Ksui93

voted

$Super Micro Computer (SMCI.US)$ Earnings call live broadcast is coming soon! Based on the recent market performance of SMCI, I have made predictions for 3 scenarios:

Best case scenario forecast

Probability:30%

In the best case scenario, SMCI can successfully turn the situation around through the following actions:

1. Quickly find and cooperate with a new audit firm, and rebuild market confidence through improved financial transparency.

2. Strengthen governance structure to ensure the independence and compliance of the management team and the board of directors, and improve internal controls.

3. Maintain technological innovation in AI servers and liquid cooling technology, seize current market demands, and continue to expand market share.

As these measures depend on the company's internal efforts, cooperation from external audit firms, and the stability of market demand, the probability is around 30%. This probability takes into account the significant impact of the current negative news on the company, but its technological advantages in the fields of AI and high-performance servers may still provide the company with a turnaround opportunity.

Worst-case scenario prediction

Probability:50%

In the worst-case scenario, the risks faced by SMCI are as follows:

1. Failure to effectively rectify financial and governance issues, leading to further escalation of audit issues, which may trigger in-depth investigations by regulatory institutions and more severe financial scrutiny.

2. Loss of customer and investor confidence, which may result in customers switching to competitors, leading to a decrease in company revenue and market share.

3. The continuous low stock price or further decline has led to financing difficulties, affecting future business expansion and technology...

Best case scenario forecast

Probability:30%

In the best case scenario, SMCI can successfully turn the situation around through the following actions:

1. Quickly find and cooperate with a new audit firm, and rebuild market confidence through improved financial transparency.

2. Strengthen governance structure to ensure the independence and compliance of the management team and the board of directors, and improve internal controls.

3. Maintain technological innovation in AI servers and liquid cooling technology, seize current market demands, and continue to expand market share.

As these measures depend on the company's internal efforts, cooperation from external audit firms, and the stability of market demand, the probability is around 30%. This probability takes into account the significant impact of the current negative news on the company, but its technological advantages in the fields of AI and high-performance servers may still provide the company with a turnaround opportunity.

Worst-case scenario prediction

Probability:50%

In the worst-case scenario, the risks faced by SMCI are as follows:

1. Failure to effectively rectify financial and governance issues, leading to further escalation of audit issues, which may trigger in-depth investigations by regulatory institutions and more severe financial scrutiny.

2. Loss of customer and investor confidence, which may result in customers switching to competitors, leading to a decrease in company revenue and market share.

3. The continuous low stock price or further decline has led to financing difficulties, affecting future business expansion and technology...

Translated

18

1

Ksui93

liked

Q3 earnings reports for U.S. stocks are in full swing, with several tech companies and chipmakers set to release their results this week. How to assess the market situation? Let’s take a look.

![]() Which sectors are in favor?

Which sectors are in favor?

