Lester Ngo

voted

Global markets

US PPI rose at 0.2%, softer than market consensus of 0.4%. This softer data helped to cool the rally of $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ US 10-year Treasury yield at 4.79% and $S&P 500 Index (.SPX.US)$ S&P500 +0.11% while $NASDAQ 100 Index (.NDX.US)$ Nasdaq -0.23%.

The biggest event risk will be CPI data to be released tonight, providing more cues on slow...

US PPI rose at 0.2%, softer than market consensus of 0.4%. This softer data helped to cool the rally of $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ US 10-year Treasury yield at 4.79% and $S&P 500 Index (.SPX.US)$ S&P500 +0.11% while $NASDAQ 100 Index (.NDX.US)$ Nasdaq -0.23%.

The biggest event risk will be CPI data to be released tonight, providing more cues on slow...

+1

15

1

2

Lester Ngo

liked

Hey, mooers!

Cathie Wood just shared some exciting insights about an AI stock she believes is significantly undervalued. Let's dive in!

Cathie's take on Palantir:

1. A "huge beneficiary of AI" that's "valued nowhere near Nvidia"

2. Offers seamless AI integration without replacing existing software

3. "The biggest bridge to the new AI world"

4. Potentially "one of the purest play AI software companies" in the long run

5. While "expensive" short...

Cathie Wood just shared some exciting insights about an AI stock she believes is significantly undervalued. Let's dive in!

Cathie's take on Palantir:

1. A "huge beneficiary of AI" that's "valued nowhere near Nvidia"

2. Offers seamless AI integration without replacing existing software

3. "The biggest bridge to the new AI world"

4. Potentially "one of the purest play AI software companies" in the long run

5. While "expensive" short...

45

23

48

Lester Ngo

commented on

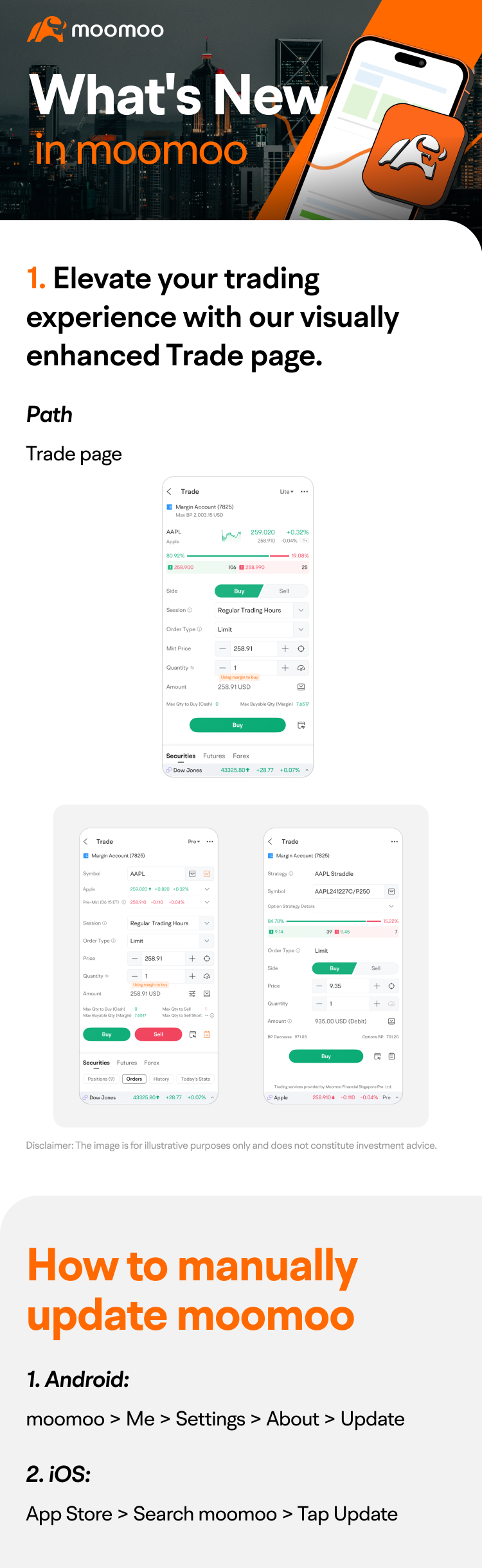

Hey there, mooers! Welcome back to "What's new in moomoo" !

This time, we've significantly improved our order page, focusing on both aesthetics and functionality to elevate your trading experience.

·Enhanced Visual Design: Our new interface boasts a more sophisticated and professional look, providing a premium visual experience that matches the caliber of your trading activities.

·Optimized Layout: We've strategic...

This time, we've significantly improved our order page, focusing on both aesthetics and functionality to elevate your trading experience.

·Enhanced Visual Design: Our new interface boasts a more sophisticated and professional look, providing a premium visual experience that matches the caliber of your trading activities.

·Optimized Layout: We've strategic...

