Limyangjie

liked

$Grab Holdings(GRAB.US$

I was as excited as most Singaporeans on this app when our home-grown brand got listed. But when I deep-dive into the company, I will likely not invest in it, at least for the short term.

Grab’s market in the South East Asia definitely has growth potential i.e. people are getting affluent, there’s an increase in digital growth etc. However, do note that Grab faces intense competition and challenges in all its businesses/services (ride-hailing, food delivery and financial services). At the moment, I don’t see very strong Moat displayed by them yet - similar to $Uber Technologies(UBER.US$

1. Ride hailing - doesn’t seem like they are going to expand to countries outside South East Asia region. And this spells limited growth, at least for the short term. Furthermore, this area of business is badly impacted by the pandemic. Taxi drivers are suffering (it’s a real problem on the ground)

2. Food delivery - sales in this area did “rocket” as everyone started working from home since 2020. But Singapore, and a few other SEA countries, are too small. There is a limit to how much they can earn in this segment. Throw in Foodpanda, Deliveroo etc, their market shares will be further capped. Personally, I don’t think there is brand loyalty when it comes to food deliveries. I used Grab most of the time, but I also used the other two when there are discounts/ vouchers etc.

3. Financial services - there are so many financial institutions around. It’s going to be tough competing against the banks, and even giants like Apple $Apple(AAPL.US$ and Google $Alphabet-A(GOOGL.US$ for their payments services. Once again, throw in Favpay, Singtel’s Dash $Singtel(Z74.SG$ Alipay $Alibaba(BABA.US$ etc etc. How much pie / market shares can they capture?

Overall, the company’s financial situation isn’t fantastic. Their revenue did grow YOY, but they are not profitable yet. Things may change in 3 to 5 years’ time (expansion by the company, covid has gone etc). But for the short term, I don’t think I would invest my money in them. The dollars can be better invested into other stocks with higher growth. Would suggest to enter only when the coast is clear. Meantime, I will just remain as their consumer using their services.

Not financial advice. DYDD and invest safely.

$Grab Holdings(GRAB.US$

I was as excited as most Singaporeans on this app when our home-grown brand got listed. But when I deep-dive into the company, I will likely not invest in it, at least for the short term.

Grab’s market in the South East Asia definitely has growth potential i.e. people are getting affluent, there’s an increase in digital growth etc. However, do note that Grab faces intense competition and challenges in all its businesses/services (ride-hailing, food delivery and financial services). At the moment, I don’t see very strong Moat displayed by them yet - similar to $Uber Technologies(UBER.US$

1. Ride hailing - doesn’t seem like they are going to expand to countries outside South East Asia region. And this spells limited growth, at least for the short term. Furthermore, this area of business is badly impacted by the pandemic. Taxi drivers are suffering (it’s a real problem on the ground)

2. Food delivery - sales in this area did “rocket” as everyone started working from home since 2020. But Singapore, and a few other SEA countries, are too small. There is a limit to how much they can earn in this segment. Throw in Foodpanda, Deliveroo etc, their market shares will be further capped. Personally, I don’t think there is brand loyalty when it comes to food deliveries. I used Grab most of the time, but I also used the other two when there are discounts/ vouchers etc.

3. Financial services - there are so many financial institutions around. It’s going to be tough competing against the banks, and even giants like Apple $Apple(AAPL.US$ and Google $Alphabet-A(GOOGL.US$ for their payments services. Once again, throw in Favpay, Singtel’s Dash $Singtel(Z74.SG$ Alipay $Alibaba(BABA.US$ etc etc. How much pie / market shares can they capture?

Overall, the company’s financial situation isn’t fantastic. Their revenue did grow YOY, but they are not profitable yet. Things may change in 3 to 5 years’ time (expansion by the company, covid has gone etc). But for the short term, I don’t think I would invest my money in them. The dollars can be better invested into other stocks with higher growth. Would suggest to enter only when the coast is clear. Meantime, I will just remain as their consumer using their services.

Not financial advice. DYDD and invest safely.

$Grab Holdings(GRAB.US$

96

1

Limyangjie

liked

$Grab Holdings(GRAB.US$ is Futu really confident that by giving 5 grab shares for the referral, it can atttact ppl to sign up? i suggest 20 instead , with such price

9

6

Limyangjie

commented on

$UOB APAC Green REIT ETF(GRN.SG$ so 1000 shares at $1 each, does this mean at IPO it will be at the same price? First timer. thanks

5

6

Limyangjie

liked

$BABA-SW(09988.HK$ stock depressed for one year. hopefully can break even soon.