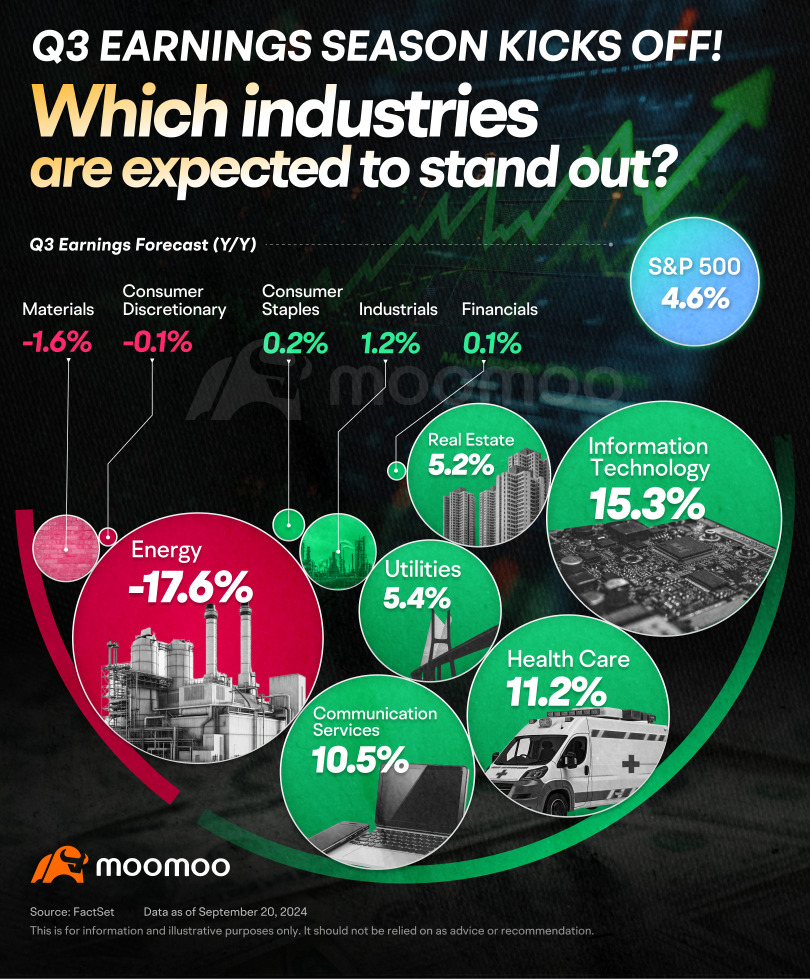

FactSet indicates that the market expects the S&P 500's earnings growth rate to be 4.6% for the third quarter.

Among the 11 sectors of the S&P 500, eight are expected to see year-over-year earnings growth in Q3. Inform...

FactSet indicates that the market expects the S&P 500's earnings growth rate to be 4.6% for the third quarter.

Among the 11 sectors of the S&P 500, eight are expected to see year-over-year earnings growth in Q3. Inform...

+5

144

45

36

Ksui93

liked and voted

Hi mooers! ![]()

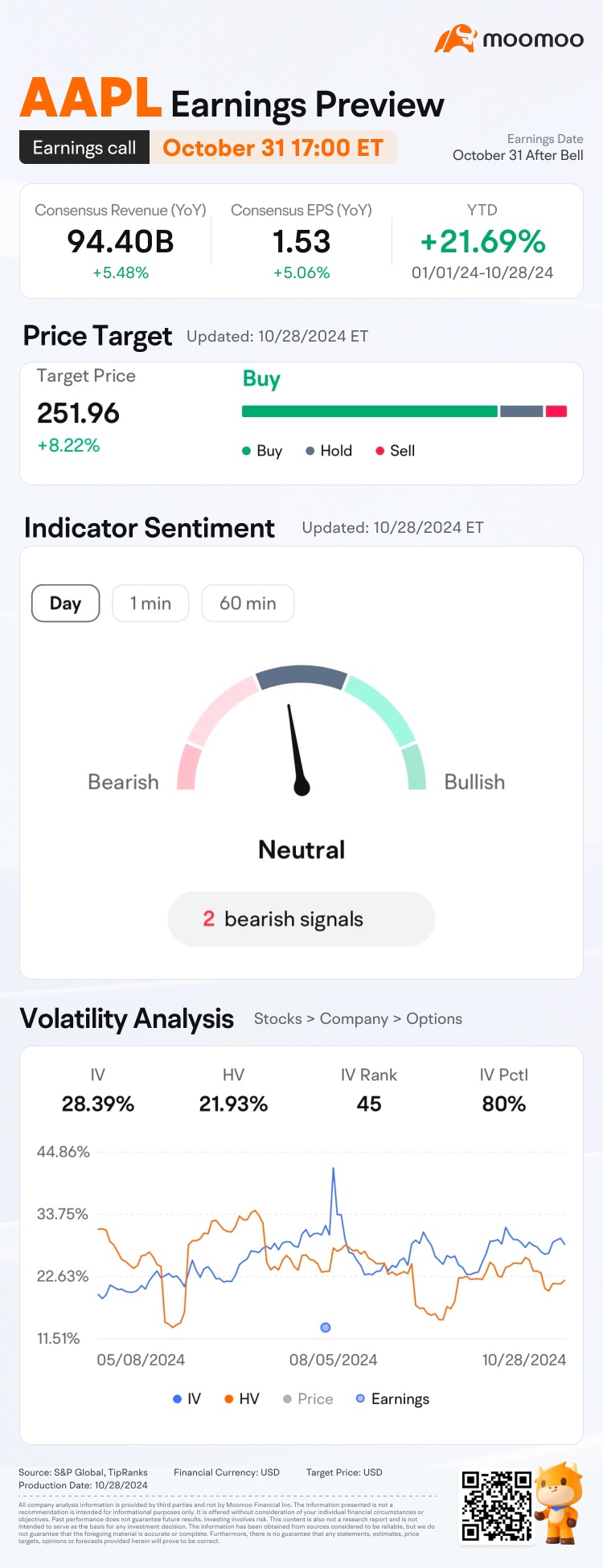

Two of the Mag 7 companies, $Apple (AAPL.US)$ and $Amazon (AMZN.US)$, are both set to release their last quarter earnings on October 31 after the bell. Who will win the market? Make your guess!

