kurohige

liked

$SEALSQ Corp (LAES.US)$

It's not just LAES going down, it's a correction, if you panic and sell now, you will miss the rebound tomorrow and incur losses!

"He who controls the rebound controls the investment."

Faint and wait.

It's not just LAES going down, it's a correction, if you panic and sell now, you will miss the rebound tomorrow and incur losses!

"He who controls the rebound controls the investment."

Faint and wait.

Translated

19

2

kurohige

liked and commented on

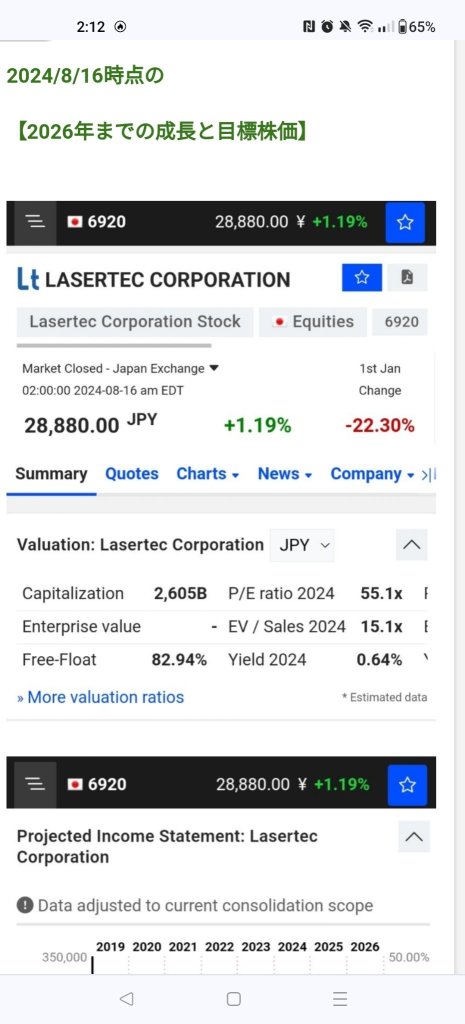

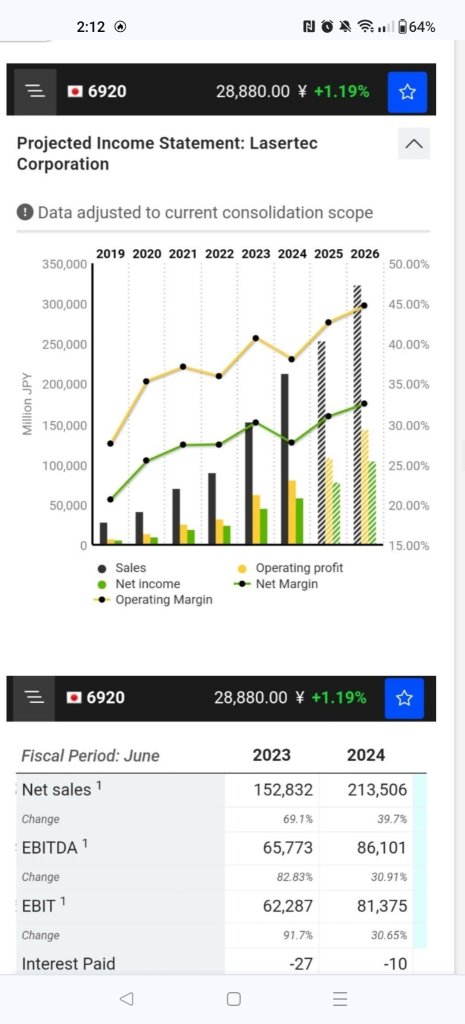

$Lasertec (6920.JP)$

The growth has just begun!

https://stembeikokukabu.blogspot.com/2023/04/2025.html?m=1

The growth has just begun!

