LWK5

voted

Last week, the markets were dominated by escalating trade tensions, with tariffs on steel and aluminum imports sparking fears of a global trade war. The European Union retaliated with counter-tariffs on $28 billion worth of U.S. goods, further spooking investors. Meanwhile, concerns over valuations and earnings continued to weigh on the tech sector, with $Adobe (ADBE.US)$ and $Intel (INTC.US)$ making headlines f...

+13

2072

359

23

LWK5

voted

Week 2's curtain falls, but the drama's just beginning!

Who's ruling our top 10 paper trading leaderboard this week?

Brace yourself for the big reveal! 📈💰

👏Congratulations to the top 10 trading titans!

@iamshf @103226286 @105405816 @ChangHorng @103178067 @105227245 @105386639 @Kenwoo @ALAN86 @Ckent2213

*The profit/loss (P/L) data is based on trading activity from March 10th to March 15th.

Last week, the standout performances of top traders revealed s...

Who's ruling our top 10 paper trading leaderboard this week?

Brace yourself for the big reveal! 📈💰

👏Congratulations to the top 10 trading titans!

@iamshf @103226286 @105405816 @ChangHorng @103178067 @105227245 @105386639 @Kenwoo @ALAN86 @Ckent2213

*The profit/loss (P/L) data is based on trading activity from March 10th to March 15th.

Last week, the standout performances of top traders revealed s...

+4

182

110

13

LWK5

voted

Hi, mooers!

Are you ready to jump into 2025 with excitement? We're delighted to lead the way by introducing our first collectible of the year—the Lively Moo!

As you've just seen, the Lively Moo isn't just any collectible; it embodies joy and creativity for the upcoming year. Plus, we've crafted special red envelopes for the Lunar New Year. 🧧

Join us as we delve into the charm and features of these exciting new items! 👀

🚨 Heart-melter alert! 🚨...

Are you ready to jump into 2025 with excitement? We're delighted to lead the way by introducing our first collectible of the year—the Lively Moo!

As you've just seen, the Lively Moo isn't just any collectible; it embodies joy and creativity for the upcoming year. Plus, we've crafted special red envelopes for the Lunar New Year. 🧧

Join us as we delve into the charm and features of these exciting new items! 👀

🚨 Heart-melter alert! 🚨...

62

21

24

LWK5

voted

Hi, mooers!

Imagine cozying up in moomoo slippers, navigating effortlessly with a moomoo mouse pad, or wrapping yourself in a moomoo towel after a delightful shower. Sounds wonderful, doesn't it? 🛁🖱️🧦

Our goal is to sprinkle a bit of moomoo magic into your everyday routines, making every moment joyful with our charming designs. 😊✨

How about enhancing your weekend leisure with a moomoo frisbee, or adding comfort to your home with moom...

Imagine cozying up in moomoo slippers, navigating effortlessly with a moomoo mouse pad, or wrapping yourself in a moomoo towel after a delightful shower. Sounds wonderful, doesn't it? 🛁🖱️🧦

Our goal is to sprinkle a bit of moomoo magic into your everyday routines, making every moment joyful with our charming designs. 😊✨

How about enhancing your weekend leisure with a moomoo frisbee, or adding comfort to your home with moom...

23

25

1

LWK5

reacted to

### Investing in US ETFs QQQ and VOO: An Ideal Choice for Long-term Stable Investment

In recent years, regular contribution (dollar-cost averaging) has gradually become an ideal investment method for investors seeking long-term stable returns. Among numerous US ETFs, QQQ and VOO have become the preferred choices for investors due to their strong performance and stable returns. This article will introduce the characteristics of QQQ and VOO, as well as why investing in them through regular contributions is a wise choice for long-term financial planning.

#### 1. What are QQQ and VOO?

- **QQQ** (Invesco QQQ Trust): This ETF tracks the Nasdaq 100 Index, which covers the 100 largest and fastest-growing non-financial companies on the Nasdaq Exchange. QQQ's constituents are mostly technology giants such as Apple, Microsoft, Amazon, and Google. Therefore, QQQ is considered an ETF focused on technology stocks.

- **VOO** (Vanguard S&P 500 ETF): This ETF tracks the S&P 500 Index, which includes the 500 largest companies in the USA across multiple industries and represents the overall performance of the US stock market. VOO's constituents are widely distributed and encompass various sectors such as technology, medical, finance, and consumer, including companies like Apple, Microsoft, Amazon, Johnson & Johnson, and Berkshire Hathaway.

#### 2. The advantages of regular investments

Regular investment is a very suitable investment strategy for long-term investments...

In recent years, regular contribution (dollar-cost averaging) has gradually become an ideal investment method for investors seeking long-term stable returns. Among numerous US ETFs, QQQ and VOO have become the preferred choices for investors due to their strong performance and stable returns. This article will introduce the characteristics of QQQ and VOO, as well as why investing in them through regular contributions is a wise choice for long-term financial planning.

