LimFun Siong

liked

38

1

LimFun Siong

commented on

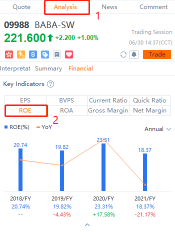

You may have seen the term "ROE" in analyst reports or financial statements many times. Do you know what it is and how the ratio can generate useful information?

Return on equity (ROE) is a measure of financial performance calculated by dividing net income by shareholders' equity.

What does ROE tell you?

Most of the times, financial ratios need to be compared with peers' data to generate useful information. ROE is no exception. For example, the average ROE in the utility sector could be 10% or less, while a technology or retail firm with smaller balance sheet accounts may have ROE levels of 18% or more.

...

Return on equity (ROE) is a measure of financial performance calculated by dividing net income by shareholders' equity.

What does ROE tell you?

Most of the times, financial ratios need to be compared with peers' data to generate useful information. ROE is no exception. For example, the average ROE in the utility sector could be 10% or less, while a technology or retail firm with smaller balance sheet accounts may have ROE levels of 18% or more.

...

+1

97

27

39

LimFun Siong

liked

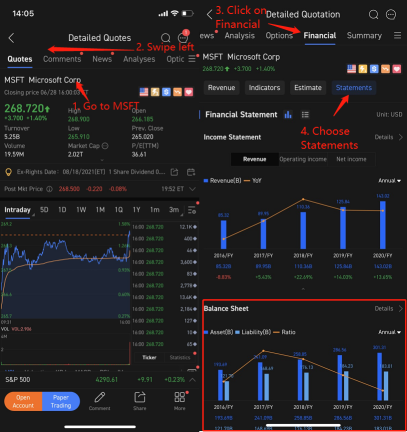

Previously, we have walked you through some basic financial ratios, such as the current ratio, which reveals - How do I avoid buying shares of a company that might go bankrupt?

In this chapter, we will guide you to find out what other factors can we use to identify risky investments.

Why we need D/E ratios?

When investors perform due diligence before investing, many amateur players simply glance at the top line (revenue) and the bottom line (profit/earning) on the income statement.

...

In this chapter, we will guide you to find out what other factors can we use to identify risky investments.

Why we need D/E ratios?

When investors perform due diligence before investing, many amateur players simply glance at the top line (revenue) and the bottom line (profit/earning) on the income statement.

...

+1

87

19

12

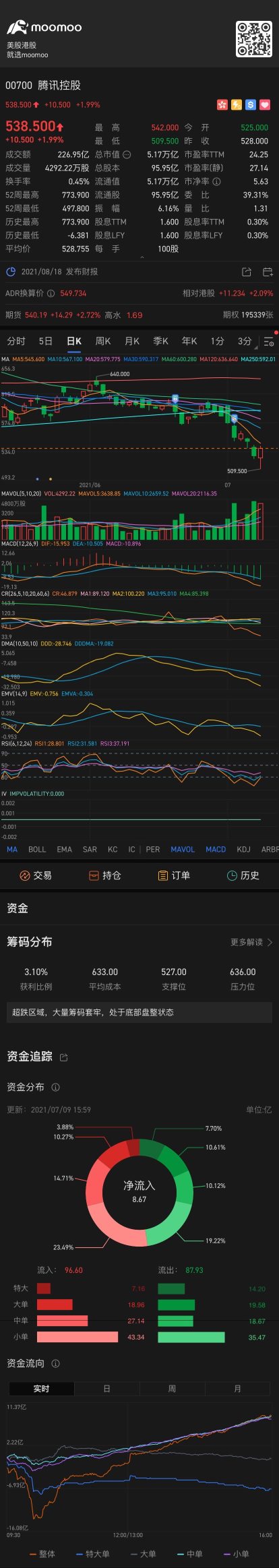

A result of 1 means a normal quick ratio. It indicates the company has just enough quick assets to cover its current liability. A quick ratio of less than 1 indicates that the company may not be able to pay off its current liabilities with its quick asset, while a company having a quick ratio larger than 1 could pay off its current liability instantly.

Anything in the 1.2 to 2.0 range is considered a healthy working capital ratio. If it drops below 1.0 you're in risky territory, known as negative working capital. With more liabilities than assets, you'd have to sell your current assets to pay off your liabilities.

Got a ratio over 2.0 and think you're golden? It's not quite that simple. Higher ratios aren't always a good thing. Anything above 2.0 could suggest that the business isn't using its assets to its full advantage.

Got a ratio over 2.0 and think you're golden? It's not quite that simple. Higher ratios aren't always a good thing. Anything above 2.0 could suggest that the business isn't using its assets to its full advantage.

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)