$Crude Palm Oil Futures(MAR5) (FCPOmain.MY)$

Business Society news on November 29th.

National Grain and Oil Information Center news on November 28th: Malaysiapalm oil.Palm oil Council (MPOB) will release the November monthly supply and demand data on December 10th. According to reports from plantation sources, palm oil production in Malaysia has decreased since November. Data from the Southern Malaysia Palm Oil Association shows a 3.24% month-on-month decrease in palm oil production from November 1st to 25th, with a predicted 5% month-on-month decrease in local palm oil production for November.

In November, the international palm oil price fluctuated at a high level, with export demand being suppressed. According to multiple shipping institutions, from November 1st to 25th, the export volume of Malaysian palm oil decreased by 8.2% to 9.2% compared to the previous month, with an expected decrease of around 8% month-on-month in November. Overall, it is expected that by the end of November, Malaysian palm oil inventory will continue to decrease to around 1.8 million tons, with a month-on-month decrease of 5 to 0.1 million tons. Attention is focused on the subsequent production and export situations from the origin.

(Source: Business Times)

Business Society news on November 29th.

National Grain and Oil Information Center news on November 28th: Malaysiapalm oil.Palm oil Council (MPOB) will release the November monthly supply and demand data on December 10th. According to reports from plantation sources, palm oil production in Malaysia has decreased since November. Data from the Southern Malaysia Palm Oil Association shows a 3.24% month-on-month decrease in palm oil production from November 1st to 25th, with a predicted 5% month-on-month decrease in local palm oil production for November.

In November, the international palm oil price fluctuated at a high level, with export demand being suppressed. According to multiple shipping institutions, from November 1st to 25th, the export volume of Malaysian palm oil decreased by 8.2% to 9.2% compared to the previous month, with an expected decrease of around 8% month-on-month in November. Overall, it is expected that by the end of November, Malaysian palm oil inventory will continue to decrease to around 1.8 million tons, with a month-on-month decrease of 5 to 0.1 million tons. Attention is focused on the subsequent production and export situations from the origin.

(Source: Business Times)

Translated

2

Transferred from: Caixin Media

2024.11.21

CITIC Futures: Is palm oil undergoing a pullback or reversal? [Slightly bullish]

Due to recent favorable weather conditions in South America, soybean planting in Brazil has been smooth.Soybean Market expectations for a bumper crop of soybeans in South America have increased, coupled with uncertainties in U.S. biodiesel fuel demand. On Wednesday, soybean and soybean oil prices fell.Due to recent favorable weather conditions in South America, soybean oil prices in the United States have dropped. As a result of this impact, the three major domestic edible oils experienced volatile and weak fluctuations today, and soybean palm arbitrage positions exited, leading to a significant decline in palm oil prices today. From a fundamental perspective, soybean harvesting is complete, and production is still increasing year-on-year. Currently, soybean exports from the United States are in the peak season, and the market is concerned about the biodiesel policy of the new U.S. government, which is expected to reduce biodiesel consumption of soybean oil.

Soybean planting in Brazil is progressing rapidly, according to CONAB data as of November 17, the soybean planting rate in Brazil was 73.8%, up from 66.1% last week and 65.4% in the same period of the previous year. According to Bourse data as of November 13, Argentina's soybean planting progress was at 20.1%. In the next two weeks, rainfall in Brazil and Argentina's soybean production areas is generally normal, enhancing market expectations of a bumper crop in South America. Furthermore, with the domestic cancellation of used cooking oil (UCO) tax rebates, the market is also concerned about the impact on domestic edible oil demand.

In terms of palm oil, since September, the price difference between soybean palm and rapeseed palm has continued to weaken, with palm oil having a relatively low cost-performance ratio. The market is concerned that palm oil demand will decrease, while the expectation of lower palm kernel oil exports since November has bearish impact on the palm oil market sentiment in the near term. However, November to February is the season of palm oil production reduction, and ITS, AmSpec, and SGS data respectively show that from November 1st to 20th, the environmental decrease in palm kernel oil exports...

