Lloyd Ghiorso

liked

Lloyd Ghiorso

liked

$Tesla (TSLA.US)$

【核心提示🔔World-class short-term trading expert, the hedge fund guru Michael H. Steinhardt and Warren Edward Buffett, renowned for his long-term value investment and considered the most successful investor in the world, are both top-tier arbitrage masters to be revered. However, if they had to compete, Elias believes that Warren Buffett, worth 141.7 billion dollars, would be the radiant sun.🌞Michael Steinhardt, whose net worth is no more than 2 billion USD, is like a candle in the dark world.🕯️The gap between the two is extremely large and disproportionate, it is clear who has more value as a learning reference.

Steinhardt prefers short-term trading and he is exceptionally accurate in determining directional trends. When he learned that interest rates might be lowered, he did not hesitate to Buy Bonds. To be informed at the earliest opportunity, he spends 35 million USD each year on acquiring all the information available on Wall Street.

Despite this, he never exaggerates the effectiveness of short-term trading. He hopes that various short-term techniques are not overheated, and he also wishes people could recognize when short-term trading is being overstated...

【核心提示🔔World-class short-term trading expert, the hedge fund guru Michael H. Steinhardt and Warren Edward Buffett, renowned for his long-term value investment and considered the most successful investor in the world, are both top-tier arbitrage masters to be revered. However, if they had to compete, Elias believes that Warren Buffett, worth 141.7 billion dollars, would be the radiant sun.🌞Michael Steinhardt, whose net worth is no more than 2 billion USD, is like a candle in the dark world.🕯️The gap between the two is extremely large and disproportionate, it is clear who has more value as a learning reference.

Steinhardt prefers short-term trading and he is exceptionally accurate in determining directional trends. When he learned that interest rates might be lowered, he did not hesitate to Buy Bonds. To be informed at the earliest opportunity, he spends 35 million USD each year on acquiring all the information available on Wall Street.

Despite this, he never exaggerates the effectiveness of short-term trading. He hopes that various short-term techniques are not overheated, and he also wishes people could recognize when short-term trading is being overstated...

Translated

8

Lloyd Ghiorso

liked

Recently, $Tesla (TSLA.US)$ (TSLA.US) has become a hot topic in the market, as this global Electric Vehicles leader is facinga significant decline in sales in Europe.、The brand image has been damaged., as well asElon Musk's political controversies, leading to a decline in market confidence, several investment bankshave lowered Tesla's Target Price. In light of this series of shocks, Tesla's stock pricehas decreased by 41% since the beginning of the year, and investors are beginning to reassess the prospects of this company. This article will analyze the impact of this storm on Tesla fromthe perspectives of market data, competitive landscape, Earnings Reports analysis, and investment strategy, combined with the professional insights of **'USA Stock 101'**, to assist investors in determining whether Tesla is still worth Holding for the long term.

With sales in Europe plummeting, can Tesla still stabilize its market position?

Tesla's sales in the European market are rapidly shrinking.In January 2025, Tesla's sales in Europe decreased by 45% year-on-year.The decline in the French market is even higher. 63%This phenomenon indicates that Tesla's competitiveness in the European market is being weakened. According to data from market research institutions,The European Electric Vehicles market has entered intense competition., with local manufacturers likeVolkswagen, Stellantis, as well as Chinese brands BYD, Xpeng, NIO and others are accelerating to capture the market.

In addition to the rise of competitors,Government policy changes. This is also an important factor in Tesla's sales decline.The EU recently adjusted the subsidy policy for Electric Vehicles, leaning towards supporting local manufacturers...

With sales in Europe plummeting, can Tesla still stabilize its market position?

Tesla's sales in the European market are rapidly shrinking.In January 2025, Tesla's sales in Europe decreased by 45% year-on-year.The decline in the French market is even higher. 63%This phenomenon indicates that Tesla's competitiveness in the European market is being weakened. According to data from market research institutions,The European Electric Vehicles market has entered intense competition., with local manufacturers likeVolkswagen, Stellantis, as well as Chinese brands BYD, Xpeng, NIO and others are accelerating to capture the market.

In addition to the rise of competitors,Government policy changes. This is also an important factor in Tesla's sales decline.The EU recently adjusted the subsidy policy for Electric Vehicles, leaning towards supporting local manufacturers...

Translated

9

Lloyd Ghiorso

liked

Hi, I'm the CEO of moomoo US. Ask Me Anything

Hello, Mooers! I’m Neil McDonald, the US CEO of Moomoo. I'm excited to connect with all of you! With over 30 years of experience on Wall Street, I've worked at major financial institutions like Goldman Sachs, JP Morgan, and Citadel, specializing in derivatives trading and quantitative analysis. Throughout my career, I've also been involved in several startups, helping develop retail trading platforms and pi...

