LY191919

liked

The Chinese market has attracted increased attention in global markets, accompanied by rising volatility as more capital seeks to capitalize on potential opportunities largely driven by government measures. This environment led to a sharp rebound at the end of September, just before the National Holiday.

A specific example of this volatility: after two days of significant declines, the Chinese stock market rebounded...

A specific example of this volatility: after two days of significant declines, the Chinese stock market rebounded...

333

120

LY191919

liked

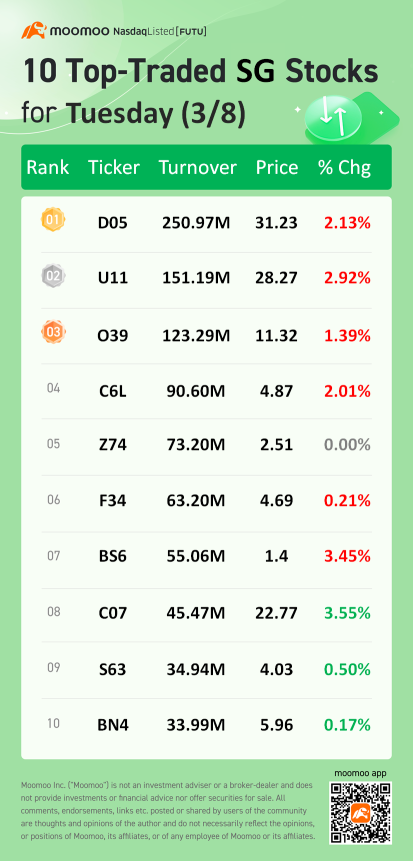

Good morning mooers! Here are things you need to know about today's Singapore:

●Singapore shares opened lower on Monday; STI down 1.01%

●Commodities face tough week as Fed angst builds

●Stocks and REITs to watch: Singtel, SPH Reit, Aspen

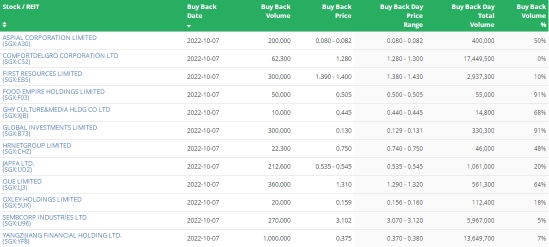

●Latest share buy back transactions

-moomoo News SG

Market Trend

Singapore shares opened lower on Monday. The $FTSE Singapore Straits Time Index (.STI.SG)$ decreased 1.01 per cent to 3,114.16 ...

●Singapore shares opened lower on Monday; STI down 1.01%

●Commodities face tough week as Fed angst builds

●Stocks and REITs to watch: Singtel, SPH Reit, Aspen

●Latest share buy back transactions

-moomoo News SG

Market Trend

Singapore shares opened lower on Monday. The $FTSE Singapore Straits Time Index (.STI.SG)$ decreased 1.01 per cent to 3,114.16 ...

1446

1387

LY191919

liked

The biggest mistake made was surely more than one of course. I believe there are so many people shared my fate.

1. Trading on others people tips & hints.

2. Trading without a Stop Loss.

3. Revenge trading.

4. Trading like every trade will 🚀🌛

5. Averaging down on bad trade.

Maybe every single mistake mentioned above is someone Biggest Mistake.

Well, hope your Biggest Mistake made is NOT YOUR LAST MISTAKE IN TRADING.

✌🍺🍻👍👍👍

$Futu Holdings Ltd (FUTU.US)$

$Grab Holdings (GRAB.US)$

$UP Fintech (TIGR.US)$

$Alibaba (BABA.US)$

$Robinhood (HOOD.US)$

$AMC Entertainment (AMC.US)$

$Top Glove (BVA.SG)$

$ContextLogic (WISH.US)$

$NIO Inc (NIO.US)$

$Apple (AAPL.US)$

$Tesla (TSLA.US)$

$SIA (C6L.SG)$

$ComfortDelGro (C52.SG)$

$Palantir (PLTR.US)$

$SNDL Inc (SNDL.US)$

$Camber Energy (CEI.US)$

$Lucid Group (LCID.US)$

$Moderna (MRNA.US)$

$Pfizer (PFE.US)$

1. Trading on others people tips & hints.

2. Trading without a Stop Loss.

3. Revenge trading.

4. Trading like every trade will 🚀🌛

5. Averaging down on bad trade.

Maybe every single mistake mentioned above is someone Biggest Mistake.

Well, hope your Biggest Mistake made is NOT YOUR LAST MISTAKE IN TRADING.