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the winner who makes the biggest %gains in intraday trading on the first day after their earnings (e.g., If 50 mooers make a correct guess, each of them will get 100...

Two of the Mag 7 companies, $Apple (AAPL.US)$ and $Amazon (AMZN.US)$, are both set to release their last quarter earnings on October 31 after the bell. Who will win the market? Make your guess!

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the winner who makes the biggest %gains in intraday trading on the first day after their earnings (e.g., If 50 mooers make a correct guess, each of them will get 100...

+1

62

69

7

Ksui93

liked

Good morning, traders. Happy Thursday, October 31. Happy Halloween! The market is falling after both Meta and Microsoft reported they spent a lot on AI data centers in the past quarter, a bad sign to come for the remaining Mag Seven stocks. Tonight, investors will see if Apple and Amazon earnings will bring investors a trick or a treat.

My name is Kevin Travers; here is the news and animal spirits moving markets today.

$Meta Platforms (META.US)$ shares s...

My name is Kevin Travers; here is the news and animal spirits moving markets today.

$Meta Platforms (META.US)$ shares s...

46

2

5

Ksui93

voted

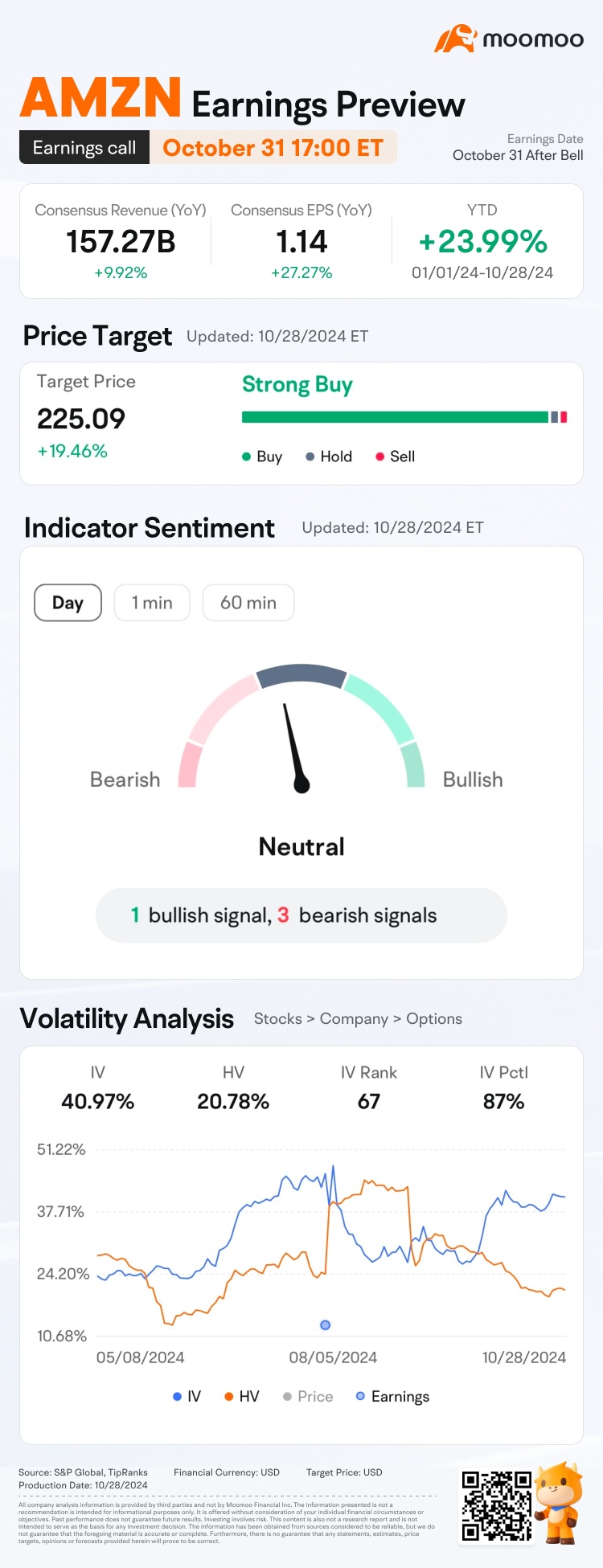

$Super Micro Computer (SMCI.US)$ pole-vaulted over $Tesla (TSLA.US)$ to become the second most active stock option amid increasing demand for protective put options that could shield the holder from further downside potential.

