market capital to its lowest level in almost six months.

Shares of Nvidia tumbled 8.8% to close at $113.92 in New York, taking its market capital to $2.78 trillion, the lowest level since September. The slump came amid concerns that escalating trade tensions could trigger a downturn for the...

Shares of Nvidia tumbled 8.8% to close at $113.92 in New York, taking its market capital to $2.78 trillion, the lowest level since September. The slump came amid concerns that escalating trade tensions could trigger a downturn for the...

40

2

28

kingtutkingben

voted

With Christmas Eve just around the corner, it seems like the markets are getting into the festive spirit! The $S&P 500 Index (.SPX.US)$ & Magnificent 7 stocks are lighting up the charts like holiday ornaments, bringing a much-needed boost to portfolios.

Today’s Highlights

• Tesla ( $Tesla (TSLA.US)$ ): Leading the pack with a stellar +4.22% gain, reminiscent of Rudolph guiding the sleigh!

• Amazon ( $Amazon (AMZN.US)$): Up +1.46%, perhaps driven by those last-minut...

Today’s Highlights

• Tesla ( $Tesla (TSLA.US)$ ): Leading the pack with a stellar +4.22% gain, reminiscent of Rudolph guiding the sleigh!

• Amazon ( $Amazon (AMZN.US)$): Up +1.46%, perhaps driven by those last-minut...

23

1

kingtutkingben

liked

3

7

kingtutkingben

voted

$S&P 500 Index (.SPX.US)$kicked off monday with a roaring start. Mostly showing gains with $Tesla (TSLA.US)$ in the lead from premarket movements. $Amazon (AMZN.US)$ & $Alphabet-A (GOOGL.US)$ making good gains as well. ![]()

$NVIDIA (NVDA.US)$hitting below 140 today with ER over and starting to analyse its Q4 expectations. With demand expected to exceed supply 2025 expected to![]() . Expecting to go long when the stock is further undervalued.

. Expecting to go long when the stock is further undervalued. ![]()

For me 135 seems like a good entry point but I ...

$NVIDIA (NVDA.US)$hitting below 140 today with ER over and starting to analyse its Q4 expectations. With demand expected to exceed supply 2025 expected to

For me 135 seems like a good entry point but I ...

8

1

kingtutkingben

Set a live reminder

While the election may be over, the implications for your portfolio are likely not. Join our panelists as they discuss the market’s reaction over the past week to the results and what’s in store for the first 100 days of the new administration. This panel will explore the historical relationship between presidential election cycles and market performance as well as the potential impact of the president-elect’s policies on specific sectors and t...

How will the election results affect your portfolio?

Nov 17 00:40

9

kingtutkingben

Set a live reminder

Listen in as three women in finance share their journeys, strategies, and practical tips for women entering the trading world. This session covers overcoming challenges, debunking myths, and embracing opportunities, with actionable steps to help you start or advance your options trading path.

Helping women reach their financial goals

Nov 16 23:50

25

2

5

kingtutkingben

Set a live reminder

Moomoo is constantly updating its features, tools and product offerings to provide the best possible trading experience to its users. This session will examine how moomoo is working to meet its customers’ needs. Explore moomoo’s recent product rollouts including a live demo of how they work. Learn about the risk controls moomoo has in place and what the next cutting edge release will be in the coming year.

Next Gen trading: What's new on the moomoo app

Nov 16 23:00

9

kingtutkingben

Set a live reminder

Moomoo surveyed its users at the end of the quarter to find out which ones are using options and the resources and tools they are using to do so. Find out which trends are supported in the overall market through data provided by Cboe. Viewers will gain a better understanding of investors’ comfort level with options while getting familiar with the advantages of products such as index options. This session will explore what’s holding investors back f...

Insights on how moomoo users are trading options

Nov 16 03:40

4

kingtutkingben

Set a live reminder

Event driven risk can come in all different shapes and sizes. Zero days to expiration options (0DTE) are designed to monetize high impact intraday events but it is important to understand the benefits and risks. Different 0DTE strategies can be utilized based on the type and time of a particular catalyst. Learn how to trade around economic releases, earnings releases, FOMC meetings and even surprise events and how to avoid time decay during periods of high expe...

Managing Volatile Markets with 0DTE

Nov 14 23:20

21

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)