Lana129

liked

#HangSengtech $Hang Seng TECH Index (800700.HK)$ made a remarkable 50% recovery in just two weeks, raising the question: is this the long-awaited reversal for Hong Kong's struggling stock market?

In this video, I explore whether this surge signals a true market turnaround and share my insights on future price movements.

Follow me for more timely insights!![]()

In this video, I explore whether this surge signals a true market turnaround and share my insights on future price movements.

Follow me for more timely insights!

19

Lana129

commented on

6

3

Lana129

liked

$Alibaba (BABA.US)$ many big fk companies and investors selling a huge amount of baba shares for securing profits after it surges, should pullback to below 92 today

9

4

Lana129

liked

$Direxion Daily 20+ Year Treasury Bull 3X Shares ETF (TMF.US)$

$Bitcoin (BTC.CC)$

$Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$

Fundamental analysis.

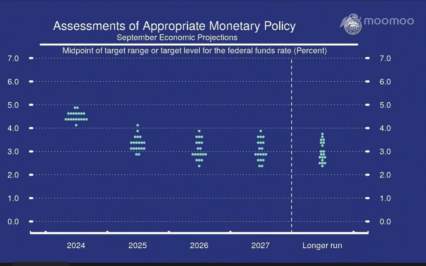

SOXL, bitcoin (rating: 3.3/5): The rate cut exceeded expectations and caused confusion, but Powell's remarks shifted to risk-on mode. However, it is likely to be a temporary increase.

TMF (rating: 3.1/5): The rate cut exceeded expectations causing confusion, negative for bonds. Also, as money flows into risk assets and the yield of US 10-year bonds temporarily rises, it suppresses bond price movements. Due to the temporary increase in risk assets, it is believed that the yield of US 10-year bonds will gradually soften in the future.

=====================================================

☆ US economic indicators (evaluation: SOXL, TMF, Bitcoin ...

$Bitcoin (BTC.CC)$

$Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$

Fundamental analysis.

SOXL, bitcoin (rating: 3.3/5): The rate cut exceeded expectations and caused confusion, but Powell's remarks shifted to risk-on mode. However, it is likely to be a temporary increase.

TMF (rating: 3.1/5): The rate cut exceeded expectations causing confusion, negative for bonds. Also, as money flows into risk assets and the yield of US 10-year bonds temporarily rises, it suppresses bond price movements. Due to the temporary increase in risk assets, it is believed that the yield of US 10-year bonds will gradually soften in the future.

=====================================================

☆ US economic indicators (evaluation: SOXL, TMF, Bitcoin ...

Translated

12

Lana129

liked and commented on

$Bitcoin (BTC.CC)$

Technical analysis (Rating: 3.2/5)

From the low point on 6/9, there is a trend of multiple consecutive positive candles. A typical Sakata's Five Methods pattern of 'Red Three Soldiers' is observed. Additionally, a short-term cycle of '①rise ②consolidation ③rise' is forming, corresponding to Sakata's Five Methods 'Three Rising Methods'. It can be seen as evidence of riding a typical uptrend.

A double bottom formation is in progress. It will be completed by breaking through the "near 64500" neckline. After completion, there is room for an increase up to around "66000". However, it may still be a while before the neckline breach of the double top formed in July.

Currently, it is in a state where it is hindered by the downward trend factors "② Halistrade reconsideration (66000)" and "③ Yen carry trade rollback concerns", and a trend reversal that cancels out ② and ③ is necessary for a new high update. As an immediate target, it is urgent to break the criteria of ②. If it cannot be broken through, there is a high possibility that the current level will temporarily become a ceiling due to the failure of the upward trend reversal. In that case, it may be necessary to accept a decline of up to 58000.

The upward momentum is strong, but the sell pressure at the current high is also great. To reverse this, a breakthrough above the resistance at ④ is necessary. If the breakout fails, the possibility of revisiting the level of ⑤ should be considered, where a potential sell-off may occur.

Technical analysis (Rating: 3.2/5)

From the low point on 6/9, there is a trend of multiple consecutive positive candles. A typical Sakata's Five Methods pattern of 'Red Three Soldiers' is observed. Additionally, a short-term cycle of '①rise ②consolidation ③rise' is forming, corresponding to Sakata's Five Methods 'Three Rising Methods'. It can be seen as evidence of riding a typical uptrend.