https://stembeikokukabu.blogspot.com/2023/04/2025.html?m=1

Translated

+1

3

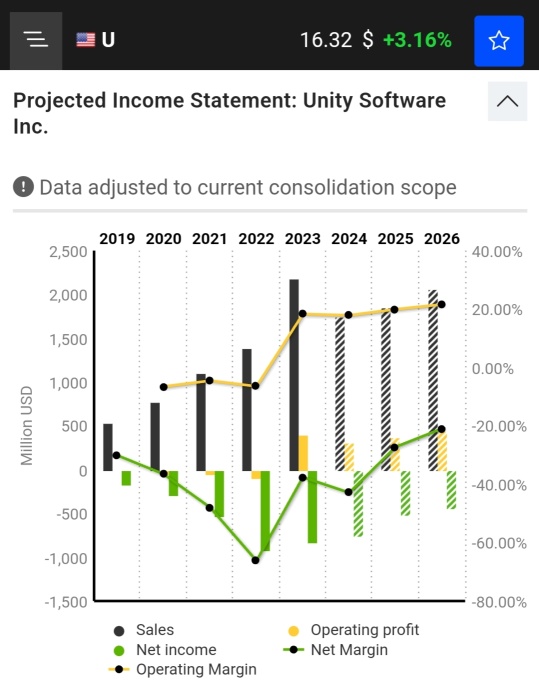

$Unity Software (U.US)$

This is the average financial estimates by analysts after the latest earnings announcement.

EBIT is positive, but it is expected that the net profit will continue to be negative.

I am concerned that the sales growth is small.

This is the average financial estimates by analysts after the latest earnings announcement.

EBIT is positive, but it is expected that the net profit will continue to be negative.

I am concerned that the sales growth is small.

Translated

1

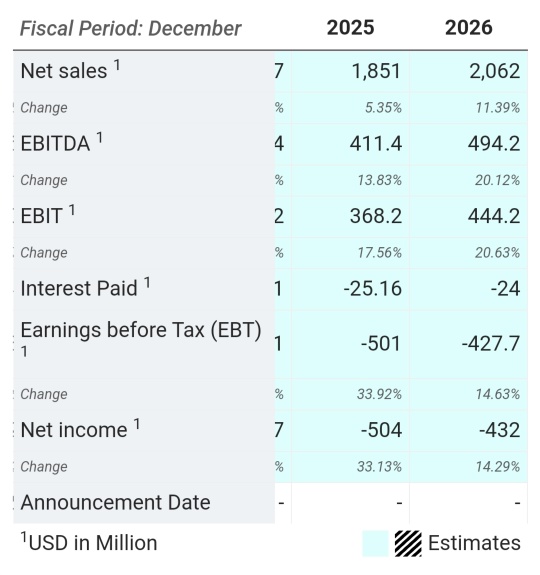

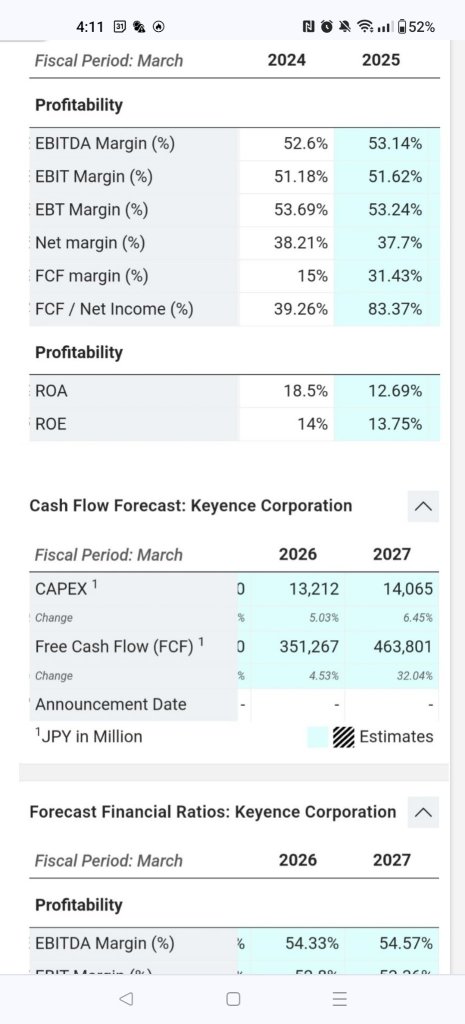

$Keyence (6861.JP)$

PER is high, but this growth rate is reasonable 🔥🔥

Free cash flow is also expected to be 460 billion yen in 2027!