SMCI shares gapped down 30% to the lowest level since January after the IT solutions provider that sells liquid-cooling solutions to $NVIDIA (NVDA.US)$ said its auditor, Ernst & Young, ...

SMCI shares gapped down 30% to the lowest level since January after the IT solutions provider that sells liquid-cooling solutions to $NVIDIA (NVDA.US)$ said its auditor, Ernst & Young, ...

51

18

33

Ksui93

voted

The market is buzzing today with an intriguing mix of gains and pullbacks across the Magnificent 7 stocks. Here’s a quick breakdown of the action:

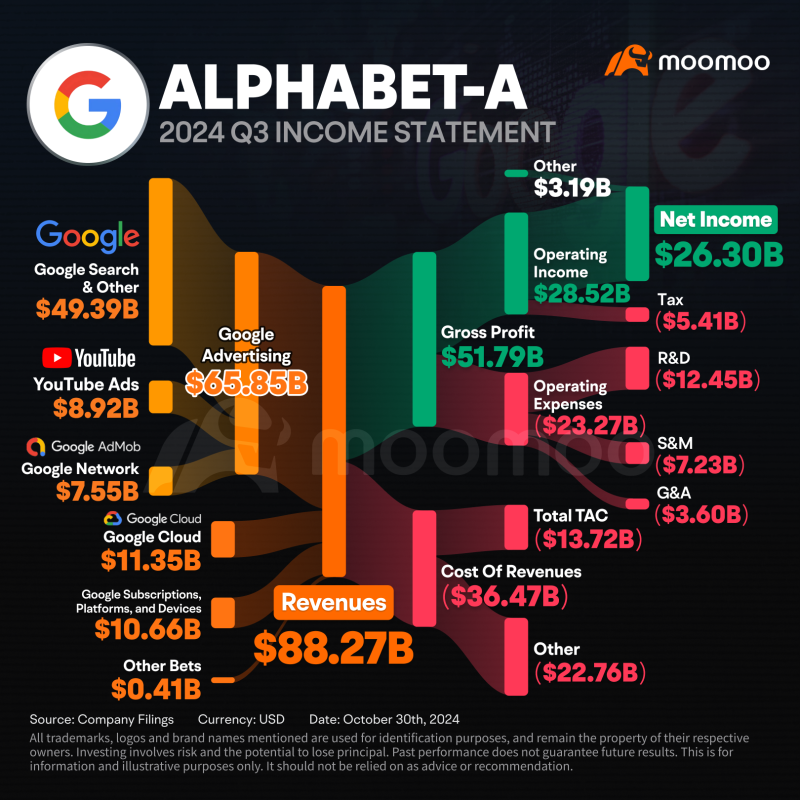

• $Alphabet-A (GOOGL.US)$ : today’s big winner, surging +6.16%. Investors are responding positively to recent AI advancements, fueling strong buying interest. Google’s MACD indicates strong upward momentum, supporting its powerful performance.

• $Amazon (AMZN.US)$ : also shines, up +2.27%. The e-commerce ...

• $Alphabet-A (GOOGL.US)$ : today’s big winner, surging +6.16%. Investors are responding positively to recent AI advancements, fueling strong buying interest. Google’s MACD indicates strong upward momentum, supporting its powerful performance.

• $Amazon (AMZN.US)$ : also shines, up +2.27%. The e-commerce ...

28

1

Ksui93

commented on

$Super Micro Computer (SMCI.US)$ for a big 4 audit firm to resign it means shit is going down.

3

1

let's see what is up today!

Ksui93

voted

Life Water IPO 讲解:

1) YouTube

2) fb.watch/vuNBS8...

Source: LIFE WATER BERHAD IPO Prospectus

Figure 1: IPO timetable of LIFE WATER BERHAD

-Will be listed on the Main Board

Info of IPO

Enlarged no. of shares upon listing: 473.1795 million

IPO price: RM0.65

Market capitalization: RM307.56 million

Estimated funds to raise from Public Issue: RM63.41million

PE ratio = 10.93x (based on FY2024)

Figure 2: Business model of LIFE WATER ...

1) YouTube

2) fb.watch/vuNBS8...

Source: LIFE WATER BERHAD IPO Prospectus

Figure 1: IPO timetable of LIFE WATER BERHAD

-Will be listed on the Main Board

Info of IPO

Enlarged no. of shares upon listing: 473.1795 million

IPO price: RM0.65

Market capitalization: RM307.56 million

Estimated funds to raise from Public Issue: RM63.41million

PE ratio = 10.93x (based on FY2024)

Figure 2: Business model of LIFE WATER ...

+5

11

3

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)