#### 1. What are QQQ and VOO?

- **QQQ** (Invesco QQQ Trust): This ETF tracks the Nasdaq 100 Index, which covers the 100 largest and fastest-growing non-financial companies on the Nasdaq Exchange. QQQ's constituents are mostly technology giants such as Apple, Microsoft, Amazon, and Google. Therefore, QQQ is considered an ETF focused on technology stocks.

- **VOO** (Vanguard S&P 500 ETF): This ETF tracks the S&P 500 Index, which includes the 500 largest companies in the USA across multiple industries and represents the overall performance of the US stock market. VOO's constituents are widely distributed and encompass various sectors such as technology, medical, finance, and consumer, including companies like Apple, Microsoft, Amazon, Johnson & Johnson, and Berkshire Hathaway.

#### 2. The advantages of regular investments

Regular investment is a very suitable investment strategy for long-term investments...

Translated

19

1

5

LWK5

liked

Happy Monday, Mooers!![]()

![]()

The September FOMC meeting is approaching, and the market generally believes that a rate cut is highly likely, which will be a significant turning point in this year's monetary policy.![]()

![]()

How will interest rate cuts affect the stock market? How will the S&P 500 index react? Come on mooers,![]() let's try to predict its possible direction!

let's try to predict its possible direction!![]()

Prediction time!

Drop your insights in the comments section:

– What impact would a ...

The September FOMC meeting is approaching, and the market generally believes that a rate cut is highly likely, which will be a significant turning point in this year's monetary policy.

How will interest rate cuts affect the stock market? How will the S&P 500 index react? Come on mooers,

Prediction time!

Drop your insights in the comments section:

– What impact would a ...

2024 FOMC Meeting

Sep 19 02:30

109

115

7

LWK5

Set a live reminder

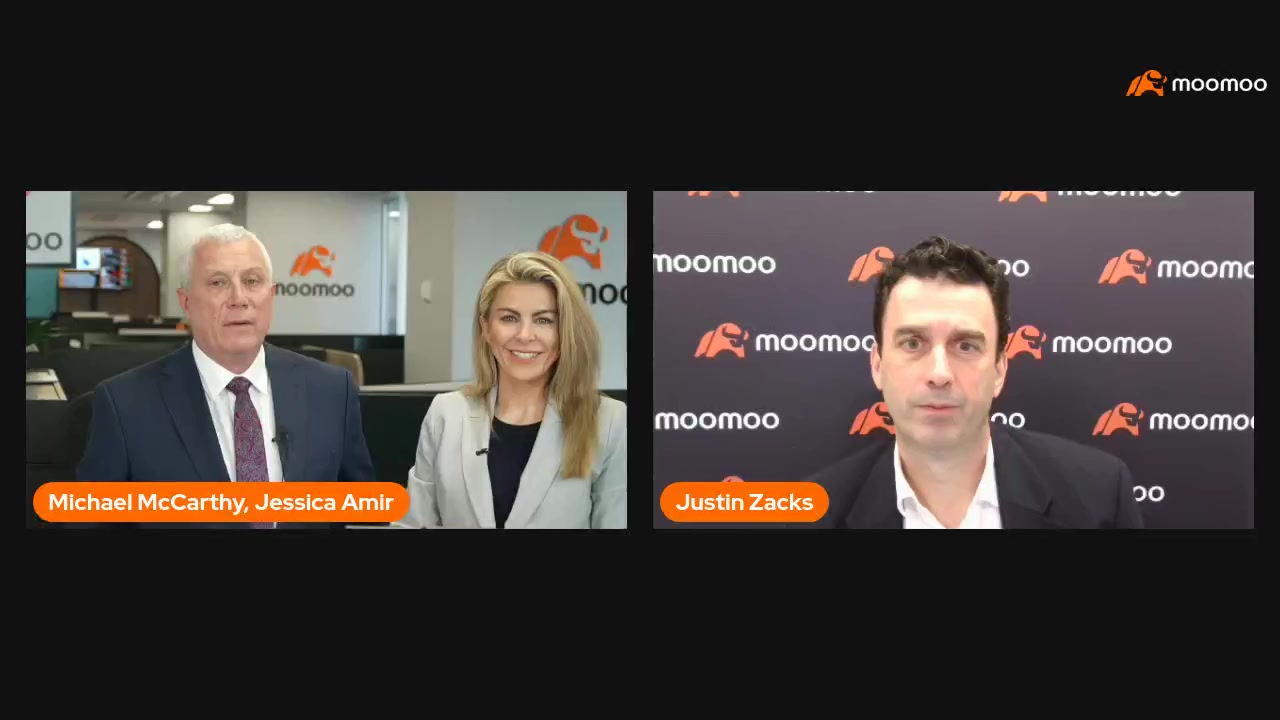

Missed the live? Watch the replay now and join Justin, Michael and Jessica as they dives deep into US rate cuts!

704

1017

29

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)