KW CHEOK

voted

KW CHEOK

voted

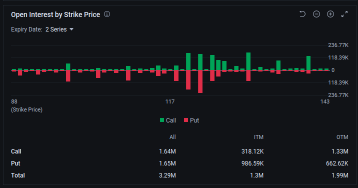

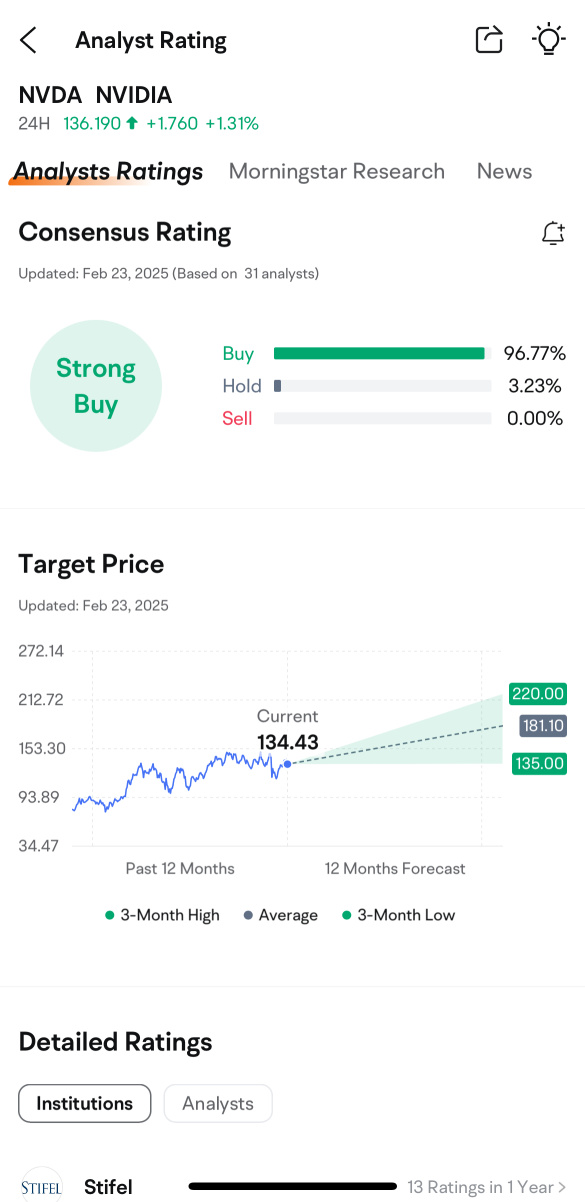

Given the extensive updates and technological innovations expected at NVIDIA's GTC 2025, coupled with historical data suggesting a high likelihood of $NVIDIA (NVDA.US)$'s stock price increasing during such events, a strategic approach to options trading can be particularly beneficial. Here's an integrated strategy that leverages both the expected technological announcements and historical stock performance.

Introduction

$NVIDIA (NVDA.US)$'s premier...

+6

108

23

14

KW CHEOK

voted

Hey mooer! Attention AI enthusiasts, $NVIDIA (NVDA.US)$ GTC 2025 is coming! 🚀

NVIDIA GTC 2025 is returning to San Jose from March 17-21, bringing together industry leaders to explore the future of quantum computing and AI. This premier event offers a unique opportunity to dive deep into cutting-edge technologies that are shaping our future.

Highlights:

– Keynote speech by NVIDIA CEO Jensen Huang (March 18, 10:00 a.m. PT) on the topic "Driving t...

NVIDIA GTC 2025 is returning to San Jose from March 17-21, bringing together industry leaders to explore the future of quantum computing and AI. This premier event offers a unique opportunity to dive deep into cutting-edge technologies that are shaping our future.

Highlights:

– Keynote speech by NVIDIA CEO Jensen Huang (March 18, 10:00 a.m. PT) on the topic "Driving t...

GTC Keynote With NVIDIA CEO Jensen Huang

Mar 19 01:00

368

340

61

KW CHEOK

voted

$NVIDIA (NVDA.US)$

Jensen Huang, Founder and CEO of Nvidia, will deliver the keynote at GTC 2025. This event, scheduled for March 18 at 1:00 PM ET / March 19 at 1:00 AM SGT / March 19 at 4:00 AM AEST, will cover groundbreaking advancements in AI, digital twins, cloud technologies, and sustainable computing.