Expand

Expand 108

34

6

Lester Ngo

liked and voted

Wondering if you can use financing for IPO subscriptions? Curious about interest charges? We've got you covered!

With Moomoo's IPO Financing, you can amplify your chances of getting new stock allocations. Here’s how it works:

💡 If you want to subscribe to more IPO shares, you can use moomoo's margin financing feature to enhance your subscription. This means you can use NOT ONLY CASH but also the buying power generated from your eligible ...

With Moomoo's IPO Financing, you can amplify your chances of getting new stock allocations. Here’s how it works:

💡 If you want to subscribe to more IPO shares, you can use moomoo's margin financing feature to enhance your subscription. This means you can use NOT ONLY CASH but also the buying power generated from your eligible ...

224

126

72

Lester Ngo

Set a live reminder

Oriental Kopi Holdings Berhad $KOPI (0338.MY)$, a cafe chain operator is targeting to debut on the Bursa ACE Market. The IPO subscription takes place from 6/1/2025 to 10/1/2025!

To provide investors with a better understanding of the company's development and future plans, Moomoo Malaysia has the opportunity to conduct a live interview session with Dato' Calvin Chan the Managing Director of Oriental Kopi on 9th Jan 2025 T...

To provide investors with a better understanding of the company's development and future plans, Moomoo Malaysia has the opportunity to conduct a live interview session with Dato' Calvin Chan the Managing Director of Oriental Kopi on 9th Jan 2025 T...

Moo Live: Exclusive IPO Investor Briefing With Oriental Kopi

Jan 9 20:00

252

132

43

Lester Ngo

liked

Boarding the datacenter train, CBH Engineering has a fair price of 48 cents.

$CBHB (0339.MY)$

A machinery and electrical (M&E) engineering service provider, CBH Engineering Holding Bhd, which will be listed on the GEM board on January 16, is being highly Bullish in the datacenter sector, with analysts giving a fair price of 48 cents, 71% higher than the IPO price of 28 cents.

CBH Engineering will issue 0.298 billion new shares, aiming to raise 83.44 million Ringgit.

According to the prospectus, out of the funds raised in the IPO amounting to 77.74 million Ringgit, 38.5 million Ringgit will be used to expand the business, with 18.48 million Ringgit allocated for the purchase of project equipment and parts, 17.3 million Ringgit for subcontractor payments, and 3.46 million Ringgit for bank guarantees and hiring engineers and talent.

The remaining 5.7 million Ringgit will be used to fund this IPO activity.

CBH Engineering is mainly engaged in electrical supply distribution systems and provides electrical-related engineering services, including electrical design supply, installation, testing, commissioning, and maintenance engineering.

It also provides mechanical engineering for building systems, such as air conditioning and mechanical ventilation, fire piping, and renewable energy systems.

Taking a closer look at the CBH project:

1) What are the main businesses of the company?

Mainly providing electrical engineering services, focusing on electrical power supply and distribution systems.

2) Is the company profitable?

CBH Engineering's revenue achieved a compound annual growth rate over 2 years...

$CBHB (0339.MY)$

A machinery and electrical (M&E) engineering service provider, CBH Engineering Holding Bhd, which will be listed on the GEM board on January 16, is being highly Bullish in the datacenter sector, with analysts giving a fair price of 48 cents, 71% higher than the IPO price of 28 cents.

CBH Engineering will issue 0.298 billion new shares, aiming to raise 83.44 million Ringgit.

According to the prospectus, out of the funds raised in the IPO amounting to 77.74 million Ringgit, 38.5 million Ringgit will be used to expand the business, with 18.48 million Ringgit allocated for the purchase of project equipment and parts, 17.3 million Ringgit for subcontractor payments, and 3.46 million Ringgit for bank guarantees and hiring engineers and talent.

The remaining 5.7 million Ringgit will be used to fund this IPO activity.

CBH Engineering is mainly engaged in electrical supply distribution systems and provides electrical-related engineering services, including electrical design supply, installation, testing, commissioning, and maintenance engineering.

It also provides mechanical engineering for building systems, such as air conditioning and mechanical ventilation, fire piping, and renewable energy systems.

Taking a closer look at the CBH project:

1) What are the main businesses of the company?

Mainly providing electrical engineering services, focusing on electrical power supply and distribution systems.

2) Is the company profitable?

CBH Engineering's revenue achieved a compound annual growth rate over 2 years...

Translated

22

14

Lester Ngo

commented on

$Advanced Micro Devices (AMD.US)$

Mark your calendars for 28/01/2025—that’s when AMD drops its Q4 earnings report. If they smash revenue and EPS expectations, especially with any good news in AI or other growth areas, we might see some real movement.

Mark your calendars for 28/01/2025—that’s when AMD drops its Q4 earnings report. If they smash revenue and EPS expectations, especially with any good news in AI or other growth areas, we might see some real movement.

wanted to learn what it Option all about and this course comes in handy. thanks

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)