✌🍺🍻👍👍👍

$Futu Holdings Ltd (FUTU.US)$

$Grab Holdings (GRAB.US)$

$UP Fintech (TIGR.US)$

$Alibaba (BABA.US)$

$Robinhood (HOOD.US)$

$AMC Entertainment (AMC.US)$

$Top Glove (BVA.SG)$

$ContextLogic (WISH.US)$

$NIO Inc (NIO.US)$

$Apple (AAPL.US)$

$Tesla (TSLA.US)$

$SIA (C6L.SG)$

$ComfortDelGro (C52.SG)$

$Palantir (PLTR.US)$

$SNDL Inc (SNDL.US)$

$Camber Energy (CEI.US)$

$Lucid Group (LCID.US)$

$Moderna (MRNA.US)$

$Pfizer (PFE.US)$

34

8

LY191919

liked

$Rivian Automotive (RIVN.US)$ declined after lower production forecast in 2022. Price is now lower than opening trade on IPO day. The company is saying that it will be falling short of its 2021 production target of 1200 by a few hundred vehicles due to supply constraints. Other automakers have also talked about supply chain issues in the past.

Analysts are still bullish on the stock. RBC and WedBush Securities have price targets of $165 and $130. Average PT is $135. This is a supply issue and clearly not a demand issue. And its affecting other automakers too. This pullback may be a good opportunity to buy.

Analysts are still bullish on the stock. RBC and WedBush Securities have price targets of $165 and $130. Average PT is $135. This is a supply issue and clearly not a demand issue. And its affecting other automakers too. This pullback may be a good opportunity to buy.

29

3

LY191919

liked

2021 is a year of recovery. In Jan 2021, the world is promised with an effective vaccine for Covid and the reopening of economy. Fast forward to Dec 2021, we have battled the Delta variant and now battling the Omicron.

With the Covid as backdrop, the world has been kept busy. Some of the key events in the market include:

* Reddit trying to take on Wall Street. This marks the beginning of meme stocks in a big way. $GameStop (GME.US)$ $AMC Entertainment (AMC.US)$

* China and her common prosperity policies which have impacted the Chinese listed companies, especially Chinese Tech. $BABA-W (09988.HK)$ $TENCENT (00700.HK)$

* $Bitcoin (BTC.CC)$ hit all time high of ~$67K and the growing popularity of NFT.

* $Meta Platforms (FB.US)$ changed its name to Meta and the entire metaverse ecosystem.

* The sell off of growth stock in Dec (probably still ongoing now). We have seen some of the growth stocks came down more than 50% from its all time high. $Sea (SE.US)$ $Zoom Video Communications (ZM.US)$

At a personal level, 2021 has been a year of learning. I shifted my focus from Singapore dividend stocks such as $DBS Group Holdings (D05.SG)$ to US growth stocks. The learning curve is steep but satisfying. My take away from my investing journey this year:

1. Build strong conviction

Conviction is build after you have done your research. Having a strong conviction about the companies you owned helps you through volatility and prevent panic selling. For example, $Pinterest (PINS.US)$ has not done well recently. I went through my checklist and the thesis still looks intact. So despite the draw down, I have decided to hold.

2. Be Patient

Companies need time to execute and that will be reflected in their share price if they execute well. Very often this does not happen overnight. Sometimes the share price may not go up in a straight line, you may have to endure some drawdown before it is up again. It is therefore important to have patience.

By being patient, it help us to find the next 100 baggers.

$Apple (AAPL.US)$

$Amazon (AMZN.US)$

3. Be humble and keep learning

The more I learn, the more I know that I do not know. Sometimes I thought I have it all covered and Mr Market threw me a curveball.

I am grateful for the great community that @Investing with moomoo @Meta Moo @moomoo Singapore have built, allow us to exchange ideas and learn from one another. We may not agree with all the points, but having an open mind and exchanging ideas will make you a better investor.

@HopeAlways @Mcsnacks H Tupack @GratefulPanda @Dadacai @NANA123 @Mars Mooo

4. Do not FOMO and hindsight is always 20/20

Fear of Missing Out (FOMO) can wipe you out if you tried to chase any of the stocks. I resisted very hard to not jump into $GameStop (GME.US)$.

Hindsight is a common feeling when we invest. Sometimes I did not buy a stock and it rocket and vice versa. I tell myself that hindsight is 20/20 and I can’t catch all the winners. Looking forward is better than regretting what have happened.

5. Have a journal

It can be an old fashioned notebook, Microsoft word, video or a post in Moomoo.

Have a journal and record my investing journey helps to crystallize my thoughts. I wrote down my reason of starting or exiting a position, my target and my thoughts.

With the virus living among us, 2021 has not been easy. We have certainly grown in resilient and hope that the resilience can be also shown in our investing journey.

Wish that 2022 will be a better year for all of us.

Cheers![]()

![]()

![]()

With the Covid as backdrop, the world has been kept busy. Some of the key events in the market include:

* Reddit trying to take on Wall Street. This marks the beginning of meme stocks in a big way. $GameStop (GME.US)$ $AMC Entertainment (AMC.US)$

* China and her common prosperity policies which have impacted the Chinese listed companies, especially Chinese Tech. $BABA-W (09988.HK)$ $TENCENT (00700.HK)$

* $Bitcoin (BTC.CC)$ hit all time high of ~$67K and the growing popularity of NFT.

* $Meta Platforms (FB.US)$ changed its name to Meta and the entire metaverse ecosystem.