Hello, Mooers! I’m Neil McDonald, the US CEO of Moomoo. I'm excited to connect with all of you! With over 30 years of experience on Wall Street, I've worked at major financial institutions like Goldman Sachs, JP Morgan, and Citadel, specializing in derivatives trading and quantitative analysis. Throughout my career, I've also been involved in several startups, helping develop retail trading platforms and pi...

77

249

14

Lloyd Ghiorso

liked

Japan’s Center Mobile Co., Ltd. (CTMB) is making a bold move, going public on the U.S. stock market with a $13 million IPO. This innovative mobile virtual network operator (MVNO) is shaking up the telecom space by offering affordable 4G LTE plans through NTT Docomo’s infrastructure.

What makes Center Mobile stand out? Its unique PLAIO app, which allows users to reduce their mobile fees by engaging with ads and games, creating an excit...

What makes Center Mobile stand out? Its unique PLAIO app, which allows users to reduce their mobile fees by engaging with ads and games, creating an excit...

7

Lloyd Ghiorso

liked

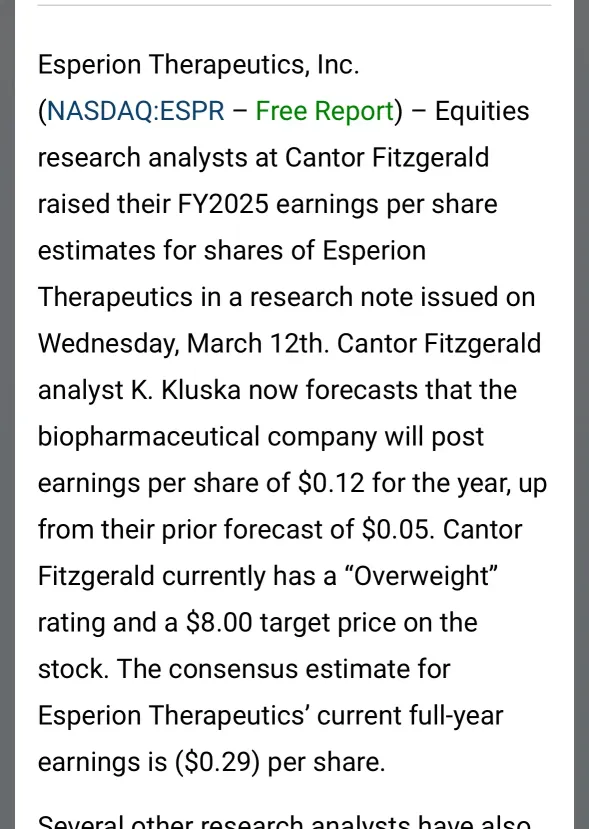

$Esperion Therapeutics (ESPR.US)$ FY2025 EPS Estimates for ESPR Lifted by Cantor Fitzgerald

Written by MarketBeat

March 15, 2025 Cantor Fitzgerald Brokers Raise Earnings Estimates for ESPR

Cantor Fitzgerald raised their FY2025 earnings per share estimates for Esperion Therapeutics in a report released on Wednesday, March 12th. Cantor Fitzgerald analyst K. Kluska now forecasts tha...

Written by MarketBeat

March 15, 2025 Cantor Fitzgerald Brokers Raise Earnings Estimates for ESPR

Cantor Fitzgerald raised their FY2025 earnings per share estimates for Esperion Therapeutics in a report released on Wednesday, March 12th. Cantor Fitzgerald analyst K. Kluska now forecasts tha...

+1

16

1

Lloyd Ghiorso

liked

$KE Holdings (BEKE.US)$ is expected to report its quarterly earnings for period ending 31 Dec 2024 on 18 March 2025 before the market open.

BEKE is expected to show a rise in quarterly revenue of 37.1% increase to CNY27.693 billion from CNY20.2 billion a year ago.

The consensus EPS estimate is expected for KE Holdings to come in at CNY1.77 per share or 24 cents.

KE Holdings (BEKE) Last Positive Earnings Call Gave Inves...

BEKE is expected to show a rise in quarterly revenue of 37.1% increase to CNY27.693 billion from CNY20.2 billion a year ago.

The consensus EPS estimate is expected for KE Holdings to come in at CNY1.77 per share or 24 cents.

KE Holdings (BEKE) Last Positive Earnings Call Gave Inves...

+1

11

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)