14

1

Limyangjie

liked

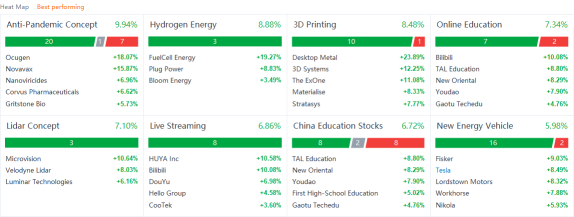

Hey mooers, check out Monday's hot sectors and hot stocks here!

$Ocugen(OCGN.US$ $FuelCell Energy(FCEL.US$ $Desktop Metal(DM.US$ $Bilibili(BILI.US$ $Microvision(MVIS.US$

$Ocugen(OCGN.US$ $FuelCell Energy(FCEL.US$ $Desktop Metal(DM.US$ $Bilibili(BILI.US$ $Microvision(MVIS.US$

27

Limyangjie

liked

Hey mooers![]()

![]()

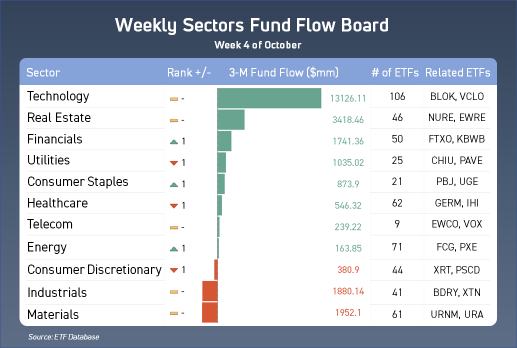

![]() Happy Friday! Weekly Sectors Fund Flow Board is here~ I got lots of positive feedback from the last post, and I hope this board could help you guys get more insight into the market

Happy Friday! Weekly Sectors Fund Flow Board is here~ I got lots of positive feedback from the last post, and I hope this board could help you guys get more insight into the market![]()

![]()

From this chart, you will be able to find out what sector ETFs have most fund inflow. Fund inflow is often considered as a bullish sign of the sector and related ETFs!

^Weekly Sectors Fund Flow Board: a sector ranking based on sector ETFs aggregate 3-month fund flows.

^3-month fund flows: a metric that can be used to gauge the perceived popularity amongst investors of different sectors.

^The board includes the following information: change of rankings, 3-month fund flows, how many ETFs are in the sectors, and the related ETFs.

For this week, I covered the top two YTD sector-related ETFs (non-leveraged)! Now, let's take a look at the board~You may find something to diversify your porfolio![]()

![]()

* Follow me to know what is hot on the market![]()

![]()

![]()

*I am collecting feedbacks on the board above.![]()

How do you think about this board? Please leave your comments and![]() thumbs up

thumbs up![]() below!

below!

Latest News of Top Sectors:

Last week, Tech, REITs, and Utilities were the top 3 sectors with fund inflows. This week we have Tech, REITs, and FIN as the top 3 sectors with the most 3-month fund inflows.

*Techonology

Tech up after mixed earnings reports

The sector looked set to slide Friday after Intel indicated that the global chip shortage was taking a toll on sales growth potential.

$Tesla(TSLA.US$shares rallied, testing all-time highs after the electric-car maker posted a robust quarterly profit and said issues with chip supply chains were not affecting its production schedule. $WeWork(WE.US$shares rose on their first day of trading, capping a journey to a listing that included the implosion of its initial public offering in 2019, and ended with the launch of SPAC $BowX Acquisition Corp(BOWX.US$. Investors piled into shares of the SPAC taking former President Donald Trump's new social-media platform public. The value of $DIGITAL WORLD ACQUISITION CORP(DWAC.US$quadrupled during Thursday's trading session.

*Real Estate

U.S. home sales jumped 7% in September

U.S. home sales surged in September with their strongest showing since January, ending a monthslong stretch when housing market activity slowed from its frenzied pace and high prices crowded out many buyers. Overall, existing-home sales rose 7% in September from the prior month to a seasonally adjusted annual rate of 6.29 million, the National Association of Realtors said Thursday.

*Financials

Financials up with treasury yields

Shares of banks and other financial institutions rose alongside Treasury yields. The yield on the two-year Treasury closed at the highest level in more than a year, while the yield on the 10-year Treasury note closed at the highest since May.

