Lisa09

liked

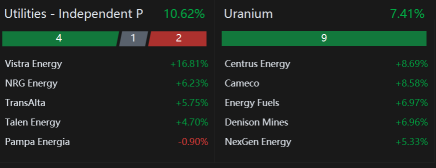

The market pulled back Friday after the S&P 500 and Dow hit record closes Thursday. Eight out of 11 sectors of the S&P 500 were falling, but energy stocks climbed: in the pursuit of AGI, Microsoft and OpenAI are planning to revive the Three Mile Island nuclear facility.

Just past 4 pm ET the $S&P 500 Index (.SPX.US)$ fell 0.19%, the $Dow Jones Industrial Average (.DJI.US)$ climbed 0.09%, and the $Nasdaq Composite Index (.IXIC.US)$ fell 0.36%...

Just past 4 pm ET the $S&P 500 Index (.SPX.US)$ fell 0.19%, the $Dow Jones Industrial Average (.DJI.US)$ climbed 0.09%, and the $Nasdaq Composite Index (.IXIC.US)$ fell 0.36%...

49

12

Lisa09

liked and voted

The much-anticipated rate cut decision has finally arrived, with the Federal Reserve announcing a 50 basis point rate cut! At this pivotal moment, investors need to have a deeper understanding of the background and impact of rate cuts.

Since March 2022, in a bid to curb inflation, the Fed has hiked rates 11 times, bringing it to the current range of 5.25%-5.50%. Now that inflation is under control, the calls for a rate cut are growin...

Since March 2022, in a bid to curb inflation, the Fed has hiked rates 11 times, bringing it to the current range of 5.25%-5.50%. Now that inflation is under control, the calls for a rate cut are growin...

+4

401

177

Lisa09

liked

Hey Mooers!

The Fed announced a 50 basis point interest rate cut on Sep 18, once again starting a monetary easing cycle after four years.

How will US rate cuts influence the global market?

What assets are more likely to outperform in the U.S. interest rate cut cycle?

Join moomoo’s global strategists for an in-depth discussion on how the Fed’s move could potentially impact your portfolio in the short and long term. And here’s a recap ...

The Fed announced a 50 basis point interest rate cut on Sep 18, once again starting a monetary easing cycle after four years.

How will US rate cuts influence the global market?

What assets are more likely to outperform in the U.S. interest rate cut cycle?

Join moomoo’s global strategists for an in-depth discussion on how the Fed’s move could potentially impact your portfolio in the short and long term. And here’s a recap ...