Huang's keynote will provide a visionary roadmap of Nvidia's role in shaping the AI-driven world. Subscribe to join the live NOW!

NVIDIA Stock Predicti...

Jensen Huang, Founder and CEO of Nvidia, will deliver the keynote at GTC 2025. This event, scheduled for March 18 at 1:00 PM ET / March 19 at 1:00 AM SGT / March 19 at 4:00 AM AEST, will cover groundbreaking advancements in AI, digital twins, cloud technologies, and sustainable computing.

Huang's keynote will provide a visionary roadmap of Nvidia's role in shaping the AI-driven world. Subscribe to join the live NOW!

NVIDIA Stock Predicti...

GTC Keynote With NVIDIA CEO Jensen Huang

Mar 19 01:00

431

331

65

KW CHEOK

liked

Last night, as soon as the U.S. stock market opened, it plummeted, and my account showed a loss that peaked at 14,000 USD (approximately 0.06 million MYR), subsequently, my automatic stop-loss and take-profit orders were triggered in succession. Initially, I wanted to witness $NASDAQ (NASDAQ.US)$ whether there would be a long-awaited circuit breaker (dropping to 7%), but by the closing time, it did not happen.

This morning, I saw a sea of sorrow in the market, the Malaysian stock market also opened lower with a gap, here are some tips to share with beginners:

1. When it is raining heavily, do not bet on when it will stop; during a crash, do not bet on where the bottom is, always respect the power of the market.

2. For every stock, you should know when to exit as soon as you enter.

3. As the market goes bearish, short-term trends will be driven by emotions, and all strategies will fail.

4. Do not expect to always do things right; if a mistake is made, you must admit it. I know it's hard, which is why I have always demonstrated how to openly acknowledge losses.

5. We can only earn the money that we can afford to lose. If the current losses are not significant, but they are beyond your capacity to bear, then that amount is your limit for profits in the Stocks market.

6. Stay focused and calm, do not let market emotions lead you by the nose. A lifelong commitment to trading means that daily, monthly, or yearly fluctuations are merely growing pains for me. As long as strict stop-losses are maintained, capital is protected, reviews are optimized, and disciplined buying and selling are followed, long-term gains will certainly outweigh losses.

*I will be making a market analysis video soon:https://bit.ly/jackinvestmentyoutube

...

This morning, I saw a sea of sorrow in the market, the Malaysian stock market also opened lower with a gap, here are some tips to share with beginners:

1. When it is raining heavily, do not bet on when it will stop; during a crash, do not bet on where the bottom is, always respect the power of the market.

2. For every stock, you should know when to exit as soon as you enter.

3. As the market goes bearish, short-term trends will be driven by emotions, and all strategies will fail.

4. Do not expect to always do things right; if a mistake is made, you must admit it. I know it's hard, which is why I have always demonstrated how to openly acknowledge losses.

5. We can only earn the money that we can afford to lose. If the current losses are not significant, but they are beyond your capacity to bear, then that amount is your limit for profits in the Stocks market.

6. Stay focused and calm, do not let market emotions lead you by the nose. A lifelong commitment to trading means that daily, monthly, or yearly fluctuations are merely growing pains for me. As long as strict stop-losses are maintained, capital is protected, reviews are optimized, and disciplined buying and selling are followed, long-term gains will certainly outweigh losses.

*I will be making a market analysis video soon:https://bit.ly/jackinvestmentyoutube

...

Translated

12

5

1

KW CHEOK

voted

Hi, mooers! 👋

The AI world holds its breath! $NVIDIA (NVDA.US)$ will release its Q4 FY2025 earnings on February 26, just before the market opens. As the AI kingpin faces heightened scrutiny amid market volatility, will it defy expectations again? This is your chance to earn rewards and gain insights by predicting the opening price. Let’s get into it! 🎉

Stay Ahead of the Game

Subscribe to @Moo Live for real-time updates, expert analysis, and t...

The AI world holds its breath! $NVIDIA (NVDA.US)$ will release its Q4 FY2025 earnings on February 26, just before the market opens. As the AI kingpin faces heightened scrutiny amid market volatility, will it defy expectations again? This is your chance to earn rewards and gain insights by predicting the opening price. Let’s get into it! 🎉

Stay Ahead of the Game

Subscribe to @Moo Live for real-time updates, expert analysis, and t...