2024.11.21

CITIC Futures: Is palm oil undergoing a pullback or reversal? [Slightly bullish]

Due to recent favorable weather conditions in South America, soybean planting in Brazil has been smooth.Soybean Market expectations for a bumper crop of soybeans in South America have increased, coupled with uncertainties in U.S. biodiesel fuel demand. On Wednesday, soybean and soybean oil prices fell.Due to recent favorable weather conditions in South America, soybean oil prices in the United States have dropped. As a result of this impact, the three major domestic edible oils experienced volatile and weak fluctuations today, and soybean palm arbitrage positions exited, leading to a significant decline in palm oil prices today. From a fundamental perspective, soybean harvesting is complete, and production is still increasing year-on-year. Currently, soybean exports from the United States are in the peak season, and the market is concerned about the biodiesel policy of the new U.S. government, which is expected to reduce biodiesel consumption of soybean oil.

Soybean planting in Brazil is progressing rapidly, according to CONAB data as of November 17, the soybean planting rate in Brazil was 73.8%, up from 66.1% last week and 65.4% in the same period of the previous year. According to Bourse data as of November 13, Argentina's soybean planting progress was at 20.1%. In the next two weeks, rainfall in Brazil and Argentina's soybean production areas is generally normal, enhancing market expectations of a bumper crop in South America. Furthermore, with the domestic cancellation of used cooking oil (UCO) tax rebates, the market is also concerned about the impact on domestic edible oil demand.

In terms of palm oil, since September, the price difference between soybean palm and rapeseed palm has continued to weaken, with palm oil having a relatively low cost-performance ratio. The market is concerned that palm oil demand will decrease, while the expectation of lower palm kernel oil exports since November has bearish impact on the palm oil market sentiment in the near term. However, November to February is the season of palm oil production reduction, and ITS, AmSpec, and SGS data respectively show that from November 1st to 20th, the environmental decrease in palm kernel oil exports...

Translated

2

Transferred from:Xinhua Finance

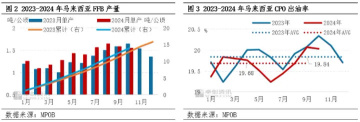

Malaysia in Octoberpalm oilWeak supply and demand were strong, and inventories at the end of the month fell short of market expectations, bringing obvious benefits to the palm oil market. Looking ahead to the future market, it is expected that horse brown will maintain seasonal production cuts in November, but at the same time, export demand is expected to decline. It is expected that inventories may maintain a downward trend in stocks at the end of November. Support on the supply and demand side will still be strong, which is beneficial to prices.

Specifically, according to October palm oil supply and demand data released by the Malaysian Palm Oil Board (MPOB), Malaysian palm oil production in October was 1.7973 million tons, down 1.35% from month to month; export volume was 1.7324 million tons, up 11.07% month on month; domestic consumption in Malaysia was 0.2104 million tons, up 36.62% month on month; inventory at the end of October was 1.8846 million tons, down 6.32% month on month. Compared with previous market estimates, production was slightly higher than expected, export volume was much higher than expected, and inventory was lower than market expectations. This report had too much impact.

On the supply side, horse brown production declined month-on-month in October, which provided favorable support for prices. According to MPOB data, in October, Malaysia's palm oil production fell 1.35% month-on-month to 1.7973 million tons, a year-on-year decrease of 7.22%. According to previous Reuters estimates, horse brown production fell to 1.76 million tons in October 2024, which was slightly higher than expected. However, during the production increase cycle, horse brown production maintained a downward trend, causing the market to expect tight supply. By region, palm oil in October...

Malaysia in Octoberpalm oilWeak supply and demand were strong, and inventories at the end of the month fell short of market expectations, bringing obvious benefits to the palm oil market. Looking ahead to the future market, it is expected that horse brown will maintain seasonal production cuts in November, but at the same time, export demand is expected to decline. It is expected that inventories may maintain a downward trend in stocks at the end of November. Support on the supply and demand side will still be strong, which is beneficial to prices.