Source: Dow Jones Newswires

$Amplify Transformational Data Sharing ETF(BLOK.US$ $Nuveen Short-Term Reit Etf(NURE.US$ $First Trust Exchange-Traded Fund VI First Trust Nasdaq Bank ETF(FTXO.US$

From this chart, you will be able to find out what sector ETFs have most fund inflow. Fund inflow is often considered as a bullish sign of the sector and related ETFs!

^Weekly Sectors Fund Flow Board: a sector ranking based on sector ETFs aggregate 3-month fund flows.

^3-month fund flows: a metric that can be used to gauge the perceived popularity amongst investors of different sectors.

^The board includes the following information: change of rankings, 3-month fund flows, how many ETFs are in the sectors, and the related ETFs.

For this week, I covered the top two YTD sector-related ETFs (non-leveraged)! Now, let's take a look at the board~You may find something to diversify your porfolio

* Follow me to know what is hot on the market

*I am collecting feedbacks on the board above.

How do you think about this board? Please leave your comments and

Latest News of Top Sectors:

Last week, Tech, REITs, and Utilities were the top 3 sectors with fund inflows. This week we have Tech, REITs, and FIN as the top 3 sectors with the most 3-month fund inflows.

*Techonology

Tech up after mixed earnings reports

The sector looked set to slide Friday after Intel indicated that the global chip shortage was taking a toll on sales growth potential.

$Tesla(TSLA.US$shares rallied, testing all-time highs after the electric-car maker posted a robust quarterly profit and said issues with chip supply chains were not affecting its production schedule. $WeWork(WE.US$shares rose on their first day of trading, capping a journey to a listing that included the implosion of its initial public offering in 2019, and ended with the launch of SPAC $BowX Acquisition Corp(BOWX.US$. Investors piled into shares of the SPAC taking former President Donald Trump's new social-media platform public. The value of $DIGITAL WORLD ACQUISITION CORP(DWAC.US$quadrupled during Thursday's trading session.

*Real Estate

U.S. home sales jumped 7% in September

U.S. home sales surged in September with their strongest showing since January, ending a monthslong stretch when housing market activity slowed from its frenzied pace and high prices crowded out many buyers. Overall, existing-home sales rose 7% in September from the prior month to a seasonally adjusted annual rate of 6.29 million, the National Association of Realtors said Thursday.

*Financials

Financials up with treasury yields

Shares of banks and other financial institutions rose alongside Treasury yields. The yield on the two-year Treasury closed at the highest level in more than a year, while the yield on the 10-year Treasury note closed at the highest since May.

Source: Dow Jones Newswires

$Amplify Transformational Data Sharing ETF(BLOK.US$ $Nuveen Short-Term Reit Etf(NURE.US$ $First Trust Exchange-Traded Fund VI First Trust Nasdaq Bank ETF(FTXO.US$

77

6

Limyangjie

liked

$Roblox(RBLX.US$ flying to the moon

7

Limyangjie

liked

$Netflix(NFLX.US$ $Tesla(TSLA.US$ $Invesco QQQ Trust(QQQ.US$ Stocks appear to have shaken off the often spooky trading pattern of October for now, and whether that continues could depend on earnings in the week ahead.

Dozens of companies are reporting, from Netflix and Tesla to Intel, Procter & Gamble and American Express. Railroads, airlines, health care, tech, financial firms, energy and consumer products companies are all reporting in the first big wave of reports.

Stocks were higher in the past week, with the Nasdaq leading the charge with a 2.2% gain. Cyclical sectors, like materials, industrials and consumer discretionary were outperformers, and tech held its own with a 2.6% gain. Real estate investment trusts were also among the best sectors up nearly 3.5%.

Dozens of companies are reporting, from Netflix and Tesla to Intel, Procter & Gamble and American Express. Railroads, airlines, health care, tech, financial firms, energy and consumer products companies are all reporting in the first big wave of reports.

Stocks were higher in the past week, with the Nasdaq leading the charge with a 2.2% gain. Cyclical sectors, like materials, industrials and consumer discretionary were outperformers, and tech held its own with a 2.6% gain. Real estate investment trusts were also among the best sectors up nearly 3.5%.

9

Limyangjie

liked

$Tesla(TSLA.US$ It was shorted at the end of the session. It did not break through the 740 pressure level in the short term, and it is likely to go down.

Translated

5

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)