645

1022

40

KW CHEOK

liked

$Spire Global (SPIR.US)$ Yesterday, the stock price plummeted by 50%, resulting in an overnight paper loss of $9,000 (approximately RM40,000). My automatic stop-loss Market Order could not be executed during the night session, leaving me to accept this wave of decline.

I think this is a rare practical experience, and I would like to Share my thoughts on how to respond to a sharp decline:

1. First, identify the reason for the sharp drop in stock price.

SPIR is a stock in the space sector, and I really like its business. In November last year, it signed an agreement to sell certain businesses to another company, which caused the stock price to rise. Subsequently, that company defaulted, and SPIR officially issued a lawsuit statement yesterday, leading to a correction of the price increase and a gap down.

Although this wave of news is bearish, it isn’t severe for me and does not directly affect the business model of SPIR, which I am bullish on.

2. Let's analyze the stock price after the sharp decline.

In my previous YouTube video about "gaps", it was mentioned that when stock prices experience a gap down, it indicates a Bearish market, leading the market to prefer selling off, which is often irrational.https://youtu.be/udX6jEygML8

From a technical perspective, the stock price fell sharply to around $9 last night, even lower than the price before the acquisition in November last year. For me, this price level is an overreaction to the bearish news and aligns with the irrational market reaction in gap theory. Therefore, there is no rush to cut losses; $9 is already a reasonable price in the bottom area (meaning that even if the lawsuit is unsuccessful, this company is likely still worth...).

I think this is a rare practical experience, and I would like to Share my thoughts on how to respond to a sharp decline:

1. First, identify the reason for the sharp drop in stock price.

SPIR is a stock in the space sector, and I really like its business. In November last year, it signed an agreement to sell certain businesses to another company, which caused the stock price to rise. Subsequently, that company defaulted, and SPIR officially issued a lawsuit statement yesterday, leading to a correction of the price increase and a gap down.

Although this wave of news is bearish, it isn’t severe for me and does not directly affect the business model of SPIR, which I am bullish on.

2. Let's analyze the stock price after the sharp decline.

In my previous YouTube video about "gaps", it was mentioned that when stock prices experience a gap down, it indicates a Bearish market, leading the market to prefer selling off, which is often irrational.https://youtu.be/udX6jEygML8

From a technical perspective, the stock price fell sharply to around $9 last night, even lower than the price before the acquisition in November last year. For me, this price level is an overreaction to the bearish news and aligns with the irrational market reaction in gap theory. Therefore, there is no rush to cut losses; $9 is already a reasonable price in the bottom area (meaning that even if the lawsuit is unsuccessful, this company is likely still worth...).

Translated

43

4

1

KW CHEOK

voted

Good morning mooers! Here are things you need to know about today's market:

Tuesday the US Market Pulls Back After Nvidia All Time High.

The FBM KLCI ended its three-day losing streak with a higher close.

Stocks to watch: Swift Enetgy,Airport.

- Moomoo News MY

Wall Street Summary

$S&P 500 Index (.SPX.US)$ 5,909.03(-1.11%)

$Dow Jones Industrial Average (.DJI.US)$ 42,528.36(-0.42%)

$Nasdaq Composite Index (.IXIC.US)$ 19,489.68(-1.89%)

...

Tuesday the US Market Pulls Back After Nvidia All Time High.

The FBM KLCI ended its three-day losing streak with a higher close.

Stocks to watch: Swift Enetgy,Airport.

- Moomoo News MY

Wall Street Summary

$S&P 500 Index (.SPX.US)$ 5,909.03(-1.11%)

$Dow Jones Industrial Average (.DJI.US)$ 42,528.36(-0.42%)

$Nasdaq Composite Index (.IXIC.US)$ 19,489.68(-1.89%)

...

28

7

12

KW CHEOK

commented on

$United Money Market Fund-Class R (MYU9100AN000.MF)$ I subsribed this fund on 20th Sep and applied the 2% 30 days yield coupon. Was able to receive the 2% returns daily but it ended on 11th Oct.(Only 20 days?) I thought its suppose to be 30 days intead of 20? Please advice.

2

7

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)