https://stembeikokukabu.blogspot.com/2023/03/keyence20233.html?m=1

PER is high, but this growth rate is reasonable 🔥🔥

Free cash flow is also expected to be 460 billion yen in 2027!

https://stembeikokukabu.blogspot.com/2023/03/keyence20233.html?m=1

Translated

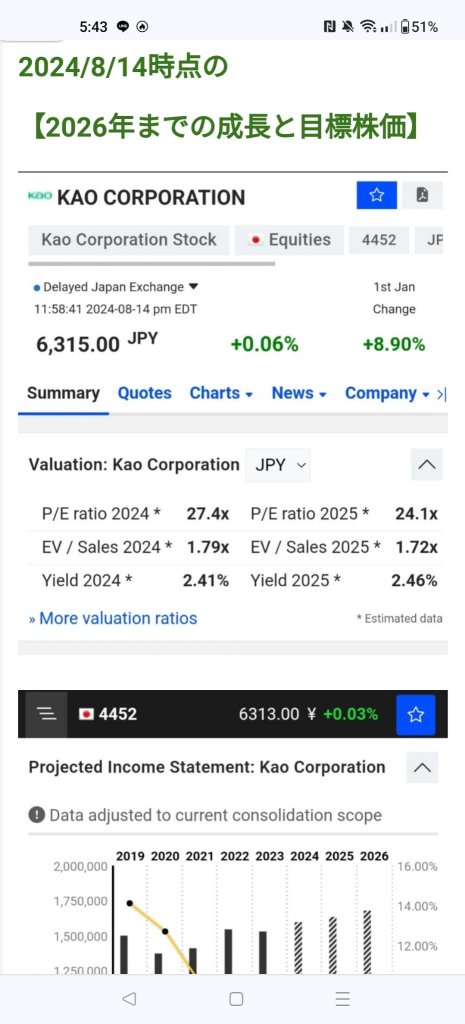

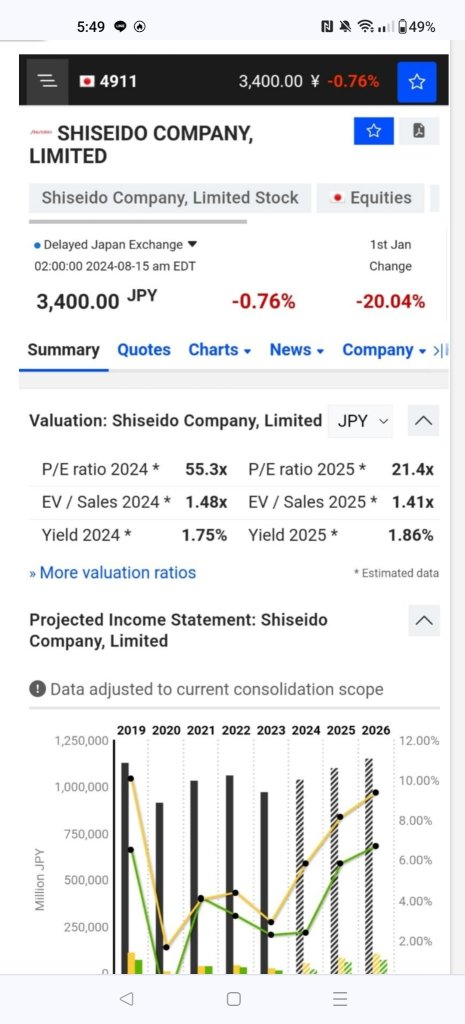

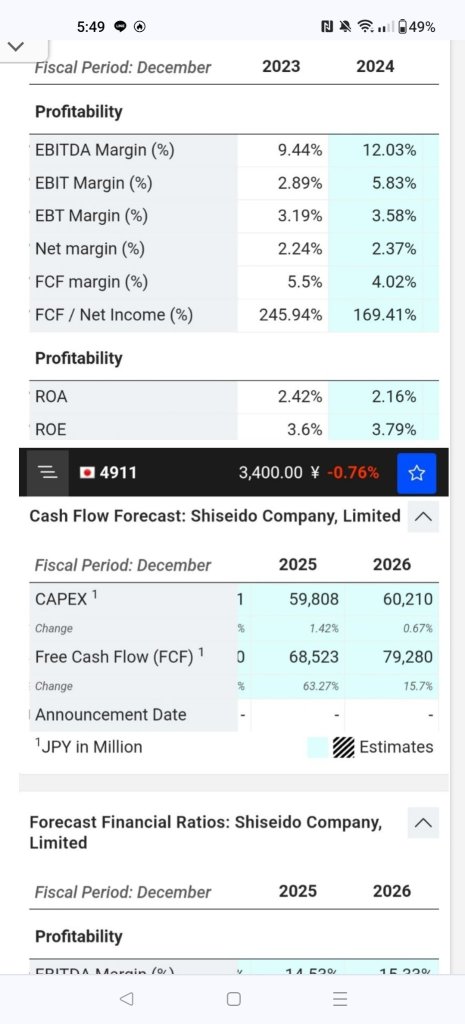

$Kao (4452.JP)$ $Shiseido (4911.JP)$

There was a comparison article after the latest financial results.

