Learningslow

commented on

$GENM (4715.MY)$ Nov, Dec, Jan & Feb are tradicionally Genting's best months due year end holidays & Lunar New Year which falls on 29/1/25.

1

Learningslow

reacted to

$GENM (4715.MY)$ everyday break new low. wtf

2

2

Learningslow

liked

$GENM (4715.MY)$

there is a specualtion that genting malaysia and genting will be kick out of KLCI in the next KLCI conponent review. whixh i think is true as 99speed mart market capital is higher than genting right now which will replace them. therefore this will cause the price to drop lower. So for those that want to buy you need to wait after they get kick out then inly go buy.

there is a specualtion that genting malaysia and genting will be kick out of KLCI in the next KLCI conponent review. whixh i think is true as 99speed mart market capital is higher than genting right now which will replace them. therefore this will cause the price to drop lower. So for those that want to buy you need to wait after they get kick out then inly go buy.

4

9

Learningslow

reacted to

$GENM (4715.MY)$ No strength left, lost going up the mountain and lost here too 😂😂

Translated

4

Learningslow

commented on

Learningslow

liked

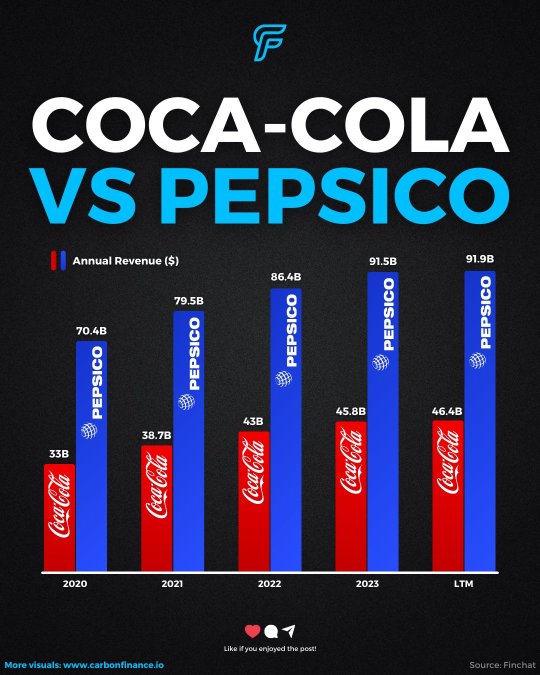

Last Wednesday, Coca-Cola reported earnings that beat expectations on both the top and bottom lines.

Organic revenue grew 9%, but global unit case volume dropped 1%, driven by weaker demand in China, Mexico, and Türkiye.

North America saw flat volume growth. How did sales rise despite declining volume?

Price increases. Coca-Cola raised prices by 10%, helping boost revenue.

That said, Coke’s CEO James Quincy said consumers are “e...

Organic revenue grew 9%, but global unit case volume dropped 1%, driven by weaker demand in China, Mexico, and Türkiye.

North America saw flat volume growth. How did sales rise despite declining volume?

Price increases. Coca-Cola raised prices by 10%, helping boost revenue.

That said, Coke’s CEO James Quincy said consumers are “e...

7

1

1

Learningslow

liked

Portfolio diversification is the strategy of spreading investments across different assets, sectors, industries, and geographical regions to reduce the overall risk of the portfolio. The idea is that by holding a variety of investments, the overall performance of the portfolio will be less dependent on the performance of any single investment, reducing the risk of large losses.

Why is Portfolio Diversification Important?

1. Risk Reduction:

Diversification...

Why is Portfolio Diversification Important?

1. Risk Reduction:

Diversification...

39

1

35

Learningslow

liked

Came across with this inspiring quotes and thought it's worth sharing.

"Working out will make you feel weak but it is actually making you stronger.

Learning new things will make you feel dumb but it is actually making you smarter.

Investing in yourself will make you feel broke but it is actually making you rich. "

"Working out will make you feel weak but it is actually making you stronger.

Learning new things will make you feel dumb but it is actually making you smarter.

Investing in yourself will make you feel broke but it is actually making you rich. "

4

1

bought at 2.32 and straight drop after that

bought at 2.32 and straight drop after that

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)