Living Stone

liked

$Palantir (PLTR.US)$

Swing Sailing for Spring Season from the Salish Sea in Sidney, BC.

1 day. 6 figures.

1 mil or bust.

thanks to the late day rip I was able to capture a great position moving into next weekm [To the Moon][Buy]![]()

![]()

![]()

Swing Sailing for Spring Season from the Salish Sea in Sidney, BC.

1 day. 6 figures.

1 mil or bust.

thanks to the late day rip I was able to capture a great position moving into next weekm [To the Moon][Buy]

5

5

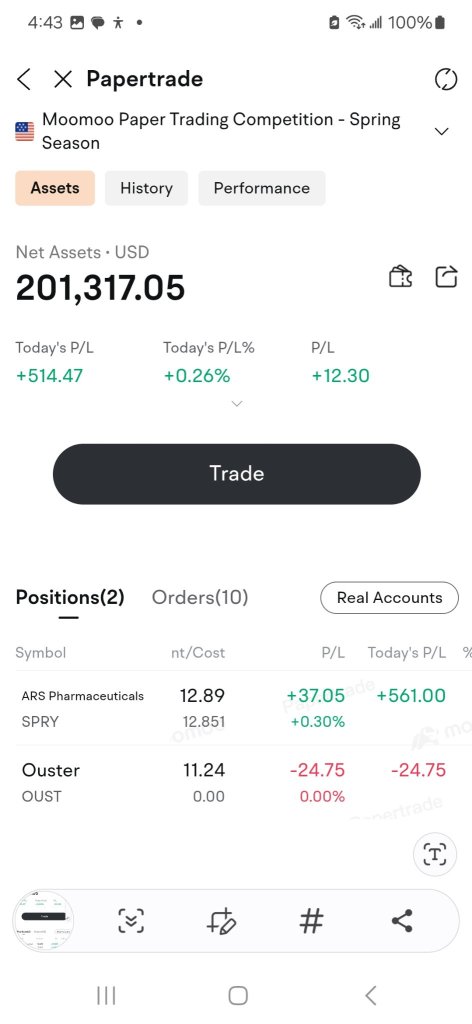

SPRY came up on my screener Friday for the second day in a row and, although skeptical, I placed a limit order. It dropped like a falling knife and instead of placing a stop limit order I kept buying to average down. It never did go back up on that day so I held it rather than realize a loss. Today it is bouncing back and I'm in the green again. I sold a few shares but am still holding until tomorrow.

A few other stocks came up on today's screener, so I bought one (OU...

A few other stocks came up on today's screener, so I bought one (OU...

Living Stone

liked

As a value investor, my focus is on strong fundamentals, reliable dividends, and long-term growth. Following Warren Buffett's principles, I carefully selected high-quality stocks in essential sectors.

✅ Chevron (CVX): A classic energy giant, providing consistent returns.

✅ Sirius XM (SIRI): Capitalizing on the subscription-based media industry.

✅ Capital One Financial (COF): Banking on financial resilience.

Every trade is a learning opportunity. My goal? To create a res...

✅ Chevron (CVX): A classic energy giant, providing consistent returns.

✅ Sirius XM (SIRI): Capitalizing on the subscription-based media industry.

✅ Capital One Financial (COF): Banking on financial resilience.

Every trade is a learning opportunity. My goal? To create a res...

4

3

2

Living Stone

liked

I’m going for short-term plays in the auto sector – lots of volatility means quick gains if you time it right. Anyone else trading auto stocks?

4

3

Living Stone

reacted to

started off very solid, had a call and put profit very well but I did not follow them through.. then I did the opposite on my last call that I stuck with to the end unfortunately missed my mark by a sliver!! casualty due to over trading.. paper money more risky trades , but the good news is I'm not out!! I still have half of what I started with so let's try this again and look to make a comeback story!!

3

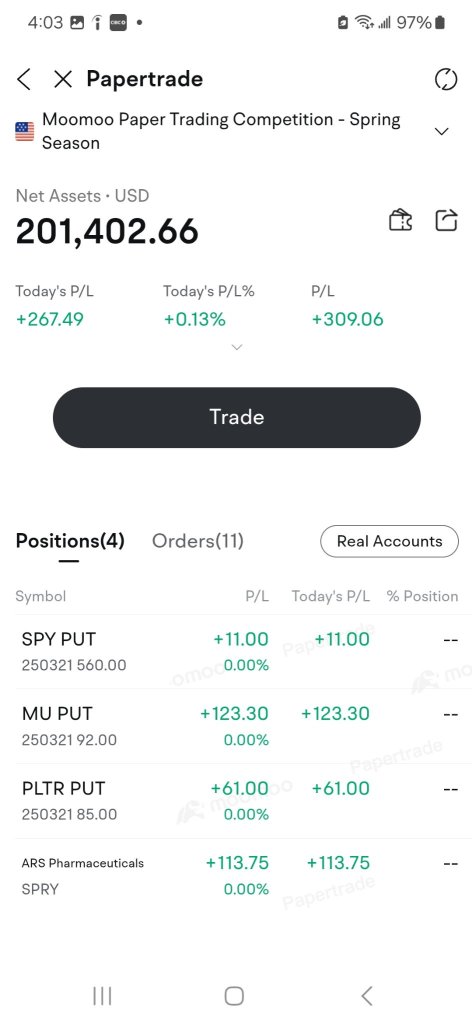

I decided to make each day separate and not hold anything over night. Today was selling put options on SPY, MU and PLTR as well as day trading SPRY because that was the only one that popped up in my screener. They were all successful. Small amounts but as a retiree I would be happy with that once or twice a week. Just a little extra spending money.

1

Living Stone

reacted to

I started late but since I'm trapped in this app and can't get my money out I may as well do something..

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)