https://stembeikokukabu.blogspot.com/2023/04/2_3.html?m=1

There was a comparison article after the latest financial results.

https://stembeikokukabu.blogspot.com/2023/04/2_3.html?m=1

Translated

+1

3

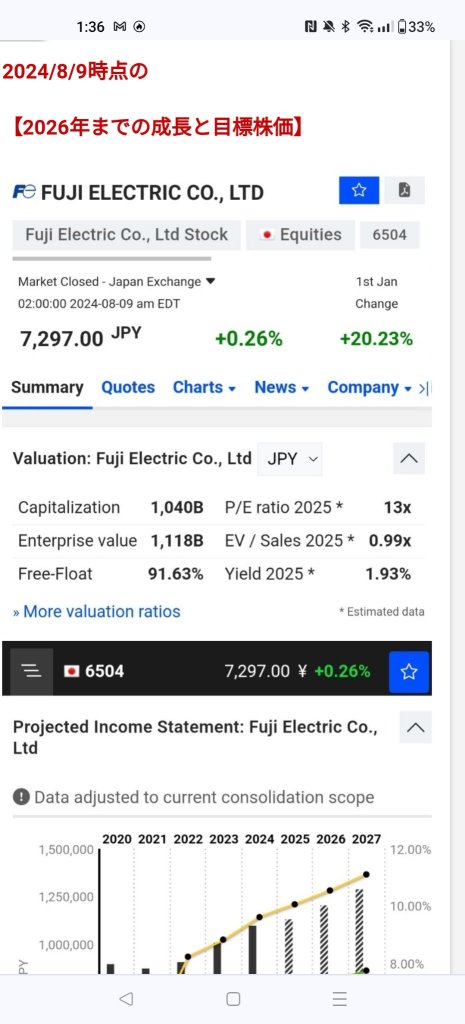

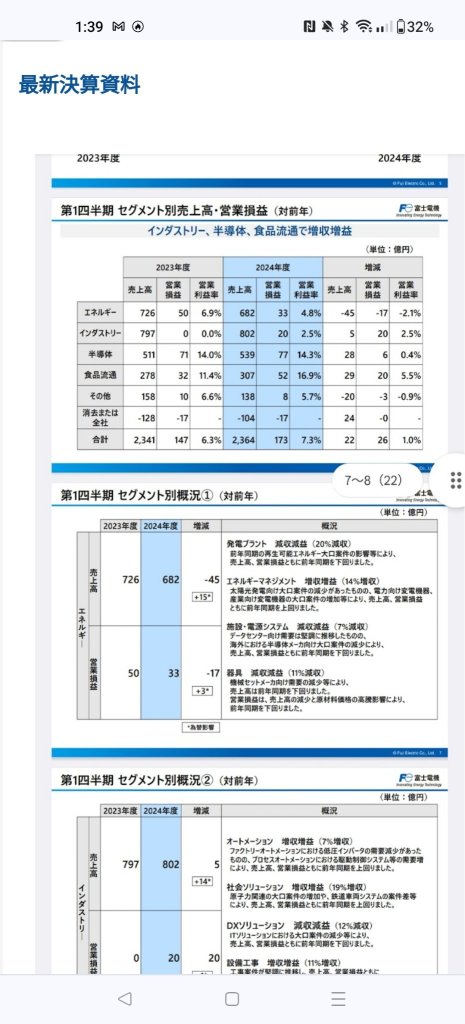

$Fuji Electric (6504.JP)$

https://stembeikokukabu.blogspot.com/2024/08/120238202482026.html?m=1

Record high profit forecast every year in the future

I'll buy it for the long term!