Specifically, according to October palm oil supply and demand data released by the Malaysian Palm Oil Board (MPOB), Malaysian palm oil production in October was 1.7973 million tons, down 1.35% from month to month; export volume was 1.7324 million tons, up 11.07% month on month; domestic consumption in Malaysia was 0.2104 million tons, up 36.62% month on month; inventory at the end of October was 1.8846 million tons, down 6.32% month on month. Compared with previous market estimates, production was slightly higher than expected, export volume was much higher than expected, and inventory was lower than market expectations. This report had too much impact.

On the supply side, horse brown production declined month-on-month in October, which provided favorable support for prices. According to MPOB data, in October, Malaysia's palm oil production fell 1.35% month-on-month to 1.7973 million tons, a year-on-year decrease of 7.22%. According to previous Reuters estimates, horse brown production fell to 1.76 million tons in October 2024, which was slightly higher than expected. However, during the production increase cycle, horse brown production maintained a downward trend, causing the market to expect tight supply. By region, palm oil in October...

Translated

11

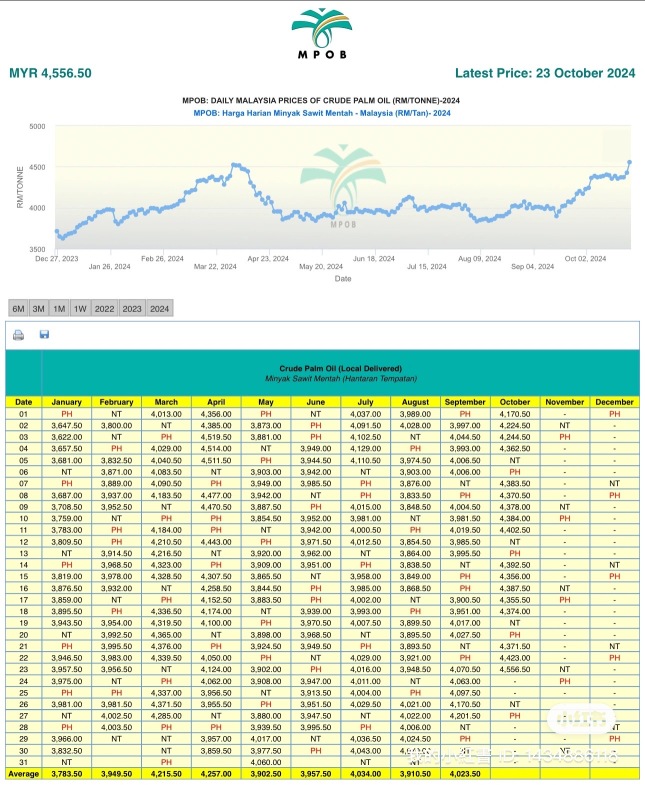

(Kuala Lumpur, 8th) Tight supply and rising soybean oil prices droveCrude Palm Oil Futuresopening high and rising today, breaking through 5000 ringgit to reach a new high in over two years.

The Malaysia Derivatives Exchange's January 2025 palm oil futures index closed up 148 ringgit or 2.99% at 5100 ringgit per metric ton, marking the highest level since mid-2022.

Crude palm oil futures rose by 4.77% this week, marking the third consecutive week of increase. Last week saw a 7.32% rise, and the week before that had a 6.60% increase.

Palm oil has risen more than 30% so far this year, as the demand for biodiesel industry is expected to grow. The growth of palm oil production is constrained by factors such as weather and aging trees. The limited supply of sunflower seeds and rapeseed globally also boosts the demand for palm oil.

Chicago Mercantile Exchange soybean oil futures surged 4.3% yesterday.

Renowned trader Mitri stated at a palm oil conference that due to the tight supply and demand of biodiesel, the price of palm oil will range from 5,000 ringgit per ton to $6 per ton until June.