* The sell off of growth stock in Dec (probably still ongoing now). We have seen some of the growth stocks came down more than 50% from its all time high. $Sea (SE.US)$ $Zoom Video Communications (ZM.US)$

At a personal level, 2021 has been a year of learning. I shifted my focus from Singapore dividend stocks such as $DBS Group Holdings (D05.SG)$ to US growth stocks. The learning curve is steep but satisfying. My take away from my investing journey this year:

1. Build strong conviction

Conviction is build after you have done your research. Having a strong conviction about the companies you owned helps you through volatility and prevent panic selling. For example, $Pinterest (PINS.US)$ has not done well recently. I went through my checklist and the thesis still looks intact. So despite the draw down, I have decided to hold.

2. Be Patient

Companies need time to execute and that will be reflected in their share price if they execute well. Very often this does not happen overnight. Sometimes the share price may not go up in a straight line, you may have to endure some drawdown before it is up again. It is therefore important to have patience.

By being patient, it help us to find the next 100 baggers.

$Apple (AAPL.US)$

$Amazon (AMZN.US)$

3. Be humble and keep learning

The more I learn, the more I know that I do not know. Sometimes I thought I have it all covered and Mr Market threw me a curveball.

I am grateful for the great community that @Investing with moomoo @Meta Moo @moomoo Singapore have built, allow us to exchange ideas and learn from one another. We may not agree with all the points, but having an open mind and exchanging ideas will make you a better investor.

@HopeAlways @Mcsnacks H Tupack @GratefulPanda @Dadacai @NANA123 @Mars Mooo

4. Do not FOMO and hindsight is always 20/20

Fear of Missing Out (FOMO) can wipe you out if you tried to chase any of the stocks. I resisted very hard to not jump into $GameStop (GME.US)$.

Hindsight is a common feeling when we invest. Sometimes I did not buy a stock and it rocket and vice versa. I tell myself that hindsight is 20/20 and I can’t catch all the winners. Looking forward is better than regretting what have happened.

5. Have a journal

It can be an old fashioned notebook, Microsoft word, video or a post in Moomoo.

Have a journal and record my investing journey helps to crystallize my thoughts. I wrote down my reason of starting or exiting a position, my target and my thoughts.

With the virus living among us, 2021 has not been easy. We have certainly grown in resilient and hope that the resilience can be also shown in our investing journey.

Wish that 2022 will be a better year for all of us.

Cheers

191

13

LY191919

liked

19

LY191919

liked

$Futu Holdings Ltd (FUTU.US)$

It only took two months from hope to disappointment and then to despair.

Why me?

It only took two months from hope to disappointment and then to despair.

Why me?

Translated

13

1

LY191919

liked

Tencent Holdings, the world’s largest video gaming company by revenue, will open its next game development studio in Singapore, which has emerged as a regional hub for game development after investments from industry giants including Ubisoft and Riot Games, according to two people with knowledge of the matter.

TiMi Studio Group, the developer behind Tencent’s biggest hits such as Honour of Kings and Call of Duty: Mobile, is setting up a new studio in Singapore, according to the people, who declined to be identified because they are not authorised to speak to the media. It will be Tencent’s first studio in the city state and TiMi’s fourth overseas studio behind Los Angeles, Seattle and Montreal. Until now, Tencent has only had its employees in Singapore work on existing games.

That move comes in the wake of Beijing’s regulatory crackdown on Big Tech at home, which has spurred companies like Tencent and TikTok owner ByteDance to look to Singapore as a base where they can hire foreign talent to develop products for the global market. The new TiMi Singapore studio has yet to be announced to the public by the Shenzhen-based gaming giant. While details regarding the new studio’s size and function remain scant, a job post listed online last month shows that it is hiring middle and senior level software engineers with experience developing AAA games, an informal classification used to describe games made with industry-leading production quality and published on consoles or PCs.

$TENCENT (00700.HK)$

5x Short $Tencent 5xShortSG230202 (DTCW.SG)$

5x long $Tencent 5xLongSG220808 (DDLW.SG)$

TiMi Studio Group, the developer behind Tencent’s biggest hits such as Honour of Kings and Call of Duty: Mobile, is setting up a new studio in Singapore, according to the people, who declined to be identified because they are not authorised to speak to the media. It will be Tencent’s first studio in the city state and TiMi’s fourth overseas studio behind Los Angeles, Seattle and Montreal. Until now, Tencent has only had its employees in Singapore work on existing games.

That move comes in the wake of Beijing’s regulatory crackdown on Big Tech at home, which has spurred companies like Tencent and TikTok owner ByteDance to look to Singapore as a base where they can hire foreign talent to develop products for the global market. The new TiMi Singapore studio has yet to be announced to the public by the Shenzhen-based gaming giant. While details regarding the new studio’s size and function remain scant, a job post listed online last month shows that it is hiring middle and senior level software engineers with experience developing AAA games, an informal classification used to describe games made with industry-leading production quality and published on consoles or PCs.

$TENCENT (00700.HK)$

5x Short $Tencent 5xShortSG230202 (DTCW.SG)$

5x long $Tencent 5xLongSG220808 (DDLW.SG)$

18

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)