After the latest financial results

Expected ROE for 2027 7.72%

2027 net profit margin forecast 19.37%

https://stembeikokukabu.blogspot.com/2024/08/120238202482026.html?m=1

Record high profit forecast every year in the future

I'll buy it for the long term!

After the latest financial results

Expected ROE for 2027 7.72%

2027 net profit margin forecast 19.37%

Translated

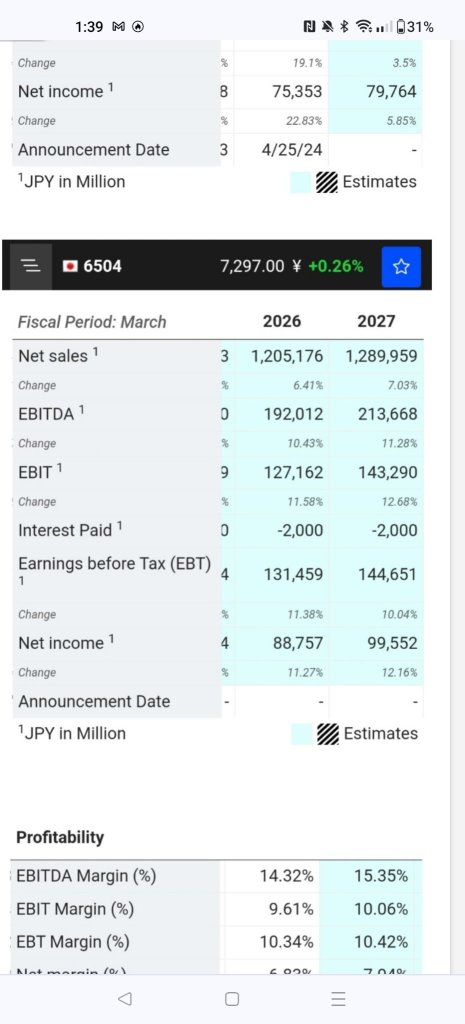

$YASKAWA Electric (6506.JP)$ $Fanuc (6954.JP)$

Summary of stock price indicators, financial indicators, revenue and profit forecasts until 2026 for the two major domestic robot-related companies, and the average target stock price from analysts one year later.It is linked.

The image has been partially excerpted from the link.

Summary of stock price indicators, financial indicators, revenue and profit forecasts until 2026 for the two major domestic robot-related companies, and the average target stock price from analysts one year later.It is linked.

The image has been partially excerpted from the link.