Indonesian energy and mineral resources department bioenergy director Eddie Weberwo expressed at an industry conference on Thursday that the Indonesian government proposed to increase the mandatory blending ratio of biodiesel to 50% by 2028.

The Indian Refining Association stated that favorable weather may promote domestic oilseed production, and India's vegetable oil imports for the 2024/5 fiscal year will decrease to 15 million tons.

Next Monday, the Malaysian Palm Oil Board (MPOB) will release...

The Malaysia Derivatives Exchange's January 2025 palm oil futures index closed up 148 ringgit or 2.99% at 5100 ringgit per metric ton, marking the highest level since mid-2022.

Crude palm oil futures rose by 4.77% this week, marking the third consecutive week of increase. Last week saw a 7.32% rise, and the week before that had a 6.60% increase.

Palm oil has risen more than 30% so far this year, as the demand for biodiesel industry is expected to grow. The growth of palm oil production is constrained by factors such as weather and aging trees. The limited supply of sunflower seeds and rapeseed globally also boosts the demand for palm oil.

Chicago Mercantile Exchange soybean oil futures surged 4.3% yesterday.

Renowned trader Mitri stated at a palm oil conference that due to the tight supply and demand of biodiesel, the price of palm oil will range from 5,000 ringgit per ton to $6 per ton until June.

Indonesian energy and mineral resources department bioenergy director Eddie Weberwo expressed at an industry conference on Thursday that the Indonesian government proposed to increase the mandatory blending ratio of biodiesel to 50% by 2028.

The Indian Refining Association stated that favorable weather may promote domestic oilseed production, and India's vegetable oil imports for the 2024/5 fiscal year will decrease to 15 million tons.

Next Monday, the Malaysian Palm Oil Board (MPOB) will release...

Translated

1

This article is from: Finance WorldAITelegram

Effin Investment Bank analyst Yan Huiling stated in a report that due to tight supply, crudepalm oilprices may rise in 2025. She predicts that the average price of crude palm oil next year will be 4,250 Malaysian ringgit per ton, while the average spot price for the past nine months is 4,003 Malaysian ringgit per ton. She believes that the planting industry in Indonesia will grow significantly.DieselThe increase in consumption and export restrictions are expected to reduce the export of crude palm oil and push up prices. She also added that EU countries may increase their purchases before the EU Forest Logging Regulations, which will take effect by the end of 2025. Affin Investment Bank has raised its rating on the Malaysian planting industry from neutral to shareholding. The bank has identified Kajang, Kuala Lumpur as its top choice due to the company's young oil palm trees and strong recovery in downstream business profits.

Effin Investment Bank analyst Yan Huiling stated in a report that due to tight supply, crudepalm oilprices may rise in 2025. She predicts that the average price of crude palm oil next year will be 4,250 Malaysian ringgit per ton, while the average spot price for the past nine months is 4,003 Malaysian ringgit per ton. She believes that the planting industry in Indonesia will grow significantly.DieselThe increase in consumption and export restrictions are expected to reduce the export of crude palm oil and push up prices. She also added that EU countries may increase their purchases before the EU Forest Logging Regulations, which will take effect by the end of 2025. Affin Investment Bank has raised its rating on the Malaysian planting industry from neutral to shareholding. The bank has identified Kajang, Kuala Lumpur as its top choice due to the company's young oil palm trees and strong recovery in downstream business profits.

Translated

3

2

Palm oil prices have reached a new high for the year, pay attention. Will this be the next theme?

Translated

$CEPAT (8982.MY)$

The plantation industry has experienced relatively rare skyrocketing. It belongs to a relatively warm sector.

Having a one-year Dividend Yield of 5.5%. It's time to buy and collect.

Palm oil has reached a new high for the year at RM4556.50.

The plantation industry has experienced relatively rare skyrocketing. It belongs to a relatively warm sector.

Having a one-year Dividend Yield of 5.5%. It's time to buy and collect.

Palm oil has reached a new high for the year at RM4556.50.

Translated

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)