330

223

Lisa09

liked

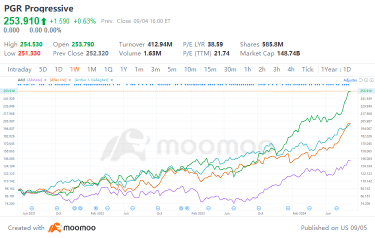

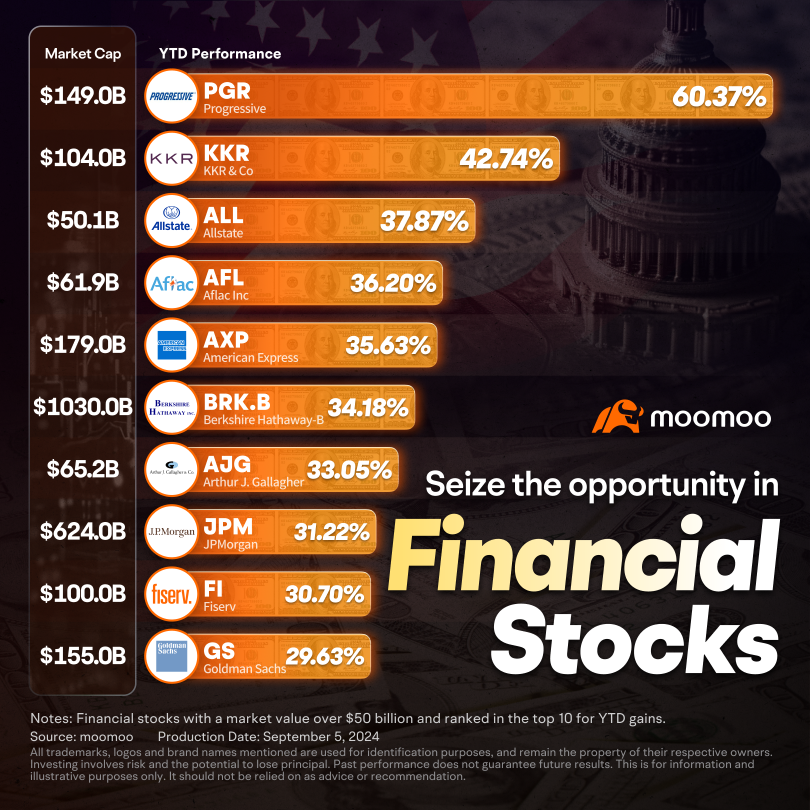

Financial stocks were once not favored by many investors, but this seems to be changing. The S&P Financial Select Sector Index has risen about 21% so far this year, outperforming the $S&P 500 Index (.SPX.US)$'s gain of 15.73%.

Source: S&P Global

According to Dave Donabedian, the CIO of CIBC’s private wealth division, “sticky money is flowing into the sector for the first time in a long time.” The reasons for this, he says, include investors looki...

Source: S&P Global

According to Dave Donabedian, the CIO of CIBC’s private wealth division, “sticky money is flowing into the sector for the first time in a long time.” The reasons for this, he says, include investors looki...

30

5

Best investment!

Translated

Lisa09

liked

$Restoration Hardware (RH.US)$ rose more than 20% after hours Thursday after the home-furnishings retailer beat analyst estimates for its fiscal Q2 earnings and revenues.

RH gained 20.5% to $309 shortly before 4:30 p.m. ET after the firm reported $1.69 in adjusted earnings per share on $829.7 million in revenues during the three months ended Aug. 3. The results reportedly beat analysts' consensus forecast of $1.61 adjusted EPS and $...

RH gained 20.5% to $309 shortly before 4:30 p.m. ET after the firm reported $1.69 in adjusted earnings per share on $829.7 million in revenues during the three months ended Aug. 3. The results reportedly beat analysts' consensus forecast of $1.61 adjusted EPS and $...

13

2

Lisa09

liked and voted

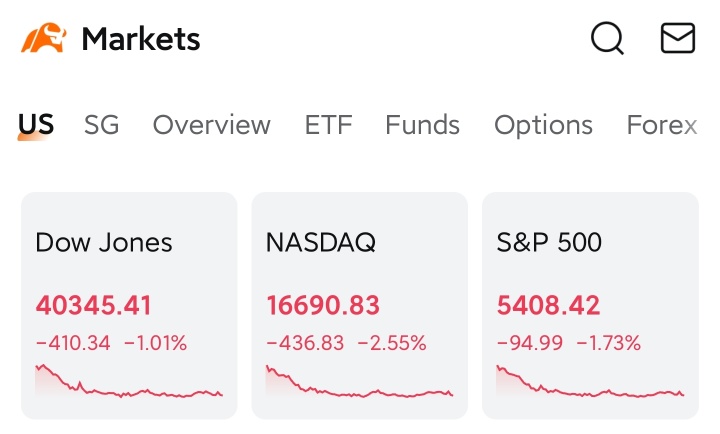

Last week, the U.S. ADP report and non-farm payroll data for August were released, indicating a slowdown in the labor market.

– Private employment: 99k (Actual), 145k (Expected);

– Non farm payrolls: 142k (Actual), 165k (Expected);

– Unemployment rate: 4.2% (2024/8) , 3.7% (2023/8).

Investor concerns about a potential recession in the U.S. have intensified, leading to a collective decline in the three major U.S. stock...

– Private employment: 99k (Actual), 145k (Expected);

– Non farm payrolls: 142k (Actual), 165k (Expected);

– Unemployment rate: 4.2% (2024/8) , 3.7% (2023/8).

Investor concerns about a potential recession in the U.S. have intensified, leading to a collective decline in the three major U.S. stock...

+3

360

184

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)