A double bottom formation is in progress. It will be completed by breaking through the "near 64500" neckline. After completion, there is room for an increase up to around "66000". However, it may still be a while before the neckline breach of the double top formed in July.

Currently, it is in a state where it is hindered by the downward trend factors "② Halistrade reconsideration (66000)" and "③ Yen carry trade rollback concerns", and a trend reversal that cancels out ② and ③ is necessary for a new high update. As an immediate target, it is urgent to break the criteria of ②. If it cannot be broken through, there is a high possibility that the current level will temporarily become a ceiling due to the failure of the upward trend reversal. In that case, it may be necessary to accept a decline of up to 58000.

The upward momentum is strong, but the sell pressure at the current high is also great. To reverse this, a breakthrough above the resistance at ④ is necessary. If the breakout fails, the possibility of revisiting the level of ⑤ should be considered, where a potential sell-off may occur.

Translated

19

2

Lana129

voted

Happy Friday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the top ten buzzing stocks on moomoo based on search and message volumes! Comment below to answer the Weekly Topic question for a chance to win an award!

By @Kevin Travers | moomoo News

Make Your Choice

Weekly Buzz

This week was about the FOMC rate 50 basis point target Federal Funds rate cut decision, released Wdnesday. After the new...

By @Kevin Travers | moomoo News

Make Your Choice

Weekly Buzz

This week was about the FOMC rate 50 basis point target Federal Funds rate cut decision, released Wdnesday. After the new...

+14

72

38

Lana129

liked

$Bitcoin (BTC.CC)$

* Since the analysis is based on a 1-hour timeframe, there is a possibility of significant volatility from here. This is being considered as one reference point.

Fundamental analysis.

- Major cryptocurrency exchangesCoinbase Global Inc Class A Brian Armstrong, CEO of Coinbase Global Inc Class A, emphasized the need for clear cryptocurrency regulations in the USA and the importance of "crypto votes" in the upcoming electionhighlighted the importance of "crypto votes" in the upcoming electionCoinbase CEO, emphasizing the "necessity" of cryptocurrency regulations and the "importance" in the election - CRYPTO TIMES

- BlackRock regarding Bitcoin (BTC)

bitcoin by BlackRockPublish the report and emphasize the 'unique diversified investment' that is detached from traditional financial risks and geopolitical risks for investors.Publish the report and emphasize the 'unique diversified investment' that is detached from traditional financial risks and geopolitical risks for investors.

Cointelegraph.com

Technical analysis (Rating: 2.12/5)

Summary: There is room for a decline after a temporary pause from the rapid rise, and it is likely to fall to around 62,000 after completing the double top chart pattern. Also, be cautious if the MDI/ADX of DMI shows a rapid rise.

- Candlestick patterns...

* Since the analysis is based on a 1-hour timeframe, there is a possibility of significant volatility from here. This is being considered as one reference point.

Fundamental analysis.

- Major cryptocurrency exchangesCoinbase Global Inc Class A Brian Armstrong, CEO of Coinbase Global Inc Class A, emphasized the need for clear cryptocurrency regulations in the USA and the importance of "crypto votes" in the upcoming electionhighlighted the importance of "crypto votes" in the upcoming electionCoinbase CEO, emphasizing the "necessity" of cryptocurrency regulations and the "importance" in the election - CRYPTO TIMES

- BlackRock regarding Bitcoin (BTC)

bitcoin by BlackRockPublish the report and emphasize the 'unique diversified investment' that is detached from traditional financial risks and geopolitical risks for investors.Publish the report and emphasize the 'unique diversified investment' that is detached from traditional financial risks and geopolitical risks for investors.

Cointelegraph.com

Technical analysis (Rating: 2.12/5)

Summary: There is room for a decline after a temporary pause from the rapid rise, and it is likely to fall to around 62,000 after completing the double top chart pattern. Also, be cautious if the MDI/ADX of DMI shows a rapid rise.

- Candlestick patterns...

Translated

7

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)