Translated

+1

4

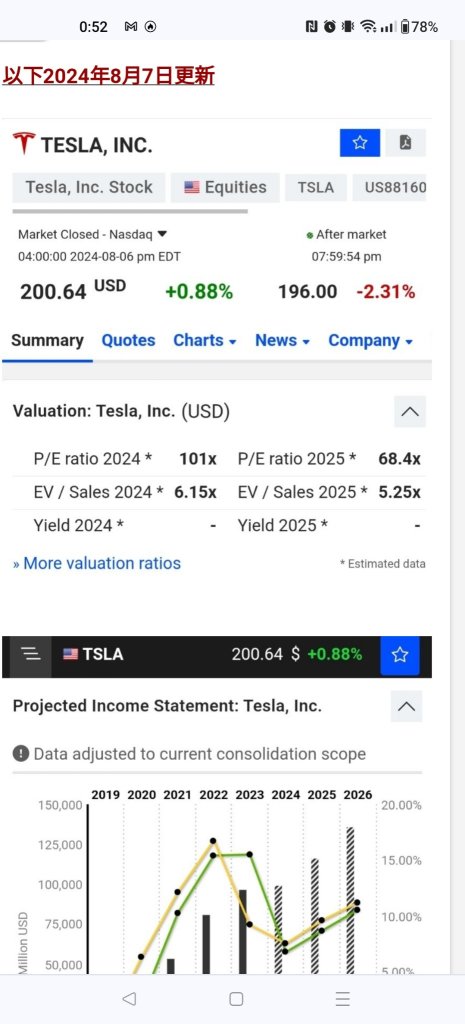

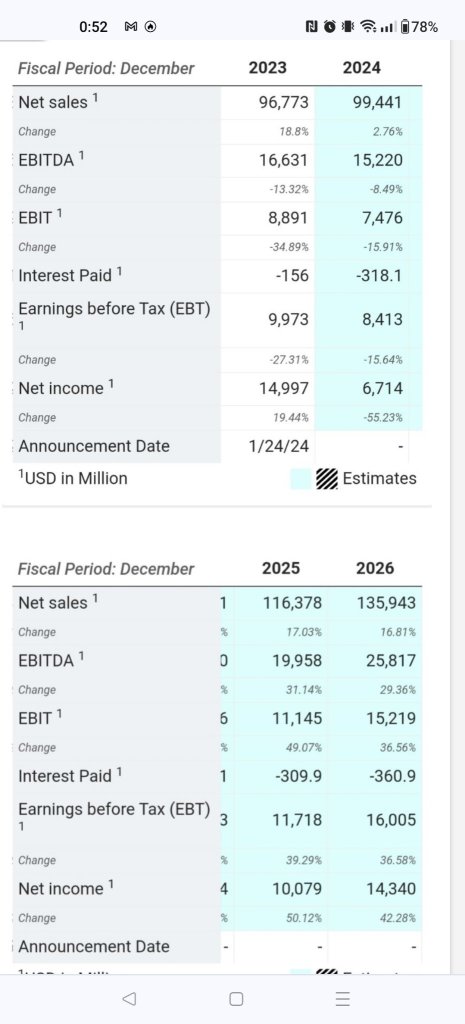

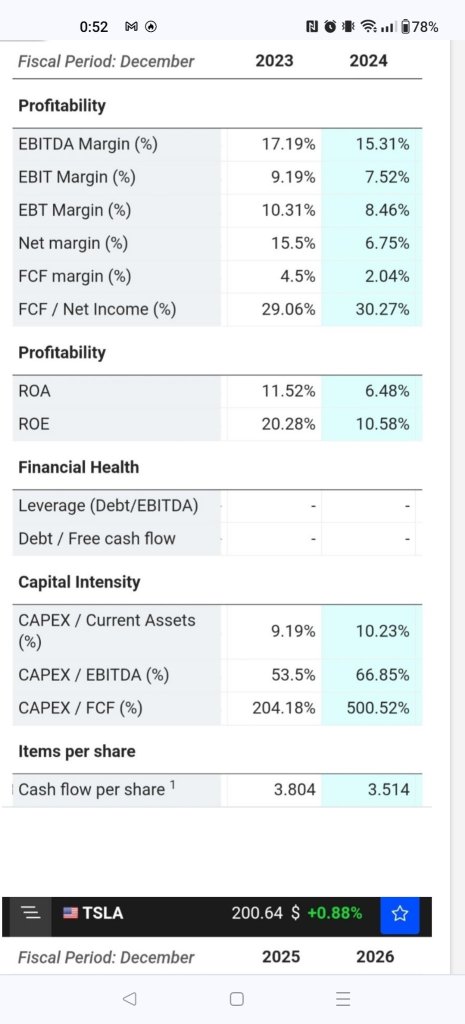

$Tesla (TSLA.US)$

There was a comparative article on the latest settlement of Tesla and TOYOTA.

If you want to buy, is it TOYOTA?

I expect that Tesla will recover its revenue, but it seems to be difficult to recover its profit margin.

If the robot taxi doesn't work out!

Image excerpt from the article below:

Financial indicators after the latest financial results for Tesla vs. Toyota

There was a comparative article on the latest settlement of Tesla and TOYOTA.

If you want to buy, is it TOYOTA?

I expect that Tesla will recover its revenue, but it seems to be difficult to recover its profit margin.

If the robot taxi doesn't work out!

Image excerpt from the article below:

Financial indicators after the latest financial results for Tesla vs. Toyota

Translated

12

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)